Monday, August 26, 2024

Durov’s arrest is not about censorship, keep an eye on the oil price, what does this mean for BTC?

“To see what is in front of one’s nose needs a constant struggle.” – George Orwell ||

Hi everyone! I hope you all had a good weekend. There are still a few days left in August, but it already feels like summer is winding down – I’m sad, I’ve loved these languid, muggy days and the short breaks that made time go a bit slower. And I have a feeling it’s going to be a manic autumn.

You’re reading the premium daily Crypto is Macro Now newsletter, in which I look at the growing overlap between the crypto and macro landscapes. Since it’s the last Monday in summer, I’m making today’s send open to all. If you’re not a subscriber, I hope you’ll consider becoming one?

IN THIS NEWSLETTER:

Durov’s arrest is not about Telegram censorship. It’s worse.

Keep an eye on the oil price

What does this mean for BTC?

If you find Crypto is Macro Now in any way useful or informative, would you mind sharing it with your friends and colleagues, and maybe encouraging them to subscribe? ❤ I’d be really grateful!

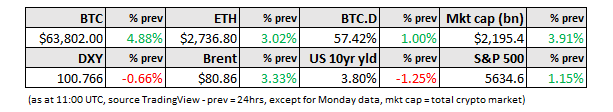

WHAT I’M WATCHING:

Durov’s arrest is not about Telegram censorship. It’s worse.

The arrest over the weekend of Telegram founder and CEO Pavel Durov is the latest and perhaps most blatant example to date of the role of layers in narrative misdirection. The reactions yesterday on X and online news were an orchestral concert of easy outrage, lifestyle gossip and smug vindications that largely skipped the buried nugget, the smallest matryoshka doll, the centre of the onion.

To peel back these layers, let’s look at the obvious conclusions that can be drawn from Durov’s arrest, and how they’re not the real story.

1) The first is that this is a move against free speech, that this is censorship, and that the authorities want to suppress certain channels and contributors. But reports suggest that the investigation was focused on the lack of moderators, not on what was said. French law enforcement is apparently arguing that Telegram’s refusal to allow oversight makes it responsible for any criminal activity conducted on the app – this makes the issue not about censorship, but responsibility.

Apparently, unregulated messaging platforms are being held to the same standards as regulated banks, who have to comply with an unreasonable amount of rules to (unsuccessfully) prevent money laundering. Never mind that those intending to commit crimes tend to not be platform-dependent – it’s the forceful image that counts.

2) The second is that this is about political influence. Telegram channels are used by a wide range of organizations, including political activists and military groups (official and not). Because of their freedom of communication, these groups can engage in politically undesirable activities such as plotting territorial incursions, perhaps even terrorism. The assumption is that the authorities insist on having access to their chats so that their intentions can be known ahead of time and their actions diverted – as if the “authorities” weren’t already infiltrating a wide range of Telegram chats, posing as interested individuals. Telegram itself doesn’t need to allow surveillance for certain groups to be monitored.

3) The third is that this move by the French authorities came out of the blue and crosses a certain line. I confess I, too, was shocked at first, and upset, until I realized that the frequency of affronts to what we understand to be civil liberties has been building. This is just one more of many signs the “elites” are panicking about losing control:

Just a few weeks ago, a European politician attempted to interfere with an American election by threatening a US-based company that was planning to host an interview of a presidential candidate that this politician didn’t like.

Just a few weeks ago, the UK government warned its citizens to be careful what they say on social media or potentially face jail sentences, and London’s police commissioner talked about attempting to extradite foreigners who engaged in undesirable language online. (Just imagine if China tried to do this.)

Just a few weeks ago, we learned that former congresswoman, veteran and US presidential candidate Tulsi Gabbard was put on a domestic watch list requiring enhanced security searches before flying, due to an unspecified “affiliation”.

Just a few weeks ago, a 2022 clip surfaced of now-VP candidate Tim Walz insisting that the First Amendment does not protect against hate speech and misinformation. It actually does.

On the one hand, it’s good that we are still alarmed and angry that the red flags are getting bigger and redder. On the other hand, it’s getting less surprising, which is itself upsetting.

