WEEKLY, Feb 10, 2024

Hi everyone! You’re reading the free weekly edition of Crypto is Macro Now, where I update and/or re-share a couple of things I wrote in more detail about during the week. If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links.

If you’re not a premium subscriber, I hope you’ll consider becoming one! It would help me continue to explore the deepening intersection of the crypto and macro landscapes - given what’s going on in the world, it matters now, more than ever. With a premium subscription, you’ll get a daily update on relevant progress along with some market commentary and deep dives into trends, narratives, experiments, opportunities and obstacles. There are also charts, links to interesting podcast episodes and long reads, and a running commentary on some of the craziness out there. And an audio version of the newsletter! A bit clunky still, but I’m getting better at the recording.

Follow me on X at @noelleinmadrid where I share photos of gorgeous city I live in, charts, comments on headlines, and, you know, stuff depending on the mood.

Of course, nothing I say is investment advice!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

Note: I’m speaking at BlockWorks’ upcoming Digital Asset Summit conference in London on March 18-20. Normally I say no to conferences, but this is one of the very few worth travelling for. If you’re thinking of going, it’d be great to say hi, and here’s a discount code you can use: CIMN10.

In this newsletter:

The crypto bill that is likely to pass and could make a big short-term difference

About that budget deficit…

BTC on the move

Some of the topics discussed this week:

Bitcoin: a new regulatory attack vector

The market rout in China and what it could mean for crypto

Buying support for BTC

How the Chinese navy is relevant to crypto

In the US, signs of easing despite inflationary pressures

What macro fund managers are thinking

The liquidity puzzle

The crypto bill that is likely to pass and could make a big short-term difference

Normally, I don’t get excited about crypto-related bills crawling their way through the halls of power, because so few of them go anywhere. Today I’m going to make an exception.

Last week, Representatives Wiley Nickel (D-NC) and Mike Flood (R-NE) together with Senator Cynthia Lummis (R-WY) presented a joint resolution asking for official congressional disapproval of a bulletin issued in April 2022 by the US Securities and Exchange Commission (SEC). The representatives and senator also presented a bill, the “Uniform Treatment of Custodial Assets Act”, that aims to prevent Federal agencies from requiring any assets in custody to require a capital offset beyond those established by banking regulators.

I bring it up because this bill has a good chance of being successful, perhaps even before the end of the current Administration. If so, it would be a very big deal for the crypto ecosystem, on many fronts. This is one worth watching and worth rooting for.

Some background:

In April 2022, the SEC published Staff Accounting Bulletin (SAB) 121, which stipulated that all listed banks had to record the dollar amount of crypto assets held in custody on their balance sheets as liabilities, offsetting this with a corresponding capital provision.

Assets held in custody are generally not held on the balance sheet, which makes sense since they do not belong to the custodian. Custody is a service and does not imply investment in or ownership of the assets.

This put the lid on plans by large, regulated institutions such as BNY Mellon, State Street (two of the largest custodians in the world) and others to offer crypto custody services to their clients. The bulletin effectively made the business line unprofitable, since the foregone income on tied-up capital would not be offset by custody fees at current market rates.

You might have noticed that none of the custodians for the BTC spot ETFs are regulated banks – this is why.

What’s more, SEC Chair Gensler himself admitted that this bulletin was drawn up without consulting bank regulators. His defence was that the SAB explicitly says that the measures “are not rules or interpretations of the Commission, nor are they published as bearing the Commission’s official approval” – but the document went ahead and gave a deadline for compliance (pretty much right away). This implied the intention to enforce… even though the measures are not rules or even interpretations. Confused?

Gensler also justified the document as an explanation, like in many other SABs, of how to apply existing accounting standards. Only, at the time there weren’t any accounting standards around crypto assets to follow.

Of course, the SEC can and should mandate disclosure and reporting requirements of listed companies. But SAB 121 sets accounting standards that materially impact the business operations of banks. That is overreach.

What’s more, the SEC’s “guidelines” are in conflict with crypto custody guidance from Basel (which sets global regulatory standards for banks) and the Office of the Comptroller of the Currency (the US bank regulator).

Obviously, this did not go down well with banks, crypto investors or other regulatory bodies.

And in October of last year, the Government Accountability Office (GAO) ruled that the SEC did not follow proper procedure in implementing this measure, and that it should be considered not a guideline but a “rule” under the Congressional Review Act (CRA). This legislation, enacted in 1996 to bolster congressional oversight of agency rulemaking, requires a detailed cost/benefit analysis and a period for public comment before submission to Congress, which has the option of rejecting the rule.

