The dollar’s drop: part of the plan

Plus: why no BTC reaction, Tether's US token, and more

“In the long history of humankind (and animal kind, too) those who learned to collaborate and improvise most effectively have prevailed.” – Charles Darwin ||

Hello everyone, and happy Fed Day! I hope you’re all managing to stay warm and dry – I confess to having spent a chunk of valuable writing time this morning staring out my window at the fluffy white flakes covering rooftops. Snow is rare in Madrid, so today is a special occasion.

At 9am ET, I’ll be chatting to Scott Melker on his live show, can’t think WHAT we’ll find to talk about… If you’re so inclined, you can watch here.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

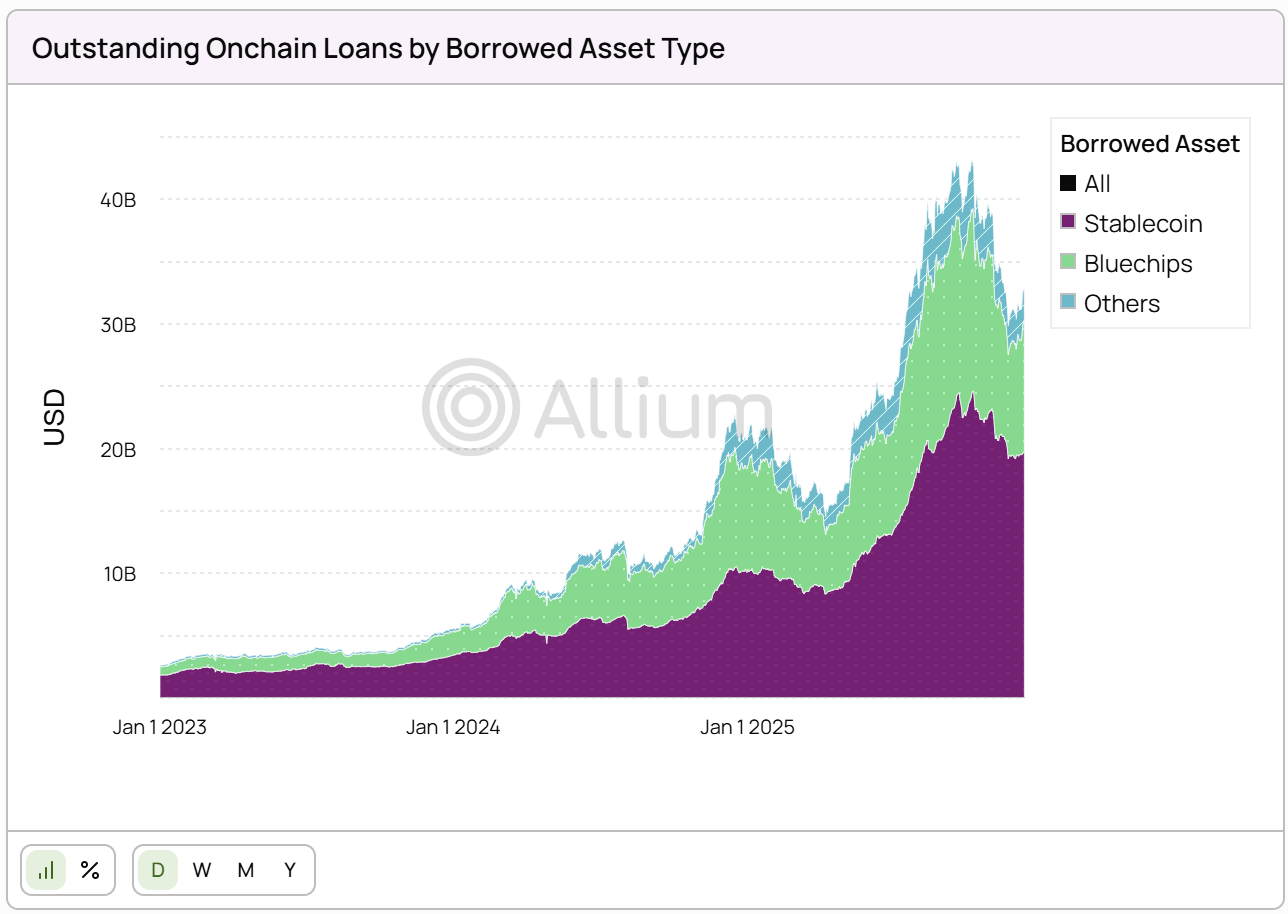

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

The dollar’s drop: part of the plan

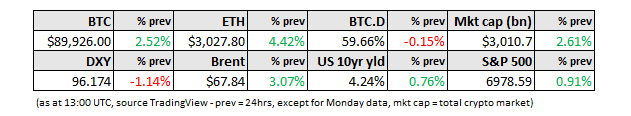

Markets: BTC still asleep

Tether: USAT touchdown

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

The dollar’s drop: part of the plan

President Trump’s comments on the US dollar yesterday seem to have awoken mainstream interest in what has been going on with the currency since the beginning of the year, with the predictable freak-outs.