4) The fourth misdirection is that the next step is to arrest Elon Musk. There are parallels: Musk is also known for his colourful responses to government attempts to control what gets published on his site. He unveiled the collusion between the authorities and the previous Twitter management over narrative control, and has consistently and bravely insisted that official censorship has no place in the world’s “town square”. Yet the situations are different – it’s easy to monitor what is published on Twitter since the whole point is that it is public. The issue with Telegram, according to reports, is that the authorities have no lens into what happens on the platform.

And Twitter does have content guidelines – we are all familiar with accounts that got cancelled for reasons we often don’t fully understand. Sometimes that is rectified, sometimes not. That’s fine, it’s Musk’s platform, he can set the rules. Of course, the authorities would like to control what is said on Twitter, but I believe that going after Musk and threatening a meaningful outlet for vocal and influential communities may be an electric rail they’re not willing to grasp.

This unveils the bigger and more sinister intent here. It’s not about censorship or narrative control. After all, there are much more effective ways to silence dissent than to suppress certain posts on a chaotic flow. One, relevant to France’s intent, is to monitor messages and create personal profiles that can then be cancelled if necessary.

In the end, if we get booted from X or Telegram, no big deal really. We’ll find other ways of communicating, ranting, sharing what we know and what we think. We’ll still be able to buy groceries and hop on a plane to visit our parents. But if enough information is collected on us to label us a “threat”, we could see our bank accounts closed. We could get put on no-fly lists. Our kids could get rejected from certain schools. Our parents could have their taxes audited.

No, it’s not so much censorship that is the issue here. It’s privacy.

The state does not need to know everything about us, before we’ve broken any laws. This seems to be what they’re asking for on Telegram. We can all agree that money laundering, terrorism, drug and sex trafficking are bad. And it’s the state’s responsibility to do what it can to protect us from the consequences of crime. But insisting on monitoring all private messages to that end is the same as insisting on checking all private transactions just in case they are for questionable purposes. It’s egregious overkill that doesn’t even guarantee protection. And asking the innocent to pay for the sins of the possibly guilty is a perversion of the original intent of constitutional justice.

What’s more, it’s starting to feel blatant. The authorities don’t seem bothered by how this looks. They’re counting on the majority not caring much as long as they feel safe. But each step in the direction of control, combined with not much impact on the prevention of crime, will end up eroding trust, especially as the steps become more frequent and ever closer to our comfort zone.

The allure is predictably hard for the authorities to resist. There’s a powerful new tool within grasp – insight into what people are thinking. Once given a powerful new tool, it would be irresponsible to not use it, right?

This brings us to an important question that I haven’t heard anyone asking: who isn’t being arrested? Which messaging platform CEOs are not worried tonight? Sure, the French move against Telegram had been signalled, and other jurisdictions probably have other priorities. I’m not suggesting that other platforms are “cooperating”, I’m sure there are some that aren’t, but surveillance is worth keeping an eye on, if you’ll forgive the recursiveness. Who is watching the watchmen?

Durov’s arrest does feel sharper than other intended or actual privacy incursions – Telegram is used by tens of millions of people, and France’s controversial Olympics did little to mask its political dysfunction. But, unfortunately, we are likely to find out that it is “just” one more step, by no means the last, in a direction we absolutely have to be worried about.

NOTE: I posted a version of the above on X last night, and got some respectful pushback from Zooko Wilcox, who knows more about privacy than pretty much anyone else in the crypto ecosystem. He pointed out that Telegram is not private, that management can see everything that goes on, and that there are rumours the Kremlin has had Telegram surveillance in place for some time.

See also:

