WEEKLY - Liberation Day, chaos, crypto

why the approach is so damaging, and what's next

Hello everyone, I hope you’re all doing well! What a week…

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days, offer some interesting links I came across, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one! For $12/month, you’ll get ~daily commentary on how crypto is impacting the macro landscape, and vice versa. I talk about adoption, regulation, tokenization, stablecoins, CBDCs, market infrastructure shifts and more, as well as the economy and investment narratives.

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

Liberation Day, what happened, what it means for crypto

Assorted links: more tariff stuff ‘cos this is a very big deal

Some of the topics discussed in this week’s premium dailies:

Coming up: Liberation Day, US jobs report, Powell, stablecoins and more

The UAE: A CBDC worth watching

Macro-Crypto Bits: US forecasts, China, Japan, bleak markets and more

France: the risk in tough decisions

Macro-Crypto Bits: US tariffs, China, India

Podcast notes: Michael Howell on the liquidity squeeze

Don’t expect tariff clarity

BlackRock and Bitcoin

Macro-Crypto Bits: US economic data, Middle East tension, a big crypto IPO

Liberation Day: the wheels came off

The details

The reaction

What I may be missing

What this could mean for crypto

Liberation Day: The wheels came off

For two days now, I’ve been digesting the tariff news, reflecting and searching for a positive spin.

Only, I can’t find one. And I’m a congenitally optimistic person.

It’s not so much the initial damage to global GDP, including economic activity in the US. That will trigger recessions in many regions, push billions further into poverty and intensify military activity around the world. But economies can, and do, reset. Greater resilience will emerge once the dust settles and the clouds disperse. In time.

What will be hard to recover is trust in the US as a political and trading partner. Beyond the inconsistent messaging around the tariffs, there’s the lack of coherence in the final announcement, not to mention the lack of diplomacy and geopolitical foresight.

Before anyone accuses me of hating anything Trump does, I would like to clarify this is not about political ideology, and I have celebrated many of his actions. While I consider myself an adamant independent, I confess I was relieved the Democrats lost, I thought that this time they deserved to. And I was optimistic about the potential to rewire the global economy, it needs some big changes and I figured only someone as narcissistic as Trump could pull that off.

But wrapping a series of actions as globally destructive as these new taxes in an aggressive “Liberation Day” label, and having a beaming Secretary of Commerce insist across the channels that this will make Americans better off, feels like watching a laughing bully take away a little kid’s lollipop with no way to step in or even get the kid a new one. It feels like a sloppy and mean power flex that will not make the US economy stronger nor the world safer. Just the opposite.

Many of you will be thinking “well what did you expect?”. I expected more intelligence to be applied to the tariff issue, some understanding of relative advantage and mutual benefit, and some acknowledgement of history. I expected better.

Below, I go over the details of what happened and the market reaction. I also search for what could be positive outcomes here – they may be unlikely, but they’re not out of the question, and we should never give up hope. And I look at what this could mean for crypto – there are silver linings there.

The details

The rates applied were much worse than expected. They are as high as those applied in the early 1900s, which were later credited with triggering The Great Depression.

(chart via @BiancoResearch)

