WEEKLY – misdirected tokenization expectations

also, the EU and public blockchains; and some Christmassy photos of my city

Hi everyone, I hope you’re all doing well!

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of articles from the past few days.

If you’re not a premium subscriber, I hope you’ll consider becoming one! For the price of a couple of New York coffees a month, I can help you navigate the tangled web of macro impacts on crypto narratives, and crypto impacts on macro narratives.

You get ~daily commentary on macro, crypto and the space in between, plus some cool links, a smattering of charts, and a daily music link because why not. AND you get access to a premium subscriber chat over on substack.com or on the app! And audio!

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

What tokenization expectations are getting wrong

EU: Public blockchains for financial services

Some of the topics discussed this week:

Geopolitical risks accelerate

Jobs: timeframe and target

The Crypto Czar

Painful, but useful

The EU: public blockchains for financial services

An inflation yawn

Ripple’s stablecoin

EU tokenization trials: indecision

What tokenization expectations are getting wrong

Group-think on retail CBDCs

Watch the developers

What tokenization expectations are getting wrong

Two core beliefs about tokenization have held true ever since the concept first started gaining traction around six years ago:

It can reform how markets work, bringing new efficiencies and functionalities while broadening access.

We don’t know how, when, or what that will look like.

This has led to a strong base of confusion dressed up as conviction, which persists despite successful live tokenization projects, many failed ones, and a deeper institutional understanding of the barriers and risks.

Last month, PwC published a survey that echoes misplaced expectations I’ve heard many times over the years, around the application of tokenization technology.

The survey covers asset and wealth managers as well as institutional investors, and asks questions about interest in and hopes for the impact of new technologies on the investing profession, in terms of both activity and product. Many of the questions were about blockchains and digital assets, with a focus on tokenization.

The baseline

Unsurprisingly, considering PwC is a consultant and would like to convince corporate readers of the benefits of expansion, the firm is bullish: it projects that the total amount of assets under management (AUM) for tokenized funds will increase from $40 billion in 2023 to around $317 billion in 2028.

I have no idea where it gets the $40 billion figure from. The rwa.xyz website puts the current tokenized assets volume at over $13 billion.

(chart via rwa.xyz)

The bulk of this is from “private credit”, largely coming from crypto lenders Figure and Maple – in my opinion, these totals should be excluded from any discussion of the impact on markets since they represent collateralized lending, not tradeable assets. Remove those, and the rwa.xyz total comes down to $4 billion.

(chart via rwa.xyz)

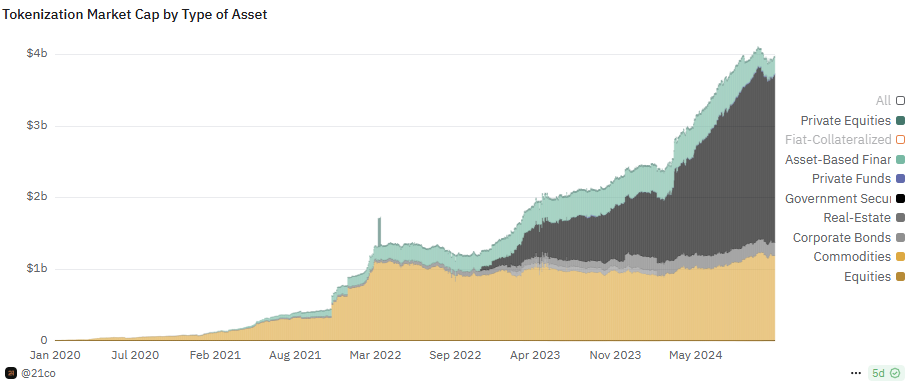

This more or less coincides with the total shown on the 21Shares Dune Analytics dashboard:

(chart via @21co on dune.com)

The PwC report doesn’t explain why the team multiplied this number by 10 for their 2023 figure, but I’ve seen similar inflation elsewhere, usually also from consultants.

The next mistake in assumptions comes from the reasoning for the growth. According to the report, the 8x growth in five years (a compounded growth rate of around 50% per year) will come from macroeconomic factors plus the “need for heightened liquidity, improved transparency and broader investment access”.

I take exception to the word “need” here – US markets work relatively well today, moving gazillions of dollars daily without system-breaking hitches. Of course, there are many issues that can and should be improved, including liquidity, transparency and access. But “need” is a stretch.

