WEEKLY - Chinese stablecoins, machines, NFTs

plus: assorted links, classic films and more

Hi everyone! I hope you’re all doing ok, and taking care of yourselves. Here in Spain, autumn is getting ready to burst forth in its coloured splendour, we have blue skies after a few days of clouds, the temperature is just perfect, and Madrid is already stringing Christmas lights around trees and lampposts in an uncharacteristic display of get-ahead planning and organization.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days and offer some interesting links.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

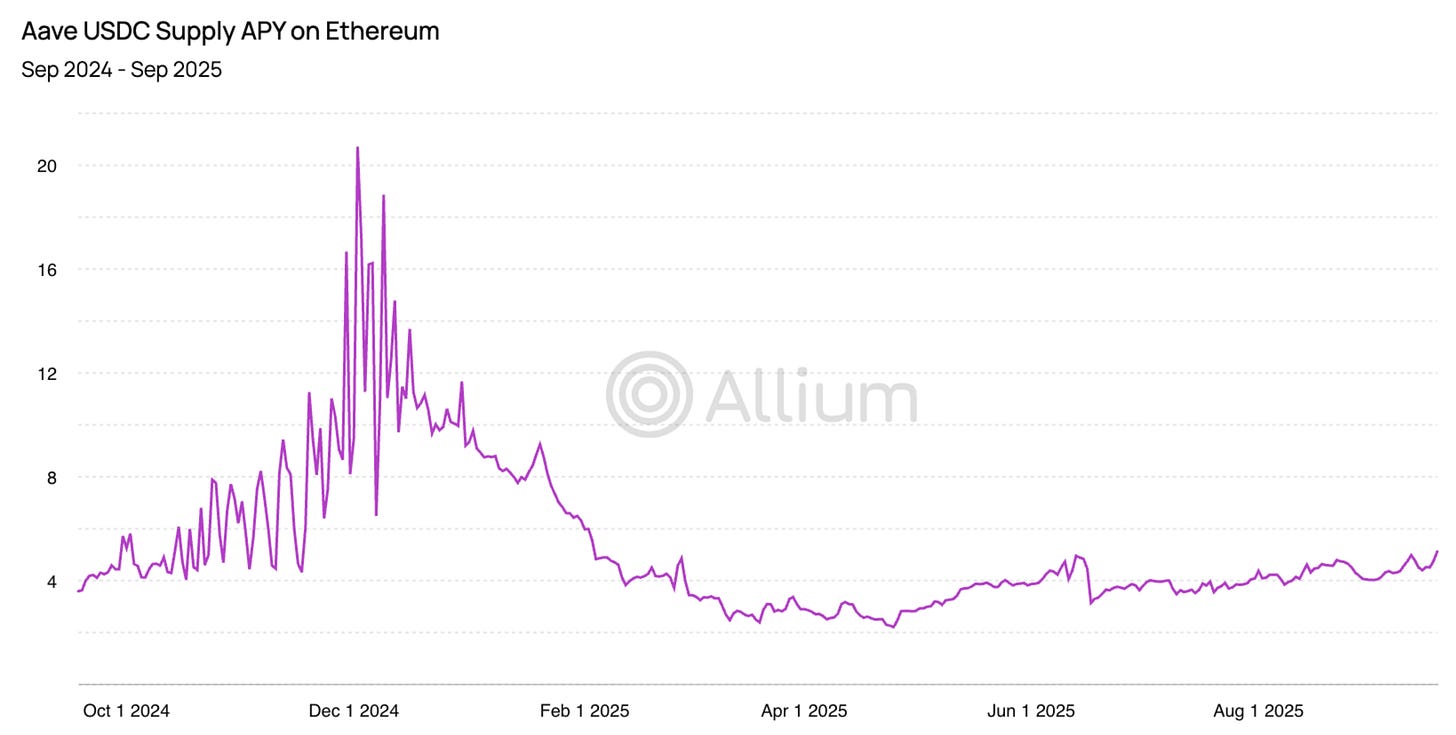

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

In this newsletter:

No, the PBOC is not banning stablecoins

Blurring boundaries: crypto assets and NFTs

The machine economy

Assorted links: reading, toddlers, attention, China and more

Weekend: jewel thieves

Some of the topics discussed in this week’s premium dailies:

Coming up: Fed conference, CPI, earnings, elections, big meetings and more

No, the PBOC is not banning stablecoins

Macro-Crypto Bits: markets confused, China’s growth

Also: FIFA tokens, Japan’s stablecoin consortium, Stripe’s bank and more

Blurring boundaries: crypto assets and NFTs

The machine economy

Macro-Crypto Bits: Japan’s vote, persistent optimism, BTC sellers

Also: crypto regulation, a coming fintech stablecoin announcement, Stripe’s raise and more

