WEEKLY Crypto is Macro Now – BRICS, Coinbase

plus, a newsletter update, and the most heart-warming photos you'll have seen in a while

Hi everyone, I hope you’re all doing well! And that you get to rest this weekend, because next week is going to be intense on so many levels. 😣

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of articles from the week.

If you’re not a premium subscriber, I hope you’ll consider becoming one! For the price of a couple of New York coffees a month, I can help you navigate the tangled web of macro impacts on crypto narratives, and crypto impacts on macro narratives.

You get ~daily commentary on macro, crypto and the space in between, plus some cool links, a smattering of charts, and a daily music link because why not. AND you get access to a premium subscriber chat over on substack.com or on the app! And audio!

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

What Coinbase’s Q3 report says about the market cycle

What alternative BRICS payment system?

Some of the topics discussed the past couple of weeks:

Markets signal: A drama in three parts

Startling political change

mBridge gets complicated

Crypto on the move

Conflicting messages on rates

Macro drums hit louder this week

What alternative BRICS payment system?

Newsletter stuff

Interesting podcast links

A crushing review of Gensler’s administration

What Coinbase’s Q3 report says about the market cycle

Tokenized treasuries and centralized control

What Coinbase’s Q3 report says about the market cycle

Normally I don’t talk about quarterly earnings, even though you could argue that publicly listed crypto companies are in the intersection of crypto and macro, which this newsletter focuses on. I should have a think about that – perhaps my reluctance has been because I don’t want this to become an investment research note (there are plenty of good ones out there), at least not when it comes to portfolio allocation. I’m more interested in trends, narratives and market plumbing.

But every now and then an earnings release throws up some interesting statements on current market conditions.

Such as, Coinbase’s latest Q3 report.

The headline figures:

Revenue reached $1.13 billion, up more than 80% year-on-year but down 18% quarter-on-quarter, largely due to lower transaction revenue.

Net income went from a $2 million loss in Q3 2023 to a profit of $75 million in Q3 2024, and more than doubled vs Q2. This was after deducting $121 million in mostly unrealized pre-tax losses on the crypto investment portfolio.

Adjusted EBITDA was $449 million, up 150% year-on-year, but down almost 25% quarter-on-quarter.

Looking closer, the breakdown contains a couple of intriguing clues about where we are in the current market cycle.

It’s still Bitcoin’s market

BTC trading volume was 37% of the total, higher than Q2’s 35%. ETH accounted for 15%, flat on Q2.

