WEEKLY - ETH ETFs, GENIUS, Citi stablecoin

plus: assorted links, gorgeous images and more

Hello everyone! Apologies for the late send today, summer weekends are inexplicably elastic – I blinked and the morning had gone.

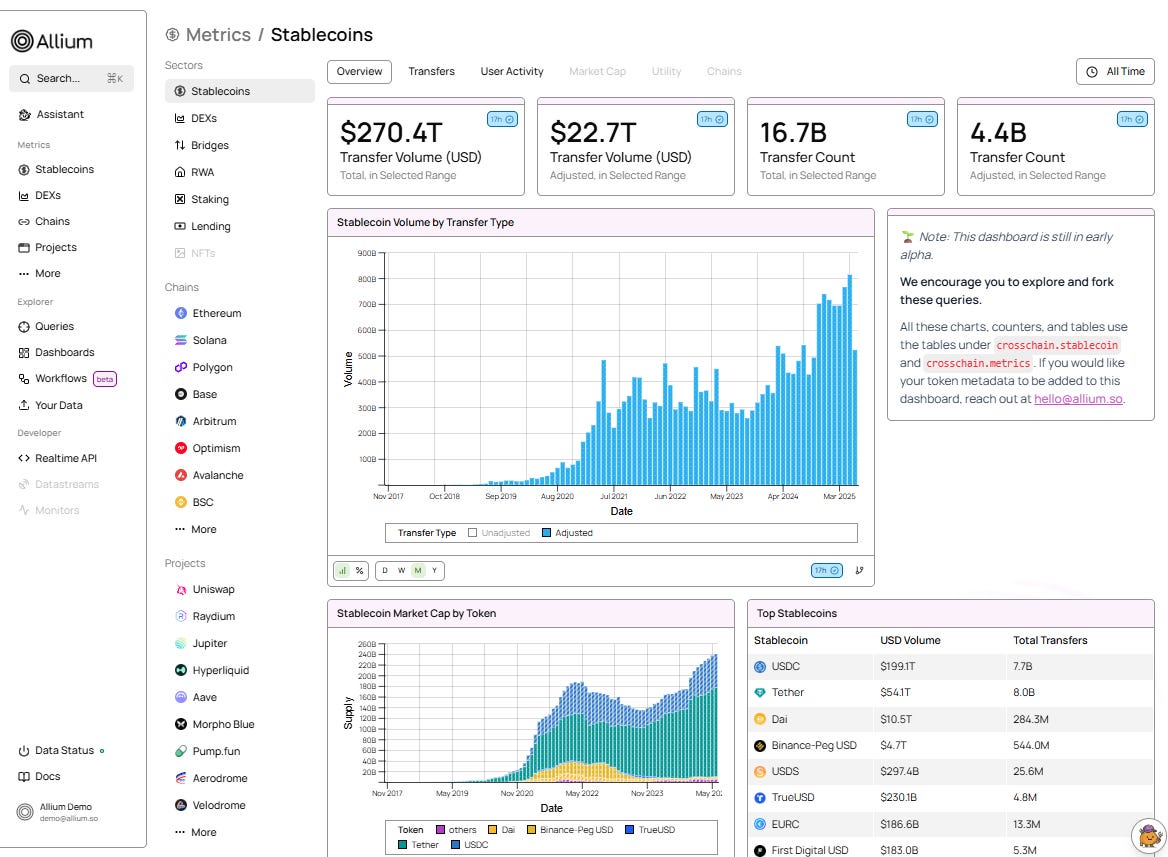

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days, offer some interesting links I came across in my weekly reading, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

GENIUS: A big day

ETH ETF staking proposals highlight a bigger issue

A Citi stablecoin is unlikely

Assorted links: rare earths, socialism, market transparency, sunglasses and more

Some of the topics discussed in this week’s premium dailies:

Coming up: Crypto Week, CPI, Q2 earnings, G20 and more

The canary in the coal mine?

Macro-Crypto Bits: more tariff craziness, ICO season?

The dollar outlook

The US bond outlook

China: not the stimulus you’re looking for

Macro-Crypto Bits: tariffs, markets

Japan’s rocky road

Inflation is stuck

Macro-Crypto Bits: BTC resilience, tariffs, empire, censorship

A Citi stablecoin is unlikely

Macro-Crypto Bits: ETH outperformance, PPI, industrial production, business mood, Genius

GENIUS: A big day

ETH ETF staking proposals highlight a bigger issue

Inflation and data quality

Bitcoin and refugees

GENIUS: A big day

The GENIUS Act was signed into law yesterday.

This is the biggest deal in crypto so far this year, up there with the change in the SEC – it’s the first crypto-focused law in the history of the United States, home to the largest financial market in the world. Just the symbolism alone is worth getting excited about.

And the fact that it is now a law rather than an agency ruling means that future Administrations will not be able to easily overturn its provisions. Should any try, by then stablecoins will be so deeply embedded in the global financial landscape, it would be futile.

