Tokenization in Q4, BTC momentum

also: Stripe's evolving stablecoin ecosystem, jobs, and more

“No longer certain that one ever does win a war, I am.” – Yoda, The Clone Wars ||

Hi everyone, and happy Friday! Cripes, this week went by fast. I hope you have some relaxing things planned for the weekend – I have a feeling next week will be even crazier than this one.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

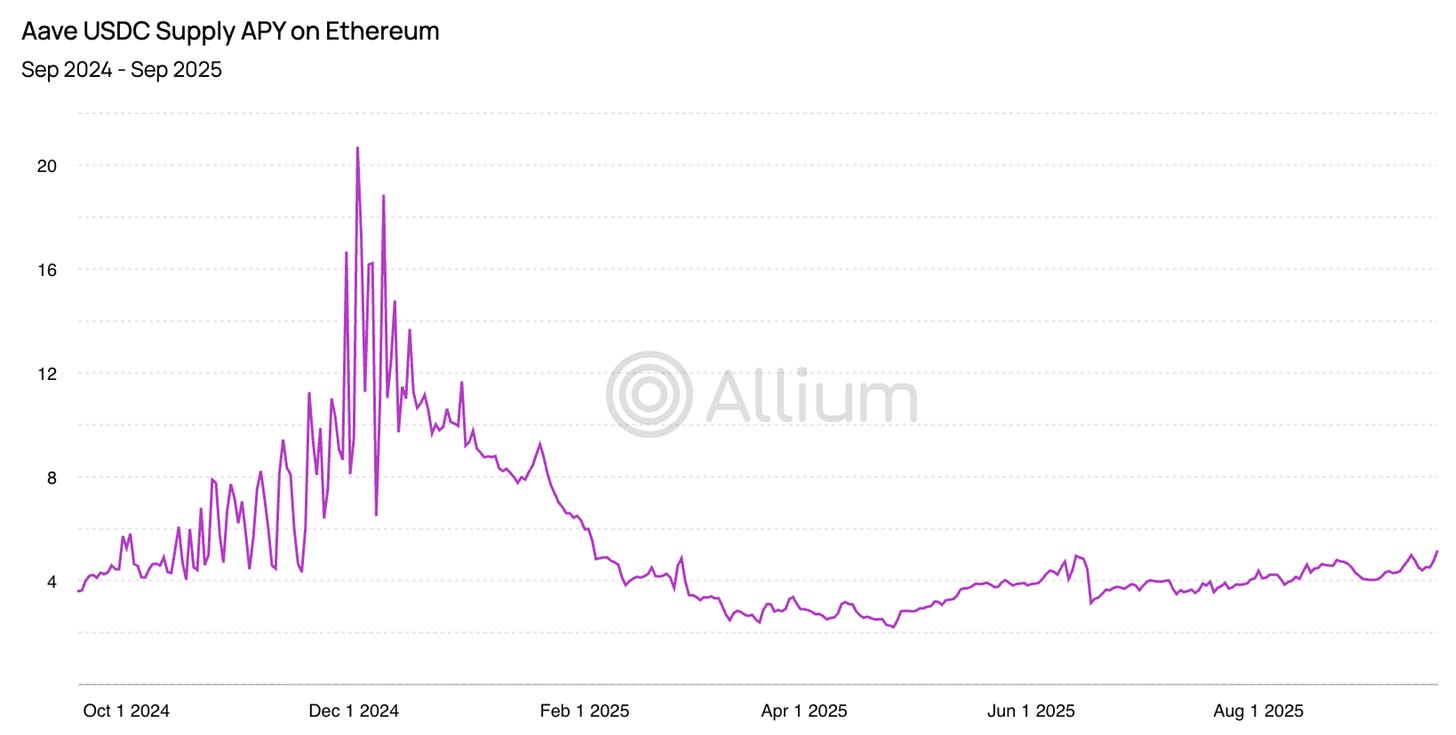

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Tokenization in Q4

Stripe’s evolving stablecoin ecosystem

BTC momentum

JPMorgan’s BTC target

Long-term BTC holders

Private sector jobs data

Drones, threats, and more

WHAT I’M WATCHING:

What’s ahead for tokenization in Q4?

Of all the “what’s ahead” categories (I shared macro and crypto earlier this week), this is the easiest: more stablecoin launch and/or adoption announcements, more investment in stablecoin infrastructure, and more posturing by bankers and politicians, everywhere, about stablecoin risks.

We’ll also see more tokenized issuance, with a focus on bringing real-world assets onchain – tokenized bonds, equities, real estate, etc.

Fine, but those have been key narratives for a while now – what’s new for Q4?

Three things to keep an eye out for:

1) Stablecoins and agentic payments.

We’ve already seen the beginning of an acceleration here, with the Coinbase-Cloudflare partnership on x402, and Stripe’s Instant Checkout in ChatGPT (see below). Expect more like this, driven by the scramble for stablecoin use cases beyond cross-border transfers (getting crowded) and by the need to come up with concrete business drivers for AI to justify the colossal capex (you may have noticed an uptick in scepticism).

To be honest, I haven’t felt compelled to dive into AI-crypto overlaps such as LLM storage, as I’m not yet comfortable with the idea of indestructible models. But agentic commerce feels like it will get significant traction, especially as the robot economy emerges before our eyes.

2) Network switching, aka. interoperability.

We are heading into a landscape of hundreds of different stablecoins. A lazy assumption is that entities won’t want to go through the technical, operational and regulatory hassle of issuing their own, they’ll use one of the liquid options already out there. But this overlooks the stablecoin-as-a-service (I can’t call it SAAS, can I?) platforms erupting onto the scene. We saw Visa launch one last year, although it has been quiet. Stripe is more likely to have success here (see below) as they understand the need for an ecosystem around said platform. There will be others, and collectively they will push the costs of issuing a stablecoin well below the potential benefits in revenue, customization, user engagement and business opportunities.

I’ve heard some point out that this will be too confusing for users. Not necessarily – that’s a design problem that can be solved. Users will adapt to the ones that are convenient, perhaps swiping between options or letting AI choose the appropriate solution for a given situation. With design issues, it’s helpful to imagine they have been solved – now, what does that look like?

3) The regulatory battle is not yet over.

GENIUS may have passed, but banks are mobilizing to further limit the business potential by blocking the ability of issuers or other market participants to offer rewards on stablecoin balances. They’re unlikely to succeed since limiting marketing opportunities for US corporations will be a hard sell – but lobbyists could convince Congress to throw a curve ball in the CLARITY Act currently in progress.

Meanwhile, stablecoin and tokenized asset regulation outside the US will see further progress: for example, Hong Kong has said its first stablecoin licenses will be announced in Q4, Japan’s first approved yen-backed stablecoin JPYC should launch this autumn, and South Korea will start debating a stablecoin regulation bill this month.

So, in sum, in tokenization over the next few months, we’ll have more of the same: more launches, progress on the infrastructure, more global regulation. But we’ll also see the consolidation of new narratives, especially agentic commerce and interoperability, as well as new regulatory conflicts.