WEEKLY - the Davos shift, and why it matters for crypto

plus, gorgeous photos

Hello everyone! I hope your January is feeling hopeful.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the week, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one! For $12/month, you’ll get ~daily commentary on how crypto is impacting the macro landscape, and vice versa. I talk about adoption, regulation, tokenization, stablecoins, CBDCs, market infrastructure shifts and more, as well as the economy and investment narratives.

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

Davos still matters for crypto, just not the way you think

Some of the topics discussed earlier this week:

The token to $TRUMP them all

Shocked, shocked I tell you

Not just gambling

What people are NOT talking about

You can’t trump that

BTC moves

Davos still matters for crypto, just not the way you think

Green crypto shoots all over

The debt ceiling liquidity boost

Trust: more than just surveys

Clearing the way: SAB 121 repealed

A Bitcoiner to lead the Senate Digital Assets Committee

The Crypto Executive Order does not disappoint

Davos still matters for crypto, just not the way you think

With the hubbub of the US presidential inauguration earlier this week, the annual jamboree in Davos felt particularly irrelevant.

But we do still have to check in on it, if only to confirm that the global “elite” still think talking about change helps them to take charge of it.

Thin mountain air

This edition of the annual World Economic Forum (WEF) conference was absent many key figures: the presidents of China, India, France and Turkey did not attend, nor did the prime ministers of Japan, the UK and Italy. The only representative from the G7 was outgoing German leader Olaf Scholz and, according to reports, only five other countries from the 27-member EU bloc bothered to make the relatively short trip to the Swiss mountains.

The head of the European Commission, Ursula von der Leyen, was in attendance, though, as were the heads of the IMF, the UN, the World Health Organization and the World Trade Organization, so there’s that.

And there was plenty to talk about, because the theme this year was “Collaboration for the Intelligent Age”, whatever that means – keeping it vague is effective in setting a tone without limiting the subject matter.

The content, according to the organizers, was split into five “priorities”:

Industries in the Intelligent Age (expect the word “transformation” to be liberally sprinkled around, again)

Reimagining growth (again)

Investing in people (by also investing in AI, I suppose?)

Safeguarding the planet (by being, I guess, “intelligent”?)

Reimagining trust

This last “priority” was easily the most interesting, on many fronts.

One is because last year the whole theme was “rebuilding trust”. That obviously didn’t pan out too well (I know, these themes are not roadmaps or even plans, but we can take them as goals), so I guess we moved on to “reimagining” what the word means, even though we’re not clear what “reimagining” means, either.

And at least there’s continuity: the 2021 theme was also about rebuilding trust. By 2022, the organizers obviously felt a change was needed – after dusting off the thesaurus, they chose “restoring trust”.

So, here we have an elite conference with an understandable obsession about global trust, and yet not a single G7 leader who expects to still be in office a month from now showed up.

A shifting elite

How is this relevant for crypto?

The obvious one is the role blockchain can play in a rearchitecting of trust in data, finance, centralized processes and more. As usual, the crypto industry was well represented in Davos this year, with a glittering array of side events and high-profile speakers. Yet its presence didn’t have the same energy as in recent editions, with AI getting almost all the “new technology changing the world” attention.

Going through the official list of talks, only one appeared to be about crypto – “Crypto at the Crossroads”, featuring CEOs and/or founders of Coinbase, Stellar, Franklin Templeton, Skybridge Capital as well as the governor of the South African central bank. (You can see the replay here – some thought-provoking stuff, mainly from the central banker and Scaramucci, with the leaders of Stellar and Franklin Templeton sounding more like marketers).

The crypto panel unearthed some interesting points, and several other talks also look worth checking in on. I’m not saying there’s nothing to pay attention to from this high-profile gathering.

I am saying that, this year, the conference felt less relevant. I spoke to people who are normally on top of things, who didn’t even know it was going on. True, there were other big simultaneous events (!!) to occupy limited mental bandwidth, and arguably the US presidential inauguration was more significant when it comes to reshaping the world.

But the dimmer sparkle from Switzerland this week is confirmation, if any was needed, that global influence is fragmenting. The annual Davos conference is nowhere near as relevant as it was just a few years ago. Chinese leader Xi Jinping’s 2017 Davos address, for instance, made space for China on the podium of global leadership. Since then, with the exception of the virtual event during the pandemic, the occasion has felt more familiar, more routine, more about the media than the substance.

