WEEKLY - What Bitcoin is not, why young frustration matters

Plus: assorted links, Christmas movies and more

Hi everyone! I hope you’re all doing well, taking care of yourselves, and getting ready to wind down 2025 with sparkle and gratitude. Speaking of which, thank you all so much for accompanying me on the incredible journey that has been the past year – I am truly grateful.

This newsletter will be taking a break until early January – the premium daily Crypto is Macro Now will be back on the 29th.

🎀

To all who celebrate: Merry Christmas!

🎀

My latest op-ed for American Banker (“The stablecoin yield fight still rages, but on a new battlefield” – paywall, sorry) looks at why banks are on the backfoot in their protests against stablecoins yields in terms of logic and principle, but politics is weird and they might win – but the bigger battle is elsewhere, and if stablecoin interest has to fall, it’s not that big a deal.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

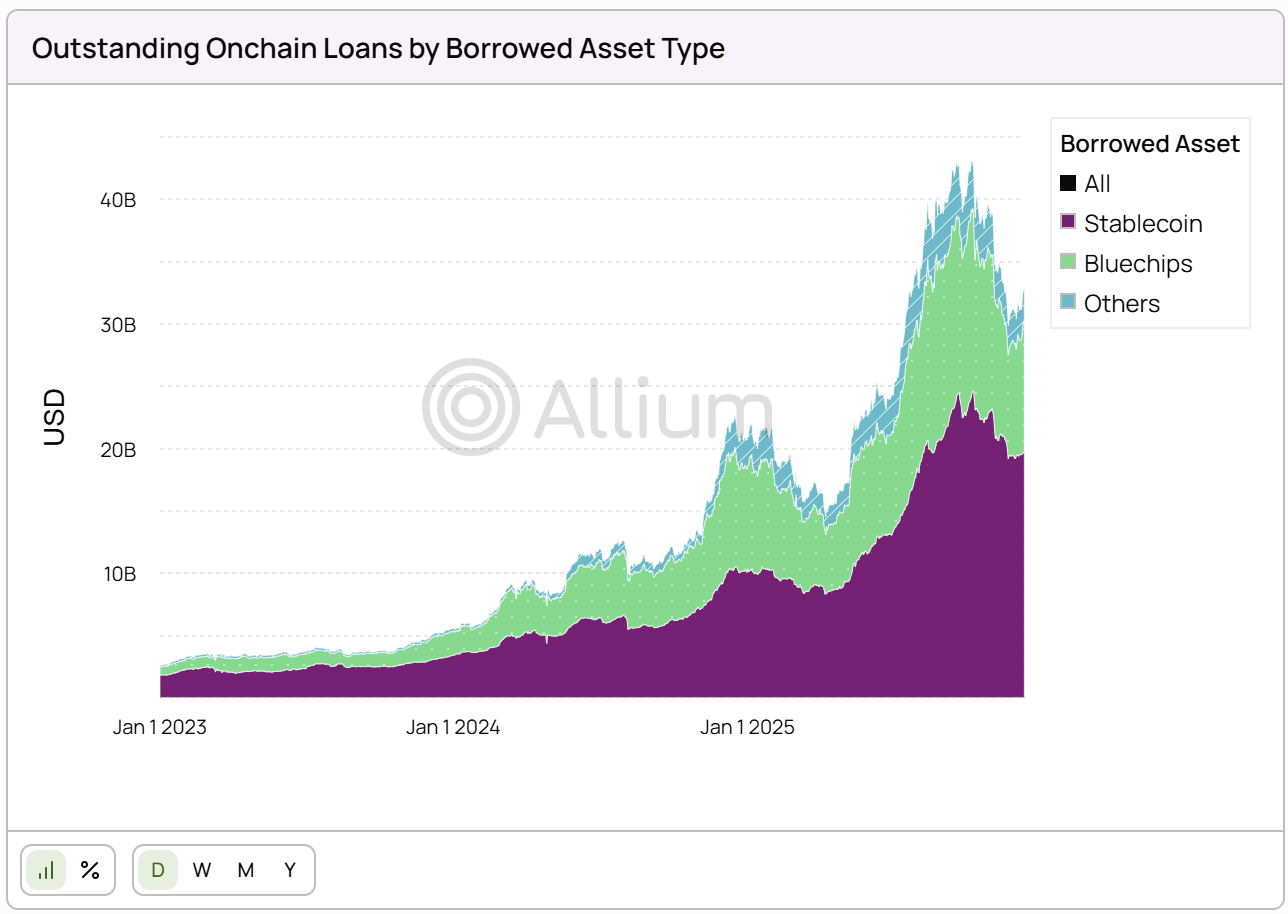

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

In this newsletter:

