WEEKLY - BTC at $100k, the widening discourse

plus, the BRICS currency that isn't, and some stunning wildlife photos

Hi everyone, I hope you’re all doing well!

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of articles from the past few days.

A couple of podcast appearances this week:

This episode of Bits and Bips features new co-hosts me (!!) and Ram Ahluwalia joining James Seyffart and special guest Alex Thorn. There were some tech issues, but it was a fiery chat nonetheless. You can see it here, or listen here (Spotify link).

On the Brazil Crypto Report podcast, I got to chat with Aaron Stanley who knows more about what’s going in crypto in Latin America than anyone else I’ve met. You can see that episode here, or listen to it here (Spotify link).

If you’re not a premium subscriber, I hope you’ll consider becoming one! I can help you navigate crypto narratives and their impact on the macro landscape, as well as macro narratives and their impact on the crypto landscape.

You get ~daily commentary on macro, crypto and the space in between, plus some cool links, a smattering of charts, and a daily music link because why not. AND you get access to a premium subscriber chat over on substack.com or on the app! And audio!

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

Why $100,000 is a big deal

The BTC window of discourse

BRICS, tariffs and the US dollar: creating new threats

Some of the topics discussed this week:

December: Cause to celebrate

Geopolitical kindling: Syria, Georgia and crypto

Macro talk gets aggressive

BRICS, tariffs and the US dollar: creating new threats

Why South Korea’s crisis matters

The digital euro moves forward

Why $100,000 is a big deal

The BTC window of discourse

Tomorrow’s data drop

Why $100,000 is a big deal

It happened!!!!

Regular readers will know that I never use exclamation marks for prices, because to be honest I don’t care much about levels – it’s the narratives I find interesting.

But BTC passing $100,000 is a big, fat, round exception.

For those of us who have been here a long time, it’s emotional. I bought my first BTC at around $250 (I sold too early in the 2017 run), and so this breach feels like our little baby Bitcoin has gone and grown up. It feels like a graduation, a step into the adult world, with head held high.

All of us who have consistently and persistently wanted Bitcoin to do well should be feeling a well-earned validation.

There’s more than a smidgen of pride: everyone working in crypto in some way helped it get there. Bitcoin has no executive leader and no marketing team other than all of us. And so if you saw old-time Bitcoiners congratulating each other on social media this week, we weren’t being smug – it’s that there’s no-one else to congratulate.

There’s also the overwhelming awe at the force of an idea. No other intangible asset, anywhere, ever, has experienced this kind of growth without a management entity behind it. You can point to BlackRock or Powell or Putin or whoever, and claim they made this happen, but they didn’t. The market did.

Going forward, BTC will rise, and it will fall, and it will continue to do so as long as “forever” has meaning. Because no one entity can decide otherwise.

But Thursday was a landmark we will never forget. It felt like the beginning of something new. BTC has since briefly gone back below $100,000, risen above, and bounced around for a bit. Even once it decisively breaks above, it could go below again at some point in the future. That doesn’t matter – for now, it is breathing rarefied air.

Like other hard-won successes, this will soon become comfortable, and eyes are already on adding another zero to this morning’s benchmark figure. But for now, at this moment in time, we have to take a moment to realize what an achievement this is.

(chart via TradingView)

See also:

The BTC window of discourse

That said, several things happened this week that may have had some influence in the sentiment boost:

Fed Chair Jerome Powell spoke favourably of Bitcoin. You read that right. The head of the US central bank, on stage at the Dealbook conference, likened Bitcoin to gold and emphasized that it was not a competitor to the US dollar. This will have some impact on remaining regulatory resistance in Washington DC (there is still some).

Russian president Vladimir Putin acknowledged that Bitcoin can’t be banned. This is notable, coming from someone who has form in banning things he is worried about. Speaking at an investment conference, he also stressed that the US weaponization of the dollar was encouraging states to turn to other assets for diversification, including cryptocurrencies. How long before we hear an official announcement that Russia is holding crypto as part of its reserves, I wonder. (China, over to you…)

President Elect Donald Trump has nominated Paul Atkins to replace Gary Gensler as head of the SEC. I haven’t had time yet to dive into Atkins’ statements on crypto, but SEC Commissioner Hester Peirce vouches for him, and since she is probably the most thoughtful official in office when it comes to the potential for financial innovation, that’s good enough for me.

