The crypto bull run: What’s going on?

The short-term and long-term narratives

“Ideas at first considered outrageous or ridiculous or extreme gradually become what people think they’ve always believed.” – Rebecca Solnit ||

Hi everyone! I hope you’re all taking care of yourself. Bull runs are exhausting, no joke.

This newsletter is going out a bit later than usual as I hopped on to Scott Melker’s live Wolf of All Streets show, which you can see here.

And you can catch the recording of yesterday’s chat with Maggie Lake here.

Today, I talk about the narratives driving the BTC run. I’m making today’s newsletter open to read for anyone, as what we’re witnessing in crypto markets is both confusing and important.

IN THIS NEWSLETTER:

The crypto bull run: What’s going on?

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

The crypto bull run: what’s going on?

Obviously, today is a day for once again focusing on markets. I have many posts in the pipeline on what’s going on in stablecoins, tokenization and CBDCs (there are indeed interesting things happening there), but crypto markets are running and it’s worth looking at why.

(chart via TradingView)

Of course, I have been talking about “why” in this newsletter for the past couple of years – but this month’s moves make that story much more relevant, and so a summary and update feels appropriate.

I’m going to break the narratives down into short-term and long-term, acknowledging the overlap, because time frame matters for thesis development and positioning, and because attention spans are finite.

Short-term

Regulatory thaw

With the resounding Republican victory in the US elections, the regulatory hostility from the world’s largest financial market will soften, supporting more innovation, build and investment of all types.

For BTC, this is less significant than for pretty much all other tokens – there is no longer any debate about BTC’s status within securities law (it’s a commodity).

But it is still extremely relevant in that traditional institutions will finally be able to offer crypto services to their clients, most likely boosting demand. Custody, trading, investment management – these are crypto services that large macro investors and wealthy clients want. Sure, they are available today through high-quality crypto-native platforms, but the comfort of using a “mainstream” name will help to overcome the “newness” barrier, especially if there is a pre-existing relationship. Crypto-native talent and experience matter, however, so we are likely to see a flurry of M&A as traditional finance scrambles to catch up.

And there’s the contagion effect – jurisdictions around the world will also be scrambling to pass supportive crypto legislation, to avoid losing startups and investors to the US. Here, a rising tide lifts all boats.

The recent icing on the cake, though, is talk of a crypto regulator, separate from other branches of the Administration. Creating a new post focused solely on crypto policy would not only send a very loud signal to the rest of the world that the US wants to recover the driving seat in the development of new financial market technology; it would also amp up likely official support for compliant innovation. Put differently, this would be more than just words, would signal real commitment, and should assuage the doubts of those who worried that Trump was just saying supportive things to get the votes.

Geopolitical tension

This narrative is not only short-term, obviously, but the launch of US and British missiles from Ukraine into Russia, and the retaliation earlier today with the first ever military use of an inter-continental ballistic missile is rattling markets (and all Europeans).

There is no suggestion that the ICBM was nuclear-armed, but nevertheless, it is an alarming reminder how fast things can escalate. A couple of days ago, Putin signed a new nuclear doctrine, lowering the threshold for a nuclear strike in retaliation for conventional missile attacks on Russian territory.

Reuters reported earlier that this ICBM had a range of 5,800km, yet was aimed at a target 700km away from the launch base. And ICBMs cost millions of dollars each, yet this one seems to have (mercifully) only contained conventional warheads. What’s more, there are suggestions that perhaps not even that, as the only burning footage we’ve been shown so far is of what looks like a private house.

This suggests expensive messaging rather than escalation intent, so we can hope the right message gets received. And we have all noticed that we found out about the launch after it had done some damage.

Adding to the tension are warnings from Russia earlier today that the new US base in Poland raises the overall nuclear danger.

And the cutting earlier this week of undersea fibre-optic communications cables in the Baltic, apparently by a Chinese ship helmed by a Russian captain, is just one more example of how conflict is spreading under different disguises.

In times of conflict, hard assets that live “outside” the system have an additional appeal when chaos reigns. Even gold is climbing, despite US dollar strength – and BTC is a lot easier to store, move and use than gold.

Scarcity and buying behaviour

With Bitcoin, more than any other asset, buying leads to a scramble to buy.

Over the past few weeks we’ve seen an acceleration of announcements from companies adding BTC to their corporate reserves. None are quite as high-signal as the intentions of MicroStrategy to keep on issuing stock and debt to finance even more BTC purchases. Yesterday, the firm announced it would increase its planned $1.75 billion convertible bond issuance to $2.6 billion due to high demand – that means even more BTC will go into the MicroStrategy vaults.