Despite the official slap on the wrist, the SEC refused to withdraw the bulletin, saying that the GAO’s opinion “does not otherwise affect the status of SAB 121”.

Nevertheless, the GAO decision put on record that the SEC overstepped its bounds.

Last week’s submissions to Congress take the pushback to the next and hopefully final step, which involves passage by both chambers and the President’s signature. It is unusual for a President to overturn a decision by an appointee, but not doing so in this case would imply a disregard for government procedure, probably not a good look in the runup to an election. (True, the President does arguably have more important things to worry about – but this is a quick fix that would win points.)

Why is this a big deal?

If SAB 121 is overturned, regulated banks could custody crypto assets. Many crypto enthusiasts will argue that this is not what the crypto ecosystem needs at all – but the greater the involvement of legacy finance, the better the investor protection, the higher the levels of institutional investment (good for prices), and the deeper the market infrastructure as well as the liquidity.

Also, it would be yet another public wrap on the knuckles for Gary Gensler’s SEC. This would further highlight the agency’s recent attempts at over-reach, its power-hungry disrespect for the legal process, its disregard for the interests of the people it is supposed to protect, and its deteriorating relationship with the entities that power the markets it is tasked with overseeing.

Finally, it would mark the starting gun on Congressional oversight of crypto assets. Unlike some of the other measures under consideration, the latest proposals are simple, and their approval could change the feasibility of bank crypto custody almost overnight.

They would also send a signal that Congress understands that crypto assets are a feature on the financial landscape, and that a significant portion of the voting public as well as some systemic institutions are interested.

The ecosystem has been clamouring for years for federal regulations that support sensible approaches to crypto asset trading and investment. The current piecemeal approach by unelected officials is inconsistent and inefficient, dampening innovation in a country that is supposed to lead the world in financial innovation and the entrepreneurial mindset.

In a hearing yesterday before the House Financial Services Committee, Treasury Secretary Janet Yellen lent her support to more comprehensive rules, saying:

"Congress should pass legislation to provide for the regulation of stablecoins and of the spot market for crypto assets that are not securities."

This is not the first time she and other senior officials have said this – but coinciding with the Nickel/Flood/Lummis bill, the statement takes on a new weight.

When could we expect to hear something? I have no idea, but hopefully before Congress gets swept up in even more pre-election chaos. The fact that it has taken almost two years to get to this stage, however, shows how s-l-o-w-l-y US legislation moves.

Meanwhile, there’s a chance of civil action taken against the SEC on this basis. Given the GAO ruling, anyone suing the securities regulator for the unlawfulness of SAB 121 has a strong chance of winning.

Even if the bills end up getting buried, they are unlikely to be forgotten. Tearing down SAB 121 matters. Stopping SEC overreach matters. And for all of us crypto market observers, encouraging more robust market infrastructure matters.

About that budget deficit…

On Wednesday, the Congressional Budget Office (CBO) released its forecasts for the evolution of US federal spending and the budget deficit for the next ten years.

There are many startling predictions in there, made even more stark by the strong likelihood that the CBO is underestimating the coming expenditures and overestimating the revenue. I’ll talk more about the CBO’s track record in a moment, but here are just a few of the eye-openers from the report:

This year, net interest expense is expected to be higher than defence spending. And that’s even with lower interest rates.

More than one third of expected individual income tax revenue this year will go toward paying interest on the government debt.

By 2034, in just 10 years, the US will be paying out more in interest payments than the whole of the 2023 budget deficit.

US government debt as a percentage of GDP was 48% on average between 1974 and 2023. This year, the percentage is expected to be more than double that.

Here is the published table with more detail:

(table via the Congressional Budget Office)

Let’s look at some of the lines more closely.

Individual income tax revenue is expected to climb over 13% in 2024. From higher wages? More people working? If either are true, we can expect US interest rates to remain higher for even longer. Or maybe tax rates will be going up? In an election year, I doubt it. Capital gains will probably be notably higher, given the strength of the stock market last year – and should the economy get shaky, many will sell. But that then calls into question the forecasts for payroll and corporate taxes.

Looking at the line for defence spending, we can see that it will be heading up. But as I wrote a couple of days ago (and on January 23), the US is being outspent by geopolitical rivals. If it wants to maintain its global influence (and we have to assume that it does), it will have to spend more, and not just on military readiness. A couple of days ago, Bloomberg reported on a $250 million US-backed railway line from Zambia to the west coast of Africa. This is to counterbalance China’s growing influence in the region, and its dominance of African infrastructure. For instance, earlier this week, China announced a $1 billion project to refurbish a railway connection from Zambia to the east coast of Africa. We can expect more of this competitive spending, especially as other geopolitical rivals are likely to soon step in.