Trump has also named founder and investor David Sacks to the new position of “AI & Crypto Czar” – this is a big deal, as it significantly reduces the risk that crypto policy will get pushed down the crowded list of priorities. With someone whose brief is to help craft policy and get it into the right hands, ideas will have a filter and a mover. I’m especially optimistic on the choice of Sacks given his early interest in tokenization – I interviewed him on a panel on this topic back in 2018, a year after he cofounded security token platform Harbor. Tokenization is one of the many crypto areas in which the US is lagging: there are plenty of tokenized money market funds, but not much else. In an interview for CNBC back in 2018, Sacks described himself as a “token maximalist” because “ownership belongs on a blockchain”.

Hedge fund Citadel founder Ken Griffin, who back in 2018 criticized crypto for distracting investment from shares which can drive economic growth, and who likened Bitcoin to tulips when it was at $10,000, said the following:

“You have to remember an intangible asset like this is valued on intangible aspects. It’s about community. It’s about standing opposed to the power of the state. People take joy in that. The American people want agency of their money, and crypto is part of that.”

The term “Overton window” refers to the range of ideas that can be reasonably discussed in public, that mainstream officials and the general public are ready to entertain. It is also known as the “window of discourse”, and I think we can say with certainty that, for Bitcoin, it is now wide open.

See also:

BRICS, tariffs and the US dollar: creating new threats

The “most beautiful word” in President-Elect Trump’s vocabulary is getting a lot of use these days. While some threats could produce welcome results, such as the proposed 25% surcharge on goods from Mexico and Canada unless they do something about the inflow of illegal drugs and immigrants, others could end up triggering a backlash that impacts demand for the US dollar.

Last week, Trump threatened to impose 100% tariffs on all BRICS members should they move ahead with the creation of a new currency, or back any currency that could replace the US dollar.

The strange thing is, the BRICS nations are not exploring the creation of a new currency. They sensibly recognize that doing so would be a gargantuan task that wouldn’t necessarily deliver the desired results. Nor is there any hint of them trying to knock the USD from its privileged perch.

Yet Trump’s statement highlights why an alternative might be desirable, inadvertently making the eventual emergence of one more likely.

The BRICS’ stance

For background, BRICS is a trade association set up in 2006 to counter US influence in global commerce – the original members were Brazil, Russia, India and China, with South Africa joining in 2010. Earlier this year, Iran, Egypt, Ethiopia and the UAE were admitted as members (Argentina was invited but declined; Saudi Arabia was invited and has not formally accepted but is hovering on the edges). At the annual summit in October, a further 13 countries including Nigeria, Turkey, Indonesia and Thailand were admitted as “partners” (it’s not clear what that term means here), and many more have reportedly applied to join.

One significant feature of the joint statement that emerged from this year’s summit was the intention to investigate the feasibility of an alternative payments system. The wording stopped short of a commitment to go ahead with one.

Point 65 of the Kazan Declaration says:

“We reiterate our commitment to enhancing financial cooperation within BRICS. We recognise the widespread benefits of faster, low cost, more efficient, transparent, safe and inclusive cross-border payment instruments built upon the principle of minimizing trade barriers and non-discriminatory access. We welcome the use of local currencies in financial transactions between BRICS countries and their trading partners. We encourage strengthening of correspondent banking networks within BRICS and enabling settlements in local currencies in line with BRICS Cross-Border Payments Initiative (BCBPI), which is voluntary and nonbinding, and look forward to further discussions in this area, including in the BRICS Payment Task Force.” (my emphasis)

The declaration does not mention the creation of a new currency. Nor does it even hint at a desire to replace the dollar in global trade – rather, it stresses the need for choice.

A main point of emphasis is the need to strengthen bilateral and group ties, which … sounds reasonable? Trump’s reaction gives the impression of the US wanting to dictate who countries can do business with and in what way. Nations that accept this dominance are essentially granting the US full control over how they conduct their business, which few are likely to be happy about. Some may even find it becomes a political issue, especially in this increasingly nationalistic and polarized age.

Plus, for some countries – such as the current BRICS Chair Russia – reducing dependence on the dollar system (and the risk of further US bullying) is a question of economic survival. And one thing the US must know is that countries pushed into a corner do find ways of pushing back, or of changing the configuration of the room.

