What’s ahead for the crypto market in Q4

plus: SWIFT, Circle, Tether, Gaza, gold and more

“I just invent. Then I wait until man comes around to needing what I’ve invented.” – R. Buckminster Fuller ||

Hey everyone! Noooooo, how can it be the end of September already??? Next thing we know, it will be Halloween, and then Thanksgiving, and then Christmas and New Year and 2026, and it feels way too soon for that…

Here’s a link to my latest American Banker op-ed, where I look at how soulbound tokens are changing our concept of identity.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

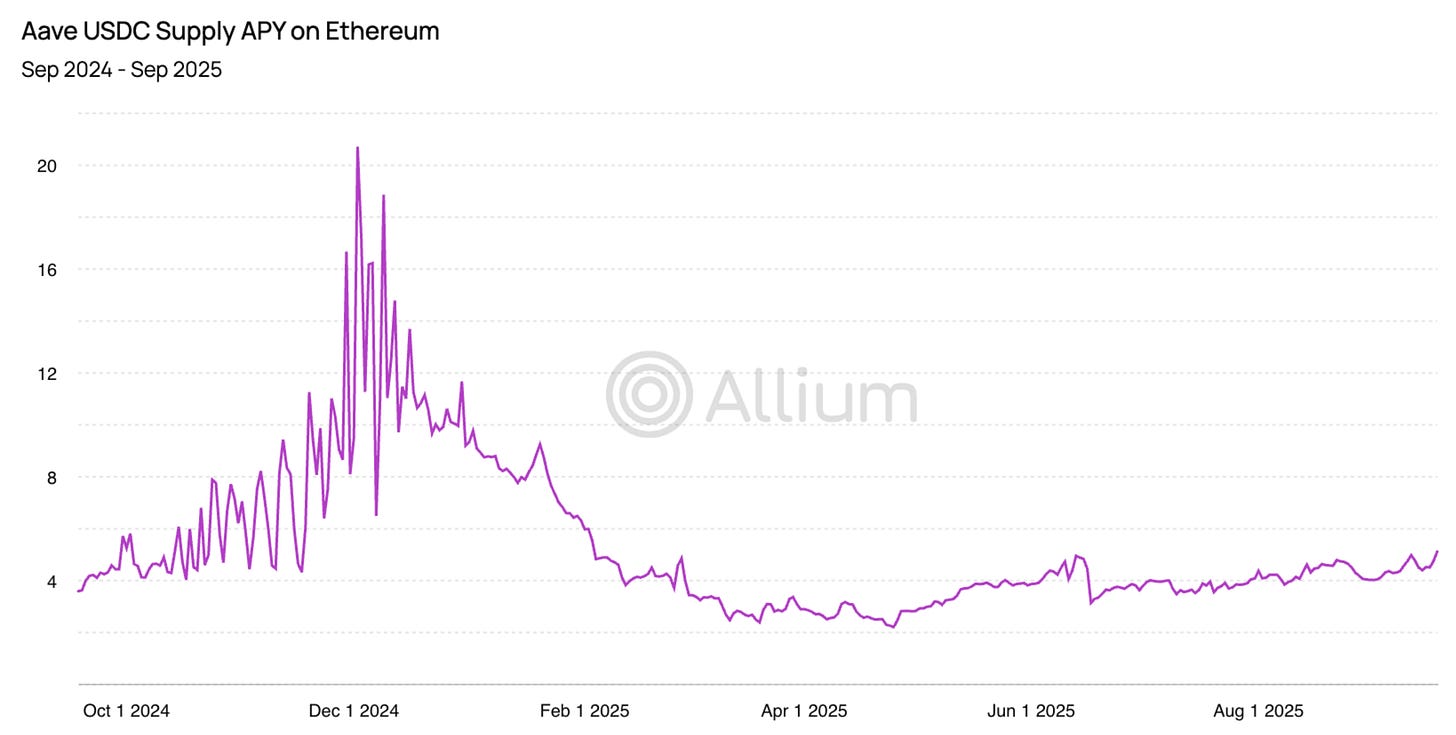

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

What’s ahead for the crypto market in Q4?

What are the hasty reactions to the SWIFT ledger getting wrong?

How can reversibility be compatible with onchain finality?

Is the looming government shutdown behind the gold price rise?

Just HOW big is Tether’s valuation?

What’s going on in Gaza?

WHAT I’M WATCHING:

Looking ahead to Q4: Crypto

(Trying out a new quarterly feature – might make it monthly? – that looks ahead at what we’re likely to see in coming months. I’ll start with crypto, tomorrow I’ll write about the macro outlook, and on Thursday I’ll tackle the tokenization field. They won’t be long comments as I’m scribbling thoughts off the top of my head, but I hope you find them useful in forming your expectations.)

Bull market?

