WEEKLY - Stablecoins, BTC, gold

plus, assorted links, a weekend recommend, and more

Hello everyone, and welcome to June! It’s crazy how fast this year is going.

You’re reading the free weekly Crypto is Macro Now, where I reshare a couple of posts from the week, offer some interesting links I came across in my weekly reading, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one! 🙏 For $12/month, you’ll get ~daily commentary on how crypto is impacting the macro landscape, and vice versa. I talk about adoption, regulation, tokenization, stablecoins, CBDCs, market infrastructure shifts and more, as well as the economy and investment narratives.

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

Stablecoin stress

Stablecoins and the innate control reflex

BTC vs gold

🌻Hey all! I’m thinking about taking on sponsors, to help keep this newsletter going. If you have a webinar, report or event you’d like me to feature, let me know! Reach out at noelle@cryptoismacro.com and I’ll send you more information.🌻

Some of the topics discussed in this week’s premium dailies:

Coming up this week: geopolitics, macro and Bitcoin

Stablecoin stress

Macro-Crypto Bits: markets, repression, realignment and more

The BTC layering trend gathers momentum

Stablecoins and the innate control reflex

Macro-Crypto Bits: markets, confidence, Japan

No more tariff flip-flops?

BTC vs gold ETF flows: not what it seems

Macro-Crypto Bits: the dollar outlook, Bitcoin payments

PCE vs CPI: what’s the difference?

The two narratives of real estate tokens

Macro-Crypto Bits: macro, markets, tariffs and stablecoins

Stablecoin stress

The panic around dollar-backed stablecoins continues.

Last week, central bank think tank OMFIF reported on spreading unease among central bankers as the US stablecoin bill marches its way through Congress, quoting one as saying:

“There is a wall of shit money coming our way, and we’re doing nothing about it.”

It’s not clear whether this official’s disdain is aimed at the dollar, or the fact that stablecoins are blockchain tokens, but it is clear that many in his profession see this payments innovation as a threat.

EU officials, for example, have publicly said that the potential popularity of dollar stablecoins is behind the accelerated timeline for the digital euro, a central bank digital currency that in theory will do all that stablecoins can do… except run on global decentralized networks, of course. Oh, and give access to a range of liquid DeFi apps. And operate without ridiculously low balance caps. But never mind, the important thing is it will be based on the euro, which surely we will all prefer because patriotism.

And, speaking at an event last week, Brazil's central bank deputy governor said that dollar stablecoins were increasing the volatility of capital flows by making it easier to bypass the normal friction for converting reals into dollars.

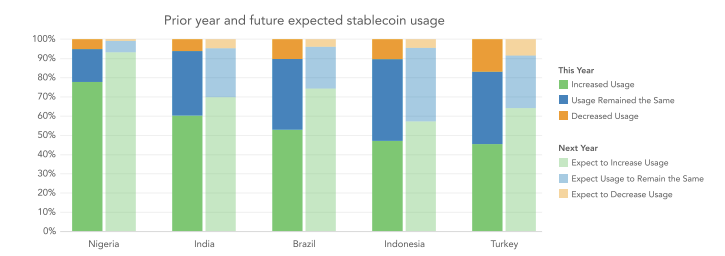

Nigeria has struggled with this, going as far as to blame crypto for the depreciation of the naira. While there’s no doubt more to the country’s currency issues, they’re not wrong to be worried: a survey conducted by YouGov canvassed five major developing economies (Brazil, India, Indonesia, Nigeria, and Türkiye) and found that Nigerians were easily the most familiar with and enthusiastic users of dollar stablecoins.

(chart via Stablecoins: The Emerging Market Story, Sept 2024)

As stablecoins march into the mainstream, central banker stress is likely to intensify, especially if US officials continue to emphasize how wonderful greater use would be for the dollar, with the “at the expense of other currencies” part left unsaid.

Stablecoins and the innate control reflex

Former CFTC Chair Chris Giancarlo penned an op-ed for the Financial Times that argues for values-based design of open systems. Digital instruments based on the dollar, he insists, should “reflect democratic values of freedom from unwarranted surveillance, censorship and control by both governments and commercial firms.”

And, he urges that we seriously consider “how to preserve the universal values for which the dollar has historically stood.”

We could just laugh at the naivete about both design and the dollar, especially coming from a former financial markets regulator.

But zooming out, we should be alarmed.

It’s not just the inappropriate sanctimony – we all know the US dollar gets up to some bad stuff all around the world. Always has, always will.

No, it’s also the bewildering assumption that decentralized networks can be controlled. The idea of banning digitized dollar access for governments or firms the US doesn’t like goes against the very ethos.

What’s more, why would entities adopt a dollar stablecoin ecosystem if they could be kicked off and/or have assets seized in the event of a “values” disagreement? Alternative networks have emerged and will continue to do so precisely to protect against that kind of risk.