Keep an eye on the oil price

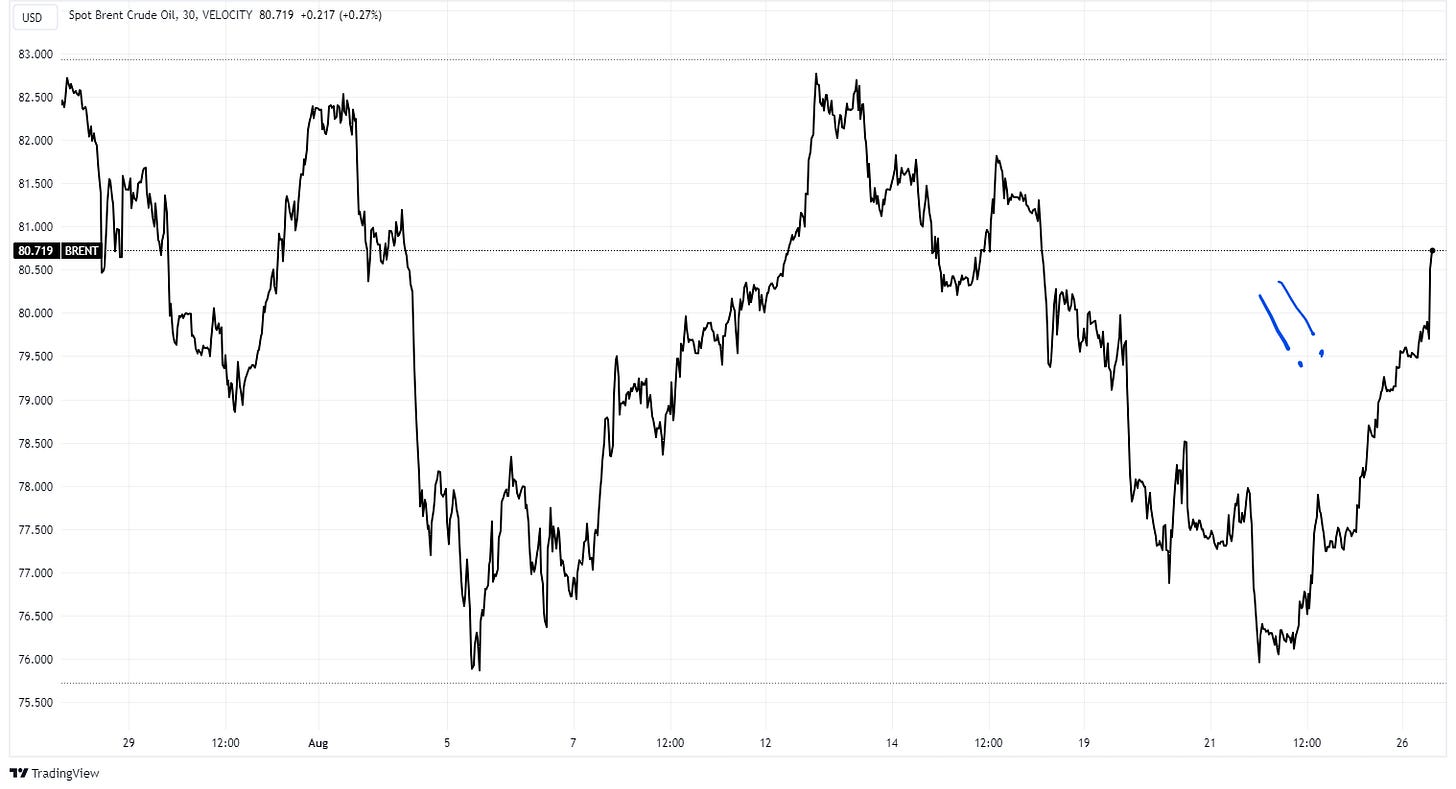

The price of crude is climbing again, in part on fears of escalation in the Middle East after Israel yesterday launched a wave of strikes against weapons in Lebanon, with Hamas [edited] retaliating by firing hundreds of missiles and drones into Israel. And the ceasefire negotiations in Cairo have ended with no deal, which is depressing.

What’s more, last week dealt an unwelcome reminder that oil supply chains are vulnerable at many key points. The Sounion suezmax oil tanker, carrying 150,000 tons (about a million barrels) of crude oil, was hit in the Red Sea on Wednesday by Houthi missiles and is currently ablaze. An ecological disaster in the Red Sea would not only make a key oil route unpassable for some time, it would also incur unquantifiable damage to the area’s landscape and infrastructure. The market’s complacency on this has been puzzling.

(chart via TradingView)

As if all that weren’t enough, Polish F-16s reportedly took to the skies earlier today to defend against Russian cruise missiles overshooting their Ukrainian marks – this is not exactly helping to calm nerves.

Geopolitical and supply chain concerns aren’t the only factors pushing oil higher, however.