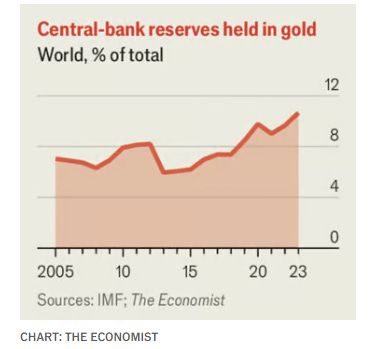

Other nations wary of a similar treatment to that doled out to Russia will also no doubt be strengthening their resilience, by exploring more efficient ways to settle trade without passing through dollars, and by diversifying state holdings. This has already started: gold now makes up 11% of global central bank reserves, vs 6% just six years ago.

(chart via The Economist)

What’s especially notable about Trump’s statement is that it misunderstands what the BRICS are trying to do, and shows a complete disregard for why.

Dollar strength

On the other hand, his statement may deliver some of the desired impact, by slowing down any internal BRICS agreement on a new system as nations understandably don’t want to lose trade privileges.

But a cohesive new BRICS payment platform was unlikely anyway. Group members are not exactly united in their relationship with the US, and anyway, some are democracies with shifting priorities. Even mBridge, the cross-border CBDC platform built under the watch of the BIS, involving the central banks of China, Hong Kong, Thailand, the UAE and Saudi Arabia, has run into governance issues, and the BIS has walked away from the project. If even a small group with an institutional guiding hand struggles to overcome differences, imagine how hard the now-sprawling BRICS organization would find the challenge.

What is likely is the emergence of what the Kazan Declaration suggests: an easier way to trade amongst “friendly” nations. This could involve CBDCs – many members are in advanced stages of exploration. It could involve new banking agreements. It might even incorporate the use of stablecoins, although this would require some complex legal changes.

These negotiations are likely to progress despite the convenience of the US dollar, largely because no-one likes a bully.

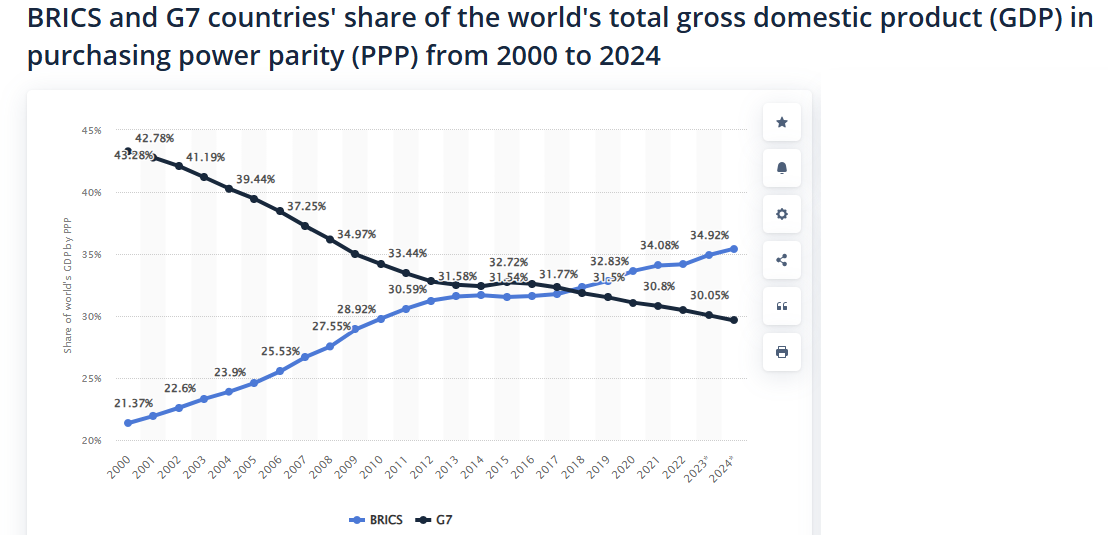

Plus, the economic heft of the BRICS is now greater in PPP-adjusted terms than that of the G7. Were Trump to carry out his threat, the trade of targeted countries would be devastated – but that of the US would also suffer a significant blow.

(chart via Statista)

In sum, we know that Trump uses threats of tariffs as a negotiating tool. But he may have overplayed his hand here. Bilateral settlement in other currencies will increase, and new networks will emerge. His attempts to stop this will accelerate the progress. And this will impact global demand for the US dollar over time.

See also:

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Voting is open for the Wildlife Photographer of the Year People’s Choice Award for 2024!

So many jaw-dropping images to choose from, but here are some of my favourites:

No Access, by Ian Wood

Edge of Night, by Jess Findlay

Earth and Sky, by Francisco Negroni

Aspen Shadows, by Devon Pradhuman

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.