WEEKLY - Markets: the dog that didn't bark

ALSO: the digital euro smokescreens

Hello everyone! I hope you’re doing well!

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the week, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one! For $12/month, you’ll get ~daily commentary on how crypto is impacting the macro landscape, and vice versa. I talk about adoption, regulation, tokenization, stablecoins, CBDCs, market infrastructure shifts and more, as well as the economy and investment narratives.

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

Markets: The dog that didn’t bark

The digital euro: more smokescreens

Some of the topics discussed in this week’s premium dailies:

Coming up: what to keep an eye on this week

Institutional crypto services: from a trickle to a stream

Market wounds

The digital euro: more smokescreens

Markets: The dog that didn’t bark

Coinbase in India

**Tokenization update: private credit, cost savings, and gold**

Tokenized private credit

Tokenized funds: it’s about the costs

Tokenized gold

Markets: The dog that didn’t bark

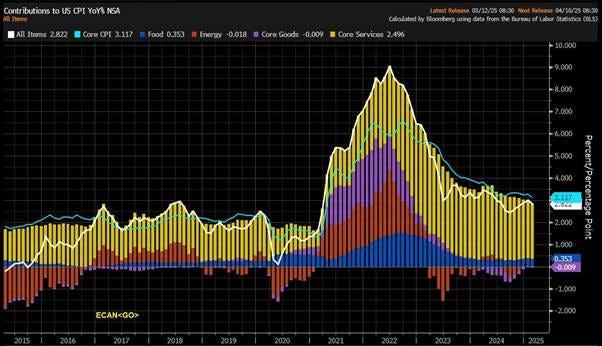

Unsurprisingly, this week’s US CPI print for February unwound part of the January upside shock – the first month of the year tends to be relatively “hot” given price reviews and contract updates. Surprisingly, it came in even softer than expected.

The month-on-month core index, which strips out more volatile food and energy components, climbed by 0.2%, lower than the expected 0.3% and January’s 0.4%. The year-on-year increase decelerated to 3.1%, under the consensus forecast of 3.2% and January’s 3.3%.

(chart via @M_McDonough)

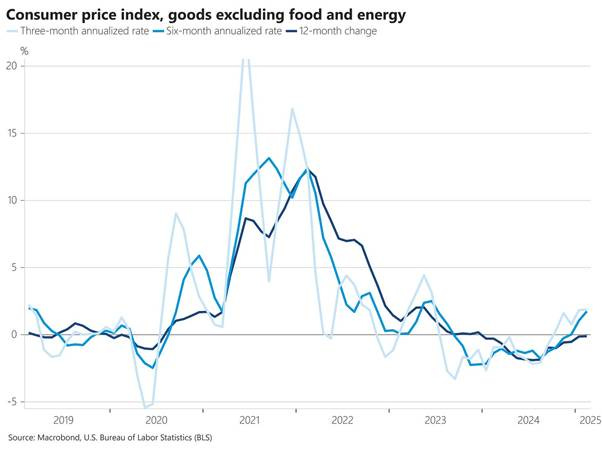

Core goods inflation – the segment most likely to be impacted by tariffs – is accelerating, suggesting that some producers are getting price hikes in early.

(chart via @NickTimiraos)

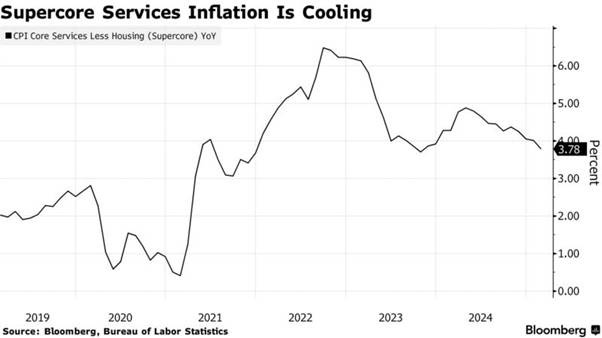

But, encouragingly, the notoriously sticky supercore index – which strips out food, energy and housing to get a measure more sensitive to monetary policy – continued to decelerate.

(chart via Bloomberg)

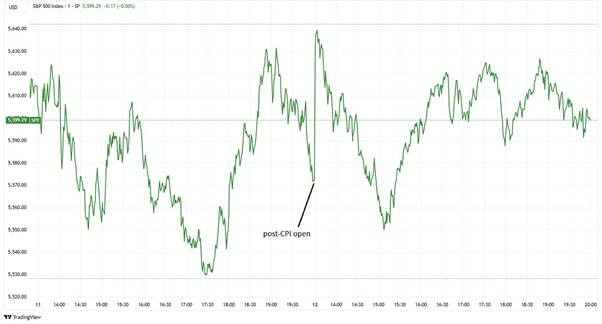

Good news, right? Only, the market didn’t seem particularly excited. As usual, there was a wild swing in the 10-year yield when the data was released (I figure these are triggered by bots), which swiftly corrected – usually there’s some residual effect, but this time it was a sharp down and up, with the market continuing pretty much from where it left off.

