WEEKLY, May 25, 2024

ETH ETFs, FIT21 and a worried market

Hi everyone! I hope you’re all doing well! What a week. And I’ve never been so happy to be so wrong: I didn’t think we’d see ETH spot ETF approvals this year. I didn’t expect FIT21 to get very far. I didn’t expect the FDIC chief to step down. I most certainly did not expect the US political hostility toward crypto pivot so fast.

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of the articles from the week.

If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links. If you’re not a premium subscriber, I do hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

Oh, this week I was on the Wolf of All Streets show talking to Scott Melker about, you guessed it, the ETH ETFs, as well as a bit of macro. And on Thursday, I joined The Close on Bloomberg to discuss, you guessed it, the ETH ETFs. I went on right after Eric Balchunas, a very hard act to follow, but I think I did ok.

In this newsletter:

A big step forward

The FIT21 sweep

A worried market

Some of the topics discussed this week:

About those ETH ETFs…

And there’s more going on

How many US hedge funds have BTC ETF holdings?

Why isn’t the e-CNY more in the news?

Stablecoins in Colombia

Economic confusion

Just how “hard” are hard assets?

Surveilling the surveillance

Inflation hedges

The US dollar vs gold

Taiwan tension

Watch those food prices

… and much more!

A big step forward

So, we now have the official go-ahead from the SEC for the first listed ETH spot ETFs in the US.

I’m still stunned, not gonna lie. Just a few days ago, I was sure it wouldn’t happen. I don’t remember when last I was so happy to be wrong.

There is still much we don’t know:

The voting split. It was 3-2 for the BTC spot ETFs, with Chair Gensler himself casting the deciding vote in favour. Here, we’re unlikely to get that information, since the votes were delegated to the director of the division.

The fees. I imagine these will be announced in coming days.

The ticker symbols. BlackRock has reportedly snagged ETHA, but I haven’t seen the others yet.

The timing! The approval only covers the 19b-4s, which is the proposed rule change filed by the exchanges. Now the SEC has to approve the S-1s, which are the registration documents filed by the issuers. This could take days, weeks or months. Approval is likely, although we may see more cosmetic changes requested.

What we do know:

Unstaked ETH is not considered a security by the SEC. Funds whose assets consist largely of securities don’t file S-1s (they file N-2s or N-1As.)

The political hostility toward the crypto industry in the US is thawing.

The above two points are the big deal here. It’s not the likely inflow of funds into the new products, because, as I wrote earlier this week, this will probably be disappointing. Rather, it’s the official validation that ETH is now a retail- and institution-ready “commodity” investment asset, with liquid and transparent markets.

It’s also the implied go-ahead for builders on Ethereum that, by handling ETH, they are not violating securities laws.

Also, it’s a loud signal to jurisdictions around the world that the US is finally getting its collective head around the fact that crypto assets are an interesting market, here to stay, and large enough to warrant official consideration. Next Tuesday, the London Stock Exchange will list BTC and ETH ETNs in a first for the UK, although for now these are only available to professional investors.

Finally, it’s confirmation that the crypto lobby is fierce and effective, and that politicians now realize voters want choice and respect more than smothering in the name of protection.

Onward.

The FIT21 sweep

This week’s vote in the US House of Representatives on digital assets framework FIT21 was nothing short of epic.

Along with the likelihood of an ETH spot ETF approval this year, I got this one wrong also. I didn’t give it any chance at all of passing, given the political hostility and the hurdle of getting enough Democrat votes in the House. Last week’s vote on the repeal of SAB 121 started to suggest a slight thaw, but the number of Democrats voting with Republicans was not that high – it was good, for sure, but that bill was relatively easy to support.

FIT21 is not only much more complex, with plenty more to reasonably argue about; it also stands to have a much bigger impact on both crypto and traditional markets. I expected to see some Democrats continue the trend of signalling opposition to the Administration’s obstructive resistance to a workable framework. But I did not expect more than 70 to break ranks. That’s one third!

Of course, this does not mean that FIT21 is a done deal. There is still the Senate vote, and before that can happen there needs to be a lot more committee debates, which will result in more proposed amendments, any of which could derail the process. But once the Senate has a version of the bill it is willing to vote on, it just needs two senators from the Democratic party (or the independents) to vote with the Republicans (assuming none of them vote against) for the bill to pass.

If that happens, then a committee made of House and Senate members works out the differences between the two versions, and the result is presented to the House and Senate for final approval. It then goes to the President’s desk for signature or veto. Earlier in the week, the White House issued a statement expressing opposition to FIT21, but notably did not say it would veto, unlike with the SAB 121 repeal.

All this could take time, especially given the somewhat huge distraction of the approaching US elections in which 33 Senate seats are up for grabs.

Still, the big takeaway from the vote – the signal that one third of Democrats in the House of Representatives are tired of the Warren/Gensler chokehold on financial innovation – will have positive short-term effects.

Even beyond actual legislation, this week reawakened hope that the US could catch up to the rest of the world in establishing crypto frameworks. This matters for the US, since it is still a good place to start and grow a business. States will benefit from jobs created, markets will benefit from new products, market infrastructure technologies, payments initiatives and more. The global crypto market will benefit from a significant inflow of liquidity as institutions and mainstream investors get more comfortable with digital assets. And, overall, the legitimacy will trigger a wave of similar initiatives in other jurisdictions, with many already well on the way.

A worried market

While the ETH spot ETF approvals are excellent news, the market didn’t seem too excited.