There are some untold stories in the CBO economic forecasts, as well.

Take a look at the expectations for the 10-year yield – it increases from around 4.0% in 2023 to 4.6% in both 2024 and 2025. Wait, aren’t rates and therefore yields supposed to fall?

(table via the Congressional Budget Office)

The CBO does have the federal funds rate dropping, as well as the 3-month Treasury yield. But, here’s the kicker, the 10-year yield goes up along with the percentage of debt to GDP, according to CBO statistical analysis. This makes sense if investors price in additional risk. But the higher yields will keep both government and corporate financing relatively expensive, which could depress GDP growth. But, no, the CBO has that picking up in 2025.

How good are the CBO forecasts? In December, the office published a report disclosing where it went wrong on its expectations for 2023. It turns out that, even adjusting for legislative changes, it overstated revenues by 11%, and understated expenditures by 9%. This itself is not surprising – forecasts are hard. It does remind us that the expected deficit for 2024 and forward is likely to be even steeper than the already dire projections.

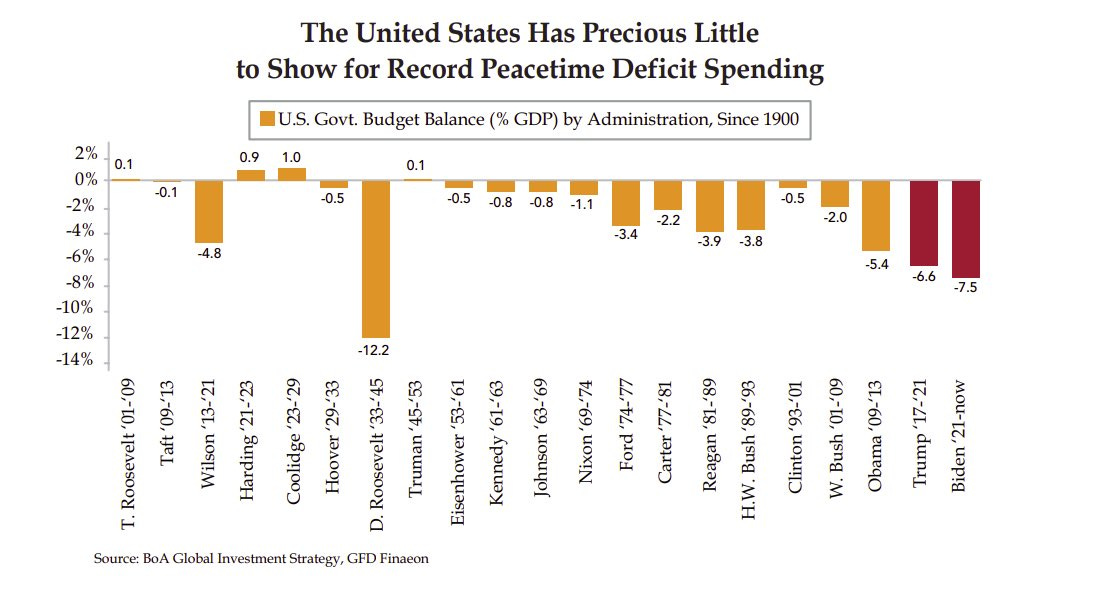

Here's another alarming statistic: the Biden Administration has the highest peacetime deficit spending since Roosevelt’s in the run-up to WWII.

(chart via @DiMartinoBooth)

One way to monitor growing unease about the levels of US debt relative to income is via the price of CDS insurance. It is currently almost three times the level of a year ago, and much higher than even during the pandemic.

(chart via MacroMicro)

All of this ties into one of the key themes supporting the growing interest in crypto assets: the inevitable continuation of liquidity injections and money printing, even in what is regarded as the world’s strongest currency.

As I’ve written often, the dollar may still continue to be the best of a weak bunch, even after the coming dilution – but measured against a basket of hard commodities (energy, gold, bitcoin), its value can only continue to erode.

BTC on the move

Is that what moved the BTC price this week? Investors are worried about dollar depreciation?

It’s probably part of the narrative driving longer-term accumulation; but as always in crypto markets, there are many things going on at any given time.

Over the past week, BTC is up almost 10%, bringing the 12-month appreciation up to 120%.

(chart via TradingView)

A few days ago, I wrote about how it appeared that some buying from Asia was keeping the BTC price from dropping in reaction to the hike in US yields and the DXY index – now, it seems that either more buying pressure is stepping up or selling pressure is easing.