No, Bitcoin is not a digital Labubu

What the young are telling us and why we have to listen

Assorted links: abstract thinking, classical doom, literary nostalgia, bookshop business and more

Weekend: top 3 Christmas movies

If you’re not a subscriber to the premium dailies, I hope you’ll consider becoming one? You’ll get access to market commentary as well as adoption insight and industry trends. Plus, links and music recommendations ‘cos why not…

🎀 If you speak Spanish and are interested in a less frequent, shorter update on stablecoins, tokenization and other developments in the crypto-macro intersection, you can subscribe to Cripto es Macro here. 🎀

Some of the topics discussed in this week’s premium dailies:

Coming up this week: macro data, geopolitics, interest rates and more

New charters and banking upheaval

Markets: low liquidity

Macro: an independent Fed

What the young are telling us and why we have to listen

JPMorgan and Ethereum

Markets: ouch

No, Bitcoin is not a digital Labubu

The slippery slope of censorship

Macro: jobs fluff

DTCC and the incumbents vs innovators debate

Markets: the rotation continues

Coinbase: blurring boundaries

Macro: a good inflation read for the US

Macro: not so much for Japan

Markets: yields and complacency

No, Bitcoin is not a digital Labubu

One day I hope to understand why smart people can be so confident on a topic on which they have done close to no research that they will happily say things in public that make them look not smart at all.

Vanguard is a respected investment house. Some may disagree with their ideas and decisions, but we can’t deny that they have legacy, and plenty of smart people.

Yet their Global Head of Quantitative Equity John Ameriks recently said, on stage no less, that Bitcoin was “a digital Labubu”.

He’s not alone, unfortunately – I’ve heard smart people call Bitcoin a Ponzi, a Beanie Baby, a scam. One well-known gentleman I won’t name, but may he rest in peace, insisted it was rat poison.

All demonstrate one of two things: either they don’t understand it at all, or they are unable to see beyond their own privilege and have complete faith in the foreverness of banks.

If the latter, that’s an understandable belief to have; it’s hard to imagine breathing a different air. If the former, why say anything at all, when reputation rests on words?

That said, criticism is good as it usually leads to further knowledge, deeper conviction or both. And so, in the spirit of welcoming any opportunity to set things straight while honing explanations, here’s why Bitcoin is not like a Labubu:

I’ll start by acknowledging that Labubus are cute in a pit bull kind of way (I know, eye of the beholder). That is their utility, they make people feel something.

Bitcoin is not cute. Its utility varies across holder profiles, but can be summarized thus: volatility asset, and insurance against currency debasement and financial system turmoil. Labubus are useless at both of those functions.

As for the demand outlook, feelings drive fads which come and go because there’s always something new around the consumer corner. Labubus won’t always be the hot toy or accessory, more’s the pity. Bitcoin has never been about consumer feelings, unless you count fear and/or speculative fever, neither of which – unfortunately – will ever completely go away (and I’ll argue that both are more about “getting by” than about “having”). So, demand for Labubus will eventually wane (signs suggest that’s already happening), while demand for Bitcoin will rise and fall and rise and fall and rise and fall, each time reaching higher lows as global awareness spreads.

On to supply: does anyone know how many Labubus there are? If you include fake ones, not even the producer Pop Mart, who by the way can change the production rhythm any time it wants. The supply schedule of Bitcoin*, on the other hand, is fixed, no-one can change it because that would require consensus which would be impossible to get. Anyone can create a new Bitcoin with a different supply schedule, but the old Bitcoin would still exist, and those that value its fixed supply feature will continue on that network rather than migrate to a less secure, cheaper alternative. What’s more, anyone can verify the supply of bitcoin at any time by checking the blockchain itself. And because a bitcoin is not a bitcoin unless it is on the Bitcoin network, which also easy to check, they can’t be faked.

(*back in my CoinDesk days, we used Bitcoin with uppercase for the network, bitcoin with lowercase for the token – I don’t love it, but I haven’t yet come up with a better way to distinguish the two, as using BTC is more for markets)

But the most obvious difference, which you’d think Ameriks would know, is that Labubu has a centralized entity deciding everything about the product, while Bitcoin doesn’t. Like gold, it just exists.

To be fair, let’s focus on what he was probably thinking of when he said what he said:

Neither Bitcoin nor Labubus have an underlying asset to in theory help set their value. Shares, for instance, have factories or IP or something that they are a share in. Bonds have interest payments or other forms of yield. Most assets have some underlying fundamentals. And in the previous century, that mattered for asset valuations – I spent three years in the Chartered Financial Analyst (CFA) program in the ‘90s learning how to scrutinize balance sheets and interest rates to extract forward-looking numbers.

