WEEKLY, March 2, 2024

BTC resilience, the long-term impact of sanctions, crypto activists win again

Hi everyone! After an intense week, I do hope you get a chance to disconnect this weekend. It’s an overlooked fact that bull markets can be just as exhausting as bear markets (although, yes, they are more fun). Take care of yourselves, this is more a marathon than a sprint.

You’re reading the free weekly edition of Crypto is Macro Now, where I update and/or re-share a couple of things I wrote in more detail about during the week. If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links.

If you’re not a premium subscriber, I do hope you’ll consider becoming one!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

In this newsletter:

BTC resilience

The longer-term impact of sanctions

Crypto activists win again

Some of the topics discussed this week:

BTC breaks through $60,000, suspense builds

Ethereum’s breakout

BTC weekend volumes are lower

Crypto and the unsolvable debt problem

The crypto opportunity for African institutions

More moves against the SEC

What European Central Bank messaging is really saying

Another bank stablecoin on a public exchange

Progress in Russia’s tokenized cross-border trade

Will slowing economic growth show up in the US PCE?

About that inflation data

BTC resilience

It feels really weird to be talking about Bitcoin resilience with the price not far from the previous all-time high.

But it looks like that’s what we’re seeing.

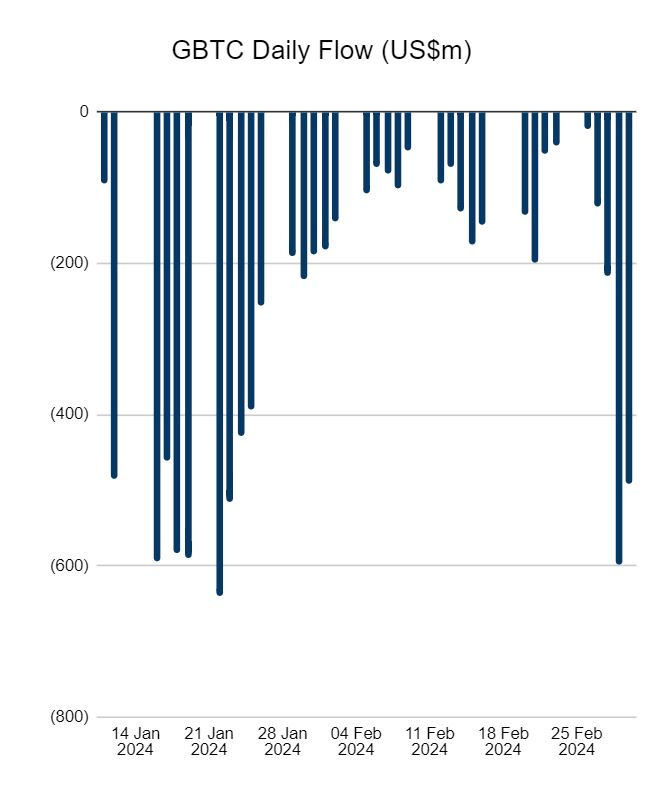

Over the past couple of days, the bitcoin market has withstood strong outflows from Grayscale’s BTC spot ETF GBTC, with Thursday’s net redemption of around 9,750 BTC (~$600 million) the second steepest exit since trading as an ETF began.

(chart via @FarsideUK)

And yet the BTC price barely budged.

(chart via TradingView)

This can only be partly attributable to the offset from net inflows into the new BTC spot ETFs, which reached a considerable $700 million on Thursday, the second strongest day so far, with BlackRock easily leading the pack as usual. Friday, however, saw the first net outflow, one of only two negative days over the past month.

(table via BitMEX Research)

In theory, you would expect the GBTC outflows to spook the market, as they are a reminder of the considerable overhang from the Genesis sale alone (in mid-February, the bankrupt lender got authorization to sell roughly 35 million GBTC shares as part of the estate settlement). Going by back-of-the-envelope calculations, the net GBTC outflows over the past two days would be roughly two thirds of the total, and maybe less if other holders were also exiting. There’s more to come.

But there’s also the expectation of more inflows, with Bloomberg reporting that Wells Fargo and Bank of America’s Merrill are now offering their clients access to the BTC spot ETFs. And Morgan Stanley could be about to add BTC ETFs to its investment platform, according to CoinDesk.

So, what I expected to be a strong dampener on the BTC price – the Genesis overhang – turns out to be (so far) not a big deal at all. The price could still correct from here, of course. But the impact of the ETF is turning out to be more positive than even I expected.

The longer-term impact of sanctions

Some anniversaries are extremely unwelcome.

Last Saturday marked two years since Russia invaded Ukraine. Two years of destruction and death, with a loud absence of the diplomacy and negotiation that usually accompany hard conflict. Two years of painful expense with virtually no gain, of existential determination on both sides, of finger-pointing and of geopolitical realignment.

We’ve also had two years to witness what could end up being one of the quietest economic earthquakes of this civilizational cycle: the beginning of the end of supreme dollar power.

While the initial round of sanctions was swift, the noisiest move was the freezing of Russian central bank foreign reserves in the US and Europe. At the time, mainstream media proclaimed this to be a “death blow” to the Russian financial system, and a few voices worried about the precedent this was setting. Indeed, 2022 saw the steepest slump on record in foreign holdings of US government debt.

Yet the death blow turned out to be no more than a scratch – the Russian financial system is still functioning. What’s more, 2022 was the year the Federal Reserve started hiking rates, making US bonds a less attractive asset and most likely triggering some sales for portfolio management reasons. And foreign holdings of US debt are again on the rise; at the end of Q3, they were back up to pre-Ukraine invasion levels.

(chart via the St. Louis Fed)

On its own, freezing sovereign reserves was not enough to dent the global need for liquid assets that perhaps are not as safe as originally thought, but are still safer than pretty much anything else that is as liquid or as easy to convert into dollars. Plus, there’s that attractive yield.