It could be the former: net inflows to the BTC spot ETFs has been picking up all week, with over $540 million yesterday alone. Total net inflows to date are now more than $2.6 billion, which is pretty amazing.

(table via BitMEX Research)

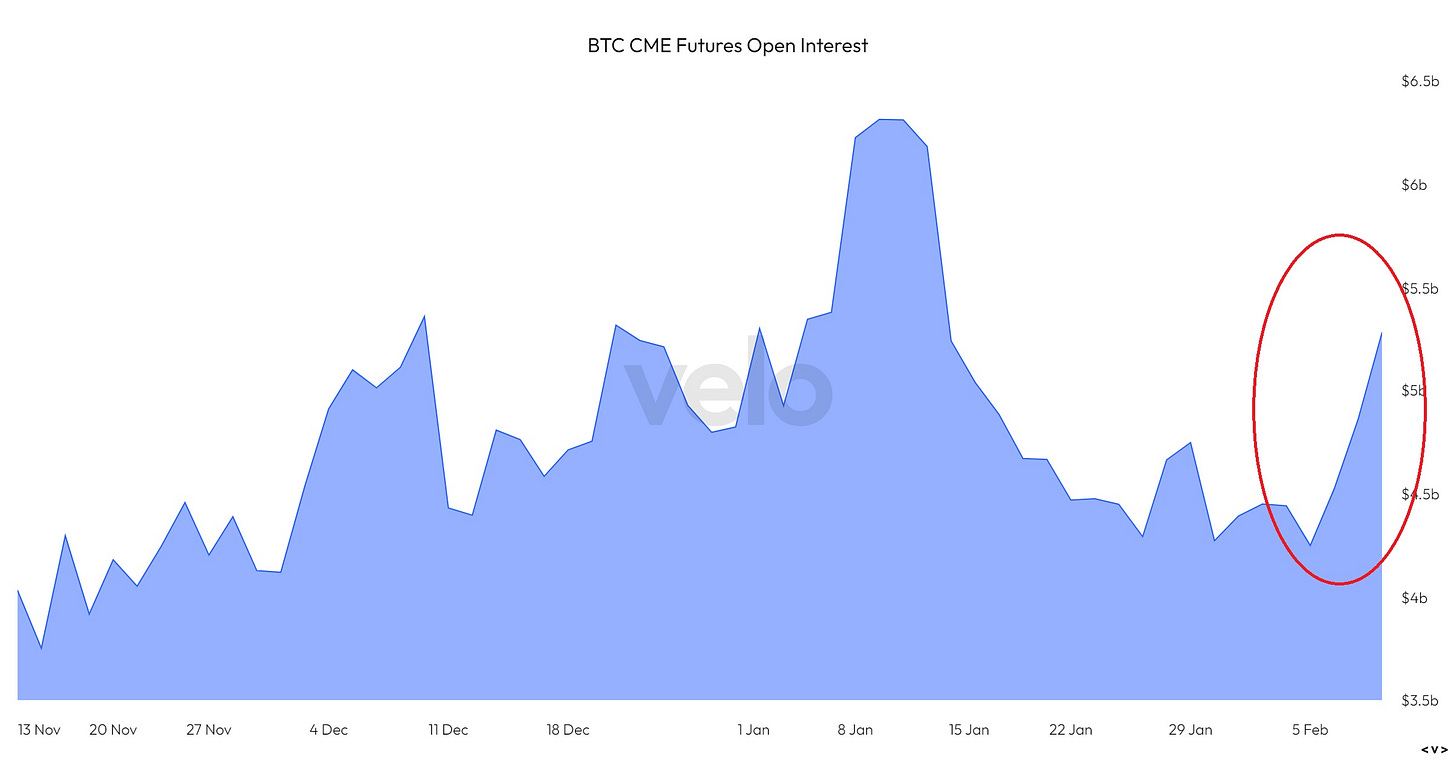

US-based institutional speculation seems to be reawakening. BTC futures open interest on the CME has been climbing since the beginning of the week, and is now back to levels last seen during the BTC spot ETF listing frenzy.