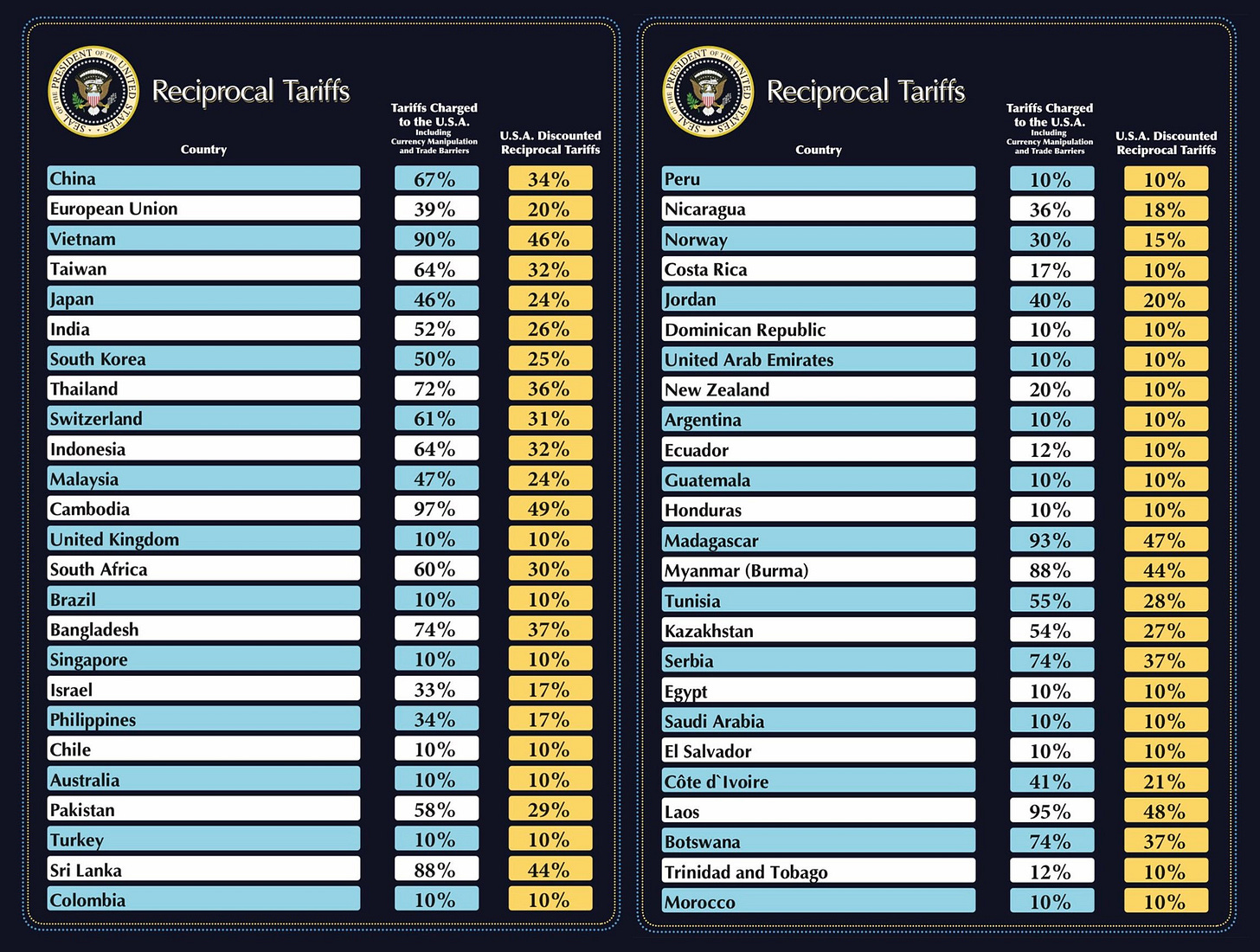

Here, for your convenience, are the first two pages of the list of targeted countries who have "looted, pillaged, raped and plundered” the US, according to President Trump. You can see more at @WhiteHouse or Bloomberg (paywall).

(via @WhiteHouse)

The lower 10% tariffs kicked in at midnight, Eastern time. Larger ones start on April 9.

Strangely, after much emphasis on how the new import taxes were fair and “reciprocal”, it turns out they are not based on the targeted nations’ average tariff on US imports at all. According to the World Trade Organization, the average EU tariff on US goods is 5.2%. For China, it’s 7.3%. Yet Trump has applied “reciprocal” tariffs of 20% and 34% respectively.

It turns out that the formula used is a given country’s trade surplus divided by its imports, multiplied by 0.5.

This suggests that the goal is no trade surplus at all, which overlooks why they occur in the first place: occasionally, it is trade barriers, but usually, it’s competitive advantage and relative wealth. Bangladesh, for instance (hit with a painful 37% tariff) exports more to the US than it imports because 1) it can make cheap clothes, and 2) it can’t afford to import much. According to the UN Trade and Development organization, US tariffs on Bangladesh are now almost double the average rate the country applies on US imports. The result will be even deeper poverty for an already poor nation, and more expensive clothes for American consumers. That is just one of many similar examples on the list.

Assuming that all trade imbalances are because of unfair barriers is economically illiterate – there is statistically little correlation between the two. And “balanced trade” is not the nirvana Trump seems to think it is, as it negates the proven economic benefit to all of specialization and strategic advantage.

