WEEKLY, NOV 9 - So it begins

the election's impact on crypto, macro and more - and some Mongolian heavy metal 'cos why not

Hi everyone, I hope you’re all doing well! What a crazy week. This may be stating the obvious, but things feel different now.

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of articles from the past few days.

If you’re not a premium subscriber, I hope you’ll consider becoming one! For the price of a couple of New York coffees a month, I can help you navigate the tangled web of macro impacts on crypto narratives, and crypto impacts on macro narratives.

You get ~daily commentary on macro, crypto and the space in between, plus some cool links, a smattering of charts, and a daily music link because why not. AND you get access to a premium subscriber chat over on substack.com or on the app! And audio!

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

So it begins

A good day for crypto

There is a negative, though

The economic tailwind

Bitcoin vs gold

The medium is the message

Tectonic plates

The ultimate winner

Some of the topics discussed this week:

The macro stage, and the next act

mBridge update: is sharing possible?

Markets bracing

When election results?

The next step in tokenized treasuries

A tokenized treasury teaser

Updated and reshared below

No election comment from the Fed

Crypto gets busy

What can be done, short term?

So it begins

Well, well.

Without declaring partisan affiliation (I’m not American), we got the best-case scenario in that a winner was declared. As I’ve been saying, the likely case going by the polls was dragged out uncertainty, and the worst case was a contested election – but the margins made even normally slow Pennsylvania a quick call.

This is a relief as with a clear winner, we – and markets – can start to get our heads around what this means.

It’s hard to fathom the coming changes, because they will affect much more than we probably realize. What’s more, the impact reaches from micro to macro, society to economy, local to global and then some.

A good week for crypto

First, there’s the structural boost for the crypto industry. Trump has promised supportive regulation, and the sweep of the House and the Senate makes the passage of crypto bills much more likely. The first out of the gate will probably be a stablecoin bill – that’s the low-hanging fruit for now, and we will see issuance frameworks, insurance requirements and the authorization of banks to enter the field.

While banks are generally not known for innovation, I think in this case they’ll surprise us. And we can expect M&A to pick up as traditional institutions scramble to acquire blockchain services and credibility.

We’ll also see strong progress on bills that recognize that crypto assets don’t fit into traditional securities definitions, and that new rules are needed. This will give clarity to issuers and their service providers, while also opening up new financing routes for innovative projects. The SEC has for decades focused on mandating better disclosures from asset issuers, which good-faith crypto builders are fine with – the frustration has come from the inapplicability of the current requirements.

A new SEC chair, as Trump has promised, will remove a significant barrier to the above. Gensler can’t be kicked off the Commission without provable cause, and that would be a lengthy, complicated process – but he can be demoted, and few would want to stick around after that (although with him, you never know).

I’ve heard Hester Peirce’s name floated as front runner for Chair, which would be excellent news – she gets the need for innovation in markets, understands that regulation by enforcement is unnecessarily repressive and a waste of resources, and cares about investor protection as well as choice. Other names floated include Dan Gallagher, current chief legal officer at Robinhood, and Heath Tarbert, former CFTC lead and current chief legal officer at Circle. We just might get someone who realizes crypto needs to be folded into US securities regulations, rather than pushed offshore.