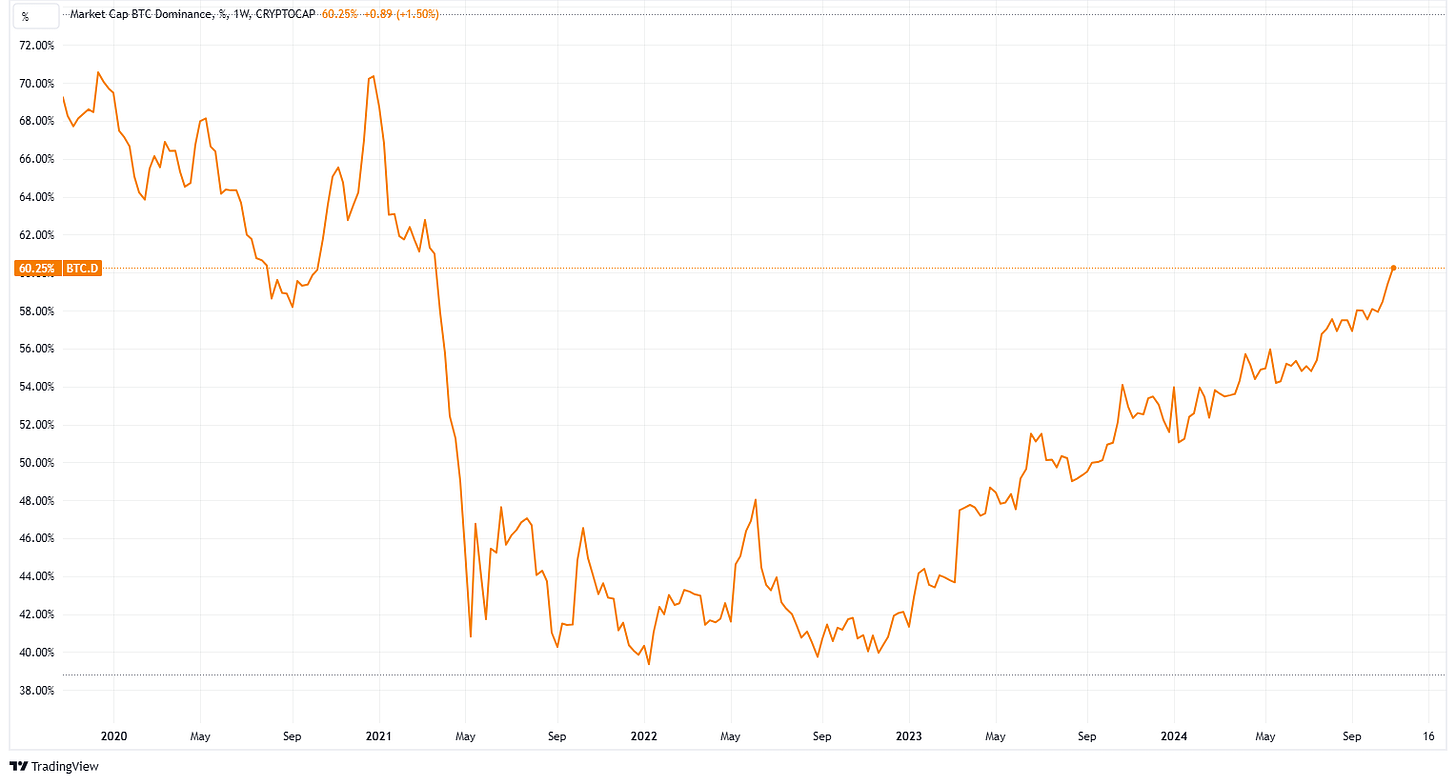

This is a clear sign that we are still early. In the initial part of any cycle, BTC tends to outperform as it is the gateway asset, the most liquid, the best-known, the one with the most on-ramps. This part of the cycle is characterized by climbing BTC dominance, which measures the market cap of BTC relative to the total crypto market cap. This week, it hit the highest point since March 2021.

(chart of BTC dominance via TradingView)

We’ll know we’re moving into the next phase of the cycle when BTC’s dominance (via the BTC.D index) starts dropping. This will indicate that investors are getting more comfortable with crypto and are willing to move further out on the risk curve. Tokens with smaller market caps tend to be more volatile and therefore, in an up market, offer higher gains. As this cycle matures, we will see some rotation out of BTC and into other crypto assets, and late investors might bypass the large caps and go straight for the riskier choices.

Retail is not yet “back”

Consumer trading volume for the third quarter was down 8% quarter-on-quarter, suggesting that retail investors are not yet excited about crypto. This also tells us that we’re early in the cycle. I hate to generalize, but retail investors on the whole tend to be “late adopters”, motivated by price-related headlines and social interest. We’ll know we’re nearing peak hype when retail is “piling in”.

This can also be seen in app store rankings – according to SimilarWeb, in the US Coinbase is not anywhere in the top 50 for either IOS or Android. Near the peak of the last cycle, when the price was lower than today, Coinbase was close to the top. This reinforces that we’re some ways off yet.

What alternative BRICS payment system?

I wrote last week about the likelihood of new payments networks eventually emerging from the BRICS alliance. The group’s summit produced an agreement to press ahead with the creation of a plan, and my point was that – even though any new platform would not topple the US dollar from its reserve currency status – just a small dent in dollar demand could make a difference, not only in currency levels but also US influence.

Since then, a couple of lines of thought have cast doubt on this – but I still think it is likely, perhaps even more now than just a few days ago.

The mBridge gap

This week, Bloomberg reported on official suggestions that the mBridge cross-border CBDC platform – currently at the MVP stage – be shut down. Apparently, the IMF, World Bank and BIS are worried it might be used as a template for any alternative BRICS system in the future, especially given plans to eventually outsource the China-built code. The BIS (an international organization set up in 1930 to support central banks) has been involved in the platform’s creation and governance from the beginning, along with the central banks of China, Hong Kong, Thailand and the UAE, with the late addition of Saudi Arabia.

In Tuesday’s newsletter, I wondered why the BIS thought that withdrawing its support for mBridge would stop the BRICS plans. It turns out that maybe the institution acknowledges that it won’t, although it obviously can’t be at all involved with anything that might help Russia, even indirectly.