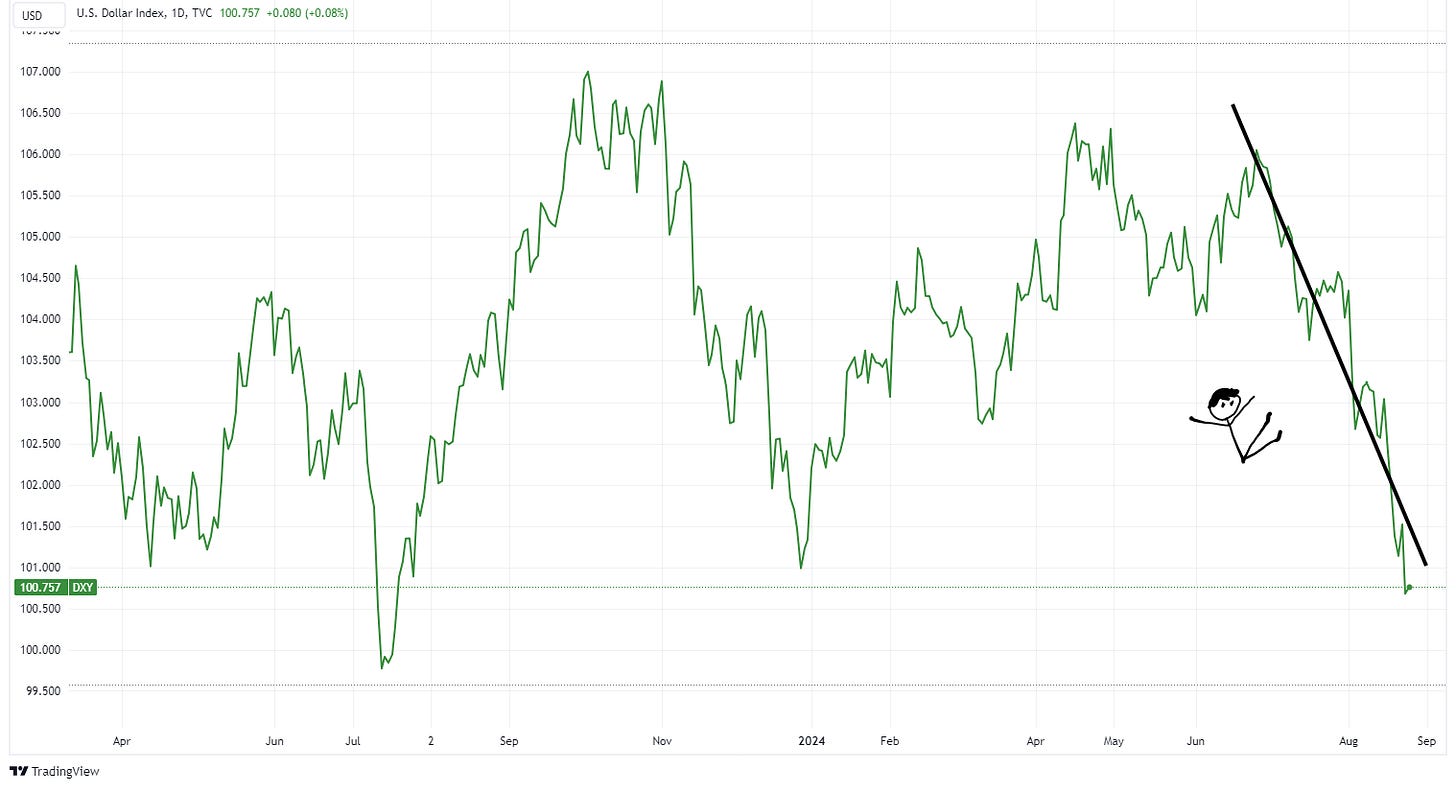

We also have the boost to economic optimism from the now almost certain US rate cut in September – Fed Chair Jerome Powell pretty much confirmed this in his Jackson Hole speech on Friday, and a chorus of Fed officials, even renowned hawks, are voicing their support.

The certainty is dragging the US dollar down, especially given growing doubts that the EU will cut again in September, and given the Bank of Japan’s reiteration that rate hikes were still on the table. The DXY index, which compares the US dollar to a basket of other currencies, earlier today reached its lowest point in over a year.