And, yes, the volatility in the DXY index is unusual.

But it’s not a surprise. The trend lower is part of the plan – and did we really think the reset would be calm and peaceful?

(DXY dollar chart via TradingView)

Last year, amid the “Liberation Day” turmoil, I wrote about a paper published in November 2024 by now-Fed Governor Stephen Miran, which outlined much of the economic strategy the Trump Administration is following.

Here’s one of the opening sentences:

“The root of the economic imbalances lies in persistent dollar overvaluation that prevents the balancing of international trade, and this overvaluation is driven by inelastic demand for reserve assets.”

The argument is that everyone wants dollars – not only is it the denominator for most of the world’s trade, it is also the most liquid currency and one of the least volatile – which pushes its value well above where it should settle based on trade flows.

This keeps inflation down (imports are cheaper in dollar terms) as well as bond yields (dollars held by trade partners get recycled into US treasuries, pushing up their prices and bringing down their yields), which is good for the economy. But it also makes US exports more expensive in local currency terms, which hurts US manufacturing and is one of the reasons the share of manufacturing in the US economy has shrunk in recent decades. Fine for those on the coasts where finance and other service industries dominate, not good for the regions gutted by the closure of factories.

So, to encourage manufacturing back to the US, a lower dollar is key.

Miran also points out that the rest of the world should be compensating the US for the service of providing the world’s reserve currency – instead, it benefits while also expecting the US to provide global security.

“The Trump Administration is likely to increasingly intertwine trade policy with security policy, viewing the provision of reserve assets and a security umbrella as linked and approaching burden sharing for them together.”

Remember all the talk last year of the “Mar-a-Lago Accord”? The term implied a Trumpian (Trumpish?) twist on the Plaza Accord of 1985 in which the leaders of the US, France, Germany, the UK and Japan gathered at the Plaza Hotel in New York to agree on coordinated market intervention to bring down the US dollar and boost the other currencies. (In what we have to pray is not an omen, in 1988 Trump bought the Plaza Hotel which then declared bankruptcy a few years later.)

As I’ve previously argued, “Accord” is the wrong term as that implies agreement. Recent moves in the Japanese market suggests that maybe, after all, there could be some coordination – but that is no longer seen as essential.

And the strategy is working:

(DXY dollar chart via TradingView)

Plus, the DXY index is probably heading lower still. Even after the sharp drop over the past week, it’s at roughly the same level as the average during Trump’s first term, when he was already voicing concerns about the currency’s overvaluation and the damage to US industry.

Of course, I’m not the only one that thinks there’s a downward slope ahead – traders are paying the highest amount on record for short-dated options that profit from a weaker US currency.

(chart via Bloomberg)

However uncomfortable we may be with the methods, we have to recognize that Trump has done what he set out to do – bring down the US dollar. That’s why he’s not wrong in declaring “the dollar’s doing great”, nor in bragging that he can make it go up and down like a yoyo (because he can). He’s treading a thin line between wanting it to go lower, but not wanting to look weak. So far, he’s pulling it off.

What’s more, the dollar is not just down against G10 currencies – even emerging market currencies are being repriced in dollar terms.

(chart via @robin_j_brooks)

A key and particularly tricky part of the plan, though, is for the drop to be “sustainable”. In theory, geopolitical chaos would push up demand for the world’s “safe haven” currency, causing it to appreciate and further squeezing US exports, defeating the point of the chaos. Plus, other regions freaking out at the climb in their currencies relative to the dollar will consider jumping in to sell their currencies in exchange for USD – scanning the Financial Times headlines this morning, I see that both the EU and Switzerland are gearing up to start thinking about it.

Would they sell the euro and the Swiss franc to buy dollars? Probably, because of muscle memory. But other nations might instead sell local currencies to buy gold. Put differently, many assume the run in gold is due to diversification away from dollar holdings; but it could also be in part a domestic currency tool, especially if reserve managers no longer see the dollar as a safe haven.

(DXY dollar chart via TradingView)

See also:

The Miran paper: off to a bad start, but here’s the plan anyway (April 2025)

It’s not a Mar-a-Lago Accord, it’s a Mar-a-Lago Pact (March 2025)

Markets: BTC still asleep

But what about BTC, why isn’t it reacting? Very good question. In theory, BTC should benefit from a weaker dollar, as well as from increased demand for a safe haven. Only, it’s not, other than a glimmer of a move this morning.

(BTC/USD chart via TradingView)

What’s keeping a lid on the price?