Furthermore, some of the listed targets actually have a trade deficit with the US, they import more from the US than they export to it. According to the World Population Review, in 2024 the US ran a trade surplus with the Netherlands, Australia, the UK, Brazil, Spain, Argentina, Peru, Colombia and many others besides. And yet these countries are now being punished.

Also, many of the listed targets don’t even have a trade surplus worth mentioning.

For instance, Norfolk Island, a 2,000-person territory which exports shoes to the US worth around $400,000 per year, has been hit with tariffs of 29% while Australia – to which it belongs – only suffered 10%.

Mayotte (actually part of France, but that apparently doesn’t matter) exported roughly $160,000 of goods to the US in 2023.

Pretty much the only economic activity in the British Indian Ocean Territory is the US military base on Diego Garcia.

The Heard and McDonald Islands are uninhabited. They have no economic activity, just some penguins. There is now a 10% tariff on its exports to the US. Why?

Speaking of which, one of the best memes from the past couple of days:

(via @MichaelAArouet)

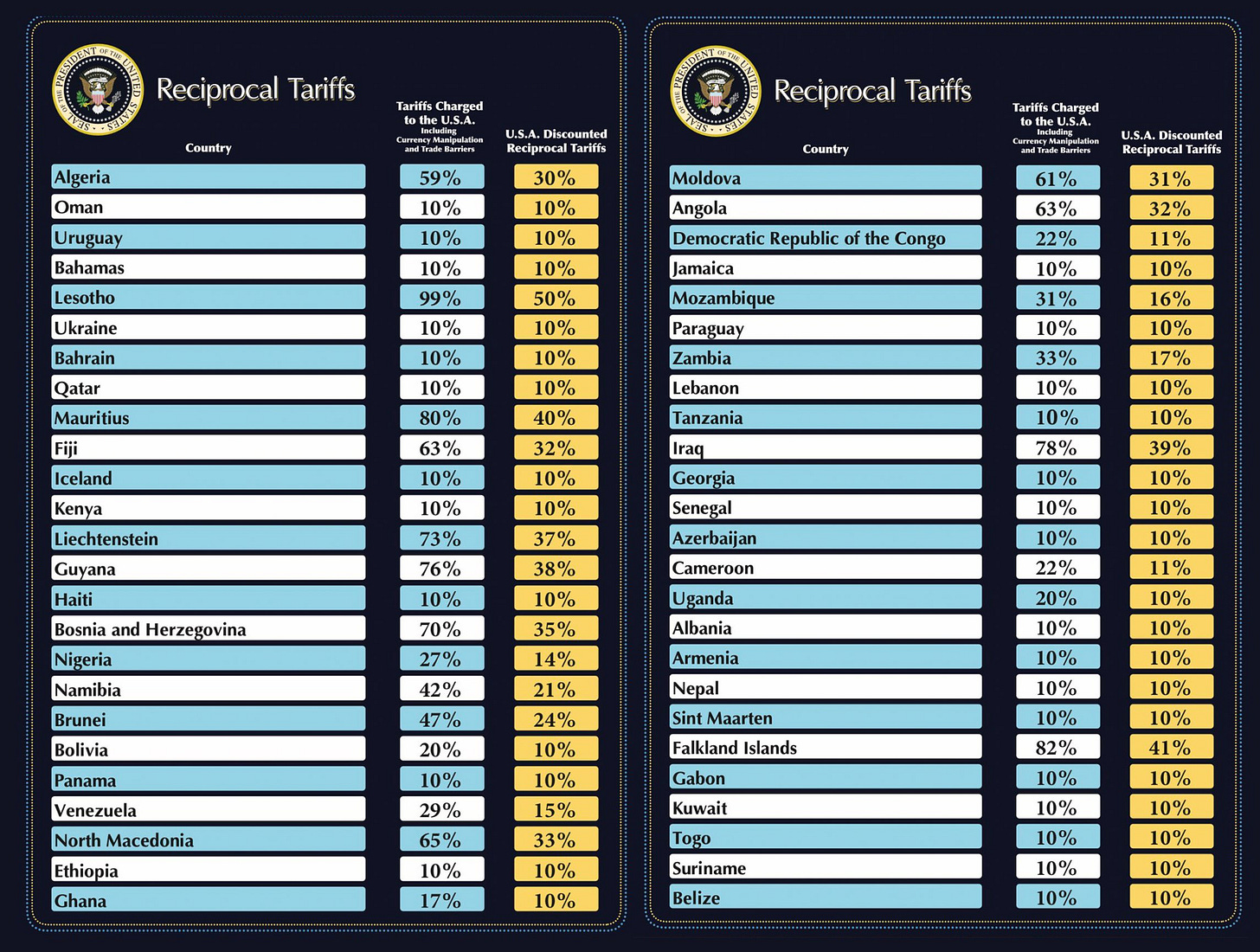

There also seems to be a fair amount of confusion within the Trump team. When journalist James Surowiecki spotted that the supposed tariffs applied by other countries on the White House sheet weren’t tariffs but trade balances, the Deputy Press Secretary continued to refute this, insisting that they were “literally” applied tariffs even though the published formula said otherwise.

(via @KushDesai47)

Plus, the tariff rates listed in the Annex of the signed Executive Order in many cases didn’t coincide with the rates brandished on the big charts presented in the Rose Garden. They were off by 1 percentage point which is not much, and they apparently have since been corrected, but it adds to the impression of a lack of precision and coordination.

Russia is not on the list, ostensibly because it is a sanctioned country. But so is Iran which is on the list, although with a lower tariff (10%) than close ally Israel (17%), which removed all tariffs on US goods earlier this week. And, according to Trading Economics, US imports from Iran were less than $400,000 in February (mainly artwork), while US imports from Russia were $288 million. Neither are material in terms of quantity, but the impression is one of sloppiness and arbitrariness.

As if all that weren’t embarrassing enough, Treasury Secretary Scott Bessent was asked in a Bloomberg interview why Canada and Mexico are not on the list. He answered: “I don’t know”. I admire his honesty.

