WEEKLY, August 31, 2024

who owns bitcoin, the SEC and NFTs, BTC by year end, wildlife photos

Hi everyone, I hope you’re all well! Wow, the last newsletter of August… This year has gone by SO fast – some big milestones, more than a few successes 😊, a couple of misses, but SO much learned, shared and appreciated. A big thanks to ALL of you, long-time readers and those of you who have just joined, for being here!!! ❤❤

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of articles from the week.

If you’re not a premium subscriber, I hope you’ll consider becoming one! It’s only $12/month, and you get:

~daily commentaries on the growing overlap between the crypto and macro landscapes,

market narratives,

regulatory moves,

tokenization trends,

adoption news

and more.

I also usually share interesting and often overlooked podcast links, some tangential reads, and music I’m listening to because why not.

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

Who owns bitcoin?

The SEC goes after NFTs

BTC at $100,000 by year end? Not an outrageous prediction.

Some of the topics discussed the past week:

Durov’s arrest is not about Telegram censorship. It’s worse.

Keep an eye on the oil price

What does this mean for BTC?

A rant about the changing role of government, extraterritorial aspects of Durov’s arrest, and why my bank needs proof of my meagre income.

First Amendment violations

About those AI earnings

Don’t fear the FOMO

Ouch: yesterday’s crypto market drop

Stablecoins: key developments from the past month – Tether, Russia, treasury tokens and e-commerce stablecoins

Market concentration and a collective shrug

The SEC goes after NFTs

BTC at $100,000 by year end? Not an outrageous prediction.

Euro stablecoins

It’s the jobs, stupid

Who owns bitcoin?

The drums of dissent

Brasil wants control

Who owns bitcoin?

A confession: I’ve had this report open on my tabs for a couple of weeks now, and I should have made it more a priority because it is eye-opening.

It’s a survey of who owns bitcoin. The origin is the realization that, in order to better educate people about the asset, we first need to understand who owns it. This will help us better understand who the education should be aimed at – obviously not people who already understand, but for that, we need to know who they are.

It turns out that the ownership base is much more diverse than expected.

The survey was conducted by Qualtrics at the behest of The Nakamoto Project, a group dedicated to broadening bitcoin awareness. It canvassed 3,500 US residents between November ’23 and March ‘24.

There are some results that fit the stereotypes: most BTC holders are young and male, as anyone who’s ever been to a bitcoin conference can confirm. (Just over half the survey respondents were female.)

(chart via The Nakamoto Project)

It’s worth thinking about why this is the case. My theory is that techies are more likely to own BTC than a chef or a real estate agent. For them, bitcoin is instinctively easier to understand, and for reasons that are also worth exploring, techies tend to be young and male. (I am obviously neither young nor male and I do consider myself a “techie” and, yes, I do own some BTC – not as much as I’d like, though.)

It may also have to do with risk preference – young males tend to be more comfortable with high levels of risk and, let’s face it, BTC is short-term risky.

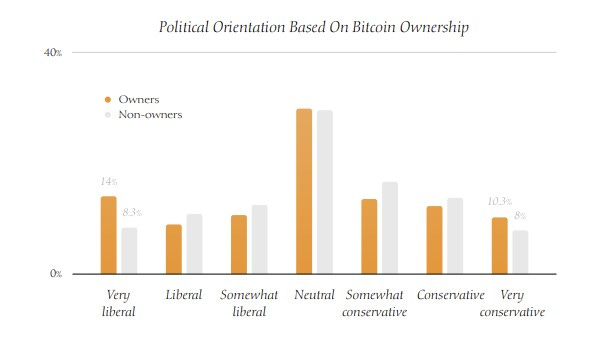

There are other results that I did not expect: BTC ownership is not “political”. A common assumption is that it appeals mainly to libertarians and conservatives worried about the encroachment of Big State in money and expression. According to the survey, ownership spans the political spectrum. Only 3% of bitcoin owners are self-declared libertarians.

(chart via The Nakamoto Project)

Is there a “predictor” of who will hold BTC? It turns out that, according to the survey, there is. Ownership is highly correlated with trust in the protocol, belief in its utility and an understanding of its “morality”.

I found this fascinating. In what way is bitcoin “moral”?

Bitcoin can be called “moral” in that it enhances individual agency, it protects savers against centralized oppression, it gives users access to a money that the authorities can’t manipulate. Basically, it’s a hedge against the state.

