WEEKLY - drama, deficits and stablecoins

plus, assorted links and a summer song

Hello everyone, I hope you’re all doing well!

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the week, offer some interesting links I came across in my weekly reading, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one! For $12/month, you’ll get ~daily commentary on how crypto is impacting the macro landscape, and vice versa. I talk about adoption, regulation, tokenization, stablecoins, CBDCs, market infrastructure shifts and more, as well as the economy and investment narratives.

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

What the latest political plot twist means for markets

Others pile in

Should stablecoins be “money”?

Assorted links: managerial class, technologies of control, SEC tech, AI otters and more

The ultimate Spanish summer song

🌻Hey all! I’m thinking about taking on sponsors, to help keep this newsletter going. If you have a webinar, report or event you’d like me to feature, let me know! Reach out at noelle@cryptoismacro.com and I’ll send you more information.🌻

Some of the topics discussed in this week’s premium dailies:

Coming up: trade talks, jobs data, an election and more

Poland’s sharp shift

Sabre-rattling with teeth

What the new face of warfare means for trade

Macro-Crypto Bits: tariffs, markets and riots

Market narratives: boats in a hurricane

Russia’s chessboard

Macro-Crypto Bits: weak manufacturing data, Russia’s crypto markets

Should stablecoins be “money”?

Tariff uncertainty bites

Macro-Crypto Bits: weakening jobs, market moves, stablecoin politics

Upping the stakes: a new wave of financial innovation

Stablecoin payments

Macro-Crypto Bits: softening activity, climbing prices, reactive markets and JPMorgan

What the latest political plot twist means for markets

Others pile in

China-US call

Circle IPO

Macro-Crypto Bits: jobs, trade, markets, Japan

What the latest political plot twist means for markets

For regular X scrollers, Thursday was even crazier than usual, and that’s saying something.

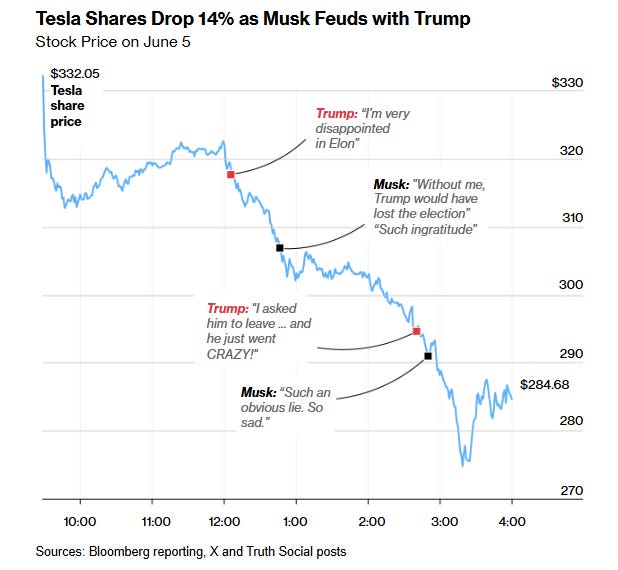

I am, of course, referring to the Trump/Musk public breakup which marched right into unhinged viciousness. Cringe and uncomfortable for sure, but also jaw-droppingly gripping with memes and jokes adding sparkle to the drama.

We are seeing the social media-triggered transformation of politics play out in real time – this is not new, but this week it burst onto the main stage, and once we dust ourselves off from the abrupt plot twists, there is much to digest on where the seat of power actually lies.

For markets, the bromance breakup is significant.

The public fight will probably blow over, since neither individual appears to have a history of holding grudges. But we can’t unsee what we saw: if President Trump, with a majority in both chambers of Congress, can’t fulfil his electoral promise of reducing the deficit, then no-one can. And now the X mainstream crowd is paying attention.

So are international investors who are reasonably worried not just about the value of their US holdings, but also the currency risk and the political instability.

Yet there does not seem to have been an immediate market reaction, outside the staggering drop in Tesla’s share price which suffered its largest one-day drop ever.