(chart via TradingView)

Stocks also barely reacted, with the S&P 500 up on the post-CPI open, but then correcting and hovering near the previous day’s close.

(chart via TradingView)

And expectations for rate cuts barely moved, despite the encouraging signs inflation is not necessarily picking up.

(chart via CME FedWatch)

Where’s the jubilant vindication? Its absence speaks loudly, and sends a worrying signal we should pay attention to.

It seems that almost no-one expects inflation to decelerate much from here. Or, if it does, the benefit will be drowned out by other concerns. February’s data was encouraging, but it’s backward-looking. What’s ahead looks ugly.

Inflation expectations are high. The New York Fed consumer survey out earlier this week showed a median prediction for inflation 12 months out of 4.3%. Yesterday’s University of Michigan report pushes its 12-month expectation up from 4.3% to 4.9%.

(chart via the NY Fed)

This makes it more likely that businesses will pass tariff cost hikes on to customers. Put differently, if consumers are expecting price hikes, it’s easier to justify implementing them.

Which means inflation expectations could be met, and possibly exceeded.

Next week, we get the updated projections from Fed economists. The dot plot, which shows individual forecasts of the fed funds rate over various time frames, will most likely show a determination to hold for now, and comments are likely to reflect greater concern for inflationary pressures ahead.

This could come as a shock to the crowd that thinks the Fed will blink and lower rates in the face of an economic slowdown.

Last week, Chair Powell stressed that the economy is doing fine for now, and we can expect him to repeat this message in his post-FOMC statement press conference next Wednesday.

But, as we have seen, hopium is resilient and is likely to continue to cling to the last cycle’s playbook of weakness leading to money printing.

There is no reason for that pattern to repeat this time. The Federal Reserve has two mandates: stable prices and stable employment. For now, the jobs market outlook is unclear – there will most likely be a significant number of layoffs as business margins get squeezed, and reductions to the federal workforce will bite.

But will it be enough to offset inflation concerns? I’m not convinced it will, especially since businesses remember how hard it was to find workers not that long ago. And, we don’t yet know how many of those currently employed will end up having to leave the United States given the Administration’s immigration policy.

Also, we can assume that the Federal Reserve will be reluctant to repeat its 2021 mistake of not taking the threat of inflation seriously. That was a deep blow to its reputation; and, it now knows that money printing has an inflation impact. It would be understandable if the Fed made a mistake in the opposite direction this time around, cutting rates too late, if at all.

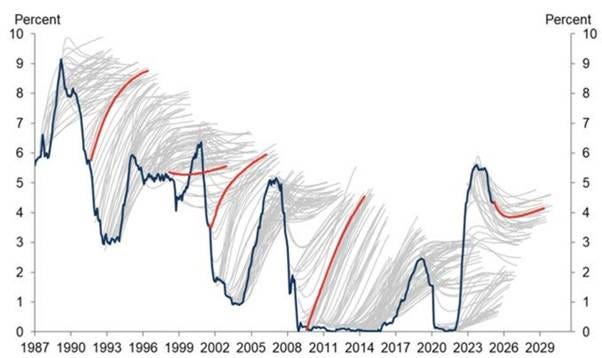

Meanwhile, here’s a chart that shows market expectations of the fed funds rate over time, and the actual figure. Conclusion? The market tends to get rate moves egregiously and consistently wrong.

(chart via @MichaelAArouet)

Maybe, just maybe, the absence this week of attention to the CPI data is a sign that expectations are more sober. The market has been battered recently, which contributes to the mood – but also, the flip-flopping on tariff policy from the Administration highlights how little we can predict about the eventual impact of the coming shift in supply chains and costs.

The digital euro: more smokescreens

“Maintaining agility affects how we can talk about the future.”

ECB Chief Christine Lagarde gave a speech in Frankfurt on Wednesday in which she acknowledged that the ECB was going to drop forward guidance on rates as it constrains much-needed flexibility in these uncertain times. But don’t worry, because the central bank will outline its “reaction function” so that investors know what to expect in this “new environment”.

Perhaps, like me, you’re wondering “what new environment?”, since no-one knows what the tariff or geopolitical situation will be by the end of the day anymore, let alone how to plan for it.

But, stepping back, we can appreciate the intent: sending the message that the ECB has all eventualities under control. Markets have no reason to panic. It’s all about communication to set expectations. And agility is essential.

Swinging narratives

This emphasis on agility in communication may sound like a large institution embracing flexibility, arguably a sound strategy in these changing times.