This shift is especially intriguing given that the rich are richer than ever, and they were well represented in the Swiss mountains. But this matters less. Rather than flying across the ocean to rub shoulders with peers, four of the top five richest people in the world spent a lot of money to get an invitation to join the throng in a crowded room in Washington DC.

A flourish and a pivot

President Donald Trump’s actions immediately after his inauguration on Monday highlight just how much the old-guard “elites” are losing relevance as the world’s power axes shift. With a flourish of signatures, Trump:

withdrew the US from the United Nations Paris climate agreement

withdrew the US from the World Health Organization

suspended foreign aid for 90 days pending review

cancelled US commitments to the OECD global tax deal

ordered an investigation into all trade agreements

… and there are probably some other globalization walkbacks I missed.

Against this backdrop, the Davos emphasis on global cooperation feels hollow.

What’s more, further emphasis of the shift can be seen in the latest annual WEF report on global risks, which publishes the results of a survey of roughly 900 “experts” in various fields of influence. In theory, the aim is to align attendees’ focus on the problems that most urgently need their high-impact attention.

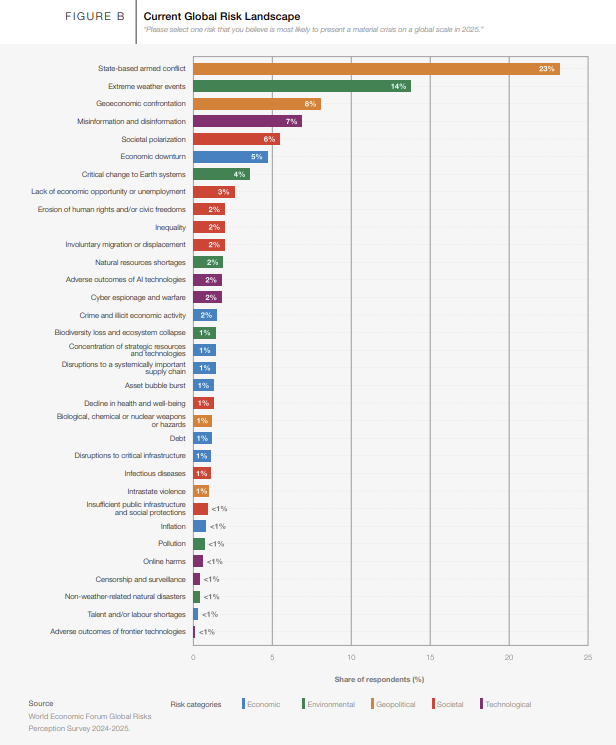

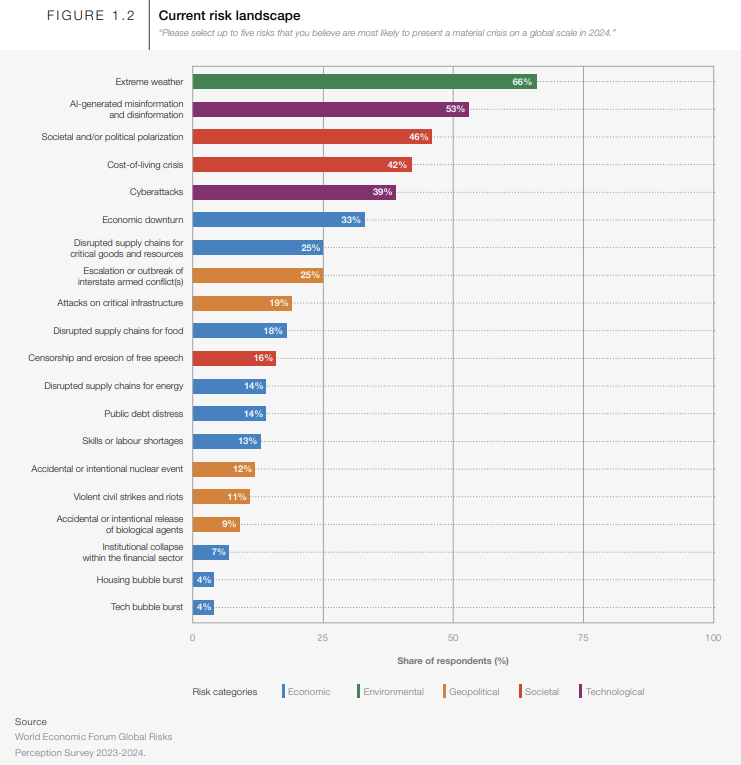

The number one concern? Armed conflict between states. Last year, this concern ranked eighth.