The suggestion that permitted stablecoin use be based on “values” is bewildering (especially from someone known as a long-time crypto advocate), but also worrying, as where does the assumption that someone should set access rules come from? Perhaps from a place of elite familiarity with control. I’m sure Giancarlo means well, and he comes across as a decent person – but he obviously doesn’t realize what his blockchain vision says about his perhaps unconscious intentions regarding stablecoin networks.

Put differently, it reveals a discomfort with open systems, and therefore also a scepticism about public blockchains. This is about more than compliance, which we can accept will be a feature of whatever system emerges. It’s about who gets to participate. Implying that only “friends” can use dollar stablecoins sketches out a gated system that will end up looking much like the one crypto was created to bypass.

Giancarlo ends with:

“If we get the values right, the value of the dollar will be sustained for decades to come.”

It wasn’t that long ago that the US started limiting access to SWIFT based on values, a move that not only kickstarted a scramble to develop alternatives but also arguably intensified a global questioning of dollar supremacy.

Insisting that US stablecoin networks have “values” brings additional scrutiny to the meaning of that word, and sheds doubt on the actual interest of US regulators in open networks. Maybe the unspoken intent is that they won’t be so open after all.

BTC vs gold

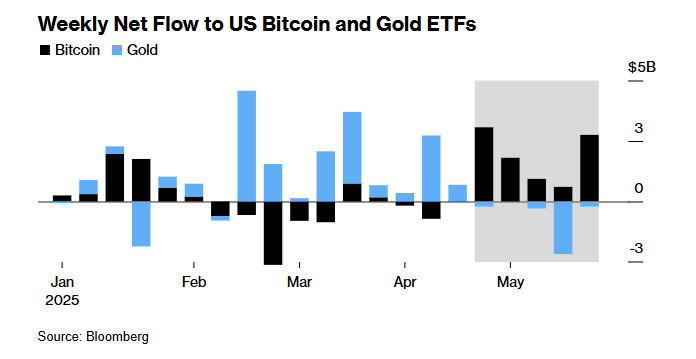

An article on Bloomberg earlier this week shared a chart comparing inflows of BTC spot and gold ETFs. The implication is that investors are rotating out of gold and into Bitcoin.

(chart via Bloomberg)

I’m sceptical that the two are as inversely correlated as the chart suggests – it feels like too tidy a narrative, and we know that many gold investors are not interested in BTC and vice versa.

Put differently, some might see this chart and thing “a-ha! digital gold is winning out over analog!”, But that assumes all BTC spot ETF buyers believe in the digital gold narrative. That’s not the case.

More likely, a significant chunk of the inflows are from investors playing the basis trade, in which they buy spot exposure and sell futures – this is even easier these days now that there are ETFs for both vehicles.

And, at time of writing, it’s profitable – the annualized basis trade return on the CME is now almost at 10%, the highest since early February.

(chart via velo.xyz)

It’s also likely that a chunk of the BTC spot ETF investors are more interested in BTC’s risk asset characteristics, which have become even more relevant in recent weeks given the reluctant acceptance from even the Administration (and key advisers) that the deficit is not coming down. This suggests continued fiscal stimulus, which could be boosted further should the treasury market require some intervention to keep yields sane.