Add to this the possibility of a US Bitcoin Strategic Reserve (remote, in my opinion), and rumours that other nation-states are buying.

The thing is, BTC going into hold-only addresses removes tokens from circulation. The more BTC socked away in long-term holdings, the lower the active supply available to new buyers, of which there are likely to be many, given price FOMO and growing awareness. This is one of the reasons BTC moves fast when it starts to move – it’s the scramble for a dwindling amount of one of the only tradeable assets whose supply schedule is not at all influenced by the price. More equity gets issued when the price climbs, same with bonds. Even the supply of gold is sensitive to the price, as at higher levels, new mining techniques become profitable. But BTC’s supply schedule can’t change, no matter what the price, no matter how great the pressure.

Risk sentiment

I know we have BlackRock out there telling the market that BTC is not a “risk asset”, but BlackRock doesn’t get to decide what BTC is.

Plus, technically, BTC is a risk asset, whatever your investment thesis. It has high volatility, no cash flows, no underlying hard assets, and variable but high growth potential. It checks all the boxes.

For me personally, BTC is a hedge and a tech investment. For others, it’s about the volatility, and that’s fine. It’s an open market. There’s room for all of us.

What’s more, given the reflexive characteristic I outlined above (buying triggers buying), the volatility can jump fast, boosting the appeal for those looking for alpha.

Obviously, these participants can leave as fast as they enter – but that, too, is what makes markets. For now, the recent jump is bringing in more risk takers and momentum chasers, propelling further climbs.

Macro tailwinds

Like gold, BTC is a hedge against currency debasement. It doesn’t necessarily act like one short-term, but all hedges are long-term in nature – markets are complex, correlations shift and hedging for the short term is best left to derivatives.

The longer-term rationale for holding gold and/or its digital equivalent is one of supply and demand. Between two assets, one with unlimited supply and one with a verifiably limited supply, it’s not a stretch to see how the latter would outperform, assuming steady demand for each.

Throw in variable demand, and the equation gets more interesting. Demand for BTC, as I’ve shown above, is likely to increase. It’s supply schedule won’t.

Demand for dollars is also likely to increase as the economy grows, and as nations around the world prefer to hold a relatively “safe” currency that can also pay for imports. But will demand consistently grow more than supply?

And threats to dollar demand should not be ignored, given shifting geopolitical alliances and the likely emergence of alternative payment networks. The US dollar will continue to be the world’s reserve currency for some time still, given the lack of a viable alternative. But that doesn’t mean some demand won’t be diverted.

This is one of the reasons longer-term macro and crypto investors keep a close eye on US fiscal expansion, Fed policy and foreign investment in US assets. If sovereigns and overseas corporates are diversifying teir reserves to reduce the risk of either US sanctions or a value debasement of the bonds, what will the continued increase in US government debt mean for the money supply? Many of us believe that we will see a combination of the Fed stepping in to support treasury demand (printing money to do so), and/or figuring out how to encourage banks to mop up government issuance (boosting the money supply through balance sheet adjustments).

This is a separate macro narrative from that fuelling risk appetite – lower rates, increasing liquidity. I’ve written often about how I don’t see the fed funds rate as relevant for liquidity conditions (even before the recent cuts, the Chicago Fed’s financial conditions index was as loose as before the hiking cycle). But the market seems to think it is, and that’s what matters for valuations.

(chart via the Chicago Fed)

Financial resilience

The ability to freely transact is a luxury taken for granted by most who live in western economies. Yet most of the world doesn’t. By some accounts, over 70% of the world’s population lives in an autocratic regime, where financial access is far from guaranteed.

This is unfortunately even the case in democracies, as we saw in Canada with bank account closures for those who donated to “offensive” but not illegal causes. Many of us in the crypto industry have had our bank accounts closed because we are deemed to be likely money launderers.

Bitcoin is seizure-resistant if held in self-custody, censorship-resistant if transacted P2P, and accepted in an ever-wider range of outlets. Yes, you can buy milk or pay rent with BTC, much more easily than you can with gold. And a pen drive is a lot easier to carry if you have to flee. For all those who fear for their right to transact and/or hold on to their savings, arguably a large and growing group, Bitcoin is a solution.

What’s more, there are deepening signs of confiscation and financial censorship even in countries once held to be bastions of liberal freedom.

