WEEKLY: Stablecoins on Bitcoin

plus, what many missed about this week's press conference - and, Superbowl ads!

Hello everyone! I hope you’re all doing well, and are resisting the overwhelm from market and media noise - it’s quite something these days.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the week, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one! For $12/month, you’ll get ~daily commentary on how crypto is impacting the macro landscape, and vice versa. I talk about adoption, regulation, tokenization, stablecoins, CBDCs, market infrastructure shifts and more, as well as the economy and investment narratives.

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

Stablecoins on Bitcoin

This week’s press conference: it’s about the visual

Some of the topics discussed in this week’s dailies:

Tariffs: he promised, he delivered

An own goal

Market impact

Outlook

The realignment

Stablecoins on Bitcoin: good for Bitcoin, good for Tether

BTC in a US Sovereign Wealth Fund?

**Regulation update: where to even start…**

Yesterday’s press conference: it’s about the visual

The stablecoin bill

The Digital Assets Executive Order

The SEC cleans house

Crypto appointments

International scrambling

El Salvador changes tack

Signals from the US Treasury: good for crypto

Jobs day is feeling left out

Employment in balance

Clouds loom – again

Stablecoins on Bitcoin

Time for some ancient crypto history:

Back in 2012, J. R. Willett published a paper proposing a blockchain layer that would run on Bitcoin, but would allow the issuance of other tokens. It wouldn’t affect Bitcoin’s code or security, but it would enable more flexibility and therefore, in theory, bring in more users of the network.

It was called Mastercoin, and became the first blockchain “layer-2”. In 2014, the first direct-redemption dollar-backed token, known as Realcoin, launched on the network – this token later became USDT. In 2015, Mastercoin rebranded to Omni.