Today, how much do underlying asset values drive the S&P 500? I’m not an equity analyst anymore, but I’d argue – going by the concentration of tech stocks betting that the datacentres they don’t yet have will get access to electricity grids that don’t yet exist – that it’s not much.

And how much do investors, especially younger ones not steeped in CFA lore, care? Again, going by the popularity of meme stocks and vibe investing and prediction markets, I’ll argue that it’s not much.

Finally, what is the underlying fundamental of gold? Its industrial use? That accounts for less than 10% of annual production. The rest is held because it makes pretty jewellery, and for the perceived utility of not being controlled by a centralized organization. Today, there’s a digital equivalent.

In sum, Bitcoin is nothing like Labubus, and those that insist it is have either not bothered to dig deeper on each, are stuck in last century’s investment philosophy, or both.

Then again, who doesn’t love a good soundbite? And, in today’s firehose of media noise, there’s a chance we’ll all forget it was said. But the rat poison and beanie baby analogies have endured. Images, after all, are stickier than concepts.

🎀 If you find this newsletter useful, I hope you’ll consider sharing it with friends and colleagues, and nudging them to subscribe? I’d appreciate it! 🎀

What the young are telling us and why we have to listen

I’ve written before about the youth protests roiling both emerging and developed economies – they have already toppled several leaders, and last week triggered the resignation of Bulgaria’s minority government. Politicians everywhere are worried about who’s next. This week alone, I read about public protests in Honduras, Romania, Tunisia.

Politicians should worry. Young people are angry. It’s not just the lack of job security and affordable housing. It’s also the diminishing trust in institutions, democracy, capitalism and country, at a time globalization is unwinding and geopolitical tension is rising.

This is relevant for the cost of military build-up – if a nation can’t call on patriotism to boost troop recruitment, it will have to pay up to entice unenthusiastic volunteers or risk unrest spilling over should conscription become mandatory.

It’s also relevant for the economy, as young people see little point in saving, which boosts consumption, inflation and the neutral interest rate.

And it’s relevant for markets, as a digital-first and disenfranchised youth sees little point in investing on fundamentals, encouraging more speculation and blurring the lines between investing and gambling, especially as prediction markets march onto traditional and new platforms.

You’ve probably heard many of these narratives already, so much so that none of them feel new. It’s disconcerting, then, to see survey after survey put numbers around a problem politics feels inadequate to deal with, but which threatens the foundations on which financial structures rest.

Over the weekend, I had a chance to look at the latest Harvard Youth Poll, its annual GenZ survey which asks 18- to 29-year-old Americans a series of questions about how they see their country.

Some sobering excerpts:

Over 40% say they are struggling or barely getting by.

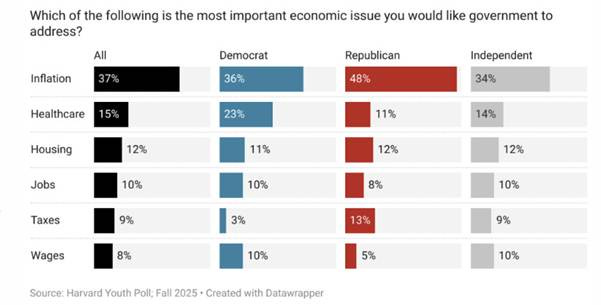

Their most urgent economic priority? Inflation, even more for Republicans than Democrats.

(chart via the Harvard Kennedy School)

Only 14% believe AI will create more opportunities – 44% believe it will take them away.

When it comes to politics, the outlook is even bleaker:

Just over 10% believe the US is “headed in the right direction”. Almost 60% think it is “on the wrong track”.

Almost 65% believe the United States is either a failed democracy or one in trouble. Even among Republicans, the percentage is over 40%.

Almost 30% do not believe it is important that the US remain a democracy.

Almost 40% say political violence is acceptable in some circumstances.

Fewer than 20% of young Americans identify as “capitalist”, and fewer than 40% acknowledge supporting capitalism.

Political tolerance is down: fewer than 35% believe those with opposing views want what’s best for the country, which does not bode well for compromise.

Yet over 40% expressed negative opinions of both Republicans and Democrats.

Relevant for the mid-terms:

46% prefer Democrat control of Congress, vs 29% preferring Republicans.

Yet approval for each party’s performance in Congress is roughly equal at around 27%.