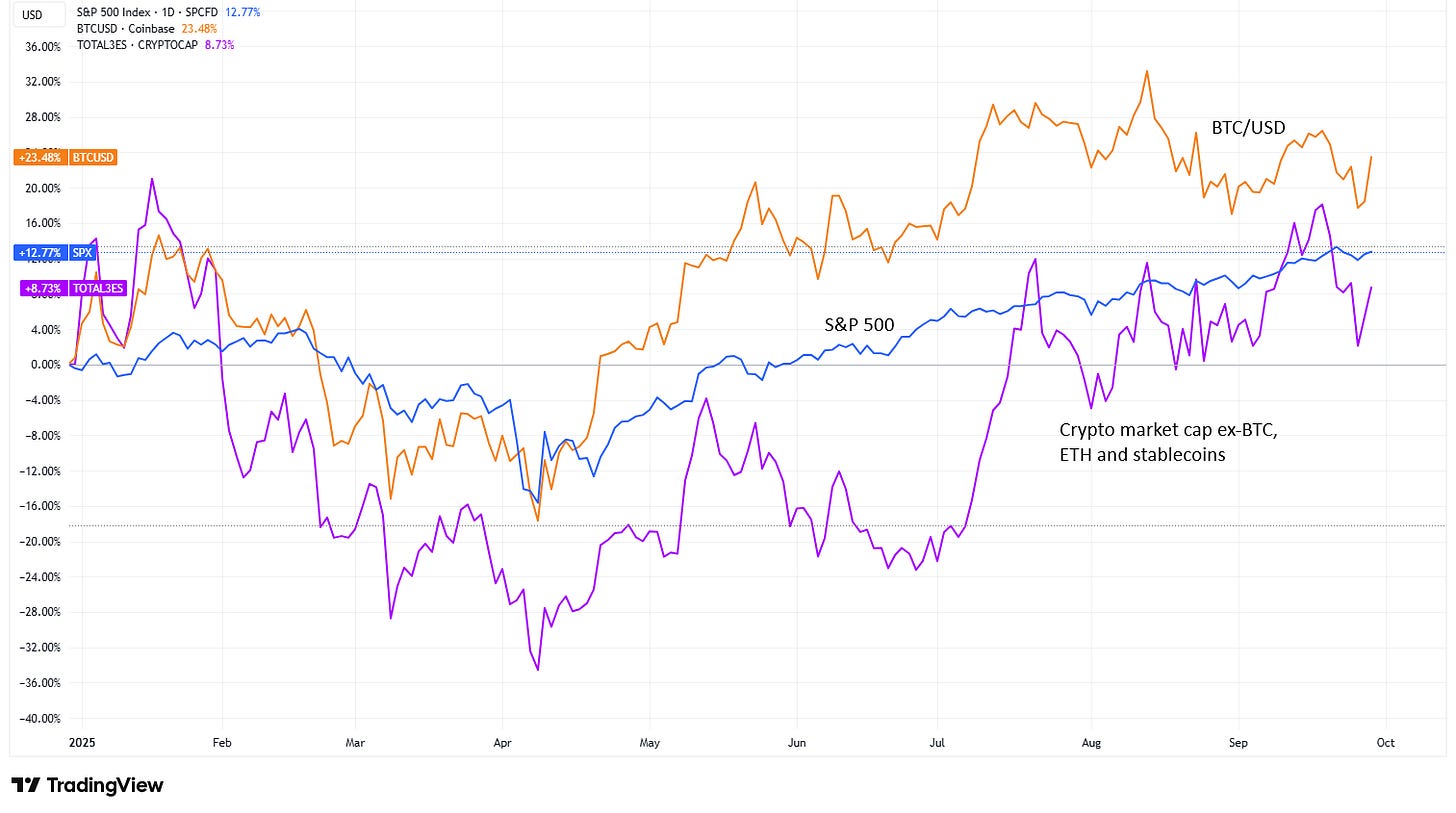

The next quarter is likely to see the start of the crypto bull market. I say “start” because what we’ve seen so far can’t really be called “bullish”. Strong price action among those with market cap greater than $10 billion has largely been concentrated in a handful of names (HYPE, BNB, XRP), and even the +21% and +25% moves of BTC and ETH respectively are not exactly frothy. Well ahead of the S&P 500’s 13%, but not great when you adjust for risk/volatility.

Remove the market caps of BTC, ETH and stablecoins, and the crypto market has grown a measly 7%.

(chart via TradingView)

Nevertheless, spirits seem to be high among crypto natives, many of whom insist we’re just not “ready” for what’s ahead – but I’ve been hearing that all year. And I, too, have been saying for what feels like ages that the tailwinds are strong; indeed, they are now arguably stronger than ever. But uncertainty is pervasive, risk sentiment is inconsistent, AI is the tech flavour of the year and the institutional adoption has been encouraging but also slower than many of us expected.

