Monday, Feb 5, 2024

what the China stock market rout could mean for crypto, a new attack vector for BTC

“If someone explains something to you in finance . . . and it doesn’t make sense, ask the person to repeat the rationale, and if that response still doesn’t make sense, you should run.” – Mark Carney ||

Hello everyone! I hope you were all able to recharge some over the weekend – I have a feeling this week is going to be intense…

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but I don’t give trading ideas, and NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going.

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Note: I’m speaking at BlockWorks’ upcoming Digital Asset Summit conference in London on March 18-20. Normally I say no to conferences, but this is one of the very few worth travelling for. If you’re thinking of going, it’d be great to say hi, and here’s a discount code you can use: CIMN10.

IN THIS NEWSLETTER

The market rout in China and what it could mean for crypto

Buying support for BTC

Bitcoin: a new regulatory attack vector

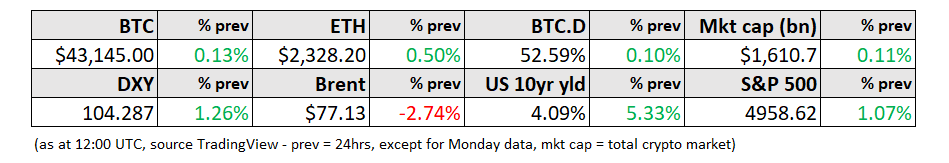

WHAT I’M WATCHING

The market rout in China and what it could mean for crypto

I don’t think I’ve ever used the word “bloodbath” in this newsletter, not even during the gory days of the post-FTX meltdown. So, this makes a first because it is what comes to mind when looking at today’s trading on Chinese stock markets. The CSI 1000 index was at one stage down almost 9% since the open in today’s trading session, with 99% of its constituents in the red. The narrower CSI 300 at one stage was down 2%.

(chart via TradingView)

As shares were falling fast, the China Securities Regulatory Commission (CSRC) issued a statement vowing to “prevent abnormal fluctuations” in stock prices and to inject more medium- and long-term funds. This seemed to trigger a bounce, with the CSI 300 closing up slightly on the day and the CSI 1000 recovering enough to close a still steep 6% down, bringing year-to-date losses to almost 30%. Over the past 13 trading days, the Chinese stock market has lost roughly $1 billion in value.

Ouch.

As usual, the promised support from the authorities is lacking in detail, and will most likely not be enough to turn sentiment around. The late rally could have been driven by the deployment of the previously announced state-backed funds into the market. The outperformance of the larger cap funds vs the broader CSI 1000, despite Trump reportedly considering a 60% tariff on all Chinese goods (which would hurt the larger industrials), suggests that this is not yet a broad-based turnaround in sentiment.

Also weighing on the Chinese market are US Fed Chair Jerome Powell’s remarks in an interview yesterday on the 60 Minutes news show in which he further emphasized that a March rate cut is extremely unlikely. This matters to Chinese investors given the probability that the People’s Bank of China (PBoC) will have to lower rates soon in order to stimulate more economic activity. If China cuts rates before the US, the yuan will get hit.

I’ve written before about how the central bank’s hands are largely tied on interest rates, given the importance of a strong yuan for China’s global image. But the longer the authorities shy away from more forceful measures, the louder the necessary adjustments will need to be.

This is positive for the crypto ecosystem, since broader stimulus (in contrast to the targeted approach so far) is likely to find its way into speculative and/or assets not tied to the Chinese economy.

Last week, the South China Morning Post reported that mainland funds were pouring into products that gave exposure to overseas equities, pushing the price of some traded products up to 40% above their underlying value.

And Macau, an autonomous region of China known for its giant casinos, almost broke its post-COVID revenue record last month.

It’s not so much that Chinese investors don’t want to invest; it’s that they don’t have a lot of confidence in the Chinese stock market, despite official assurances. Foreign stock exposure is one avenue. Gambling is another. Crypto markets, on the other hand, could deliver the benefits of both.