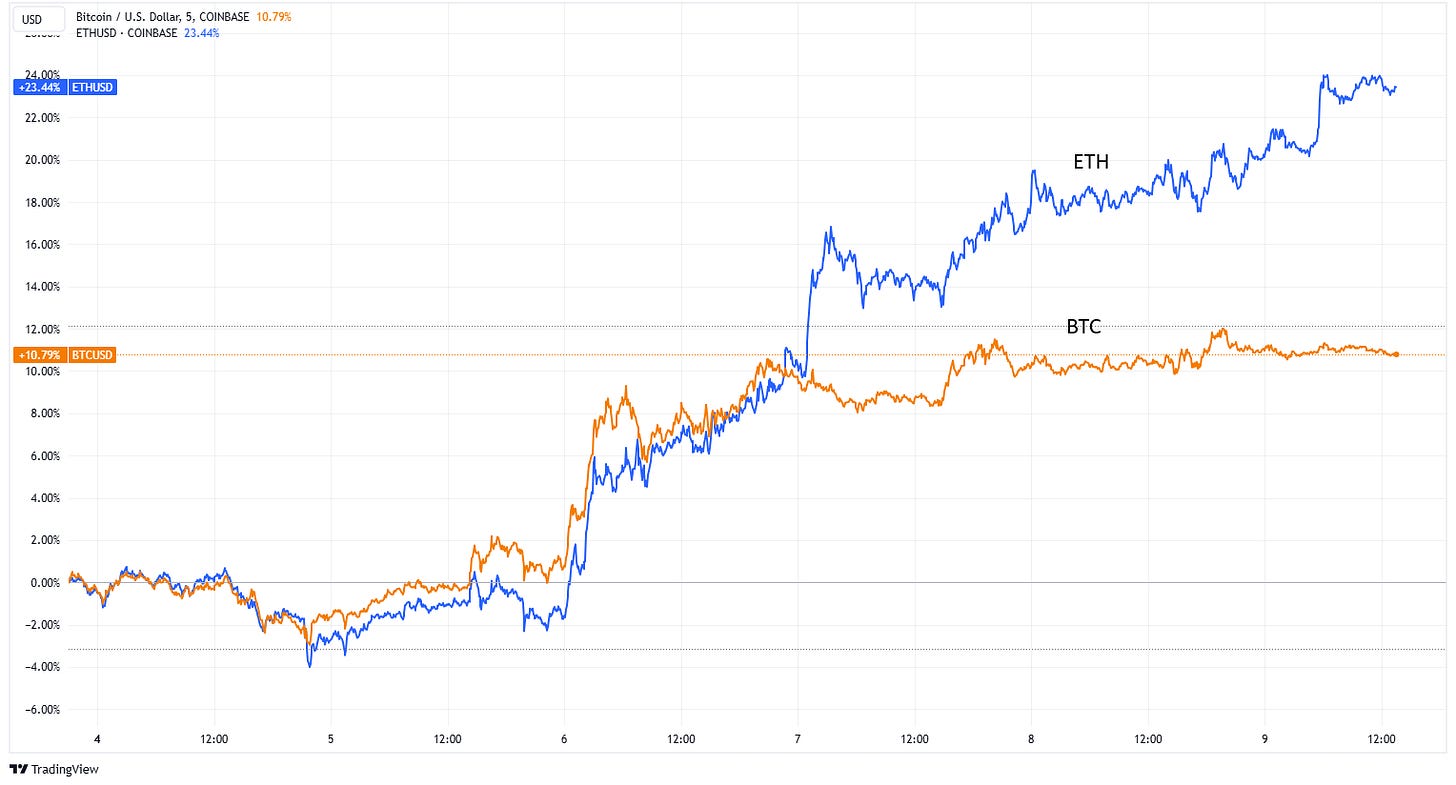

So, for the crypto market, this is a good week, and BTC has reached consecutive all time highs.

(BTC/USD chart via TradingView)

ETH is doing even better – in Friday’s newsletter, I wrote about why this is, what it says about where we are in the cycle, and which other assets could benefit even more than BTC from a policy thaw, although the degree and the timing of any changes are still unclear.

(chart via TradingView)

There is a negative, though

An unfortunate side effect is the crowing I’m seeing on X from crypto activists convinced that it was the current Administration’s anti-crypto stance that lost it the election, as if crypto was the only thing voters care about. There’s also the disrespect and arrogance from certain crypto names calling those that supported Harris “retards” or similar. And we wonder why many mainstream investors think our world is not for them.

Crypto should not be partisan – true, the current Administration’s approach made it so, for many. But crypto is for everyone, whatever the political allegiance, and those wanting to suppress different opinions, or dismissing them as not worth considering, are not only painting themselves as narrow minded and small. They are doing a disservice to the ecosystem’s inclusive ethos. No-one gets to decide who is welcome, that’s the point. And reinforcing the reputation that crypto has of being populated by right wing assholes does not help the industry at all.