Why the gold correction is good news

Also: no summit, Tether, crypto M&A

Unhelpful institutional hype

China’s priorities for the next five years

Macro-Crypto Bits: complacency, CPI

Also: sanctions, prediction markets, Hong Kong ETFs

Onchain capital raises: the market trend I’m waiting for

Global crypto adoption

Macro-Crypto Bits: markets, Japanese inflation, European growth, currency arbitrage

Also: prediction markets (again!), tariff spats (again, sigh), legacy funds and more

No, the PBOC is not banning stablecoins

Last weekend, the Financial Times reported that at least two mainland companies that had announced plans to issue stablecoins under Hong Kong’s legal framework – JD.com and Ant Group – have withdrawn their applications at the behest of the People’s Bank of China (PBOC).

At first glance, this looks like an official clampdown on yuan stablecoins. It’s not.

According to multiple sources, the government is concerned about tech companies issuing currencies. Note that this concern is not specific to China – even in the supportive US framework, tech companies need to jump through hoops to get special approval. But in China, it takes on a more systemic interpretation, given the role of the leading tech platforms in citizens’ daily lives. On the Alipay app (operated by Ant Group), to pick an example, users can do, well, just about anything, from shopping to medical appointments to buying stocks to finding a date to getting a ride. Imagine the power of an Alipay stablecoin.

But wanting to stop tech companies from issuing currency is not anti-stablecoin. Rather, the PBOC wants to make sure it can control their issuance and use.

Also over the weekend, the China Daily – a media outlet owned by the Chinese Communist Party (CCP) and its main international mouthpiece – gave some colour as to how “China’s accelerating drive of finance digitalization” was progressing and evolving.

The article quotes Zhu Xiaoneng, Party secretary of the School of Finance at Shanghai University of Finance and Economics, as saying: “digital assets and stablecoins will redefine the logic of capital market operations.” He went on to stress the advantages of tokenization, insisting that “stablecoins are the key to unlocking this new ecosystem.”

It’s worth repeating that this was published in the party’s English language media outlet. That doesn’t sound anti-stablecoin to me.

And in recent months, we’ve have a handful of current and former officials warning of increased dollarization via USD stablecoins, as well as reports from “insiders” on PBOC plans to establish a framework and targets for stablecoin use.

Earlier this week saw the kickoff of China’s Fourth Plenum, which outlined the main themes of the next Five Year Plan. One of them is a deeper push into digital technology. Another is greater internationalization of the yuan.

Just last week, Chinese authorities announced support for greater yuan use as a financing currency for foreign institutions, which would facilitate payment of cross-border trade in renminbi.

And three weeks ago, the deputy governor of the central bank unveiled three platforms to encourage use of the digital yuan in cross-border payments, one of which focuses on adoption of the central bank-issued digital currency.

The other two seem to leave the door open, or perhaps slightly ajar, to other digital currencies. One is a blockchain service platform for onchain payments and cross-chain interoperability. The other is a digital asset platform that will connect traditional finance to standardized digital asset services.

Of course, any stablecoins would need to be fully interoperable with the digital yuan, but it’s possible that the authorities realize the additional flexibility and perhaps international trust that bank-issued stablecoins could bring. Given the control of the CCP over the country’s financial system, these technically wouldn’t be totally private – but choice, even if controlled, can boost acceptance while enhancing innovation.

In sum, the PBOC caution reported in the Financial Times doesn’t represent a retreat or a clampdown. In fact, I think it shows an encouraging determination to support stablecoins and tokenization in a careful manner, shifting focus away from pilots and technical experimentation to institutional integration.

The China Daily piece quotes Zhu as saying:

“Digital finance in the future will be defined not just by technology, but by institutions.”

Put differently: tech companies, take a beat. The banks have got this.

See also:

China’s evolving crypto policy (Jan 2025)

Blurring boundaries: crypto assets and NFTs

OpenSea – one of the crypto market’s earliest and largest NFT marketplaces – has quietly been adding token trading to its platform. So far this month, tokens have accounted for 90% of total volume, while NFTs pick up the remaining 10%.

Some have painted this as OpenSea throwing in the towel on the NFT market, confirming the category’s demise.

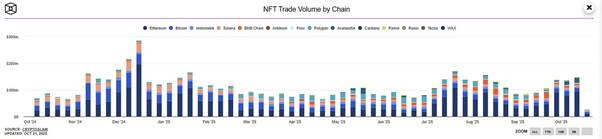

But data doesn’t back that up. According to CryptoSlam, monthly sales are over $500 million, well below the $3-5 billion seen in the 2021-22 heyday, but not nothing.

(chart via The Block Data)

What’s more, there are still active participants in the ecosystem, and NFT use cases are still being explored. The NFT market is down but not out.