What’s more, the report’s authors insist that this “need” is especially obvious “within alternative funds, which could include private equity, real estate, commodities and other non-traditional assets.”

I understand the interest in tokenizing real estate and commodities, as they are relatively simple assets whose tokens could both expand existing markets and create new ones.

But private equity?

The wrong target

This segment does seem to be the unspoken emphasis of the PwC report. Asset managers and institutional investors were asked which types of digital assets they were planning to offer/hold over the next 2-3 years. Private equity was the only segment whose box was ticked by more than half of each group.

(chart via PwC)

This is puzzling, as the tokenization benefits for private equity, unlike many other asset segments, are not clear at all.

Private equity funds hold shares in non-public companies. They are illiquid, somewhat opaque and have gated access, all by design.

To see why this is relevant, let’s compare private markets to public ones. To raise funds without piling on debt, a company can issue equity for trading on a public exchange, where anyone in the applicable jurisdiction can buy its shares. Or, it can take on private investors, ceding part of its shareholder equity to one or several qualified entities.

The first option delivers access to broad and potentially liquid markets, but comes at the expense of onerous filings, public scrutiny and regulatory surveillance. For many businesses, the cost is too high.

The second option has a much lower cost because of the limited reach – reporting requirements are thinner, and there’s a much lower operational overhead for investor and regulatory relations. This is one of the reasons the number of private firms is now much greater than those with public listings.

(chart via Bloomberg)

For investors, private equity tends to have a higher risk than stakes in companies that trade on regulated exchanges – the shared information does not benefit from public scrutiny, and the lack of liquidity means a timely exit at a beneficial valuation is far from guaranteed.

The additional risk limits private equity investments to qualified investors, who expect higher returns in compensation. What’s more, these investors often get involved in the management of the business with the aim of boosting returns and planning an exit. In private equity, there’s often a closer relationship between investors and management (this is not always a good thing – I recommend the book “Plunder” by Brendan Ballou if you’re interested in this angle).

So, what are the supposed benefits of tokenization for private equity, according to PwC? Let’s see…

1) More liquidity – But one of the advantages of private equity is that it isn’t liquid. This binds investors and businesses in a relationship focused on boosting valuations, and keeps disclosure and compliance costs well below that required for liquid securities. Private companies may not want more liquidity for their shares. Furthermore, the lack of liquidity enables more subjective valuation methods, as well as a higher potential return to compensate for the additional risk. Investors may not want more liquidity, either.

2) More transparency – Of what? If the aim is greater insight into investor identities and holdings, this is unlikely to be approved, for privacy and competitive reasons. Of the underlying assets in private equity funds? That would be good, but those lists already exist and, because of the relatively low liquidity of the holdings, don’t change frequently enough for real-time updates to be a strong need. How about of the valuations? A key advantage of private equity investments is that they can record their holdings at “fair value” rather than “market value” which, as I mentioned above, leaves a lot more room for subjectivity. They are not necessarily going to want more transparency on the valuations.

3) Greater access – Opening private equity investments to retail participants? This would mean a lot more regulatory scrutiny over private company accounts, cap tables, etc., since protecting retail investors is a key part of market oversight, much more so than for institutional investors who in theory know what they’re doing and can afford more risk. Private companies wouldn’t want this for cost reasons; private equity investors would also lose the “edge” and additional return that comes from limited access.

In sum, the benefits that tokenization could supposedly bring to private equity funds would make them much more like public equity funds, removing the advantages of the asset class.

This no doubt goes a long way towards explaining why the current market cap of tokenized private equity, according to 21Shares, does not even reach $20 million.

Of course, there are many ways in which tokenization could improve private equity investment. Although speed is not a feature of private investment, reducing settlement time from months to even just days or less would reduce uncertainty and unlock funds sooner. On-chain record-keeping could reduce administration costs while streamlining reporting requirements. And greater standardization of investment representation (such as embedding the relevant information in a token) would facilitate transfer should that be desired.

Even more interesting than squeezing asset groups into benefit buckets that don’t quite fit, however, is the idea of creating new types of assets. Tokenization could give rise to investment opportunities in between public and private markets, through the onchain issuance of equity or bonds, with greater transparency but lower compliance costs, broader access but programmatically limited to whitelisted accounts, and deeper liquidity without relying on traditional public markets.