As with all bills, there is much to argue about, and of course not everyone is happy, not even within the crypto ecosystem. But overall, the framework will almost certainly boost stablecoin use and experimentation, with more issuers, onramps, applications and platforms seeing increased volumes while feeding more innovation.

This will benefit the whole crypto ecosystem in several ways:

It will boost market liquidity overall. Crypto markets are typically liquid anyway, but stablecoins make it easier to invest in crypto assets. There’s a wider range of trading pairs, settlement is faster and cheaper, and so more stablecoins in the hands of more investors should lead to more crypto trading activity and more liquid markets.

It will benefit the traditional payments landscape. Stablecoins enable faster and more transparent cross-border transfers, which means a standard activity for the majority of businesses can take less time and hold up less capital. This also applies to the billions of individual users around the world hit by high remittance costs and unstable savings vehicles – easier access to dollars not only enables them to transfer money to friends and family more cheaply, it also gives them access to online services that don’t include their local currencies in their baskets.

What’s more, stablecoins offer potential innovations: for example, programable payments is not new, but embedded programmability could broaden the reach and the flexibility.

In sum, GENIUS Act is a first but an essential step towards kickstarting the mainstreaming around the world of onchain token use. A major milestone was reached yesterday – but it’s by no means the last.

ETH ETF staking proposals highlight a bigger issue

Earlier this week, BlackRock filed a proposal to include the distribution of staking rewards for its ETH spot ETF. The asset management giant is behind on this, several other issuers filed similar proposals a while ago. The first final deadlines are in October whereas the final deadline for BlackRock’s iShares fund proposal isn’t until next April. But, there’s no obvious reason for the SEC to make BlackRock wait that long once the decision is already taken.

This gets to the heart of a bigger issue with SEC ETF decisions. It’s likely that the SEC will authorize staking distribution for all ETH spot ETFs at once. But some asset managers are pushing for a more orderly process, with the first to file getting to launch first. Last month, VanEck, 21Shares and Canary Capital sent a letter to the SEC arguing that bulk approvals hurts competition as the “first movers” get no advantage, especially if the big funds come in late once they’ve seen there’s likely traction and then get most of the inflows merely due to their size.

Put differently, the bulk decision policy makes it harder for the “little guy” to offer something new. This, the authors of the letter argue:

“diminishes investor choice, compromises market efficiency, and fundamentally undermines the commission's mission of protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation.”

We could soon see this play out in the ETH spot ETFs.

Franklin Templeton, Grayscale, 21Shares and Fidelity have already filed to allow the distribution of staking rewards, some as far back as February. Understandably, they want a head start on BlackRock’s iShares ETHA vehicle, which is much larger and benefits from the mammoth BlackRock distribution engine.

BlackRock, on the other hand, will no doubt insist it is more a more efficient use of SEC resources to bulk-approve, arguing it gives market participants more choice, not less.

There is a lot at stake here, and it goes beyond who wins the fund inflow race. It’s also about the SEC’s reputation for fairness, and what some suggest is the outsized influence of crypto market participants in the current Administration. Before the BTC and ETH spot ETF approvals (by the previous Administration), the norm was to approve on a first-in-line basis.

We won’t have to wait long to find out what the SEC will do – as I mentioned above, the first final deadline is October, but it’s unlikely the agency will make us wait that long. Approval is expected – but for all of them, or just for the early filers?

A Citi stablecoin is unlikely

In this week’s Q2 earnings call, Citi CEO Jane Fraser confirmed that, like many US banks, her organization is looking into issuing a stablecoin.

This does not mean they will do so, as “looking into” is the easy part, and saying “no, we’re ignoring that” would trigger more adverse publicity than is warranted.

But, I’ll go on the record as saying they won’t issue a stablecoin. And they know this.

They don’t seem to think it's a good idea – tokenized money moving around a permissioned network, on the other hand, solves some client pain points while positioning banks as innovative. Put differently, doing what they’ve always done only on a new type of ledger is as far as they seem willing to go.

Fraser pretty much confirmed this in her answers to analyst questions, some of which gave easy opportunities to expand on why she said they were “looking at the issuance of a Citi stablecoin”. She adroitly avoided the topic, instead focusing on the virtues of a closed blockchain network, stressing how successful Citi Token Services has been and how staying within the bank’s walled garden could save considerable transaction costs when converting from stablecoins into fiat.

Basically, without uttering these exact words, she pretty much said “we’re looking at stablecoins because we have to, but we plan to focus on our core competency which is managing our clients’ payments and for that our permissioned Citi Token works just fine”.

An analyst followed up with another stablecoin opening, outlining the advantages of a multi-bank network such as what Circle is building, and how “impenetrable” a stablecoin collaboration with other big banks such as Bank of America and JP Morgan would be. Her answer? “We don’t need another bank.”