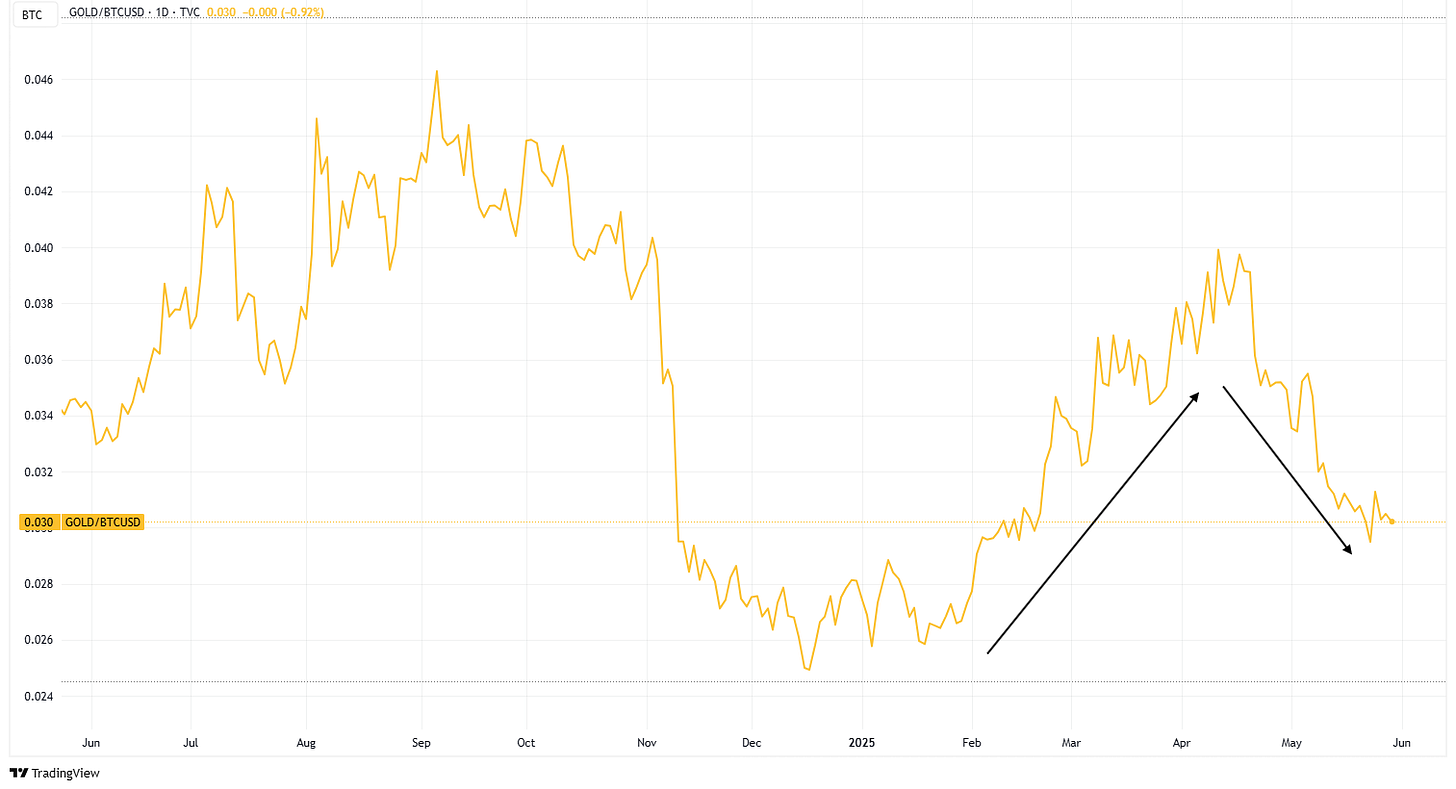

For those keeping score, gold has outperformed BTC year-to-date, with the “safe havens” up 25% and 16% respectively. But in recent weeks that has flipped as BTC is doing some catching up while benefitting from a resurgence of interest in risk assets: it is up 14% over the past month, while gold is down 2%.

(gold/BTC chart via TradingView)

ASSORTED LINKS

(A selection of reads outside of crypto and macro, although these may find their way in anyway. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Record producer Rick Rubin and Anthropic have collaborated on a truly strange but also captivating project called The Way of Code. An example of what I call techno-chill, a better title would probably be The Way of the Vibe Coder – the work consists of 81 poems or “meditations” with AI-generated images that you can modify with a simple prompt: “make it more colourful”, “add some flowers” and so on. The idea is to get us involved in the art, and it feels like a return to the ethos of the early days of the internet where the prevailing philosophy was “try it!”. I’m totally here for that.

An interesting take on the emerging crypto-state coalition, and how it goes against the original libertarian principles of decentralization. (The new crypto is criming and state coercion, wrapped up into one, Programmable Mutter)

The US Defense Intelligence Agency has published its 2025 Worldwide Threat Assessment that touches on China, Russia, Iran, North Korea, drones, ISIS threats, the Arctic, the weaponization of space, quantum technology, biomanufacturing and a whole lot more. Don’t read this if you have trouble sleeping at night.

Emily Chamlee-Wright shares some thoughtful reflections on AI, the printing press, and the coming “crisis of meaning”. (Our Gutenberg Moment, Persuasion)

FT Alphaville on the operating costs of the European Banking Authority and the importance of good office coffee. (The most expensive coffee is the one you don’t buy, FT Alphaville)

When AI replaces the challenge and thrill of learning, motivation goes out the window. “We’ve been focused on how students use AI to cheat. What we should be more concerned about is how AI cheats students.” (The Myth of Automated Learning, New Cartographies)

James Lucas shares some stunning examples of pareidolia, when we see familiar patterns and shapes out of context. For instance, a bear in the form of a cloud, or a face on a potato – apparently, it’s to do with social instincts. (Pareidolia: Seeing Patterns in Randomness, James Lucas)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

This weekend I have a series recommendation for you. I’m not all the way through yet, but I’m loving The Eastern Gate on Max. A Polish military/political thriller with excellent acting and gloomy cinematography, it highlights the building tension between nations bordering on the Suwalki Gap which joins Belarus and Kaliningrad. Complex, unflinching and extremely well done, it’s also a terrifying reminder of the fragility of the status quo.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.