WEEKLY, Sept 28, 2024

BTC spot ETF options, privacy liability

Hi everyone, I hope you’re all well, and that autumn is arriving gently where you are! Things are starting to feel different in my tiny pocket of the world, not just the crisp air but also the market mood…

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of articles from the week.

If you’re not a premium subscriber, I hope you’ll consider becoming one! It’s the price of a couple of New York coffees a month, and you get ~daily commentary on crypto, macro and the space in between. Plus some cool links, a smattering of charts, and a daily music link because why not. AND you get access to a premium subscriber chat over on substack.com or on the app! And audio most days!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

BTC spot ETF options!!

Privacy: Who is liable?

Some of the topics discussed the past week:

BTC spot ETF options!!

The twilight of retail CBDCs?

The political tea leaves

Waiting for more from the Fed

But the liquidity…

The SEC in the hot seat, with charts

Banks get uneven crypto rules

A global crypto adoption index

Finally, China seems serious about stimulus

It’s all about rhythm

The market impact?

Geopolitical hotspots get hotter

Who is liable?

Chinese crypto channels: exchanges incoming?

The launch of tradfi custody

Paypal and crypto “money”

More fintech stablecoins?

BTC spot ETF options!!

Last Friday, the SEC gave the ok for Nasdaq-listed options on BlackRock’s IBIT spot BTC ETF. This was both long-awaited (the proposals were first filed in January) and expected – the regulator had already allowed the trading of options on BTC futures ETFs, so the only reason to deny those on the spot ETFs would be to do with legal differences between the respective filing Acts (the futures ETFs are filed under the ’40 Act, the spot ETFs under the ’33 Act).

It’s also a big deal for the outlook for BTC demand and liquidity.

Options primer

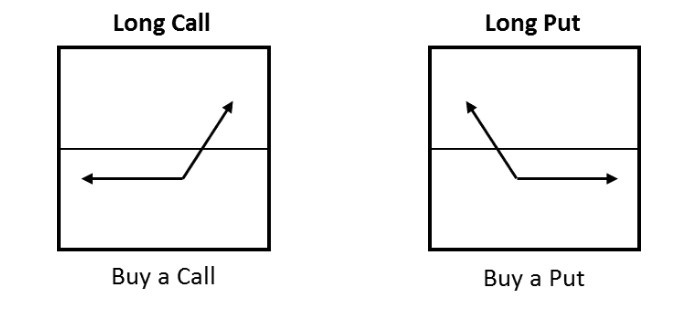

For those not steeped in derivatives terminology, “options” are similar to “futures” in that they allow investors to bet on future price movements. But futures entail delivery or receipt of the underlying asset (or the cash equivalent) at some point in the future. An option gives the holder the right, but not the obligation, to deliver or receive the underlying asset.

If you think the price of IBIT is going to go up, for instance, you can buy an option that reflects this (known as a “call”), one that gives you the right to buy IBIT from the option seller at a higher specified price (the “strike price”). The amount you pay for the option (known as the “premium”) reflects the odds that you’re right. If IBIT’s price climbs well above your strike price, you activate your option, pay the strike price, receive IBIT and then sell it in the market for a profit. Your total outlay has been the cost of the option and what you paid for IBIT (the strike price). If IBIT’s price does not climb above your strike price plus premium, you do nothing – you’ve only lost the premium.

If you think the price of IBIT will go down, you do the same thing in but in the other direction. You buy the right to sell IBIT at a lower price (known as a “put”). If you’re correct and IBIT drops below your strike price, you buy the ETF in the market and then sell it to your option counterparty at the set price – you’re selling it higher than what you paid.

(Of course, there are many other strategies besides, but I don’t want to complicate this too much. These two are the “basics”.)

You can see how options make good hedging vehicles: they are a relatively low-cost way to limit the downside of a position while allowing unfettered upside.

Imagine you hold a lot of IBIT but want to protect yourself against downside. You buy some puts, which give you the right to sell your IBIT at a price higher than market – with this, you know what your downside is going to be (the drop between purchase and the selling price, plus what you paid for the puts), whereas those who just hold unhedged IBIT don’t know how low it will go. If IBIT doesn’t drop, you’ve just lost what you paid for the options, and your potential upside is intact.