What is Citi Token Services? It started out in September 2023 as a pilot exploring tokenized deposits, contracts and other assets on a private blockchain. Among the early users were shipping giant A.P. Moller-Maersk, testing tokenized letters of credit as well as payment, and consumer goods manufacturer Mars, testing treasury management and instant transactions.

The pilot for tokenized deposits, known as Citi Token Services for Cash, went live in Singapore and New York in October 2024, has since added the UK as well as Hong Kong. According to Fraser, Citi Token Services has already moved “billions in transaction volume in this year”.

This highlights what banks are good at: servicing as much of clients’ financial activity as possible. And offering tokenized services could lead to more business – clients get fast, cheap transfers which perhaps encourages them to transact more, and they might as well experiment with other tokenization services now that they have streamlined administration and convenient settlement.

What are banks not good at? Deep innovation in their business models. To a large extent, it’s not their fault as regulation won’t let them stray from careful boundaries. But it’s also just not in their DNA – ask anyone who has tried from within to get them to understand that the marketplace is changing. Most ended up leaving to join a startup; and those that haven’t, well, they probably will.

Just as it was unrealistic back in the day to expect candle makers to explore electrical wiring, or to expect typewriter manufacturers to even think about how to beat tech companies at word processing services, banks will continue to see finance through their client-centric lens. For them, it’s about owning the relationship, while public blockchain services are about the breadth and flexibility of networks.

That doesn’t mean banks won’t be instrumental in the emerging digital asset space. Those of us in the crypto industry forget that most bank clients are conservative, either afraid of change or unaware of the opportunity. For them, digitizing a corporate bond is as “cutting edge” as they can contemplate, and of course they’ll want to do it with trusted partners.

It’s a valuable step. This is the safe onramp mainstream corporates will need to move into the onchain economy. But once there, confidence will grow as will curiosity about the potential market reach outside the walled garden.

But that’s a long way off yet. As Fraser pointed out, even Citi Token Services is still in early days: “What's holding us back at the moment is our clients' readiness to operate”.

With time, this will change, especially with passage of the GENIUS Act and, hopefully, a crypto market structure bill later this year. Meanwhile, we will see additional walled garden services from banks, more frequent explorations with crypto-native securitization and enterprise application firms, and more big names getting excited about tokenization of real world assets.

We will also continue to see misplaced excitement around big banks “looking at” stablecoins, when what they will really be doing is diving into better payment services between clients. That’s fine, excellent even, and any step forward in lived tokenization experience should be celebrated – but it’s not yet institutional validation of the potential.

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one! For $12/month, you’ll get ~daily commentary on how crypto is impacting the macro landscape, and vice versa. I talk about adoption, regulation, tokenization, stablecoins, CBDCs, market infrastructure shifts and more, as well as the economy and investment narratives.

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Tyler Cowen argues that the pivot of the young to socialism is not about a belief in that particular economic and political ideology – it’s about “negative emotional contagion”, which is leading to the embrace of a dark, pessimistic version of the doctrine. (Why Won’t Socialism Die?, The Free Press – paywall)

Insight into just how powerful China’s rare earth strategy is, and what Europe could do to counter it. (The Rare Earths Noose, The Brawl Street Journal)

On the surface, this article is for market infrastructure nerds – but it’s actually about the debate around trade transparency. Do traders have a right to know what’s going on in the market at any given time? The intuitive answer is yes, but transparency comes at a price: it can increase the risk of adverse market impacts of large block trades, which in turn can make them more expensive while causing some market makers to step back. (How some sunshine will affect Europe’s bond market, FT Alphaville)

There are few things more controversial than “best film” lists, whoever does the compiling. Yet rather than get upset over inexplicable inclusions and glaring omissions, they’re really a trigger for introspection – what do we enjoy and why? What does that say about us? This list from Greg Gioia is thought-provoking, and I confess I haven’t even heard of at least half of the films on here. But I appreciate how he identified his criteria, and the consideration he gave each entry. Have you tried making your own list? (The 100 Best Movies of the 21st Century, All the Movies)

I don’t read sports articles much, but this moving take on Amanda Anisimova’s handling of her brutal defeat in Wimbledon last weekend is a reminder that failure is rarely the end – much depends on how we face it. (Why Amanda Anisimova’s emotional post-match interview was a masterclass in handling failure, The Athletic – paywall)

I have to admit I have never given much thought to sunglasses beyond “do these look good on me?”, but this podcast episode opened my eyes (ha!) to just how fascinating their origin and evolution are. (Sunglasses, Articles of Interest by Avery Trufelman)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

It’s been a while since I shared a photography contest selection with you, and given the noise in our feeds, it feels like a particularly appropriate time for glimpses at worlds far away (even if nearby).

These are from the recent International Aerial Photographer of the Year competition – not necessarily the winners, but images that took my breath away. Enjoy.

by Azim Khan Ronnie

by Chris Ha

by Vitaly Golavatyuk

by Christopher Harrison

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.