(chart via velodata)

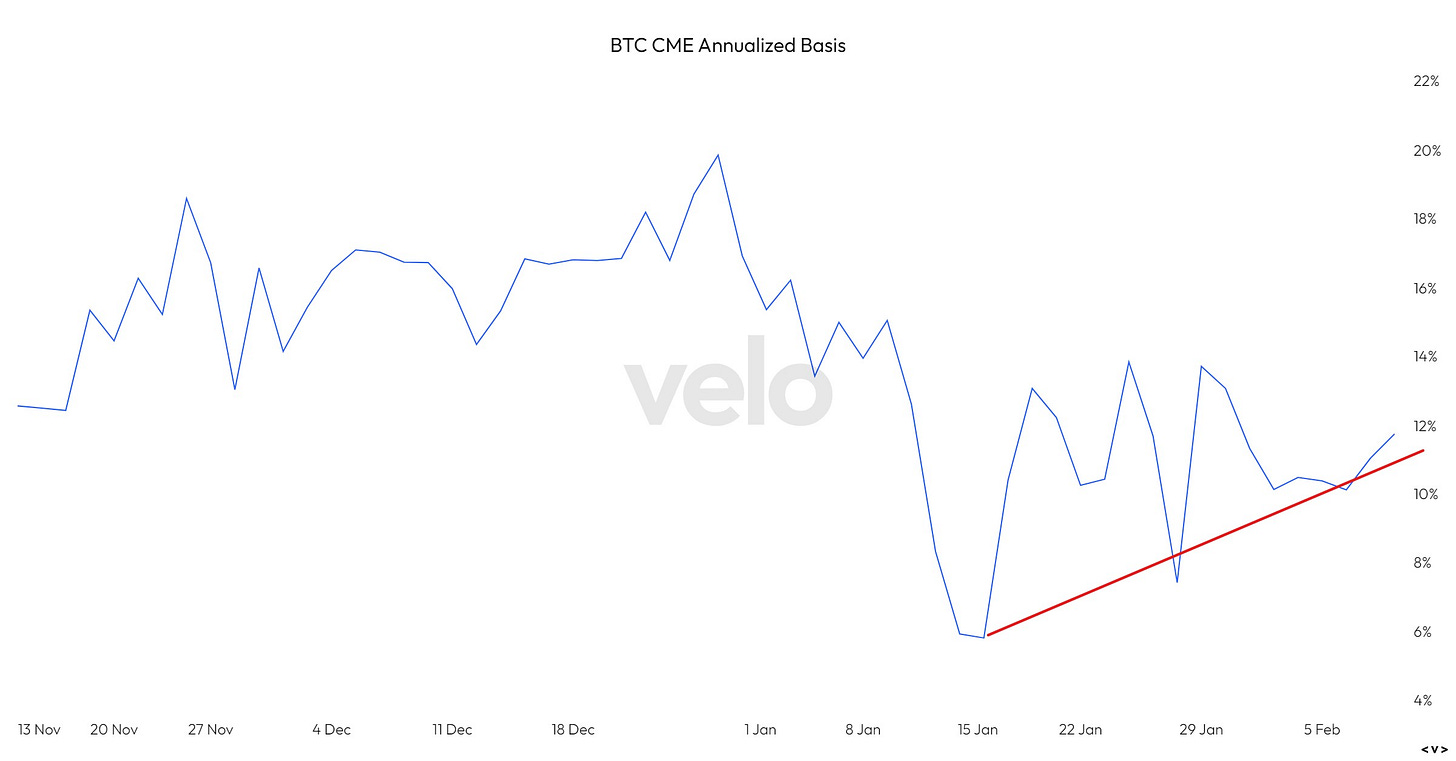

And the 3m basis (the difference between the futures price and the spot price) is rising.

(chart via velodata)

Of course, BTC will continue to swing up and down as long as there are speculators, and I still believe it could get hit by risk-off sentiment should the stock market turn.

But, the global currency depreciation narrative will only get stronger from here; access to BTC as a portfolio diversifier is getting significantly easier; the tone from the mainstream media is starting to shift in favour again; and the halving is coming up, which is likely to trigger even more interest, especially against a backdrop of government budget crises and spending bills.

HAVE A GREAT WEEKEND!

I have a movie recommendation for you this weekend: Marcel the Shell with Shoes On.

It offers scoopfuls of quirky charm with bowls of creativity and a sprinkling of weirdness – the perfect antidote to the firehose of foaming rage and sharp anxiety in our feeds and chats.

There’s no way to describe what it’s about that does it justice, but I can say that it involves a shell called Marcel and he does have shoes. Beyond that, it’s about friendship, family and fear of loss, and it had me chuckling and weeping and feeling like the connections that life throws our way can make the day-to-day utterly sublime.

Thanks. You write that “the US is being outspent by geopolitical rivals”. Doesn’t sound right, maybe in small, specific corners of the world, but not globally.

US has been - by big margin - the biggest military spender according to sources I could find, some mentioned here: https://www.perplexity.ai/search/aaae1551-1083-415a-a542-0da7888bcb71