The reaction

I have never before seen markets so uniformly hate a Presidential action.

During Trump’s Rose Garden speech, US equity futures started plummeting, and the rout continued once markets opened, delivering the worst two-day slump for the S&P 500 since the pandemic shock. Roughly $5 trillion of value has been wiped out since the announcement, so far.

(chart via TradingView)

The US 10-year yield dropped below 4.0% for the first time since last October.

(chart via TradingView)

This dragged down the US dollar, with the DXY index more than unwinding all post-election gains.

(chart via TradingView)

Oil slumped to its lowest level early 2021 – lower energy prices are good, but not when the signal is expectations of a global slowdown.

(chart via TradingView)

And the reaction from analysts, economists and investors is universally bleak. Here are just some quotes I’ve seen:

Tyler Cowen, economist: “This is perhaps the worst economic own goal I have seen in my lifetime.”

Via Morgan Housel: “If the market actually processes what happened yesterday it would be down 30-40%. The fact that it’s not is either denial or a belief that it will soon be reversed.”

Larry Summers, former US Treasury Secretary: “Trump's tariffs are the most expensive and masochistic the US has pursued in decades. A very crude estimate of Trump's tariffs puts the projected loss at $20 trillion dollars, or well over $200,000 per family of four.” [this was later amended to $30 trillion and $300,000]

Tracy Chen, portfolio manager at Brandywine Global Investment Management: “Short-term it’s inflation but longer-term growth will continue to slow down. So the best scenario is stagflation, the worst is a global recession.”

JPMorgan: “We estimate that today’s announced measures could boost PCE prices by 1-1.5% this year. … The resulting hit to purchasing power could take real disposable personal income growth in 2Q-3Q into negative territory.”

Peter Tchir of Academy Securities: “I don’t see how many leaders could pick up the phone to negotiate after this.”

Howard Marks, Oaktree Capital: “This is the biggest change in the environment that I’ve seen, probably in my career.”

Dan Ives, Wedbush Securities: “Never have we (or others that have covered the markets for 50 years+) seen a self-inflicted debacle of epic proportions like the Trump tariff slate over the last 36 hours.”

Ken Rogoff, former IMF chief economist: “He just dropped a nuclear bomb on the global trading system.”

Apart from markets, which probably have further to drop, there will most likely be serious political fallout from this.