I say this not because I’m sad the Democrats lost – to be honest, I’m not. I say this because people we disagree with will generally be right about some things, and broad, prejudiced assumptions are the main cause of the polarization problem that I see as one of the biggest threats to democracy worldwide.

Ok, end of rant.

The economic tailwind

Second, there’s the impact on the economy, still uncertain but it’s looking like Trump will be able to push through the promised tax cuts, tariffs and spending plans, especially given Republican wins in the Senate and House (although the latter is still awaiting confirmation).

The likelihood of a pickup in inflation just got even higher – tax cuts, the deportation of immigrants, and tariffs are all likely to push up spending, wages and the price of basic goods. Leaving the political impact of that aside for a second (it could be harsh), it adds to the tailwinds propelling crypto and gold.

And any inflationary trend will be exacerbated by dollar debasement, as either the Fed or banks will have to step in to mop up treasuries in the face of declining investor demand. Foreign holders have been diversifying out of treasuries for a while, which could accelerate given geopolitical, trade and currency concerns. US investors could see more upside in equities and crypto, reducing their holdings (especially if volatility and declining bond prices make bonds not quite so “safe”). And there’s a hefty amount of supply in the pipeline as government debt will continue to soar, while a further retreat from established trade relationships could impact demand (why hold dollar reserves if you don’t need so many dollars, especially if you are concerned about currency dilution).

Or, a stronger faith in US strength could increase demand for US treasuries as a “safe haven”. This uncertainty could be seen in bond yields this week, with the 10-year yield soaring to a 15-month high after the election results emerged, only to correct as investors recalibrated and as the Fed yet again cut interest rates by 25bp.

(US 10-year yield via TradingView)

Stock futures are also flashing green despite the bond market’s initial warning, signalling optimism about deregulation, lower interest rates and continued fiscal stimulus.

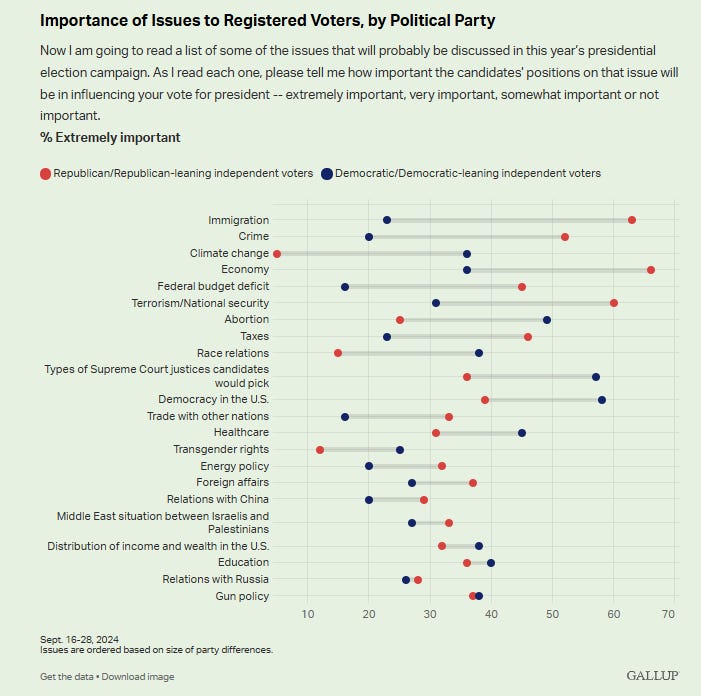

True, stocks would probably also have been going up had the result swung the other way, for the same reasons but swapping out trade for deregulation. But recent polls from both Gallup and Pew showed that the economy was the number one concern for Republican voters while Democrat voters were more worried about democracy.