That said, the delay in the start of the bull market means it will have longer to run. And signs are pointing to some sort of ignition in coming months if not weeks.

Bitcoin

Regular readers will know that I often write about geopolitical developments here, because they are an intensifying tailwind for BTC. As I wrote yesterday, we are seeing signs that the market is starting to take on board the building uncertainty – just look at the gold price and stubbornly high long-term bond yields.

(chart via TradingView)

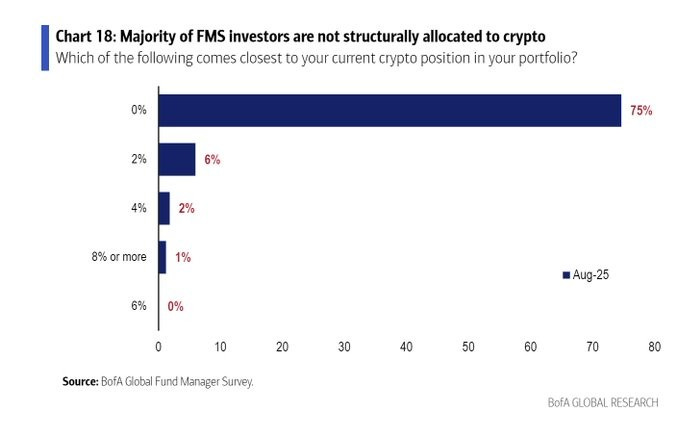

Even beyond the escalating risk of new conflicts, US inflation is more likely to increase than decrease, increased borrowing around the world will intensify currency concerns, and what’s good for gold is also good for BTC, especially since it is still woefully under-allocated.

(chart by Bank of America via @Callum_Thomas)

Plus, the incoming rush of market support – lower rates, yield curve control and lots and lots of “money printing” – will boost global liquidity, which will seep into the riskier corners of institutional portfolios. For many of the “big money” players, BTC is as “risky” as they’ll be allowed to get.

And the retail market will start to stir. So far, we haven’t seen signs of the typical retail excitement associated with the late stages of bull markets. There have been inflows into the ETFs, but not nearly on the scale as we are likely to see going forward with newcomers finally realizing some “insurance” is a good idea, and those with BTC exposure fearing they don’t have enough. This will accelerate as headlines start to comment on the price increases, and momentum kicks in.

In the crypto world, we’re used to thinking retail will prefer the rollercoaster of smaller tokens, especially when there’s hype behind them. But we forget that our world is still small, and most mainstream retail investors do not consider themselves either traders or risk-takers. Most don’t want to have to check prices every hour. For them, exposure to BTC, ETH and maybe one or two other big names will be risky enough. And, in aggregate, their market influence is huge.

Altcoins

The coming quarter should bring the kickoff of “alt-season”, as attention starts to turn away from the “majors” (BTC and ETH) and towards smaller, more volatile tokens. In aggregate, they haven’t yet done much – the OTHERS index (the total crypto market capitalization outside the top 10 tokens) is down 11% so far this year, and even over the past few months, has not notably moved relative to BTC.

(chart via TradingView)

The catalyst for the kickoff should be a combination of liquidity as central banks around the world deliver rate cuts and other forms of market support (more on this tomorrow), as well as a flurry of big-name token issuances that remind investors of the innovation. Just some of the names I’m familiar with that have plans to issue tokens in coming weeks: MetaMask, OpenSea, MegaETH, Build on Bitcoin, Katana, maybe even BASE…

It’s not so much the token generation events (TGEs) themselves that I’m interested in as the reawakening of interest in the purpose of the web3 ecosystem beyond memes and gambling (nothing wrong with either of those, but they’re not exactly transformational).

Combine this with progress on regulatory clarity around the world, and we’re likely to see a notable mood shift.

Actually, it’s already started. I’m probably not alone in thinking that blockchain building has felt insular recently, with more focus on the big institutions than the upstart visionaries working on the pipes of new transaction layers; and with more emphasis on doing the old stuff on new rails than on blurring boundaries. Ahead, we’re going to be hearing more about layers, DeFi, composability, fractionable yield and probably some things I’m not yet aware of.

Plus, we’re almost certainly going to see a flood of crypto spot ETF issuance, starting soon, now that the SEC has approved a standard framework and has asked ETF issuers to withdraw their filings (with clear rules, they won’t be necessary).

This will add to the overall noise, but it will help “mainstream” some of the smaller tokens as brokers start to help clients allocate some of the “play money” part of their portfolios to riskier ventures – in the process, broadening awareness that the crypto market is not a monolith and not just about macro, that it is about a new technology still finding its feet.

This newsletter is not about to go all “degen” on you, it will continue to weave together the macro and crypto threads, especially as things start to unravel on the big board over the coming months. But I am looking forward to getting back to why I fell in love with this sector in the first place, 11 years ago: creating a new financial system.