(chart via TradingView)

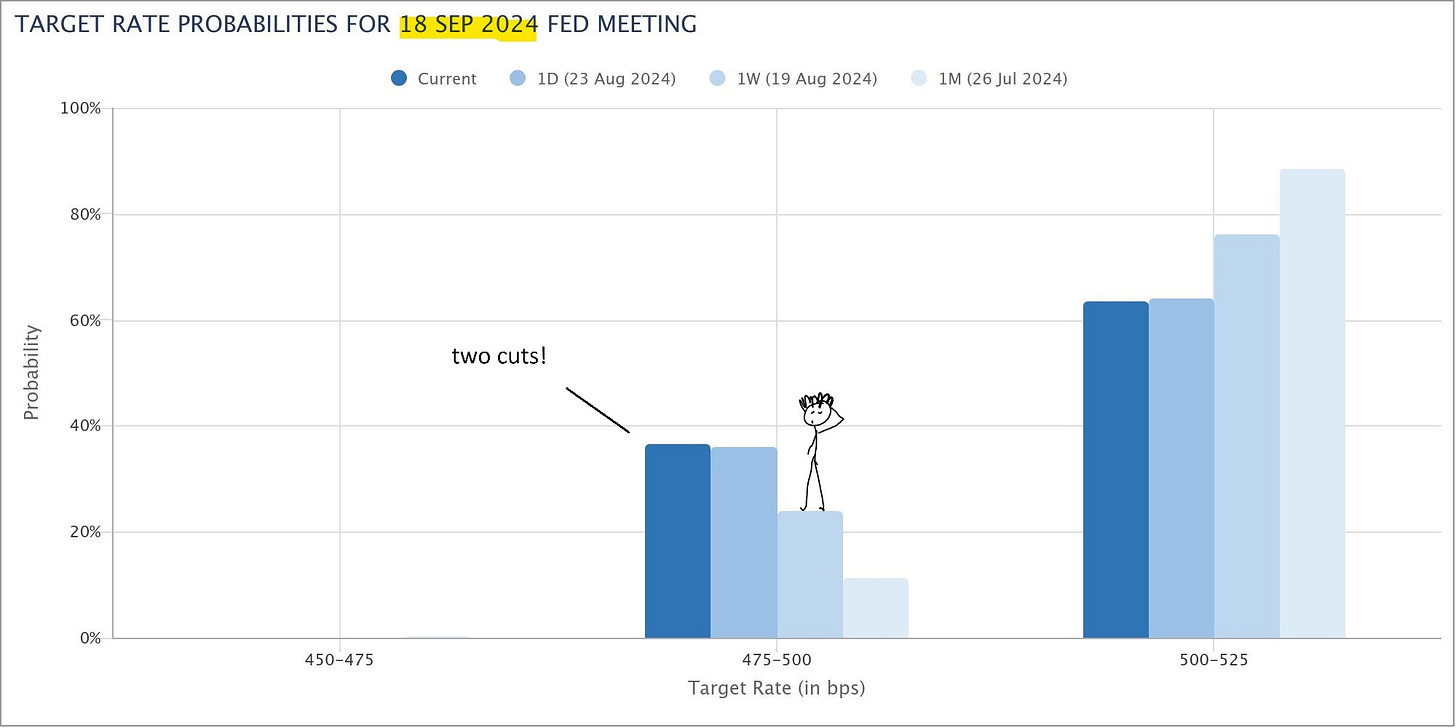

Bewilderingly, expectations of two cuts in September are climbing, with the CME-priced probability now up to almost 40% – this is despite Fed officials insisting that the cuts would be “methodical” and “gradual”, and a double cut being neither. (I’ll hopefully have pixelspace to talk more about this tomorrow, because it is nuts.) Traders could be assuming last week’s steep downward employment revision means that the US jobs market is in dire shape – only, it’s not. Even with the revision, the number of employed is growing at a reasonable clip. The Fed has no reason to panic.

(chart via CME FedWatch)

Back to oil for a moment: even though any tension-driven spike is likely to be temporary, there is a non-zero risk it could hold. That would be really bad for inflation expectations, and therefore also the outlook for rate cuts. It could also rock the now-balanced political boat in the run-up to the US elections in November.

See also:

What does this mean for BTC?

All this continues to add to the tailwinds piling up behind the BTC price.

