WEEKLY, March 16, 2024

BTC is still (also) a macro asset, US budget deficit ballooning, misplaced ETH ETF enthusiasm

Hi everyone! I hope you’re all doing well.

You’re reading the free weekly edition of Crypto is Macro Now, where I update and/or re-share a couple of things I wrote in more detail about during the week. If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links.

If you’re not a premium subscriber, I do hope you’ll consider becoming one!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

Programming note: I won’t be publishing a weekly next Saturday, March 21, since I’m travelling next week with an irregular schedule. Back the following Saturday!

In this newsletter:

BTC reminds us it is still (also) a macro asset

US budget deficit continues to balloon

Misplaced excitement about ETH ETFs

Some of the topics discussed this week:

Record BTC ETF inflows

Politics and crypto

Meme signals

Crypto spot ETFs in the UK?

Swedish hypocrisy

Dencun goes live

The weird reaction to the employment data

Where the CPI could matter

BTC reminds us it is still (also) a macro asset

Rate cuts? What rate cuts?

Thursday delivered even more evidence that inflationary pressures have not disappeared, further consolidating the Fed’s cautious stance.

The US producer price index (PPI) represents prices paid to US producers and is often regarded as a leading indicator of consumer price index (CPI) moves as it more closely reflects input costs passed on to the final customer. And it’s sending worrying signals.

On Thursday, we got the US PPI data for February, which came in much higher than expected with a 1.6% year-on-year growth in February (vs 1.1% expected, 1.0% in January) and a 0.6% jump month-on-month (vs 0.3% expected and previous), the highest increase in six months.

Core PPI also beat forecasts although by less, highlighting the role of energy costs in the headline figure. Core PPI in the US for February increased by 0.3% month-on-month, higher than the 0.2% expected but less than January’s 0.5%. The year-on-year figure held steady at 2.0%.

(chart via Bloomberg)

What’s more, US retail sales for February came in at 0.6% month-on-month, slightly less than the expected 0.8% but still the highest growth since last September.

This latest confirmation had a stronger impact on rates expectations than did the upside surprise to the CPI data out on Tuesday, with the consensus number of cuts by the end of the year dropping to three, finally matching the Fed’s official forecast. Next week, after their rates-setting meeting, the FOMC will publish an update to their economic projections which could show higher expected fed funds and inflation for 2024.

(chart via Bloomberg)

Thursday’s data also had a more pronounced effect on US benchmark 10-year yields, briefly pushing them above 4.3% for the first time this month.

(chart via TradingView)

The cumulative effect of the week’s bad news on inflation jolted BTC out of its confident climb. The CPI data on Tuesday had a delayed impact (possibly due to initial buying support which eventually waned), but prices swiftly recovered pre-data levels. The latest reminder of the gravity of the rates expectations adjustment understandably did more damage, pushing BTC back below $69,000, with the continued hit to sentiment continuing yesterday.

(chart via TradingView, downloaded Friday 12:30pm)

While always disconcerting, drops like this serve as a reminder that BTC will never totally decouple from macro drivers. However, currency dilution continues and is likely to take the investment narrative mantle again once the market calms down. And Putin’s sabre-rattling about nuclear weapons isn’t exactly going to weaken the need for geopolitical hedges.

US budget deficit continues to balloon

Earlier this week, the US Treasury published a budget deficit update, with some startling but not surprising figures:

In the first five months of this fiscal year (October-February), the US budget deficit has grown by almost 20%… in a period of economic growth and no direct war involvement.

Interest costs are up more than 40%. They now make up over 16% of total government outlays, vs 12% for the same period in the previous fiscal year.

In contrast, defence spending was up only 12%, and health and social spending was up around 3%.

The chart below shows the breakdown of government outlays over the past five months, with the largest chunks going to social expenditure and interest payments. Social expenditure (medicare, social security, income protection, etc.) will almost certainly increase notably in an economic recession without some politically unpopular adjustments (extremely unlikely in an election year). And with US CPI inflation seemingly stuck, the likelihood of interest costs coming down any time soon is unfortunately infinitesimally low for now.

(chart via US Treasury)

So, we’re looking at a ballooning US deficit, which will necessitate even more debt issuance.

