WEEKLY - Sony, the NYFed, euro stablecoins

plus: assorted links, musical taste and more

Hey everyone! To all readers in Spain, Feliz Día de la Constitución! I hope you’re all taking care of yourselves – this time of year is exhausting, with so many of us scrambling to close things out for 2025 while also wanting to revel in the festive season.

Here’s a link to my op-ed published last week in American Banker (paywall, sorry), in which I question what, in an era when anyone can issue a dollar stablecoin, what does “a dollar” even mean? This matters more than you might think, for the economy and for geopolitics.

🍂

I was on Scott Melker’s daily show on Wednesday, with Dave Weisberger filling in for Scott – we talked markets and macro, of course. You can see that here.

🍂

I’ll be on Yahoo Finance TV on Monday at around 9:30amET for more market talk, if you feel like tuning in.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

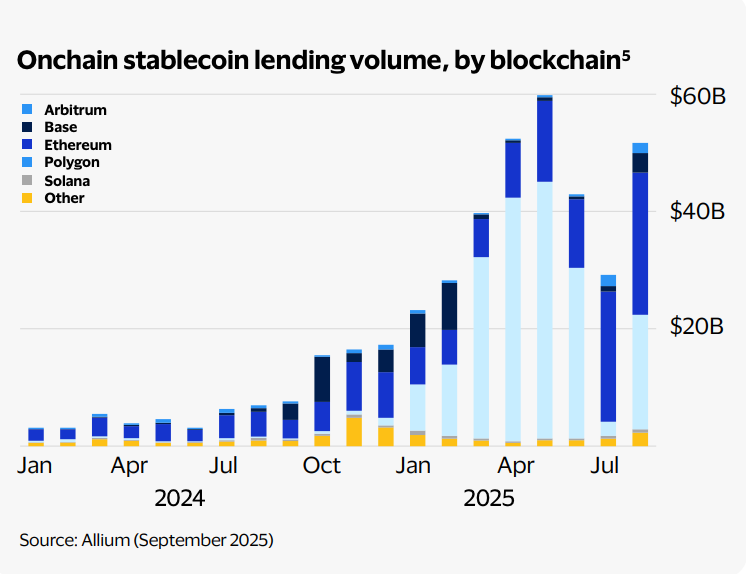

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

In this newsletter:

Sony’s stablecoin: some interesting threads

The New York Fed: in defence of public blockchains

Euro stablecoins: overcoming scepticism

Assorted links: The hive mind, attention spans, advent calendars, lost property and breakfast.

Weekend: majestic nature photos

If you’re not a subscriber to the premium dailies, I hope you’ll consider becoming one? You’ll get access to market commentary as well as adoption insight and industry trends. Plus, links and music recommendations ‘cos why not…

💃 If you speak Spanish and are interested in a less frequent, shorter update on developments in the crypto-macro intersection, you can subscribe to Cripto es Macro here. 💃

Some of the topics discussed in this week’s premium dailies:

Coming up this week: US jobs, PCE, economic activity, diplomacy and more

Markets: a bad start

China and stablecoins: what I do, not what I say

Macro-Crypto Bits: a strange divergence, Black Friday and inflation

China and stablecoins: there’s more

Stablecoins: the regulatory push

Markets: not yet

Macro: US manufacturing

Sony’s stablecoin: some interesting threads

The Fed understands permissionless blockchains

Euro stablecoins

Markets: hunh

Amundi’s tokenization: the hidden story

The BIS and real estate tokenization

Markets: knives out?

Macro: US jobs and services activity

Citi: Blockchain in the Background

Macro: US jobs, and who’s to blame for inflation

Sony’s stablecoin: some interesting threads

Sony is planning to launch a US stablecoin next year.

There are two interesting threads to this story:

1) One is the big-name support for a new type of stablecoin use case: community and in-app transactions. So far, most of the excitement has been around cross-border payments, and most of the use to date has been for crypto trading. Here we have a different type of potential application that in turn could power a different type of brand engagement.

Some background: stablecoin issuance has been on the cards for Sony since early 2024, when it started experimenting with currency-linked tokens on Polygon. Then came the launch of its blockchain Soneium in January of this year, with Circle having joined as a partner a few months earlier. I was expecting Sony to eventually launch a yen stablecoin on Soneium, so I confess this week’s announcement caught me by surprise – although it shouldn’t have, seeing as how Sony’s venture arm invested in stablecoin service platform Bastion’s recent $14.6 million raise. (So did Samsung Next, hmm.) The venture arm made the investment, not Sony Bank itself, but still.