Rate cuts are good for BTC, as it is particularly sensitive to monetary liquidity conditions (seen as a risk asset, with no cash flow or margins to get hit in a slowdown).

A weaker US dollar is good for BTC, as it tends to boost monetary liquidity by lowering the cost of capital. Plus, expectations of continued dollar weakness highlight the utility of a dollar hedge, and should boost spending power (and hedge interest) in other jurisdictions. And, the dollar is the denominator of the most-quoted pair (BTC/USD).

Longer-term, hints of the return of inflationary pressures in the US from a weaker dollar and/or a higher oil price could further boost hedge interest (although short-term, market volatility does also impact crypto prices).

(chart via TradingView)

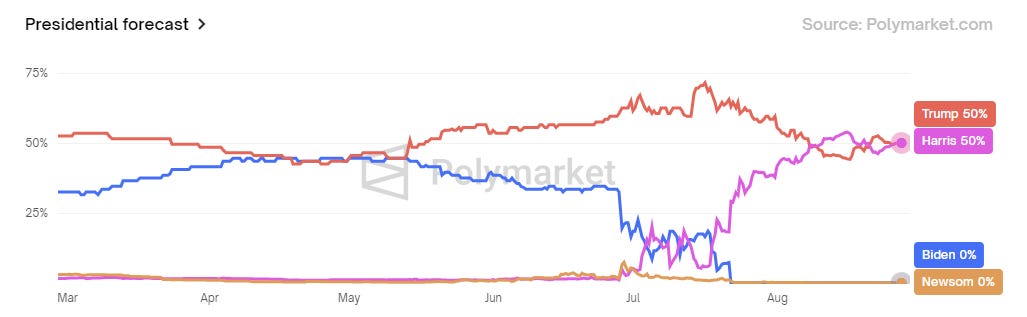

Even more significant, however, at least for now, are the US political winds. Despite pro-crypto candidate Robert Kennedy withdrawing his name from the ballot in 10 swing states and throwing his support to pro-crypto Donald Trump, Harris and Trump are tied as likely winners on betting platform Polymarket.

(chart via Polymarket)

Even a Harris victory is looking not catastrophic for crypto, however, as a key policy advisor has said that the candidate is supportive of allowing the ecosystem to grow.

So, what is keeping the BTC price muted? The bump on Friday felt more orderly than euphoric, despite the strongest net inflow into the spot BTC ETFs so far this month.

There’s still considerable political uncertainty – until we hear from candidate Harris on crypto, clearer regulatory skies ahead are not a sure thing. Plus, there’s the easy allure of liquidity-sensitive tech stocks for those that believe the AI “revolution” is undervalued (I’m not one of them, more to come on this). These reasons feel flimsy, though. More likely, it’s probably that interest is picking up, but not with enough net inflow to overcome selling pressure from governments, miners and Mt. Gox distribution recipients. Plus, summer is typically quiet. Now that it’s drawing to an end, however…

LISTEN/READ:

In the latest GoodFellows video, Bill Whalen talks to John Cochrane about something I’ve been jumping up and down on recently: the Fed’s moves don’t matter that much to the overall economy. Small businesses will have an easier time getting and servicing loans, markets will love any hint of easing, but other than that, the economy itself will continue to dance to the fiscal drum.

Peter St. Onge talks to Lawrence Lepard about monetary policy, what the next “cover” for printing might be, the Fourth Turning, and how long it could take people to come around to the idea of sound money.

In this Hidden Forces episode, Dmitri Kofinas talks to Patrick Boyle about the recent market turmoil, the outlook for inflation, the impact of the internet on culture, and more.

WHAT I’M LISTENING TO: Some classical Spanish guitar to set a chill yet determined tone for the week – Asturias (Leyenda) by Issac Albéniz, performed by Croatian guitarist Ana Vidović.

HAVE A GREAT DAY!

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

Noelle you wrote : Israel yesterday launched a wave of strikes against weapons in Lebanon, which retaliated by firing hundreds of missiles and drones into Israel.

I would like to stress that Lebanon's authority is not in control and it is a militia named Hezbollah which is, for reasons the Lebanese are not responsible for. The Lebanese and the Lebanese state are held as hostages and thus it would be more correct to write, the Hezbollah retaliated.