(chart via Bloomberg)

Going by the absence of invective on the protagonists’ respective social media platforms yesterday, tempers seem to be cooling, although it appears the promised “peace talks” didn’t happen.

Yet, both individuals are unpredictable, to say the least, both wield a lot of power, and it remains to be seen who “wins” or even what that would look like, and over what timeframe.

Headlines and op-eds so far seem to lean towards Musk conceding defeat – but I don’t think we’ve seen that yet. It’s easy to assume the President of the world’s largest economy is the most powerful person in the world. But that overlooks the puppet-master role played throughout history by those that can control the narrative.

Others pile in

Beyond Elon Musk calling Trump’s tax bill a “disgusting abomination”, the number of prominent voices sounding the alarm is climbing. On Thursday, Citadel Securities President Jim Esposito said at an event that the US deficit and mounting debt levels were a “ticking time bomb”.

BlackRock CEO Larry Fink, speaking at a different event the same day, said the US was “going to hit the wall” unless the economy could grow enough to offset higher deficits.

And former Treasury Secretary Lawrence Summers said on Thursday that the pace of debt accumulation from the world’s largest debtor was “putting at risk its status as the world’s greatest power”.

All this comes a few days after JPMorgan CEO Jamie Dimon said that a crack in the bond market was “going to happen”.

And Goldman Sachs President John Waldron said at a conference last week that tariffs were not what bond markets were worried about – it’s the US fiscal outlook.

Will any of this be enough to stall the tax bill and its spending promises? I don’t know – but the public rift between the US President and his wealthiest and arguably most influential supporter for sure has thrown a wrench into the Administration’s disregard for market concerns.

Should stablecoins be “money”?

In an op-ed in the Financial Times a few days ago, Ignazio Angeloni – former supervisory board member of the European Central Bank – raised an interesting point about stablecoins.

The current direction of regulation guarantees stablecoin convertibility 1:1, effectively giving them central bank-like guarantees even though they are not backed by central bank balance sheets.

This is having undesirable secondary effects.

The European Central Bank (ECB), for example, sees dollar-backed stablecoins as a threat to its monetary domain and is working on creating a competitor: the digital euro.

And the US authorities are taking the arguably lax approach of inferring money-like stability on assets backed by short-term instruments such as repo, bank notes and government bills. None of these are guaranteed to be stable, and treating them as if they are could introduce unseen risk into financial plumbing.

In the end, it comes down to what we mean by “money” and for central bankers, that means a value representation guaranteed by the central bank. I’ve been doing a lot of thinking on this topic – what IS money?? – and I don’t yet have an answer so we’ll put aside for now whether I agree with this definition, it’s not relevant to Angeloni’s point, which is that we’re making the wrong assumption here.

Many of us have long thought that central bankers’ resistance to an evolution in the definition of money stems from not wanting to lose their relevance. I’m coming around to the idea that it’s not that: rather, they and others believe that only the central bank can guarantee stable money (I know, stable against what?, but that’s a different conversation).

Angeloni proposes that we drop the pretence: don’t guarantee 1:1 redemption. Don’t put them on the same security basis as central bank money, because they’re not the same. And that’s ok. Stablecoins can still be extremely useful.

Where I disagree with him is in the frictions he suggests to further ensure substitutability is not perfect: settlement lags, conversion fees and transfer limits. This would put shackles on a new monetary technology, effectively pushing innovation offshore and users into unregulated and unprotected transaction networks. By now, you’d think that authorities have realized that public blockchain activity is impossible to control everywhere, and the more they try, the more they highlight the appeal of open access to those who bristle at overreach. Then again, his suggestions are understandable given central bankers’ instinctive conviction that they can control “money”.

A more practical approach could be to ease off on the promise of convertibility and allow stablecoins to be riskier. No additional frictions are needed – they just don’t carry perfect convertibility guarantees. This may dissuade some banks from wading into the business and thus also hamper the “mainstreaming” of the concept. Or, banks may feel more emboldened to facilitate new payment products if they can worry less about deposit substitution.

