Why the gulf between sentiment and economic activity matters

Plus: the Digital Dirham, and market short-termism

“If the misery of the poor be caused not by the laws of nature, but by our institutions, great is our sin.” – Charles Darwin ||

Hello everyone, I hope you’re all taking care of yourselves! At this time of year, the days may be shorter, but the weeks feel longer.

Production note: this newsletter will take a short break over the Thanksgiving holiday, so no dailies on Thursday and Friday, but I will publish the free weekly on Saturday. 🍎

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

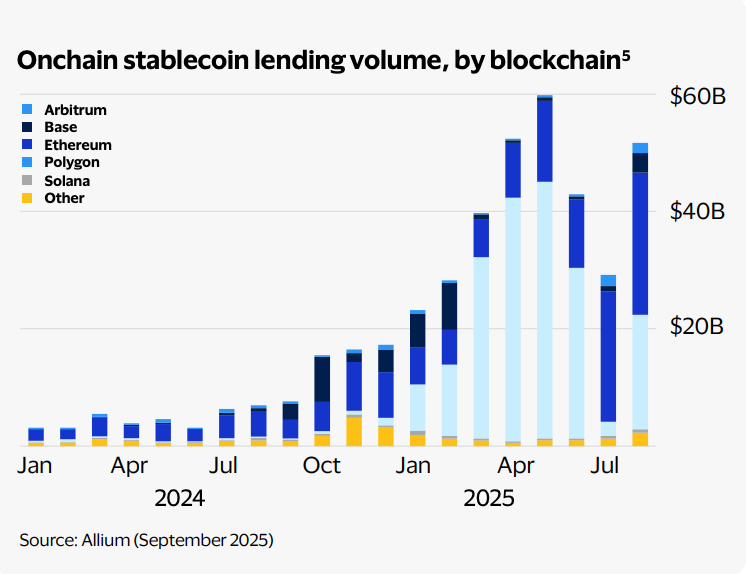

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Why the gulf between sentiment and economic activity matters

CBDCs: mBridge launches in the Middle East

Markets: short-termism

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

WHAT I’M WATCHING:

Why the gulf between sentiment and economic activity matters

Regular readers by now will know that I often focus on global unrest because of its longer-term impact on economies, markets, and demand for alternative financial rails – as the censorship instinct pushes groups clinging onto power to reach for the debanking button, we can be glad Bitcoin and stablecoins exist.

But I rarely focus the unrest lens on the United States, despite obvious examples of political turmoil and the need for systemic change. After the election, I commented on the opportunity for brave measures to restore economic hope for voters anxious about their economic outlook and more concerned about growth as well as making ends meet than “values”. However, other than vigorously defending the relevance of US consumer surveys and other “soft” data readings, I feel like I’ve written more in recent months about the GenZ riots in emerging economies and the signal in the rising gold price than about building resentment in the world’s largest economy.

As the US starts gearing up for the mid-term elections next October, this may change, especially in light of some refreshingly stark data that helps identify the malaise.