In the UK, we saw Nigel Farage debanked for his unpopular views (the bank insists it was because he didn’t meet the minimum threshold, although minutes later showed that was not the only reason). Others have also had issues with financial access, for no reason other than their job. And we regularly see headlines of people receiving police visits or even being arrested because of what they wrote or said in public.

The US is also not immune from the temptation to censor speech, as we have seen with recent attempts to redefine the First Amendment and outlaw “misinformation”. Plus, there’s the real risk of confiscation. I was astonished by threads on X this morning detailing how the state of California quietly upped payroll tax because it is in financial difficulty. (Are they true? They look legit. But even if not, the fact that they’re plausible should give pause.)

Long-term

Looking further out, all of the above narratives are likely to still hold, to varying degrees. Hopefully, geopolitical uncertainty will diminish, but history tells us that’s a risky assumption. Hopefully, inflation will not have come roaring back in the US, but it can more easily flare up in other regions, keeping hedge demand high. And the demand for risk assets waxes and wanes along with monetary and economic sentiment, that will always be the case.

New technology

I expect an emerging narrative in coming years to be growing demand for Bitcoin blockspace. This will rise and fall along with BTC investment demand, but there are other uses as well.

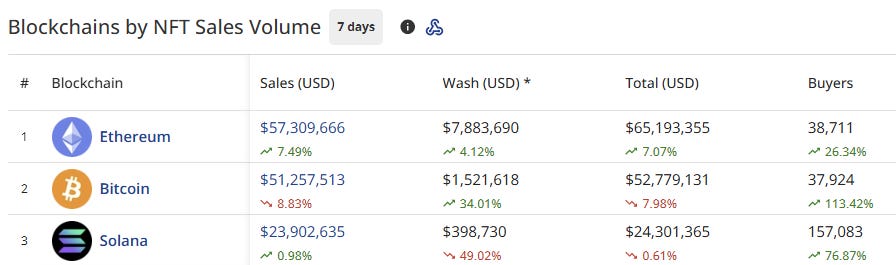

Over the past 24 hours, Bitcoin is the most used network for minting and trading NFTs. Over the past 7 days, it’s close to Ethereum’s lead.

(chart via cryptoslam.io)

And if you don’t find growing experimentation with digital ownership interesting, there’s the usability of BTC on other networks. New versions of wrapped BTC are appearing, boosting the asset’s usability in DeFi apps. Over the past couple of months, several projects have raised funds to develop new Bitcoin-backed stablecoins, or bring USDT to Bitcoin. We have Bitcoin liquid staking and restaking projects, active Bitcoin layer2 development, and I could go on.

Longer term, we will be reminded that Bitcoin is a new technology, with evolving use cases and demand. As author William Gibson has said: “The street finds its own uses for things.” This does not feel priced in.

No doubt there will be some narratives I’ve overlooked (I wrote about the likely impact of the launch of ETF options earlier this week), but the above hopefully gives some idea of the scope.

What is clear is that this historic BTC move is about more than number-go-up, fun as that may be for holders. It represents broadening awareness of a new concept, which in turn will trigger different types of thinking.

And, stepping back, it also encapsulates a deeper shift in economic expectations, political philosophies and acceptance that things change. If I had to sum up why Bitcoin has long attracted independent thinkers, of which there are more and more – of why it is today one of the most interesting debates you can have with friends, family and colleagues – it’s this: Bitcoin represents change. Even if we don’t want it, we can’t deny it’s not happening. And those of us who long ago understood the potential for a new form of data transfer to alter how citizens view authority and how authority views society, it’s both encouraging and a bit alarming to see the validation.

(A semantics note: I generally try to use BTC when talking about the token, Bitcoin when talking about the network and the concept. Confusing, I know.)

WHAT I’M LISTENING TO: Embrace the chaos – What’s Up?, by 4 Non Blondes

If you find Crypto is Macro Now useful, would you mind hitting the like button? ❤ I’m told it feeds the almighty algorithm.

HAVE A GREAT DAY!

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

Excellent Post. This would help so many of the peeps on the fence, or just recently starting to invest in Bitcoin. Part of the reason I'm still buying at these levels is that Bitcoin is so dramatically misunderstood. And that fact continues to give us asymmetry towards the upside. For the many real world benefits of Bitcoin and NGU.

It may be germane to mention that some $9 billion in Tether has been minted since the election. I wonder what it is being used for?