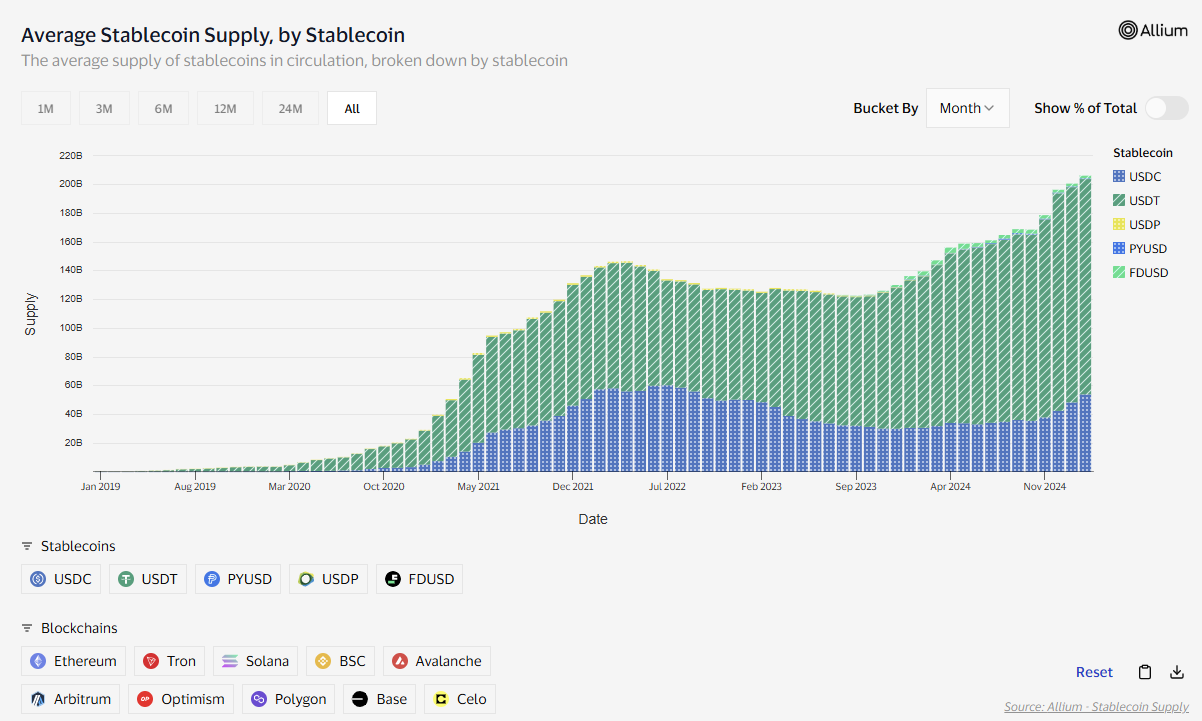

For the first three years of its life, USDT was limited to the Bitcoin network; it wasn’t until early 2018 that it expanded to Ethereum. Today, it runs on more than 10 blockchains, and its almost $150 billion market cap makes it roughly three times the size of its nearest competitor USDC.

(chart via Visa’s stablecoin dashboard)

Even in the early days, USDT use on Omni faced several obstacles. There were no tokens other than BTC to interact with, whereas over on Ethereum a sea of trading pairs and use cases was emerging. Plus, settlement on Omni was slower, and fees were higher.

In 2023, USDT’s issuer Tether pulled the plug on Omni support but left the door open to returning to the Bitcoin ecosystem on another layer.

Less than two years later, it has used that door. Last week, Tether announced that it was integrating USDT into the Bitcoin ecosystem. Users will be able to trade and hold the stablecoin both on the base layer and on the Lightning Network, one of the main Bitcoin layer-2s designed with fast, cheap payments in mind.

Good for Bitcoin

It is doing so via the Taproot Assets protocol, created by the team behind the Lightning Network to support the minting of asset-backed tokens. The protocol connects with Lightning to streamline both the issuance and transfer of digital assets, effectively bringing greater flexibility to Bitcoin’s established decentralization and security.

What Bitcoin does not yet have, however, is the vast network of developers and applications of the Ethereum and Solana communities. Taproot Assets, Lightning and many other Bitcoin layer-2s and applications are working to close the gap – but it’s an ambitious goal.

With USDT now active on Bitcoin, however, that goal becomes more achievable. A “missing piece” in the growing Bitcoin DeFi ecosystem was a liquid stablecoin, a token that can not only act as a settlement currency in Bitcoin-based smart contracts, but one that can also facilitate the transfer of value within the ecosystem. This move seems to solve for that.

What’s more, USDT’s ubiquity on other networks enhances not just Bitcoin’s flexibility – it also hints at greater connectivity between DeFi communities.

And, it should benefit the Bitcoin ecosystem as a whole, by increasing network use and therefore transaction fee revenue, and by encouraging the development of apps that give BTC holders something to “do” with their BTC beyond just having it sit inert in addresses.

Good for Tether

The move fits into Tether’s broader strategy of diversification in both networks and applications. In an X post on Friday announcing the Q4 results, CEO Paolo Ardoino stressed that more product launches were in the pipeline:

“In the following months we aim to launch several new products across all Tether pillars: from Artificial Intelligence platforms and apps to telecommunications, from new financial tools and services to broader educational efforts.”

It’s likely that some of the coming announcements will further extend support of the Bitcoin network, building on other recent initiatives such as the launch of a wallet development kit, and the commitment to invest up to 15% of profits in BTC.

That’s not a small amount. Tether’s latest results revealed a profit of $6 billion in Q4, bringing 2024 profit to $13 billion. (For comparison, Goldman Sach’s 2024 profit was just over $14 billion.)

Some back-of-envelope math suggests a buy just based on Q4 results alone of $900 million. That’s a drop in the ocean compared to MicroStrategy’s investment of over $18 billion in BTC over the previous quarter – but it’s not nothing.