(diagram vs the CME)

Options also allow IBIT holders to earn a yield on their holdings by writing (= selling) calls, collecting the premium and delivering IBIT at the established price if the option is redeemed (either from their holdings or by buying in the market if they don’t want to reduce exposure). Their upside may be more limited than those that simply hold, but can still be substantial, and meanwhile they are earning an income via what people pay for those options.

The IBIT options will be American-style, which gives holders the right to redeem at any time up until expiry. European options only allow redemption at the end of the contract.

The impact

I’m not a derivatives trader so there are no doubt nuances I’m missing (and please don’t ask me about vanna and vega), but my lay-person’s understanding is that this decision matters for the following key reasons:

It essentially authorizes the listing of BTC options on Nasdaq. Sure, the options are actually on BlackRock’s IBIT BTC spot ETF, but BlackRock has very little counterparty risk and so can, for macro portfolio positioning purposes, be taken as a BTC proxy (except at night and on weekends, of course!).

There are high-quality BTC options exchanges, but the only large regulated counterparty for crypto options in the US has been the CME, and – from what trader friends tell me – their contracts are relatively expensive, high-maintenance and low-volume. Open interest is more than double that of a year ago but lower than earlier this year, and they are not loved.

(chart via velo.xyz)

A liquid, easy way to play volatility curve positioning for either hedging or speculation, while offering the assurance of a regulated counterparty, will appeal to both big players and retail investors, bringing new participants into the market.

It could also encourage deeper BTC liquidity by giving market makers more flexible hedging options as well as the opportunity to earn a yield on their positions through call writing (issuing call options on held IBIT or BTC). More liquidity will in turn attract larger players which should further encourage liquidity, in a virtuous spiral.

A potentially even larger liquidity boost could come from increased use of IBIT as collateral. For now, the Depository Trust Company (DTC) does not allow spot crypto ETFs to be posted as collateral for settlement purposes (market participants pledge securities or cash as insurance that a trade’s transfer and payment will happen without a hitch), and this is unlikely to change. But lenders could feel more comfortable extending loans based on IBIT collateral, now that options offer more sophisticated hedging. This extra liquidity is likely to be ploughed back into the market, boosting overall activity.

While options don’t directly translate to BTC purchases, the availability of a convenient hedge on the same exchange as the underlying asset should encourage interest in said asset, which does translate into BTC demand. This is not exclusive to BlackRock’s ETF, as the IBIT options offer hedging and leverage to any type of BTC position. Plus, we are likely to soon see approval for options on the other major spot ETFs.

Options can contribute to volatility if positions build up and become actionable – for instance, if there were billions of dollars of calls betting that IBIT’s price would rise above a certain level, and IBIT started climbing toward that price, those that had sold those call options (those that had committed to deliver IBIT at that price) would scramble to buy the asset in the market, pushing the price up further. This is known as a “gamma squeeze”, and it wasn’t that long ago we saw what these can do, with the surge in GameStop’s share price. What slowed that down was the issuance of a flood of new shares – well, that can’t happen with BTC.

The same could work in the other direction, but the normally positive funding rate on BTC perpetual futures suggests that crypto traders tend to be optimistic, and we’ve seen that lower prices entice buyers. So, any impact is likely to be more pronounced on the upside.

What next?

Stepping back, the availability of options is also likely to give birth to other types of products, such as yield-bearing BTC-linked assets, or zero-downside “bonds” that deliver variable upside. This would give crypto market financialization another boost, bringing in more sophisticated players which should further help overall liquidity and market depth.

Could this make BTC itself more fragile? Only if unregulated high-yield products supposedly but not really backed by BTC become so popular they overwhelm the regulated market. We saw what this can do in 2022. Whatever crypto natives may think about market regulation, it makes that less likely.

We don’t yet know when the options will start trading as they still need approval from the CFTC and the Options Clearing Corp – that should follow pretty soon, although there is no set deadline.