And, it could give more scope to the tokens themselves, from basic features such as earning yield to more innovative twists like granting access to certain applications and privileges while at the same time paying for them.

I’m not necessarily arguing for this approach – not yet, anyway, I have to do more noodling here – but it does fit into my thesis that our deeper understanding of what money even IS has changed. Both users and regulators know this, only we’re all still struggling to articulate how that fits into the evolving financial and technology landscapes, while adjusting to a new monetary security paradigm. It’s not easy.

I mean, if even money – one of the key pillars of global society – is changing fast, then what can we absolutely count on?

See also:

ASSORTED LINKS

(A selection of reads outside of crypto and macro, although these may find their way in anyway. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Nathan Levine peels back layers of political philosophy to arrive at the core difference between Trump-style populism and the authoritarian doctrines that came before, be they fascism, communism or New Deal-era social democracy: it’s the role of the managerial class, and the steady creep of bureaucratic control in all areas of life. This Administration is mounting the most meaningful attempt in decades to disrupt not just the global economic order, but also how the US is governed. Unsurprisingly, given entrenched interests, it’s meeting stiff resistance.

(This Idea Explains a Lot About What Has Happened in Trump 2.0, New York Times – paywall)

An eye-opening take on the stark differences between experts and elites, that explains the dynamics between journalists and opinion columnists, advisors and directors, academics and public intellectuals, social scientists and natural scientists… and, the chaos that ensues when elites start to care about a topic. (Experts and Elites Play Fundamentally Different Games, Rob Henderson’s newsletter)

A powerful read from Evan Armstrong on the “technologies of power”, the modern-day panopticon of online social pressure that watches and nudges, and how AI will make surveillance more effective and cheaper. What’s more, we happily walk into the equivalent of Michel Foucault’s “prison”, sharing even our innermost thoughts with apps that compile and track. (The Silicon Panopticon, The Leverage)

The history of the very first financial exchange, at a tavern in Bruges run by the Van der Breuze family (which is where the French word for stockmarket, bourse, comes from). (The Innkeeper of Bruges, The Terminalist)

Oddly endearing, here is an article about how fast AI image generation is evolving that actually resonated with me, one of the first to do so – prepare for a lot of otters. (The recent history of AI in 32 otters, One Useful Thing)

Stuart Kirk rants against our collective disregard for numbers these days, something I’ve fretted about also – $2.4 trillion more on the US deficit? Who cares. Want a good soundbite? Just make up the number of annual fentanyl-related deaths. And those discrepancies in the reported number of Russian planes destroyed? You’re missing the bigger picture here. (No one cares about numbers anymore — go figure, Financial Times – paywall)

On the smugness of youth, the generational persistence of moral condescension, and the constancy of changing values. “OK is temporary.” (The Work of the Worst Article I Ever Wrote, Oliver Bateman Does the Work)

A mind-blowing story by Liam Vaughan for Bloomberg about Ukrainian hackers, seriously shady practices at the SEC, vulnerabilities in archaic data architecture, and the money in information. (The SEC Pinned Its Hack on a Few Hapless Day Traders. The Full Story Is Far More Troubling, Bloomberg, paywall)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

I know it’s only the beginning of June, but here in Spain you can feel that people are gearing up for the summer ritual of closing up their city residence and heading to the beach for a couple of weeks or even longer. Personally, I’m not a beach person and I wouldn’t know what to do with a long holiday, but I do love the mood.

In that spirit, today I want to share one of my favourite songs from the “Spanish pop” genre: here you have Las Ketchup (daughters of the famous flamenco musician El Tomate, geddit?) singing “Aserejé”. The lyrics and the tune beautifully make fun of Spaniards’ inability to correctly replicate lyrics from well-known American rap songs, in this case the Sugarhill Gang’s “Rapper’s Delight”. Unabashedly fun.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.