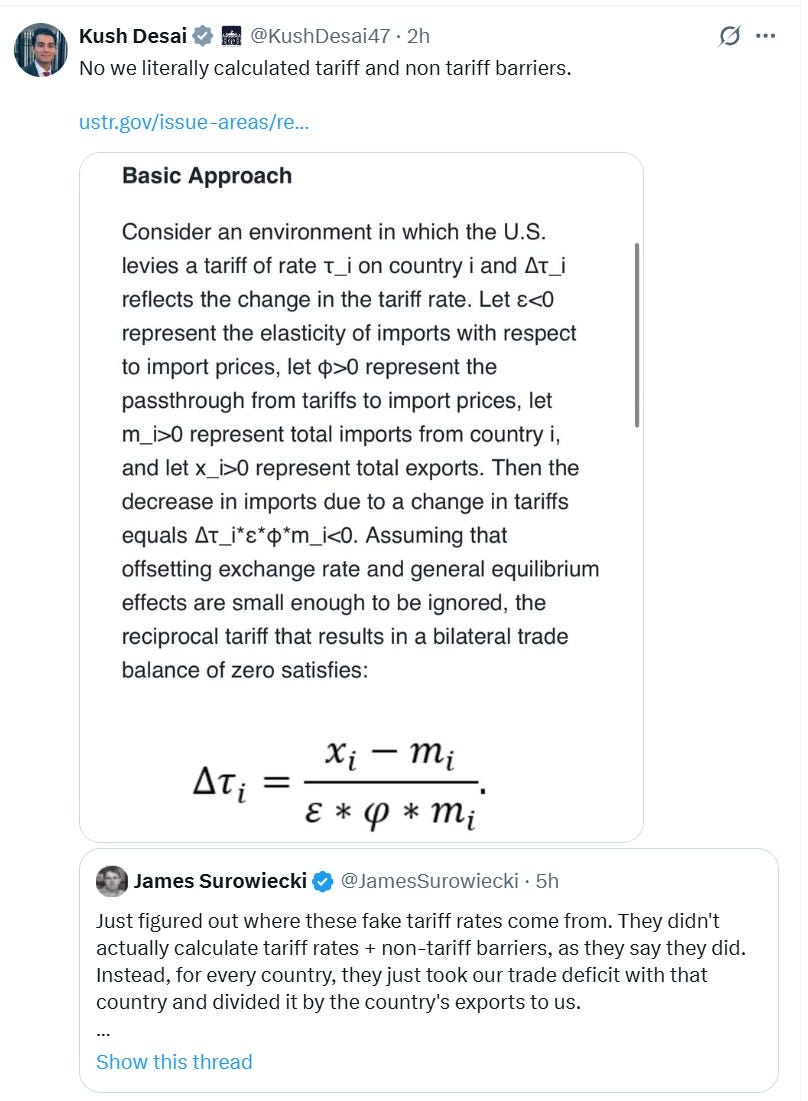

According to a Gallup poll published last month, over 80% of Americans see foreign trade as an opportunity for economic growth, up from 60% a year ago. Only 14% see it as a threat to the economy.

(chart via Gallup)

And those hit by higher prices in coming months – that is, everyone – will be screaming at their elected representatives, many of whom are up for re-election in a year and a half. Next week in the premium dailies I’ll dive into what a Congressional pushback could look like.

Meanwhile, we’re already seeing some nations promise stimulus to offset the economic pain for businesses and consumers, others ask for negotiation, and others start to build alternative trade alliances. I’ll be focusing on these next week also.

What I may be missing

Ok, there is – at a stretch – a way in which this miscalculation is all part of a larger and devastatingly intelligent plan.

It’s possible other nations will accept that trading with the US is, as Commerce Secretary Howard Lutnick insists, the only option. And they will get on the phone and promise the US Administration whatever tariff reduction it wants. They will then get exemptions or a lower tariff rate, markets will rally and Trump will claim victory.

But, if their politicians value saving face (and in many cases their jobs), there will need to be a strategy to reduce dependence on an unreliable trading partner. There are short-term fixes available to many, but that is not a long-term solution to the imbalanced relationship.

There’s also the possibility that hurting the stock market is part of the strategy. It was frothy, some valuations were unrealistically high, and the appeal of markets was diverting investment from more mundane applications such as infrastructure and factories. Also, Trump’s “base” is not, on the whole, large holders of equities. A lower stock market combined with more investment in manufacturing could end up redistributing some of America’s wealth while boosting average incomes and its capital base.