Indeed, Sony will be issuing its stablecoin through Bastion, which will handle token minting and burning, reserve management as well as custody. I haven’t found any indication as to the blockchain, but it makes sense it would be Soneium – this was created to be compatible with Ethereum’s structure, so bridging to other ecosystems to broaden the reach could be a possibility. Launch is expected in 2026, pending regulatory approval.

The initial use will be internal treasury management, with obvious advantages for a sprawling multinational with plenty of cross-border transactions between and within divisions.

Consumer-facing applications will follow. Here is where it could get interesting, offering an engaged community new types of transactions in familiar environments, and expanding the reach of and connectivity between Sony properties.

For instance, a stablecoin for in-game transactions, with Soneium-based decentralized exchanges facilitating asset swaps or lending. Is that finance, or is that play? Or, micropayments for streaming, in-app tipping for content creators, the possibility of earning while watching something on one of Sony’s entertainment platforms or participating in a metaverse activity. Stablecoins can enable transactions that have not been feasible in the current card-dominated landscape.

2) Now, about that regulatory approval:

Sony Bank is based in Japan. In October, it applied to the OCC for a US national trust bank charter for its subsidiary Connectia Trust, National Association. This would, if granted, give it the GENIUS-compliant entity needed to issue stablecoins in the US – indeed, the application specifies the intention to issue dollar-pegged stablecoins, maintain the corresponding reserve assets, offer non-fiduciary digital asset custody and also asset management services as fiduciary to “certain affiliates” (I’m not sure what form this last part will take, but it sounds intriguing).

The Independent Community Bankers of America (ICBA) has objected, alleging that issuing retail stablecoins is beyond the scope of the charter. This is an odd objection, since the GENIUS Act specifically empowers national trust banks to do that. But, the ICBA is kicking and screaming about stablecoins generally, as they stand to be more impacted by the diversion of deposits than the large mega-banks. Their objection resurfaces their allegation that the OCC overstepped its authority in its interpretive letter clarifying that trust banks can engage in non-fiduciary activities such as passive custody.

The ICBA has a point in that holding stablecoin balances on behalf of clients is akin to accepting deposits, which trusts can’t do – that function is reserved for banks. Although, this was one of the big deals of the GENIUS Act: trusts are sidling into bank territory, all for the sake of encouraging stablecoins and therefore demand for US treasuries.

So, it’s very likely Sony will get the necessary approval, because stablecoins.

But here’s a twist. There is no US entertainment company that owns a bank, because the Bank Holding Company Act forbids it. In Japan, there are no such barriers.

This implies that Sony will be able to issue stablecoins to enhance the utility and profitability of its entertainment properties, with most of the benefits presumably flowing to the head office in Japan. Disney, a US company, can’t – unless there’s a legal workaround that would enable Disney to issue a stablecoin. Perhaps, I’m not a lawyer. But it is striking that it is easier for foreign non-financial conglomerates to issue stablecoins in the US, essentially taking deposits and offering financial services while boosting innovation, engagement and profit, than it is for a US non-financial conglomerate.

See also:

Sony’s blockchain backlash (Jan 2025)

The Sony blockchain has momentum (Sept 2024)

Sony’s crypto exchange: the convergence? (July 2024)

Sony takes over blockchain? (Sept 2023)

🎀 If you find these newsletters interesting, would you mind sharing with friends and colleagues, and nudging them to subscribe? I’d really appreciate it! 🎀

The New York Fed: in defence of public blockchains

Last week, the New York Fed posted an article about the advantages, yes, the advantages of permissionless blockchains.

It points out that stablecoins are not much of an improvement on traditional payments rails such as FedWire, except for their accessibility. Traditional rails require a bank account; stablecoins don’t if they run on permissionless blockchains.

This not only broadens access to the unbanked or underbanked. It also solves for the lack of efficient international reach of domestic payment rails.

And, permissionless blockchains enable smart contracts built by anyone.

They also encourage “composability”, in which smart contracts and assets can interact with each other to expand services and create new ones, without needing to wade through the process of coordination and consensus from all of the moving parts.

The article also highlights the barriers to greater public blockchain adoption, especially the need to comply with anti-terrorism and money laundering rules. That’s a big one, but there’s also the desire for transaction privacy, and the usability friction – crypto wallets are still somewhat intimidating for most.