(chart via Gallup)

This doesn’t necessarily mean Trump’s policies will be better for the economy (let’s hope someone talks him off the tariff cliff), but it does suggest that investors might be responding to those concerns hopefully being addressed.

Bitcoin vs gold

Around the world, investors are going to focusing on 1) hedging currency debasement and 2) the Trump market play. Both point to BTC.

Gold is the traditional currency debasement hedge, and is much easier for mainstream retail and institutional investors to understand. But it has arguably already had a strong run, and BTC has underperformed due to (now removed) regulatory uncertainty.

Looking at the ratio of BTC to gold, we can see the downward trend (gold outperforming) since March is turning.

(chart of BTC/GOLD via TradingView)

Plus, gold doesn’t stand to benefit from the Trump bump of greater clarity on crypto rules, greater institutional involvement in the market, and the possibility (however remote) of a strategic BTC reserve in the US and elsewhere.

So, we could see some marginal rotation as well as new money flowing into the digital alternative.

The medium is the message

The third profound shift we need to think about is the changing role of media. In this election, mainstream outlets had less of a political reach than a well-known podcaster and a social media platform, and the bias inherent in once-neutral sources became increasingly obvious.

It looks like we are heading into a landscape of greater strength for independent voices – excellent for creativity and diversity, not so good for the level of noise. In the end, we’ll have to choose our biased sources (independent does not mean neutral, usually just the opposite), which in turn implies deeper echo chambers, and we have no idea how that could shape political and economic thought. I try to subscribe to newsletters from both extremes of the spectrum to keep balanced, but I do find myself spending more time with some than others – that’s only human and there are too few hours in the day.

Beyond the shift in “sources of truth” (cough), there’s the looming change to business models. It remains to be seen how advertisers adjust spending habits, and what dwindling revenues mean for journalists. More independent projects, more creativity but also more noise and deeper niches. Add the impact of new technologies that enable format flexibility and original combinations, and we’re heading into an exciting phase of letting the market rather than brands decide what works. We do now know that the “old style” of establishment-supported broadband talking heads doesn’t.

Tectonic plates

Then, there’s geopolitics. The immediate reaction of some people I’ve spoken to this week is fear that Trump will provoke a world war. It’s just as (if not more) likely that he could prevent one, by being unpredictable. Antagonists and allies alike could end up being more careful for fear of triggering an unexpected reaction, while building alternative alliances and developing internal military strength, just in case.

Of course, there is the possibility that his tariffs wreak such economic havoc on key trading partners that they have no choice but to instigate aggressive action to distract an unhappy population. Let’s hope the likely economic damage and the carrot of new trade channels makes that the least attractive option.

Europe is potentially in trouble as it will have to spend more on defence whether NATO holds together or not, and this could increase the polarization problem we already have.

And the move towards a non-dollar cross-border payments system could either accelerate given overall wariness, or decelerate in the face of US threats and/or the walkback of the current sanctions regime. We don’t yet know how Trump feels about the blunt and ultimately ineffective stick wielded by the Biden administration, but the incoming Administration might be not so hostile to Russia.

(chart via Bloomberg)

The ultimate winner

Coming back to the present, the big winner this week was democracy. People wanted a change, and they voted it in. Whatever you may feel about the result, the fact that there is one should be appreciated. And if people want another big change four years from now, they will be given the chance to vote it in, because those claiming Trump will dismantle democracy are underestimating the strength of the US institutions built to protect it.

Change is always scary, but it’s also always an opportunity. We just have to find the ones that most resonate with our priorities.

That said, it's fair to feel anxious, even if you’re relieved at the outcome. We don’t know what’s ahead and the stakes are high. The antidote is to work as hard as we can to build tools of resilience, to defend individual rights, to spread a more nuanced view of global trends, and to be glad to be alive, now.

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

This morning, I fell down the rabbit hole of Mongolian heavy metal music (don’t ask, but it might have something to do with needing a media break).

I’m hooked. In part it’s the escapism, in part it’s the gorgeous instruments, in part it’s the bad-ass attitude – watch this and tell me it’s not cathartic:

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.