But BTC ownership seemed to be concentrated in “moderates”.

The takeaway is that a much broader spectrum of people are concerned about state overreach than is generally understood, if the results of the survey can be taken as representative.

Now, we probably all know people who just hold BTC for the volatility and the potential profits. Morality and utility are not part of their equation. But they’re 1) not representative of the broader population, and 2) probably not going to respond to surveys like this one.

So, the “morality” justification may seem new to some of you, but it’s worth considering.

Bigger picture, I sincerely hope the utility and morality of the world’s first truly decentralized network become a key part of bitcoin education, not just because they are the big eye-openers, but because they also trigger other deep political and philosophical questions about the role of the state, who gets to define money, and how much “protection” we actually want.

The SEC goes after NFTs

NFT platform OpenSea revealed this week that it has received a Wells notice from the SEC, informing the company of a possible action for selling unregistered securities.

This is an astonishing move on the part of the securities regulator – it will not be easy to convince a judge that digital art and collectibles are securities, even if this were to go to trial before the election (unlikely). It also unwinds any approach VP Harris’ campaign may have made to earn support from the crypto industry.

While the left hand doesn’t often know what the right hand is doing in government, and while it’s probable that the SEC moved without the campaign’s knowledge, this news does significant damage to the Democratic candidate’s credibility going forward.

Predictably, the outrage has been swift and fierce, even from vocal Democrat supporters. There’s either some chess board positioning going on behind closed doors, with Chair Gensler perhaps urged by others to remind policy makers of the unregulated nature of the industry in a classic misdirection tactic. Or, it could be yet another example of how Gensler is both out of touch and not a team player.

OpenSea has said it will fight back, and it has good legal precedent and talent on its side. The firm is also pledging $5 million to help any creators slapped with similar notices or related actions.

An eventual court ruling will, hopefully, deliver some much-needed clarity and allow the industry to move forward. Meanwhile, resources are wasted on both sides, progress slows, and the Democrats close a high-value window of opportunity.

BTC at $100,000 by year end? Not an outrageous prediction.

This week, a journalist asked me why “experts” make outrageous predictions for BTC (she cited Adam Back, who back in February said he believed the price would reach $100,000 by year-end). Surely that is now unattainable, right?

So I crunched some numbers.

Between the end of August and the end of December in 2020, after the previous halving, BTC’s price climbed ~270%.

(chart via TradingView)

For BTC to reach $100,000 by the end of this year, the same time-period length and stage in the four-year cycle, it would need to increase by only 70%. Sure, in 2020 we had an unprecedented amount of monetary easing, and the net impact on flows this year, even assuming modest rate cuts, will be less. And, now there is formidable political uncertainty, as well as the AI frenzy distraction.

But, this cycle we have new onramps, greater awareness, potential political decongestion and the increasing worry about government debt and money printing, not just in the US.

So, I’m not saying it will happen, but $100,000 – only a 70% bump from here – is not an outrageous forecast (I repeat, it’s not mine!).

Plus, if my math is correct, for BTC to deliver a return of 70% between now and the end of the year (~120 days), it would need to increase by 0.45% per day. That’s all. Given the choppy summer with its uncomfortable drops, I get that even that small number on a consistent basis seems out of the question. But we should be wary of recency bias.

September is around the corner, and with rate cuts and political shifts, the mood just might change.

HAVE A GREAT WEEKEND!

It’s been a while since I shared stunning photographs with you, and this past week presented the perfect excuse to change that: the organizers of the Wildlife Photographer of the Year 2024 competition released a preview of some of the Highly Commended images, and they are stunning – the winner will be announced on October 8, and the exhibition kicks off at London’s Natural History Museum on October 11.

Here are a few of my favourites so far:

Jose Manuel Grandío, via The Atlantic

Shreyovi Mehta, via BBC (runner up in the 10 years and under!)

William Fortescue, via BBC

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

I agree that the Nakamoto Institute survey was eye-opening and made me feel considerably less lonely than I normally do during the day-to-day scrum of interaction with sovereign individuals. As someone who used to conduct surveys for a living, the methodology also seemed robust enough, but is so at odds to my lived experience it made me curious. Do you think it can/will be replicated?

Noelle, it seems that with the arrest of Durov, and this blog regarding Gensler/Harris, etc, you are getting red pilled daily.