But the big takeaway is that the authors believe traditional finance should head in the decentralized direction and embrace the flexibility and access of public networks. This is just a blog post, not an official statement – but it does feel like a meaningful shift in the institutional approach to the idea of permissionless blockchains.

I’ve been saying that permissioned networks are more likely to power the first wave of tokenization migration – not because I think they should (decentralized offers more flexibility and resilient), but because I believe it’s what the regulators and institutions can get comfortable with at this early stage.

Posts like this, however, are putting official acceptance of the permissionless advantages within sight – not near, and not without significant obstacles on the way, but at least more possible than even a few months ago.

Euro stablecoins: overcoming scepticism

In October, I wrote briefly about Citigroup joining a European bank consortium to develop a euro stablecoin, and I wondered how President Trump would feel about a US bank helping to develop a competitor to dollar stablecoins.

Earlier this week, the resulting company, going by the name of Qivalis, released its first official statement. Citigroup was not named, so I’m not sure if the original reporting was incorrect (although a spokesperson confirmed the news to Bloomberg) or if they have backed off.

Anyway, BNP Paribas has stepped in to keep the participant number at 10.

Only, BNP Paribas is also a member of another consortium, along with Bank of America, Citigroup, BNP Paribas, Deutsche Bank, Banco Santander, MUFG, UBS, Goldman Sachs and TD Bank, that is exploring stablecoins based on G7 currencies – presumably including the euro?

The more, the merrier, I guess?

I’m much less sceptical of the consortium approach than I am of banks choosing stablecoins over deposit tokens. The are barriers to cooperation between competitors, but when it can be highly profitable, it can work. Zelle is an example in the US, Wero in Europe – Qivalis could join them. The product in question is not expected to launch until late next year, so there’s plenty of time for the industry to evolve in the meantime.

There’s also the hope that progress will have been made on capital markets union – one unresolved issue of the Qivalis stablecoin is what backing reserves it will rely on. Bank deposits that yield almost 0%, sure, but presumably also “safe” liquid securities such as government bonds. Which government bonds? Just how safe are they? Europe does not yet have a deep and liquid pool of government debt in the form of EU bonds.

Also, by late 2026 we should know whether the digital euro CBDC will go ahead. According to the official statement, the ECB is supportive of Qivalis. For now, the use cases do not seem to overlap – according to a Reuters report, the private token will initially focus on crypto trading while the ECB focus is on a retail payments platform. There is a wholesale CBDC in the works, too, but that will be for interbank and large cross-border transfers, so no overlap there.

See also:

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Ted Gioia asks an uncomfortable question: what do two of the most popular TV series this year say about our deepest fears, and are they coming true? (The New Anxiety of Our Time Is Now on TV, The Honest Broker)

Daniel Parris crafts a compelling narrative around what grabbed our attention most in 2025, why it wasn’t TV and music, our new valuation metrics for time, the colossal cultural impact of Donald Trump, and more. (What Captures Our Attention in an Algorithmic Age? A Statistical Analysis, Stat Significant)

If you’ve ever wondered what happened to that umbrella you left on the London Tube once, this is for you: Reuters visited London Transport’s lost-and-found warehouse to see how it was organized, and where the unclaimed stuff ends up. I mean, who leaves a giant plushie on the Underground? Lots of people, apparently. And I could swear I saw a wedding dress in the video. (From mobile phones to cooked frogs, inside London’s biggest lost property office, Reuters)

Trivia, but oh so relevant. George Dillard takes us through the history of breakfast. (Inventing Breakfast, Looking Through the Past)

This beautifully written romp through advent calendars past and present offers a reminder of their origins while revelling in the absurd consumerism of the range available today. (Help! I’m addicted to luxury advent calendars, Michelle Taylor for the Financial Times – paywall)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