But it also hints at a degree of manipulation. Lagarde is explicitly acknowledging that messaging matters for expectations. The logical extension of this is that if one narrative doesn’t work, try another one.

We’re seeing this play out in the discussions around the digital euro, the EU central bank digital currency (CBDC) project. The prevailing narratives put forth by officials have changed over time, with no obvious move in support.

A year ago, ECB officials were convincing us that the digital euro was a necessary evolution of the central bank business model, an acceptance of the digital age.

In the second half of last year, the narrative pivoted to it being about consumer choice and convenience – apparently we are frustrated by the lack of a uniform payments platform that works anywhere in the bloc, for any use case (news to me, but whatever).

Earlier this year, the tone shifted to one of “Europe first” – our payment services are too dependent on US and Chinese platforms, so obviously the state needs to build a bloc-wide alternative (rather than address the internal barriers that have prevented a European private sector competitor from emerging).

None of that has worked.

A couple of weeks ago, a survey conducted by management and technology consultancy BearingPoint across nine European countries showed that only 30% of respondents would use a retail CBDC, with online shopping the preferred use case. Only 20% would use it more than once a week – in other words, no-one sees it as a substitute for either current payment services or for cash.

(chart by BearingPoint)

And banks really don’t like the idea: even a €3,000 holding limit could siphon off deposits to the tune of over €700 billion, according to a study from late 2023.

So, in the spirit of maintaining agility as Lagarde recommended, out comes a new narrative. We now have another reason why Europe needs a digital euro and maybe, they’re probably thinking, maybe this one will resonate.

It’s the threat from the Americans.

The urgency

The latest trigger is the relatively rapid progress of stablecoin bills in the Senate and the House of Representatives, and the full-throated support of the Trump team for stablecoins as a way to extend dollar influence around the world.

Even before the recent fracturing of the US/EU relationship, European finance ministers were twitchy about global demand for euros being eroded by market preference for dollars in international commerce. Now, they see US dollar convenience as an existential threat.

Few dispute that using stablecoins for cross-border payments is more convenient than traditional rails – they are faster, cheaper and always available. European officials are understandably worried that any business or individual accustomed to that convenience is aligning themselves with the US, even if only subliminally.

The problem is, there’s no viable alternative.

Euro-backed private stablecoins are largely a non-starter given the lack of demand, even with the bloc-wide MiCA framework throwing significant home-court advantages to issuers – they currently account for around 0.1% of total circulating supply.

So, if the private sector isn’t able to make it work then the state of course should step in (rather than amend EU rules that dampen the business case, such as onerous authorization requirements, reserve allocations, size constraints and more). Put differently, if the private sector can’t get euro stablecoin demand going, the state will figure out a way.

Because, after all, it is the state’s role to protect Europe and Europeans. Yes, the current CBDC narrative seems to be about protection, making us less vulnerable, appealing to our patriotic sentiment and desire for greater resilience. It feels like they’re gearing up to tug at the fear reflex.

This new narrative was emphasized last week by comments from Lagarde, in which she stressed the need to accelerate digital euro development.

And on Monday, it was made even clearer at a meeting of EU finance ministers. In the summary press conference, the finance minister for Ireland said:

“We know this is a global market, and policy decisions in other jurisdictions can have important consequences for us here in Europe. These discussions are fundamentally linked to our own autonomy and to the resilience of our currency. The digital euro is critical to staying ahead of the curve in this area.” (my emphasis)

He was, of course, referring to the renewed US emphasis on stablecoins.

These comments, like on many other occasions, were accompanied by reminders of how Europe has been abandoned and the US is unreliable. Over the past couple of weeks, I’ve heard more than one official say, “we are on our own”.

The implication is that a European central bank digital currency is about sovereignty, European competitiveness and bloc-wide resilience.

Perhaps inadvertently, this gets closer to the original impulse: centralization, for our own good. After all, Lagarde reminded us last week that work on the digital euro began in 2019, long before Europe started freaking out about the US yanking military and economic support. It was never about protecting us, as the wide swings in the accompanying narratives show – it was always about centralization of digital payment services, as well as greater central bank relevance in consumer transactions and economic activity.

The timing

What does the “acceleration” mean for us? It does not, contrary to some hysteria you might have seen on X over the past few days, mean that the digital euro launches in October.