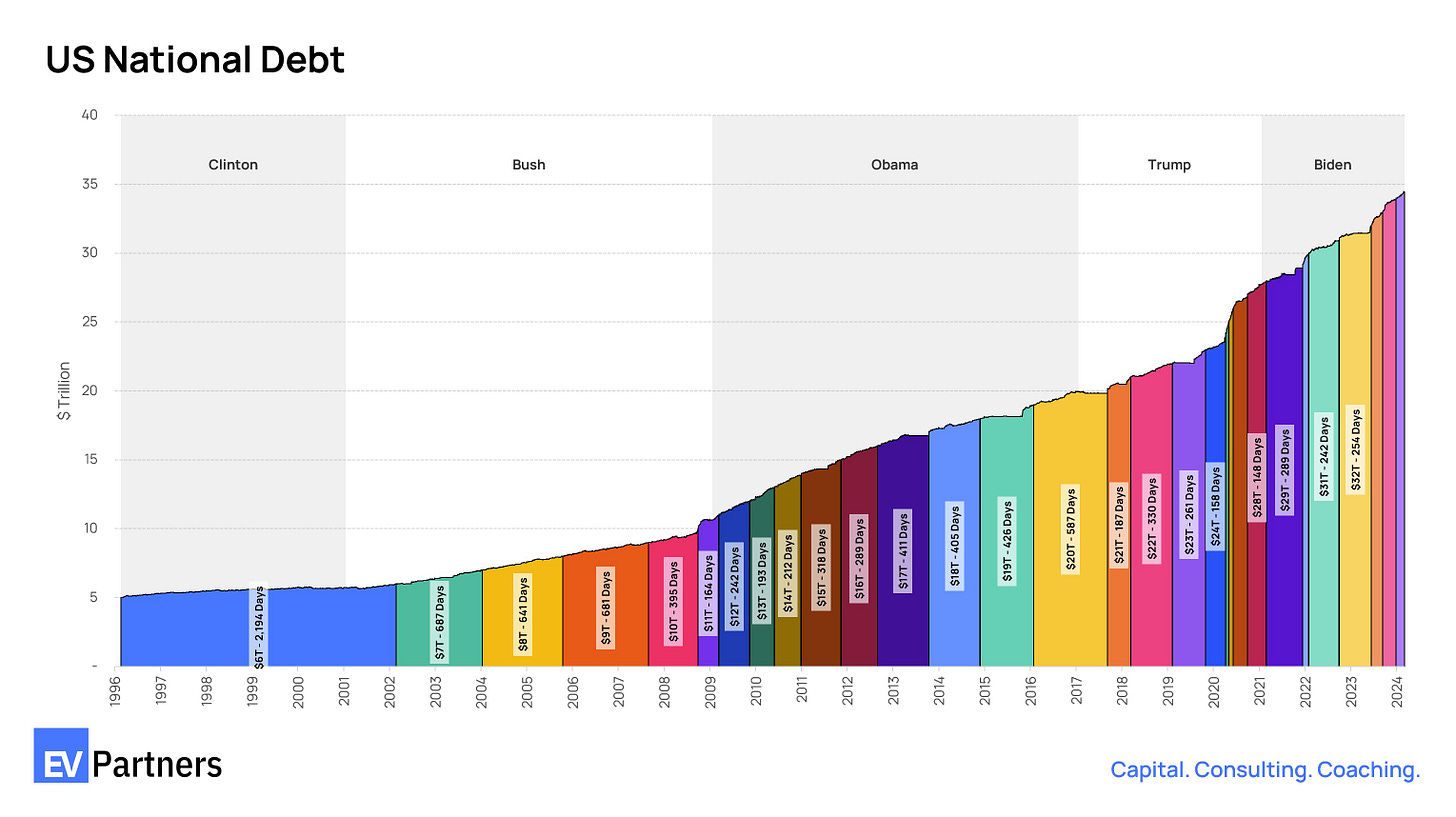

This chart shared on X by Robert Sterling is a colourful way to grasp the acceleration of the growth in US government debt – each bar represents an additional $1 trillion.

(chart via @RobertMSterling)

Extrapolating forward, unless domestic and foreign demand for US debt keeps pace with the acceleration of issuance, US yields will remain elevated, pushing the interest burden even higher. One solution could be for the Federal Reserve to step in and mop up unwanted bonds, officially bringing back Quantitative Easing. Either way, the supply of dollars is likely to head up at an accelerating rate.

With other currencies likely to fall into a similar trap, portfolios will increasingly need the diversification potential of assets with a hard supply cap. And even old-school bankers will start to realize that bitcoin is not just about speculation.

Misplaced excitement about ETH ETFs

There’s a fair amount of chatter swirling around this week about the ETH spot ETF proposals, and not necessarily of the optimistic kind. Earlier this week, Bloomberg ETF analyst Eric Balchunas posted that he has halved his odds of an ETH spot ETF listing in May from around 70% to 35%, largely due to the lack of signs of movement from the SEC. The regulator did meet with Grayscale and Coinbase last week about the former’s proposal to convert its Ethereum trust into an ETF. But, as far as I know, we haven’t heard of meetings with the other issuers.