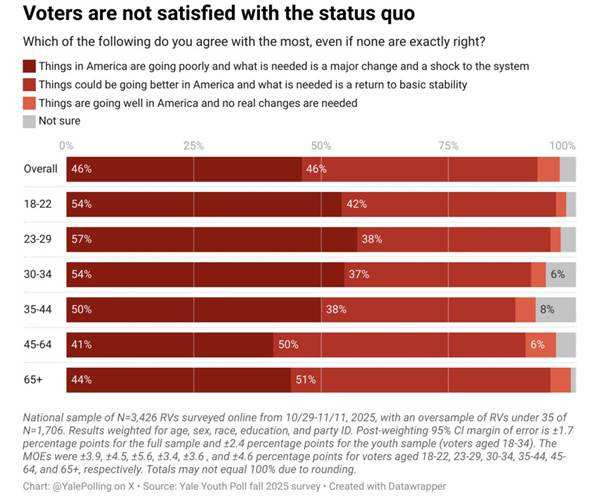

There’s more. Yale University recently published the results of its fall survey of young voters.

More than half of those surveyed think that things are bad and “what is needed is a major change and a shock to the system”.

(chart via Yale Youth Poll)

Over 30% think the Democratic Party stands for change vs 18% pointing to the Republican Party, with around a quarter saying “neither”.

The most important issues? Cost of living and affordability, chosen by over 90% of respondents.

Of course, these days there is no shortage of polls to make us fret. In part, the nature of polling favours gloom over optimism as a stranger asking questions is seen as an opportunity to vent. But the combination of stark underlying messages combined with the had-enough physical demonstrations cannot be ignored, especially given their power to trigger similar unrest elsewhere.

I write about this often, and will regretfully continue to do so, because it is a key element of 1) why we should be glad Bitcoin exists, and 2) how it will grow in adoption.

Unrest always triggers attempts at censorship as power scrambles to hold on. In a digital world, this is likely to include debanking. Before it became a predominantly institutional asset, Bitcoin was often referred to as “dissident money” – that characteristic hasn’t changed even though the investment narrative has.

And for a generation with plummeting trust in institutions as well as a deepening awareness of why privacy matters, holding at least some BTC rather than betting on fiat currencies being stable and accessible can start to make more sense to more people.

Even bigger, though, is that the youth protests highlight how the change occurring beyond our screens is deeper than most realize.

If you define a “revolution” as the toppling of elites, a quick glance at headlines can confirm we are seeing some of that. If the revolution is stoked by the young (as has often been the case throughout history), we have to pay attention when they tell us what they’re thinking. And we should start thinking about what kind of a world they want, as well as how they will go about getting it.

See also:

Why the gulf between sentiment and economic activity matters (Nov 2025)

The slippery slope (Oct 2025)

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Jordi Visser draws an elegant line between the genius of Picasso and the changing world of investing in the era of AI – out go the process, the standards and the textbooks, in comes a creative interpretation of rules that don’t even exist yet. The big change we’re struggling to navigate is not technological; it’s epistemological. (The Picasso Problem: Why the Future of Investing Looks Abstract, with Bitcoin as the Epilogue, Jordi Visser)

“This is not a world that rewards better spreadsheets. It rewards those who can hold

ambiguity without demanding premature clarity.”

Ted Gioia shares his end-of-civilization reading list, leaning heavily on the classics. My conclusion is that civilizations rise and fall and rise and fall, more often because of people and personalities than external events – but also that we humans endure. (A Reading List for the End of Civilization, The Honest Broker)

Sam Kahn eloquently gazes into the cloudy eyes of The New Yorker and asks where its quest for literary and journalistic excellence went. The piece evokes a wistfulness for lost stories and a regret that sameness spreads fast – the attention-span-deficit allure of known names and quick hits is tough for media to resist. I’ll throw in a question of my own: is there any traditional publication that we regularly discuss with our friends, or can name-drop at parties without cringing? (How The New Yorker Became Irrelevant, Persuasion)

In an uplifting reminder of the coziness, escape and introspection of physical books, Chloe Fox shares the inspiration, drama and satisfaction of opening a small, independent bookstore in rural England. (I opened a bookshop. It was the best, worst thing I’ve ever done, Financial Times – paywall)

And, for the festive season, one from the archives that dives into the mystery of the origins of the word “cocktail”. I won’t spoil it for you, the explanation requires some build-up to be fully appreciated. (Ancient Mystery Revealed! The Real History (Maybe) of How the Cocktail Got its Name, Saveur)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Since this is the last free weekly of the year, I’m going to share three of my favourite Christmas movies in the hopes at least one will inspire you to snuggle in for an uplifting rewatch over the festive season.

💖 From the bottom of my heart, I wish you and yours a sparkly winddown of 2025, and a loving start to 2026. 💖

The Family Man

Klaus

The Holiday

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.