On Thursday, BIS General Manager Agustín Carstens announced that the BIS is handing over management of the platform’s governance to the involved central banks. This is being spun as a “the project is so successful it doesn’t need us anymore” exit, which could be true – yet it remains to be seen whether the central banks are able to agree on key governance issues without a neutral mediator. Signs of friction have emerged, according to comments from PBoC officials at SWIFT’s Sibos conference last week, and the exit of the BIS could be subversive sabotage, an attempt to widen any cracks.

Either way, though, whether mBridge goes forward or not, the platform’s structure and code could end up being re-used, perhaps even more easily with the removal of any restraining influence.

Divide and conquer

Just how important is a new payments platform to the BRICS group? The research team at Doomberg thinks not very, and published a report this week (paywalled) that laid out why I might be wrong. In a word: Brazil.

The analysts suggest that Brazil is playing both sides – it wants to remain close to the West while also keeping options open with the East, and so will “play along” but then make sure any actionable agreement doesn’t happen.

They may have a point. But, I’m not convinced.

One clue offered is that the promises to investigate an alternative payments system appear halfway through the Kazan Declaration – not exactly a high priority, presumably because the group knows that the likelihood of consensus is remote.

Then again, the first 60-or-so points have to do with a recognition of and respect for “the emergence of new centres of power, policy decision-making and economic growth, which can pave the way for a more equitable, just, democratic and balanced multipolar world order.” By signing, members confirm support for rules-based governance, encourage reform of the UN (whose head was in attendance), condemn illegal sanctions, promise to respect biodiversity (maybe a dig at Brazil?), vow to improve global coordination regarding conflict (hunh? this section is worth an eyebrow-raising read) and, overall, foster economic and financial cooperation.

The commitment to work on new payment systems is tucked into a section covering this last point, which makes sense – it doesn’t mean it is a priority downgrade. And it’s not unreasonable to expect the geopolitical affirmations to take centre stage.

Also, point 12, up near the top, recognises “the crucial role of BRICS in the process of improving the international monetary and financial system”, which sounds high priority to me.

Still, all that doesn’t make agreement likely any time soon.

Meanwhile, Doomberg points out that Brazil nixed the ascension of Venezuela to the BRICS group, as an example of how it is the West’s “representative” in the organization. But I imagine there would have been further opposition anyway, as it has yet to be established that Maduro actually won the last election. So that’s also not conclusive.

What’s more, Brazil has often pushed for more payment in local currencies. And is planning to launch a CBDC next year (although there have been some delays).

So, despite huge respect for the high-quality analysis and excellent writing from the Doomberg team, I still think the BRICS group is serious about a new payments system. Agreement will take years, and a lot can happen in the meantime. But it’s the drift that’s important, and the more the US insists on weaponizing access to the US dollar, the stronger the drift is going to get. This week, the US Treasury added another 275 individuals and entities onto the sanctions list – these came from 17 jurisdictions, including India, China, Thailand, Turkey and Switzerland.

That said, Brazil assumes the presidency of BRICS next year. Who knows what the world will look like by the time of the next group summit.

See also:

Newsletter stuff

It’s been a while since I gave a newsletter update! I’m now well past 5,000 subscribers, which I am VERY grateful for. Premium subscriptions are still slow, though, my conversion rate is well below 10%, so any suggestions on how to get those up would be much appreciated!

I think the audio recordings are going more smoothly – I feel like I’m getting better at it, and I’ve made friends with my Shure microphone for recording. It doesn’t work at all for interviews, though, if I’m not right up against the mic when I speak, you can barely hear me, even with the gain turned way up. This is a puzzle, and I like puzzles, so I will figure it out, but to be honest I’d rather be spending my time thinking about how markets are changing. 😝

Speaking of which, I’m thinking of doing a weekly recording, separate from the daily reads. (I guess that is technically a podcast, but I’ve been reluctant to use that word because it seems like there are soooooo many podcasts already.) If I do this, it would focus on the blockchain impact on markets more broadly: the assets, the infrastructure, the rules. It’s why I got into crypto in the first place – I’m a markets nerd, and am here to watch them change.

Thoughts? Should I add video? Feedback and ideas very welcome!

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Back with some photography to share this week! Only, as well as breath-taking, these are also heart-warming, as they come from finalists of the 2024 Dog Photography Awards. (Cat lovers, you may want to skip this section!)

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.