And, lower yields are needed. Not just wanted, needed. There is a wall of debt refinancing due this year that was issued when rates were much, much lower. Rolling over into higher-yielding (= more expensive for the issuer) debt will further weaken the US fiscal situation.

Plus, tariff revenue should, all else equal, help lower the deficit, perhaps allowing for lower debt issuance and/or tax cuts.

But, the probability I assign to all that working is now lower than it was, mainly because of the way this strategy was executed.

If countries start trading less with the US, either because there is less demand given the higher prices for importers combined with a slowdown in overall consumption, or because of a rewiring of trade patterns, they will have fewer “surplus” dollars to invest in US treasuries. Lower demand for new US treasuries implies higher yield.

And the belligerence and inconsistency will go a long way toward further weakening trust. Even if the US walks back most of the applied measures, nations won’t want to be dependent on a partner, however large, that can wield its power so carelessly. Full recovery of trade relations is unlikely.

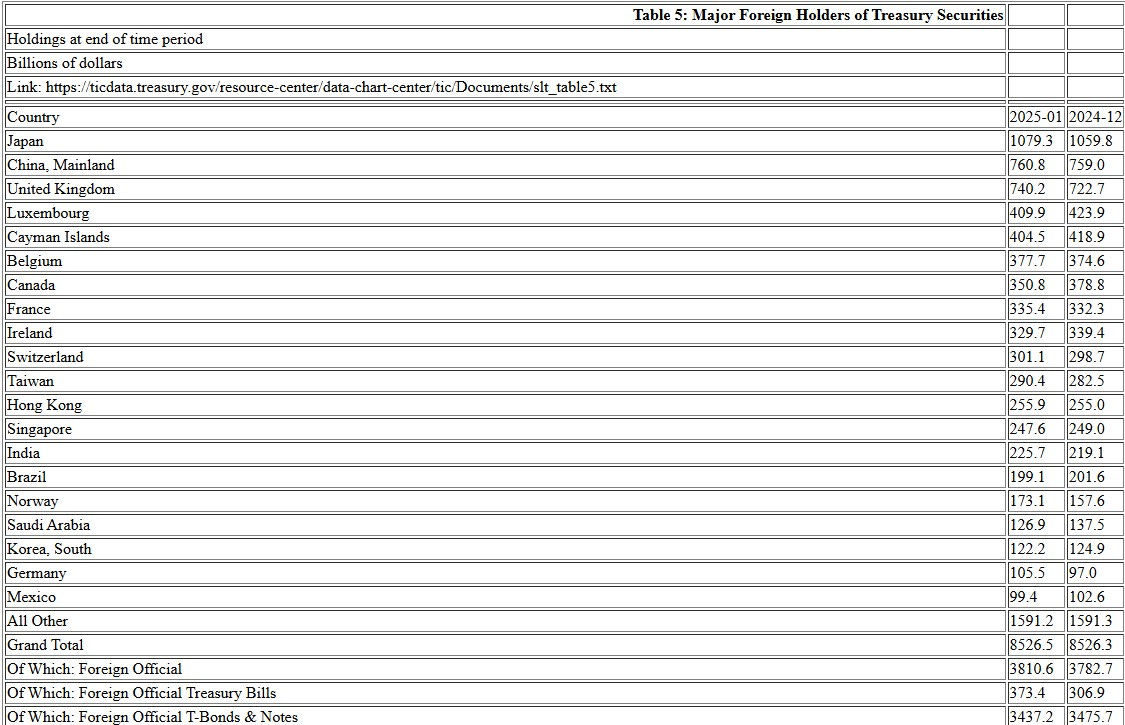

Plus, many of the targeted nations are large holders of US securities. Any offloading because of USD risk and/or the need to raise cash will dent the market, lowering stocks while raising yields.

(table via the US Treasury)

And meanwhile, US inflation will head up.

Maybe large US retailers can either absorb part of the margin squeeze, or pressure foreign suppliers to lower their prices to offset the additional cost. This could have the unfortunate effect of continuing the centralization of retail, with large chains pricing out smaller businesses who don’t have the same negotiating clout.