This authorization, along with large US banks finally starting to custody crypto assets, suggests a likely boost to BTC demand for Q4. I’m seeing traders on X use terms like “explosive” and “fantastic” and, while that would be fun, it’s worth remembering that traders are not exactly known for their descriptive restraint. But the approval is a big deal, although the impact will be realized over time.

Unlike many much-hyped crypto announcements, this move is designed to appeal to mainstream investors of any size. On its own, it’s just a new product. But as a piece of a much bigger market puzzle, it is widening the aperture for BTC exposure.

Privacy: Who is liable?

A US judge ruled this week that the Department of Justice’s case against Tornado Cash developer Roman Storm will proceed to trial. He is charged with money laundering, operating an unlicensed money transmitting businesses and violating international sanctions, as his decentralized and anonymous coin mixer was used by bad actors such as North Korean hackers.

This will be a spicy one, as it rests on whether software developers are liable for what happens on the programs they write, and what constitutes a “money transmitter”. It also gets to the heart of whether technology-enabled privacy should be a right – Tornado Cash was often used by innocent individuals who want to protect their privacy and enhance their personal security by hiding blockchain traceability.

The ruling itself is contentious, in that the judge does not think that “control” is sufficient for the act of money transmission, which in turn has the obligation of control – in other words, despite not being able to control the app’s use and despite not holding customer funds, Tornado Cash should comply with money transmitter AML/KYC rules. Does this make all crypto wallets money transmitters?

Also, to be declared guilty of money laundering, the prosecution does not need to prove that Storm knew about specific users or illicit transfers – it just needs to prove that he knew bad stuff was happening on his platform, and didn’t do anything about it.

I’m not a lawyer, but I’m trying to figure out why engineers wouldn’t be held liable for getaway cars escaping on a bridge they built, or gun makers wouldn’t be liable for gun-related murders. They know bad things happen because of their output. It’s to do with the nature of money, perhaps? But why are crimes involving money judged differently from crimes involving hardware? Or maybe it’s the regulatory obsession with money laundering, obviously the root of all evil?

The trial could also end up being about much more than privacy; it could also touch on free speech. Storm has alleged that code is a form of expression, and therefore protected under the First Amendment. The judge disagreed. Could this be a tentative step towards encryption becoming illegal?

HAVE A GREAT WEEKEND!

This week, a departure from the usual pattern of music or photos or series recommendations, to discuss something both culture- and crypto-related:

By now, you’ve probably heard about Moo Deng. I’m late to the show, my daughter told me about her a few days ago, and I confess I don’t get the frenzy so I did some digging.

Moo Deng is a pygmy hippopotamus born in July in a zoo roughly 100km southeast from Bangkok in Thailand. There are pygmy hippos in zoos around the world, but some timely social media posting from her zookeeper has pushed this one into the spotlight and captured the hearts of hundreds of thousands of people around the world.

(photo via BBC)

The zoo where she lives has doubled visitors over the past few months, and has to limit Moo Deng adoration to 5 minutes per person on weekends.

Her smiling face now graces t-shirts, pyjamas, caps and more. She decorates mugs. There are figurines. Sephora has a Moo Deng-inspired advertising campaign for blushes, because who wouldn’t want to look as pretty as a hippo…

And now, of course, there’s a Moo Deng meme coin, MOODENG, which in the space of two days has reached a market cap of over $300 million. (This is not investment advice!! Do not buy MOODENG expecting a positive return!!) According to CoinGecko, the trading volume over the past 24 hours was almost $190 million, which is more than DOT, LDO, even TIA.

This may sound crazy, but then again, why not?

And stepping back, the real world-crypto link hints at the deeper significance of meme coins. They reflect cultural interest – they don’t “do” anything, they don’t have utility or “fundamentals”, they just reflect sentiment. For now, memecoins are niche. But as they become more mainstream, maybe they are a way to put “value” on cultural attention. It’s not yet clear what can be done with that, but it’s a twist on the intersection of community and markets. Worth keeping an eye on.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.