Furthermore, Tether recently announced that it was moving its headquarters to El Salvador, the first country in the world to make BTC legal tender. This ruling has been walked back in the face of pressure from the IMF, but the institutional support for Bitcoin remains. Not only is this support likely to be boosted further by Tether’s presence in its country – Tether’s 2024 profits are roughly equivalent to 35% of El Salvador’s annual GDP, according to IMF data – it’s also likely to spread across the Latin American region.

In sum, Tether seems to be delivering on its strategy of becoming much more than a stablecoin issuer that leverages blockchains to reap handsome profits. The firm is increasingly getting involved in network development, with what looks like an obvious preference for Bitcoin’s potential.

This week’s press conference: it’s about the visual

There have been several “emotional” moments in crypto since Donald Trump took office.

One was the commutation of Ross Ulbricht’s sentence – not only was it the just thing to do, it was also a signal that Trump just might keep the promises he made in his speech at last year’s Bitcoin Conference in Nashville.

Another was the publication of the Executive Order (I wrote more about this here).

And then there was Tuesday’s press conference, in which Trump’s Crypto & AI Czar David Sacks outlined his team’s plans for the next six months.

For many crypto watchers, it was a nothingburger – men in suits saying words, but no real news. BTC once again dropped below $100,000, on the back of what appeared to be disappointment that no announcement was made on a Strategic Bitcoin Reserve.

(chart via TradingView)

This highlights just how noisy much of the support on crypto social media has become. Expectations of an announcement that the US government will start buying BTC were unrealistic to start with (that will most likely have to get congressional approval), and disappointment that it didn’t materialize shows just how many observers are missing the bigger picture.

It wasn’t so much what Sacks said before the cameras that was interesting. As far as I could tell, he didn’t say anything new.

No, what was interesting was who was standing behind him when he said it.

You had:

Representative French Hill, chair of the House Financial Services Committee

Representative Glenn Thompson, head of the House Agriculture Committee

Senator Tim Scott, the chair of the Senate Banking Committee

Senator John Boozman, head of the Senate Agriculture Committee

For those wondering why agriculture policy makers were there, remember that the House and Senate Agriculture Committees have oversight of the CFTC, while oversight of the SEC is shared between the House Financial Services and the Senate Banking Committees.

So, you had representatives from key committees in the House and the Senate, publicly committing to working together in order to draw up crypto frameworks that support both innovation and investor protection. This matters a lot because, without their support, Sacks wouldn’t be able to get anything done.

Anyone with experience in US politics knows that it’s not what you want to do that gets bills through the chambers; it’s who you recruit to work on it with you. And virtually nothing moves forward without various teams across the legislative structure getting involved.

The event sent a loud message that the government is serious about crypto regulation, and that Sacks has the political backing to make a difference.

He did say that his team would be studying the idea of a Strategic Bitcoin Reserve – either this means that Cynthia Lummis’ bill proposing the concept isn’t going to go anywhere for a while, or that Sacks’ team is conflating “Reserve” with “Stockpile” (holding on to seized crypto assets). Either way, he threw a bone to the crypto frothers.

But, the big deal from the press conference is who was in the room. This here is a powerful image:

(screengrab from the Senate Banking Committee’s YouTube channel)

See also:

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Let’s just come out and say it: the Superbowl is not just about mighty American football, jaw-dropping concerts and tasty snacks. It’s also about the ads, the snips of multi-million dollar video that ends up being much more than a commercial – they often represent cultural statements, and signpost changes in both the economy and the zeitgeist.

Here are some of my favourites of the ones that have been pre-released – no doubt there will be more pleasant surprises on the day:

Budweiser (lump in throat)

Uber Eats (with more cameos than you can shake a football at)

Doritos (talk about topical)

Stella Artois (loving the trend of celebrities making fun of themselves and/or each other)

Hellmann’s (updated nostalgia)

If you’re planning on watching, enjoy the game! 🏈

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

Very stoked about Tether on Btc network!