A few weeks ago, Trump’s chair of the White House Council of Economic Advisers Stephen Miran insisted in an interview that tariffs would not be inflationary. Consumers have a choice, he said, they can buy local. If that were the case, the demand for imports would not be so high today. The US cannot produce clothing at the same cost as Bangladesh, Vietnam and other labour-intensive exporting nations. The US doesn’t have the climate to grow coffee, cocoa, bananas and avocados at the same scale. The US alone cannot offer American consumers the variety of products they are used to.

There is so much more to go into on this topic, and it will give us all plenty to worry about in coming months.

Before closing out…

What this could mean for crypto

Surprisingly, given its sensitivity to risk sentiment, BTC has held up relatively well over the past couple of days. It is down 1% over the past week, while the Nasdaq is down more than 12%.

(chart via TradingView)

And while the economic outlook just got a lot bleaker, that for crypto arguably improved.

Above, I mentioned the likelihood of increased stimulus as nations scramble to at least partially offset their income hit. We’re already seeing some announcements along these lines, such as from India, Taiwan and France.

Any stimulus will be aimed at supporting businesses and individuals, but it does invariably find its way into monetary liquidity which in turn tends to boost risk assets. BTC and other crypto tokens are the only “risk assets” that trade without jurisdictional restriction around the world, 24/7.

Stimulus also tends to dilute currencies, boosting the demand for hard-cap hedges such as gold and BTC.

What’s more, the likelihood of more stimulus is not limited to nations hit by Trump’s move. Traders are now pricing in four cuts in the federal funds interest rate this year, up from two just a few weeks ago. While that would not be great for markets as it would most likely be a risk-mitigation move rather than a reaction to lower inflation, it could still reawaken risk appetite.

(chart via Bloomberg)

There will also be currency turmoil as relative growth profiles are reset. This further boosts the demand for long-term unrelated hedges.

And, nations shifting reserves out of dollars either as a defensive (concern about depreciation) or punitive move (don’t want to hold US assets) will need to rotate into something else. Gold is the traditional “safe” option. BTC is a digital alternative that has not had the same run-up as its analog counterpart in recent months – that could work in its favour.

Finally, capital controls will increasingly become a concern as nations (including possibly the US) scramble to stop outflows. Gold and Bitcoin both represent seizure-resistant assets, but only one of those can move across oceans in minutes at low cost. Reports suggest that Germany is considering the repatriation of the gold it holds with the New York Fed, a reminder that the traditional store of value brings with it custody and transport issues. Bitcoin doesn’t.

In sum, bad news. But the damage has been done, and now it falls upon us all to look ahead at the coming reset. We knew change was on the table, we knew we wouldn’t like much of it but that it was necessary, and we knew there would be unexpected damage in some corners. What happened on Wednesday was worse than most of us feared – but we now have to focus on getting ahead of what’s coming. It won’t all be bad. And it sure will be interesting.

ASSORTED LINKS

Introducing a new section where I share, you guessed it, assorted links that I found interesting over the past few days. There’s a high risk this ends up getting too long as I read a *lot* and most of it is jaw-dropping, brow-furrowing, view-changing or just plain inspiring, but I’ll do my best to keep this list varied and relatively concise.

So, I didn’t get nearly as much non-crypto, non-macro reading done this week as I usually do because, well, other stuff was going on. And while of course the tariff wrecking ball is not the only interesting thing going on in the world these days, it is the most consequential. Our obsession with getting our heads around this will pass, but for now, it’s hard to focus on anything else. Back to a more diverse collection next week!

Austin Campbell’s thread on X, @CampbellJAustin

Tyler Cowen, “‘Liberation Day’ Was Even Worse Than Expected”, The Free Press (paywall)

Jason Furman, “Trump Is About to Bet the Economy on a Theory That Makes No Sense”, New York Times

Yanis Varoufakis, “Will Liberation Day transform the world? The Nixon Shock set a radical precedent”, UnHerd

Cullen S. Hendrix, “Trump's April 2 tariff spree could cripple developing economies”, Peterson Institute

Matthew C. Klein, “How to Think About the Tariffs”, The Overshoot

Irina Slav, “Bad day at Brussels”, Irina Slav on Energy

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Today is definitely a day to share a few songs from my therapeutic “This Is Not Good” playlist – you have one of those too, right?

Sam Cooke – A Change is Gonna Come

Nine Inch Nails – The Hand That Feeds

Fall Out Boy – This Ain't A Scene, It's An Arms Race

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.