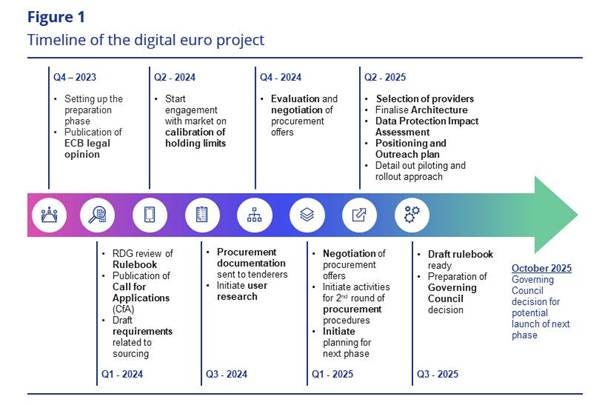

The confusion stems from Lagarde’s mention of an October deadline right after emphasizing development acceleration. What she meant was the deadline for the final decision to go ahead is in October. This will be the culmination of a two-year plan launched in, you guessed it, November 2023 to study the pros and cons and potential design features, to talk to stakeholders, and then to come to a decision on whether or not to proceed with development.

(chart via the ECB)

Of course they will decide yes, because it’s not at all about what stakeholders want – that part is for political show.

According to the timeline, this quarter has focused on procurement tenders (who will develop the technology, internal bank components and related services). Next quarter is all about finalizing the architecture, figuring out the data protection rules, and detailing what the pilot would involve. By the end of the third quarter, the committees should have finalized the rulebook (which will ensure uniformity on how it actually works), and by the end of October, the ECB Governing Council will decide to move on to the next phase.

That involves drafting the necessary legislation, designing and launching the pilot, and embarking on an extensive education program for banks, businesses and consumers. For full launch, we’re probably at least a couple of years away.

One intriguing twist in Lagarde’s comments last week is that work on a wholesale CBDC will go ahead – despite the obvious benefits (cheaper and faster cross-border transactions for businesses), this was put on the back burner in favour of a retail version. Now, the US-triggered panic seems to have made it more of a priority. Or, maybe Lagarde misspoke.

We’re due another progress report from the ECB in the next quarter. I will be scrutinizing this for further confirmation of the favoured narrative.

The last report, published in December, contained this key line in the “next steps” section:

“Public communication efforts continued to focus on raising awareness about why a digital euro is needed.”

Not, please note, whether it is wanted or warranted.

And the accompanying press release highlighted the following gem:

“The digital euro project is a European initiative being developed for the benefit of millions of citizens across the euro area.”

Of course. It’s for our benefit.

The curiosity illusion

In her speech on Wednesday, Lagarde said the following:

“Central bankers will need to show agility to adjust their stance and their tools to changing circumstances, and they will need intellectual curiosity to challenge established principles and conventional wisdom.”

That sounds characteristically uplifting, the sort of thing you would expect a central banker to say. But it inadvertently highlights the determination of the European Central Bank to elbow its way into consumers’ digital activity, whatever it takes.

Very little of the intellectual curiosity Lagarde promises has been employed in explaining why retail CBDCs have not gained traction in any of the jurisdictions in which they have been tried. Not even in China.

Nor has curiosity addressed why the US is so against the idea of a retail CBDC – when asked about this last week, Lagarde used condescending superiority to paint it as an opportunity. “Nature does not like a vacuum,” she said.

The only interpretation I can come up with is that, if the US isn’t going to launch one, then obviously Europe should? You’re not alone here, I don’t understand that logic either.

A more sinister angle is that we know the retail CBDC will not be received with open arms, even by those that don’t care about possible incursions into financial privacy or the risk of behaviour control.

We know it, and ECB officials should know it if they pay attention to surveys. But they’re going to do it anyway, because it’s not about us.

The thing is, if it doesn’t work, they’ll find ways to make sure it does. Once launched, failure is not an option. That’s the part that worries me the most.

It’s not just that we’ll find nudges or even mandates to use the digital euro for certain use cases – travel, education, perhaps utility bills.

It’s also that we have a state institution competing with and eventually pushing out private enterprise in a key pillar of economic activity. This is more than a technology question, more than a currency sovereignty issue – it’s also about ideology.

And, projecting this out along the arc of time, the risk is economic power continues to accumulate in the hands of the state, with less opportunity for businesses and less choice for individuals. Even more worrying, this is being orchestrated by an unelected body.

However, central banks do reflect the sentiment that gives European officials power. Mercifully, there are periodic elections. The next round in mid-2029 will almost certainly be too late to stop the launch of the digital euro; but maybe, just maybe, it will be enough to encourage more detailed scrutiny as to the motives.

See also:

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

St. Patrick’s Day, coming up on Monday, is not something we celebrate at home, even though I am Irish. It’s not widely celebrated in Ireland, either. Rather, it’s an Americanized version of Irish nostalgia, which we acknowledge because it’s actually kind of fun, and because Irish culture generally feels overlooked.

So, in the spirit of appreciating Irishness this weekend, here are three of my favourite traditional Celtic tunes, which just might have you doing a jig or reaching for a pint of Guinness. ☘ Sláinte! ☘

Loreena McKennit, Ripples in the Rockpool

The Dubliners, Whiskey in the Jar

The Foggy Dew, Sinead O’Connor + The Chieftains

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.