A much bigger impact comes from sanctions and the exclusion of Russian banks from the SWIFT messaging service. Like the freezing of foreign reserves, the economic impact is so far questionable: the Russian economy shrank in 2022, but only by 1.2%, which is far from the decimating blow the West was expecting. On Wednesday, we saw Russia’s GDP data for January come in higher than expected and higher than in December, with a year-on-year growth of 4.6%. True, much of that may be from weapons production – but that does not sound like an economy about to completely crumble.

The strategic impact, however, is both quieter and deeper. Financial flows have been re-routed; trade patterns have been re-designed; and the development of alternative cross-border payment systems has been kicked into a new urgency that is producing results.

Just a few of the many examples:

Russia is steaming ahead with the development of a digital ruble that can be used in cross-border payments.

China has upped its cross-border trials of the e-CNY with several successful commodity trades.

mBridge, a multi-bank cross-border digital currency initiative between the BIS, China, UAE, Thailand and Hong Kong, is expected to launch an MVP in Q2.

The BRICS trade group expanded earlier this year from five to 10 members, with Egypt, Ethiopia, Iran, Saudi Arabia and the UAE joining Brazil, Russia, India, China and South Africa. A further 18 countries have applied for membership consideration.

Russia is the current chair of the association, and is drafting a group report on how to improve the current international payments system.

According to the Russian central bank, the share of BRICS trade settled in BRICS currencies has gone from 26% to 85% in just two years.

Last week, the US announced further sanctions against 500 Russian people and businesses. This may sound like a large number, but since the Ukraine invasion, thousands of entities have been put on sanctions lists, and yet the war grinds on with Russia not showing any signs of giving up. It’s unlikely the new batch will make much of a difference.

It could, however, add further layers of tension to international relations. The US sanctions, which come on top of similar measures earlier in the week from the European Union and the UK, are not limited to Russian targets.

Also in the package are trade restrictions against almost 100 non-Russian entities that stand accused of facilitating the evasion of sanctions on Russia. This impacts certain operations in seven countries, including China, India, Turkey and the UAE, which last week was removed from FATF’s dreaded “gray list” for improving its controls over money laundering. (Yes, it’s confusing.)

Understandably, this is not going down well in countries that had never signed on to the sanctions program in the first place.

The end result is likely to be further annoyance all around, while the necessary adjustments are made so that Russia can go on shipping and receiving, and its trading partners can continue to do business with whomever they choose. There will be some economic impact, but it is not likely to be crippling, further underscoring the ineffectiveness of the US policy of weaponizing the dollar.

New alliances, deepening currency corridors and the development of new payments technologies will further erode the power of the US to choke off certain jurisdictions from global trade. And this trend is likely to be hastened by the sharp inward turn in both foreign policy and economic priorities should there be a change of administration in the US next year.

This shift has so far been and will continue to be noisy on the surface, with empty proclamations and much hand-wringing. But the impact to date has been and will continue to be quiet, as CBDC testing, settlement diversification and the reshaping of supply chains tend to not attract the same level of patriotic fervour.

Plus, they do take time. Now, however, they are seen not so much as efficiency gains that may or may not be worth the considerable investment, as steps necessary for economic independence and survival.

Crypto activists win again

A moment of appreciation, if you don’t mind, for crypto activists who don’t take US regulatory overreach lying down.

A few weeks ago, I wrote about the ludicrous and yet mandatory survey for all US-based Bitcoin miners from the Energy Information Administration (EIA), and how it placed onerous requirements on just one industry (ignoring other energy guzzlers such as artificial intelligence) while hinting at restrictive regulation to come. What’s more, it ignored the usual public and Congressional comment process, citing the risk of “public harm”, which does not exactly signal neutrality.

Well, the Texas Blockchain Council together with Bitcoin miner Riot Blockchain sprang into action, filing a law suit against the EIA citing the “unprecedented and illegal data collection demand”, and accusing the agency of not complying with federal requirements for information gathering.

Almost immediately, the EIA suspended the survey, which suggests that they knew their motives would not hold up in court.

Indeed, earlier this week, a Texas judge issued a temporary restraining order on the initiative, accusing the EIA of acting “arbitrarily and capriciously in violation of the Administrative Procedure Act”. The ruling’s summary is powerful:

“This is a case about sloppy government process, contrived and self-inflicted urgency, and invasive government data collection.”

And to cement the victory, yesterday the EIA officially withdrew the survey. The lawsuit has been withdrawn. The EIA could well try again, but it will have to follow the process established in law, which gives the public and regulators the opportunity to opine on any particular use of official resources.

As I wrote a while ago, information gathering is good, but not when it starts out from a position of unfounded hostility and bias.

The success of the law suit so far adds yet another notch in the legal battles won by the crypto ecosystem against government prejudice that is not representative of the majority of individuals or even fellow regulators.

A round of applause to those involved, and may the wins continue. It can feel frustrating to have to fight regulatory overreach case by case, but the wins do add up, and eventually – hopefully – the antagonists will realize that there are more justified battles for them to be fighting.

HAVE A GREAT WEEKEND!

Earlier this week, the winners of the 2024 Sony World Photography Awards were announced, and – as always – there are so many moving images that remind us how vast and humbling the world is. Many of us (myself included) sometimes get so wrapped up in the noise that surrounds us that we forget the beauty, heartbreak, hope, work, luck and sheer diversity rippling through every second of time, just beyond our limited horizons. Photography contests and shows give us a glimpse of a different panorama, which I personally find both grounding and uplifting.

In that spirit, here are a few of my favourites from the winners, but do go and take a look at the impressive line-up for yourself!

Jasper Doest

Lukas Zeman

Nick Ng