This is what I sincerely hope we start talking more about: rather than focus on how to wrap traditional securities in a new wrapper for efficiency gains, I hope we start thinking about what we can do on-chain that hasn’t been done before.

EU: Public blockchains for financial services

Last week, I came across an interesting paper published by the European Union about the potential benefits of public blockchains. You read that right – a sprawling and conservative governing institution is tentatively suggesting that public blockchains be used in regulated markets.

The key idea recognizes that financial onchain development will largely be on private distributed ledgers, but posits that the best connector of these “silos” will be a public blockchain.

Over the past few months, the BIS, the IMF and several other consortia as well as tech solution providers have been talking about the need for either a “unified ledger” (with everyone using the same technology, extremely unlikely) or a connecting layer in the hands of the market regulators. The problem, as the paper’s author points out, is that a centralized connector introduces new risks, whereas a robust, decentralized and transparent public solution can deliver not only greater trust, but potentially also greater utility through its broader scope and flexibility.

Of course, there are risks inherent to public ledgers, but the paper offers an entire section on mitigating policies. There is also still a deep misunderstanding in traditional finance of the properties of public blockchains, with many focusing on advantages that don’t exist. To compound the frustration, many still mistakenly assume that the traditional definition of the term “transaction” applies in the distributed ledger world.

The author lays out in easy-to-understand detail how the main benefit public blockchains deliver, is that of distributed governance. This cannot be replicated either in traditional finance or private blockchains. Programmability, automation and efficiency, characteristics widely associated with distributed ledgers, are not exactly absent in traditional systems. What is absent is distributed governance that is open and transparent. Focusing on this feature highlights the appeal of a public blockchain as finance’s “base layer”.

In this role, a public blockchain will prevent any one entity from dominating the underlying technology to the extent it can influence its function; in theory, this should prevent monopolistic consolidation and promote competition.

What’s more, a permissionless connector will foster interoperability and therefore more technological experimentation. If an entity is not concerned with achieving a large network size, since that can be achieved through a connecting script, it will have greater scope to experiment with features and functionalities. It could also lead to greater “composability”, in which services can test combinations even across private chains.

The author recognizes that public blockchains don’t eliminate all governance issues, and that they could give rise to new ones. One is, of course, regulation; but he points out that, while public blockchains themselves can’t be regulated, entities can. The users of the public blockchain – be they issuers, service providers or investors – could meet compliance requirements at the connecting level.

The document also covers transaction finality (possible on public blockchains), forks (problematic but manageable), programmability (not exclusive to blockchains), privacy (degrees of which can be added as a layer) and whole lot more.

It’s a good paper, thoughtful and easy to read while being both technical and conceptual. This is not surprising given that it was written by Fabian Schär, a professor of digital finance at the University of Basel and co-author of a book on bitcoin, blockchain and cryptocurrency. He’s been writing insightful papers on various aspects of the crypto ecosystem since 2015. This year alone, he’s also published research on Ethereum governance, land valuation in the metaverse, and how to regulate DeFi.

He’s a researcher, not a politician, and he is one of those rare individuals with a deep understanding of both traditional finance and the potential of distributed ledgers.

What is surprising is that this was published in the name of the EU’s Directorate‑General for Financial Stability, Financial Services and Capital Markets Union. It’s enough to make me feel ever-so-slightly more hopeful that the European regulators can seize the opportunity to re-think markets, drawing on the deep well of intrigued talent, harnessing the momentum of interest from traditional finance, wrangling official support for more experimentation at the private and public level, and eventually filling the need for a common bloc-wide capital markets technology.

True, it’s just a paper that only reflects the views of the author, and the EU has published many of those. But it’s not nothing, either.

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Regular readers will probably know that I live in Spain, a country best known perhaps for its beaches and cuisine. It should also be known for its gorgeous mountains and its music, but that’s a topic for another time.

My home is in the capital Madrid, which I am convinced has to be the most beautiful city in the world in December. Sure, I haven’t seen all cities at this time of year, but I’m sticking to that conviction anyway.

Below, I share some images I’ve snapped while wandering around at night – and there’s still so many neighbourhoods I haven’t had a chance to get to yet!

If you’d like to see more, I regularly share pics of Madrid over on X, at noelleinmadrid@gmail.com.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.