(chart via TradingView)

Initial enthusiasm held the ETH price move sideways for most of the day while the broader market fell, but then fizzled out and ETH joined the downtrend.

(chart via TradingView)

What’s behind this disappointing reception of arguably one of the most positive ETH catalysts in recent months?

For one, the ETFs won’t list for a while.

But mainly, macro pressures are doing their thing.

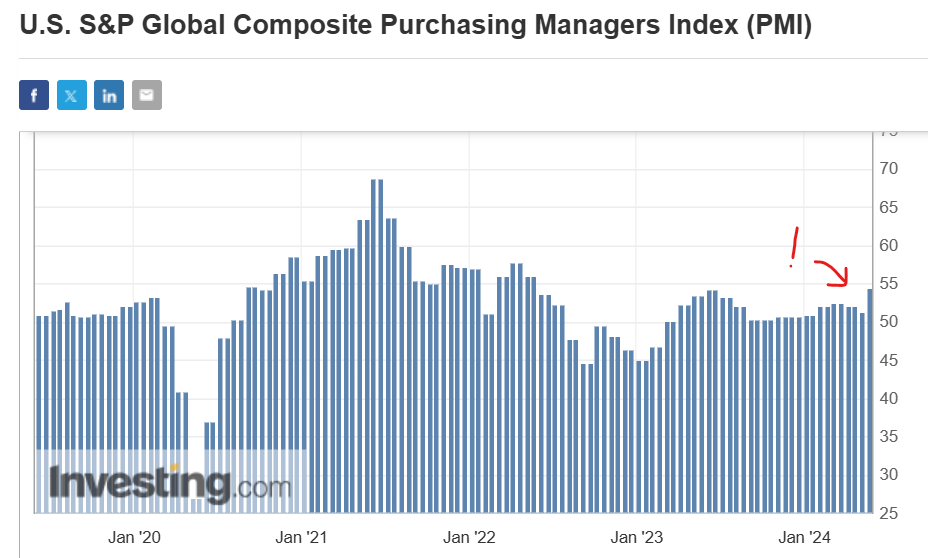

On Thursday, we got the flash reading of the S&P PMI data for May, which us an advance look at one of the leading gauges of economic activity in the US. The numbers were quite stunning.

The composite measure came in at 54.4, the highest in two years, much higher than the forecast 51.1 and higher than the previous read of 51.3. The services activity index reached 54.8, its highest level in almost a year, and much higher than the forecast 51.2. Even the manufacturing index advanced further into expansion territory, with a read of 50.9 (anything over 50 signals expansion).

(chart via Investing.com)

Let’s look at what the “flash” release is. It’s a preliminary read of the monthly S&P purchasing managers surveys, based on a tally of 85% of the responses. Revisions are released on June 3 (manufacturing) and June 5 (services and composite).

Normally the two reads (flash vs revisions) are close, although there can be a difference of a few decimal points – for April, the revisions came in slightly higher than the flash.

What does the composite read of 54.4 mean?

I’ve written about what PMI data represents before (in the send of Jan 25, if you want to check it out) – here’s a recap:

The S&P PMI is a “diffusion index”, which measures direction but not magnitude. Survey respondents reply with various forms of “up” or “down”, and the resulting indices reflect the number of respondents seeing an uptick vs a down trend. Readings of over 50 suggest expansion, while under 50 implies contraction.

This is easy to understand and provides a useful early indicator of more official data, but it has limitations. For instance, imagine there are only ten businesses in the survey – four are seeing an almighty crash in business activity, but six are seeing slight upticks. The “up” responses more than offset the “down” responses to deliver a result over 50, signalling overall expansion although there is a strong net slump.

Could that be what we’re seeing here? A net loss but with enough companies seeing a pickup to deliver a higher index? It doesn’t sound like it. It looks like the US economy is in full expansion, with the manufacturing sector joining services in keeping inflation high.

The May flash read marks more than the 16th month of expansion – it also shows an acceleration.

The most disconcerting part is the input prices index. Its climb accelerated in May to register the second-largest increase in eight months. This was especially sharp in manufacturing, which saw the largest cost rise in 18 months, with companies reporting higher prices in a wide range of inputs.

Here’s a quote from the S&P unit’s Chief Business Economist Chris Williamson:

“What’s interesting is that the main inflationary impetus is now coming from manufacturing rather than services, meaning rates of inflation for costs and selling prices are now somewhat elevated by pre-pandemic standards in both sectors to suggest that the final mile down to the Fed’s 2% target still seems elusive.”

And it looks like companies are able to pass along the cost hikes to customers: the increase in selling prices accelerated.

So, a pickup up in the improvement in activity, plus signs of accelerating inflationary pressure? It looks like rates are going to be truly “higher for longer”. This has moved expectations of a rate cut in the US even further back. Fed funds futures are now (black line) pricing in just over one cut by the end of the year, vs two just a week ago (blue line).

(chart via Bloomberg)

Next week, we get the US April CPI data, as well the second read of Q1 US GDP and yet another consumer confidence index. More bond market swings ahead?

HAVE A GREAT WEEKEND!

After such an exhausting week, I think we could all use some heartwarming images, so here are my favourites from the finalists of this year’s Comedy Pet Photography Awards:

(photo by Lock Liu)

(photo by Atsukuyi Ohshima)

(photo by Philippa Huber)

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

All that we know is that Gensler got skipped and bypassed completely and purposefully — no decision has been confirmed wrt COMMODITY status of ETHER either = coming later = need SEC & CFTC to collaborate together

Gensler was not even allowed to vote btw

The ETH ETF decision skipped his desk entirely and was decided for him