As Eric’s colleague James Seyffart points out, by this stage in the BTC spot ETF process, the SEC was fielding frequent meetings with issuers and flinging out detailed comments. It seems that none of that has happened yet. And crypto lawyer Jake Chervinsky has suggested that the policy mood in Washington DC right now makes a denial more likely.

I agree with this. Unless the already overworked SEC team embarks on a flurry of meetings with issuers over the next few weeks, it doesn’t look like all the boxes will be checked to the regulator’s satisfaction by the first set of final deadlines (the last week of May for VanEck, ARK and Hashdex, according the latest information I have). Plus, the SEC has no interest at all in giving the crypto industry another win, and it has little reason to divert scarce resources.

So, come May, the SEC could issue a denial with reasoning, which could include something about ETH maybe having become a security with the transition to proof-of-stake – Gensler has hinted about this in the past (although the classification of ETH does not need to impact its viability for a spot ETF – both commodity and security ETFs exist). A denial in turn could result in either a lawsuit, which would drag on for months and could go either way. Or, the issuers could just refile and hope that Gensler loses his job with a change in administration (or sooner).

Another possibility is that the SEC asks the involved issuers to withdraw their applications and refile. This would buy the SEC more time, and the issuers may choose to go along rather than enter a knuckle fight.

One of the reasons could be that there’s less at stake (ha!) with an ETH spot ETF. It’s unlikely to be anywhere near as successful as the BTC spot ETFs, which have arguably exceeded even optimistic expectations, and have entered the record books with levels that will be almost impossible to beat. In just two months (has it really been only two?), the BTC spot ETFs have accumulated over $55 billion in net assets and generated $110 billion in volume. BlackRock’s IBIT and Fidelity’s FBTC are third and fourth among all ETFs in terms of year-to-date flows.

(table from March 11, via @EricBalchunas)

Why would an ETH spot ETF be less successful? Because, even though some issuers have included staking distribution in their proposals, it’s unlikely to be allowed since there’s still a lot of regulatory fog around the activity. And without staking, an ETH spot ETF is a bad product, notably worse than simply holding and staking products on one’s own account, or investing in products outside the US that do distribute at least some staking rewards.

Plus, there’s a conceptual issue here that is not as present with BTC. This statement may irritate many, but ETH was created to be used, not held. It is the fuel for the largest distributed computing platform in the world, and powers a breathtaking range of decentralized applications. There are also a wide range of applications even beyond staking that can deliver an attractive yield to ETH holders willing to deposit tokens in certain contracts – this is not available to ETF holders. ETH can be a store of value, but that’s not where its main advantage lies, and the more ETH is held in “store of value” accounts such as ETFs, the less it is pushing finance into a new paradigm. BTC, on the other hand, will perhaps one day also power decentralized applications – this is being worked on, and is fascinating, but is at an early stage.

Basically, for BTC a spot ETF makes sense. For ETH, less so.

That said, choice is good, and offering institutional and retail investors the opportunity to diversify portfolios with ETH exposure in a convenient package will benefit crypto and traditional markets. Approval of the US listing of an ETH spot ETF would be very good news indeed, in terms of market structure and opportunity.

What I worry about is the expectations. There are many drivers behind ETH’s eye-watering price increase so far this year (62%, same as BTC).

(chart via TradingView)

One is the Dencun upgrade, which went live on Wednesday and should boost activity on Ethereum layer-2s.

Another is ETF expectations, and if these end up being disappointed, this could deflate the market. A slump in ETH could drag other crypto assets down with it, which would interrupt the current bull market momentum.

Hopefully none of this comes to pass. I expect the SEC will eventually approve the US listing of ETH spot ETFs, and hopefully by then the bulk of the bull run is already behind us, profits have been locked in, and a change in SEC governance is near. Hopefully ETH spot ETFs will attract enough flows to avoid sharp disappointment, and the liquidity injection will boost the DeFi ecosystem back to previous bull market levels. One can hope.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

HAVE A GREAT WEEKEND!

In honour of St. Patrick’s Day tomorrow and of my Irish grandparents, today I want to share a few of my favourite Irish toasts, or at least the ones that motivate and uplift and apply to pretty much any situation, drink in hand or not:

“May your heart be light and happy,

May your smile be big and wide,

And may your pockets always have

A coin or two inside!”

“May you have the hindsight to know where you’ve been,

The foresight to know where you are going,

And the insight to know when you have gone too far.”

“Always remember to forget

The things that made you sad.

But never forget to remember

The things that made you glad.”

“May the roof above us never fall in,

And those gathered beneath it never fall out.”

“May the road rise up to meet you.

May the wind always be at your back.”

(photo by Anna Church on Unsplash)