Rather, OpenSea’s expansion feels like a move towards broadening “markets”.

I’ve often written in the past about blurring boundaries between asset groups, and NFTs are but a code snippet away from potentially being classified as securities if they, for instance, pay “dividends” in the form of new NFTs. Us old-timers will remember CryptoKitties, whose popularity practically collapsed Ethereum back in 2017. You could collect unique images of adorable cats with different characteristics, and if two of them hit it off, you found yourself with virtual kittens.

Gary Gensler types would insist that’s a dividend. More open-minded people would argue that it’s not a redistribution of profits, it’s a new piece of “art” generated by code.

Plus, many bought CryptoKitties to speculate on being able to re-sell at a higher price – but, purely based on vibes, not on the efforts of a team.

That intangible market driver also applies to meme coins which trade alongside revenue-earning tokens on many marketplaces. So why shouldn’t token exchanges also trade NFTs? Both Coinbase and Kraken launched NFT platforms a few years ago; both have since been wound down.

But Coinbase didn’t exit NFTs entirely, it moved them over to its layer-2 Base which is now one of the largest NFT blockchains. Binance also trades NFTs, as does Crypto.com. For now, they all seem to separate NFTs and crypto tokens into distinct platforms, which makes sense given the different visualization needs and liquidity data.

But the key to watch is how close NFTs can get to tokens in the trading experience, and how far this goes in changing our understanding of what markets trade.

If you’re not a subscriber to the premium dailies, I hope you’ll consider becoming one as you could be getting SO much more out of this newsletter.

The machine economy

Back in June, Abu Dhabi and Dubai unveiled plans for a Machine Economy Free Zone (MEFZ) to explore how machines can operate with each other on decentralized networks. The goal was to establish a sandbox for experimentation with new machine-based business models, as well as to create a hub for projects, academics and officials to exchange ideas and goals.

One intriguing MEFZ project is “Universal Basic Ownership”, in which profits generated by machines could be distributed to those displaced by their use. Another is a “Machine Tokenization Framework”, which will explore fractional ownership of robots.

There has been some progress, albeit slow: The initial decentralized technology partner was peaq, an EVM-compatible layer 1 which last week signed a memorandum of understanding with Dubai’s Virtual Assets Regulatory Authority (VARA) to work on a regulatory framework for connected machines and their token-based transactions.

Peaq was created with the machine economy in mind and, while I haven’t had time to dive into the tokenomics, so far it feels like a welcome antidote to the moans I often hear that crypto has gotten boring, that’s it’s all about number-go-up and tradfi adoption, that there’s nothing truly innovative going on. Blockchain is still innovative, robotics development is accelerating, and the application of AI onto autonomous machine economies is just getting started.

Blockchains built for machines encompass solutions for onchain identity, network access, communication, economic transactions, action validations, spatial awareness and more. It’s a fascinating field that will do as much for factory floors, retail and possibly public services as finance-focused blockchains will do to banking and traditional markets. We should brace for some surprising headlines as momentum gathers.

A sobering thought experiment is to try to imagine a project like this happening in peaq’s home country of Germany. According to reports, peaq has relocated to the Middle East, and it’s worth asking how many other innovative ideas born in Europe will have to leave in order to build the economies of tomorrow.

🌻If you find this newsletter at all useful, would you mind sharing with colleagues and friends and nudging them to subscribe? I’d appreciate it! 🤗

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Henrik Karlsson writes not so much about the joy of reading as about how to extract maximum value from it. I picked up some useful tips from this. (How I read, Escaping Flatland)

As someone who constantly overestimates what I can squeeze out of a day, I appreciate reminders like this one from Derek Thompson that our stamina and our attention are not infinite, and that we can choose how to allocate them. (Whose Cup Are You Filling?, Derek Thompson)

Tim Urban shares his thoughts on fatherhood, deliciously endearing for anyone who currently spends or at any time in the past has spent time with toddlers. (Toddlers, Wait But Why)

The Dollars and Sense newsletter gives a refreshingly informed take (from someone who has studied, lived and worked there) on China’s internal strength, economic stress aside, and why it is winning the trade war. (First Principles, Dollars and Sense)

Bloomberg offers a good breakdown of meme stock manias, touching on why they get started, what drives the momentum, and how they end. (Why Meme-Stock Mania Keeps Happening, Bloomberg – paywall)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Last weekend, our collective imagination was captured by a daring heist at the Louvre Museum in Paris, with the thieves making off with priceless jewels.

So this is an appropriate time to dust off the trailer to a classic jewel thief movie: The Pink Panther. Sure, it feels a bit dated now – it was released in 1963, after all. But it manages to combine slapstick with glamour and a tinge of European class mixed with shabbiness. Somehow, that makes it feel more real than the slick productions on our streaming services today.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.