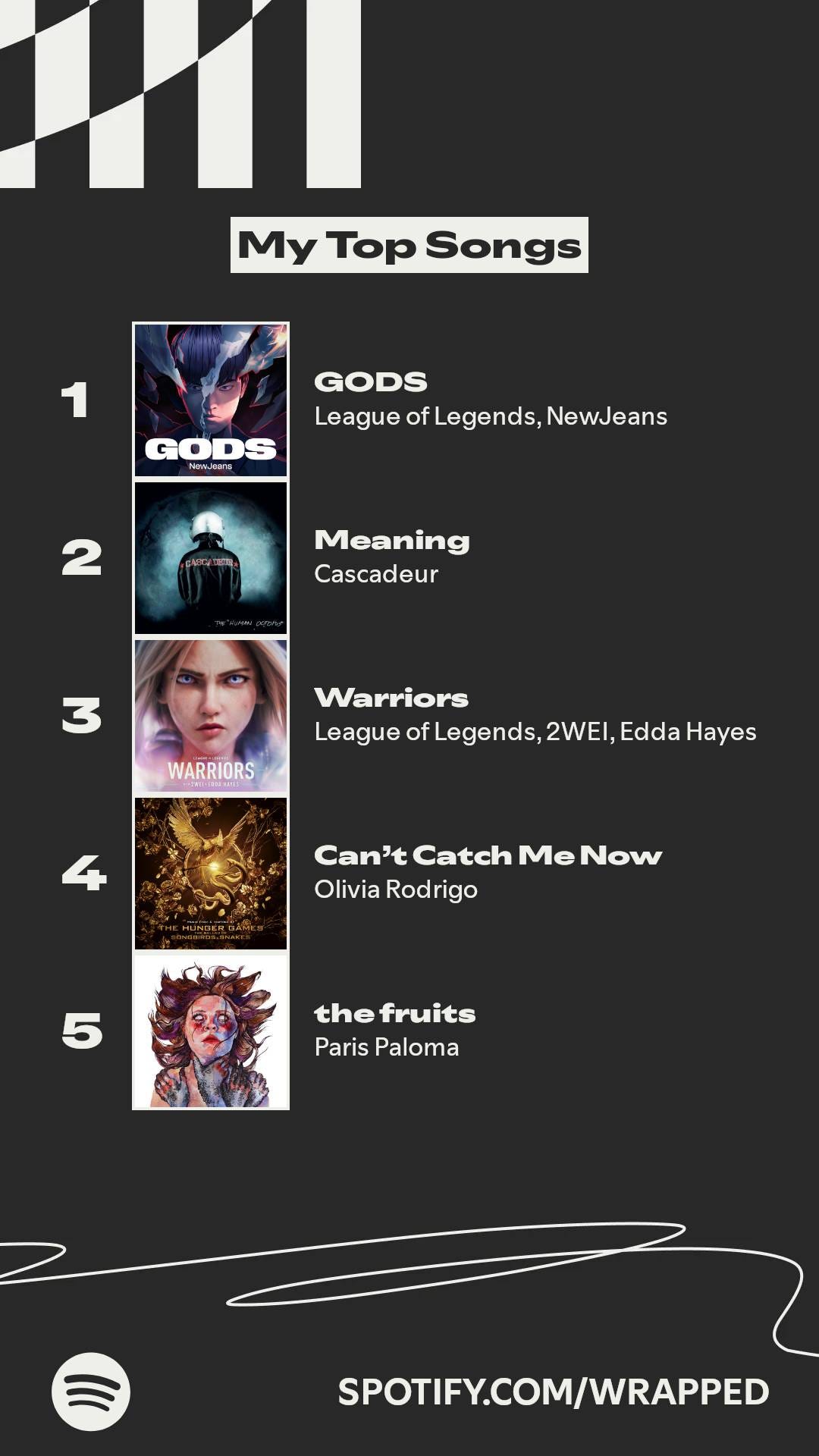

It’s the Spotify Wrapped time of year. I know it’s meaningless and usually does not match with our recollection at all, but it’s fun. The designers manage to make it feel special, like a gift, and while I’m uncomfortable with the idea of datafying our personal lives (and music taste is personal), it so far feels like a celebration of sound and resonance.

Of course, I have quibbles – in my case, I listen to classical, sometimes electronic or even soundscapes in the morning when I’m writing, to quiet the mind and help with focus. The afternoon is for energy music. When I’m doing chores or travelling, then my “favourites” come out. So, my minutes-listened list is often a reflection of my work-life balance and not necessarily of preferences – although, digging deeper, of course it reflects preferences, just not necessarily in music.

Anyways, in the spirit of getting to know each other better, here are my top artists (extra points for diversity?):

And my top songs - I have no recollection of listening to these as often as Spotify claims, but I like them, so:

Number of genres: 476

And my listening age is 78. Sounds about right.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.