This doesn’t exactly suggest that Davos has had much success in making the world better off.

(chart via the World Economic Foundation Global Risks Report 2025)

Also notable is the swing in overall consensus. This year, 23% of respondents pointed to armed conflict as one of their top five concerns, while 14% were worried about extreme weather. Last year, 25% put armed conflict on their list, while an overwhelming 66% were worried about the climate. That’s an astonishing swing in what was painted as an existential risk for the entire planet just 12 months ago.

(chart via the World Economic Foundation Global Risks Report 2024)

Did that threat dissipate? Did it get solved? Or did attention, like influence, also fragment?

And note the swing in concerns about polarization – in the 2024 report, almost half of respondents had this risk in their top five. This year, it’s down to 6%. Perhaps, with increased polarization now a fact rather than a fear, it’s not as scary? I can’t think of any other explanation.

Of course, these are just surveys, which are almost always limited and can be tilted by the way the questions are framed – there were changes in the wording of some risks this year (for instance, last year’s “AI-generated misinformation and disinformation” became just “misinformation and disinformation”) which can make direct comparison pointless. But surveys can reveal shifts in the median sentiment, which itself often tells an interesting story.

Filling the cracks

The story here is one of a fragmenting world with fragmenting priorities. This will come as no surprise to regular readers of this newsletter, as it is something I write about quite a bit – when it comes to the impact of crypto on the macro landscape and vice versa, it’s relevant.

It’s not just about the possible impact on US domination of the global payments landscape, although that does matter. More countries either are or will be exploring and even using payment connections that don’t touch SWIFT or US banks, and many of these will discover how efficient and resilient blockchain rails can be.

It also matters for the evolution of local growth. The crypto ecosystem has demonstrated the relative ease with which new marketplaces can spin up – after all, the industry got started from the ground up, piecemeal, with independent platforms around the world growing in a haphazard and chaotic way, but one unfettered by gatekeepers. Necessary rules and the complications of plugging into the existing system of course will slow market building down, and for investor protection against scams that’s a good thing – but crypto still makes new venues more possible in more places. For local growth, marketplaces matter.

Crypto is also relevant for potential wealth generation, anywhere. Trump changed the global conversation with his memecoin launch last weekend, and while this couldn’t be replicated in, say, Nigeria or Croatia given their limited market size and influencer brand recognition, it’s not hard to imagine other key global figures capitalizing on their name, either for self-enrichment or a good cause. We’ve already seen how new media technologies influence cultural norms and give rise to wealth unconnected to the “establishment”. Crypto has the potential to turbo-charge that, making the establishment even less relevant in power distribution going forward.

In sum, the World Economic Forum – like most pan-national organizations – is waning in influence. We’ve been hearing this in fringe media for years, but now we’re actually seeing it play out. The IMF’s recent flailing to retain economic power is another example of institutional decay, as are the internal conflicts in the United Nations and the increasingly public rejection of the International Criminal Court’s authority.

At the same time, we’re witnessing the development of not only a new technology that atomizes and distributes the idea of financial transactions; we’re also watching technology and politics change our understanding of decentralization, while trust in global institutions crumbles.

All of this, I believe, is more significant than most of us realize today, especially when we are caught up in the daily noise of markets, macro and mayhem. Zooming out, bigger changes are happening, and the lens of history will show us that we had a front row seat all along.

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Regular readers will know that I love photography contests. They not only showcase inspirational talent, they also give us a glimpse of corners of life we would not otherwise get to see, and they remind us that the lens through which we see things is as important as the subject in front of us.

One of the most sweeping photography contests is the 1839 Awards, named after the year in which the medium was first made widely available to the public. Other competitions have a thematic focus; the 1839 Awards are dedicated to the art of photography itself, which delivers a breath-taking array of techniques and styles.

The organizers have shared winners for 2024’s submissions for Photographer of the Year. I didn’t feel particularly moved by the two top winners (professional and non-professional), but there were many astonishing images in some of the sub-categories.

Here are some of my favourites:

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.