WEEKLY - China, tokenization, stablecoins

plus: assorted links, stunning photos and more

Hi all! I hope you’re doing well in these crazy times. And Happy Valentine’s Day, if you celebrate! We do in our household, in a very low-key way – this morning, with the sun shining for a change, we went out for pastries. ❤

If you’re not a subscriber to the premium dailies, I hope you’ll consider becoming one? You’ll get access to market commentary as well as adoption insight and industry trends. Plus, links and music recommendations ‘cos why not…

EDIT: Forgot to add that I have to skip next Saturday’s publication of the free weekly, sorry! Having eye surgery on Thursday, am told I won’t be able to see well for a few days 😖😖.

If you speak Spanish and are interested in a less frequent, shorter update on developments in the crypto-macro intersection, you can subscribe to Cripto es Macro here. 🎿🥌

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

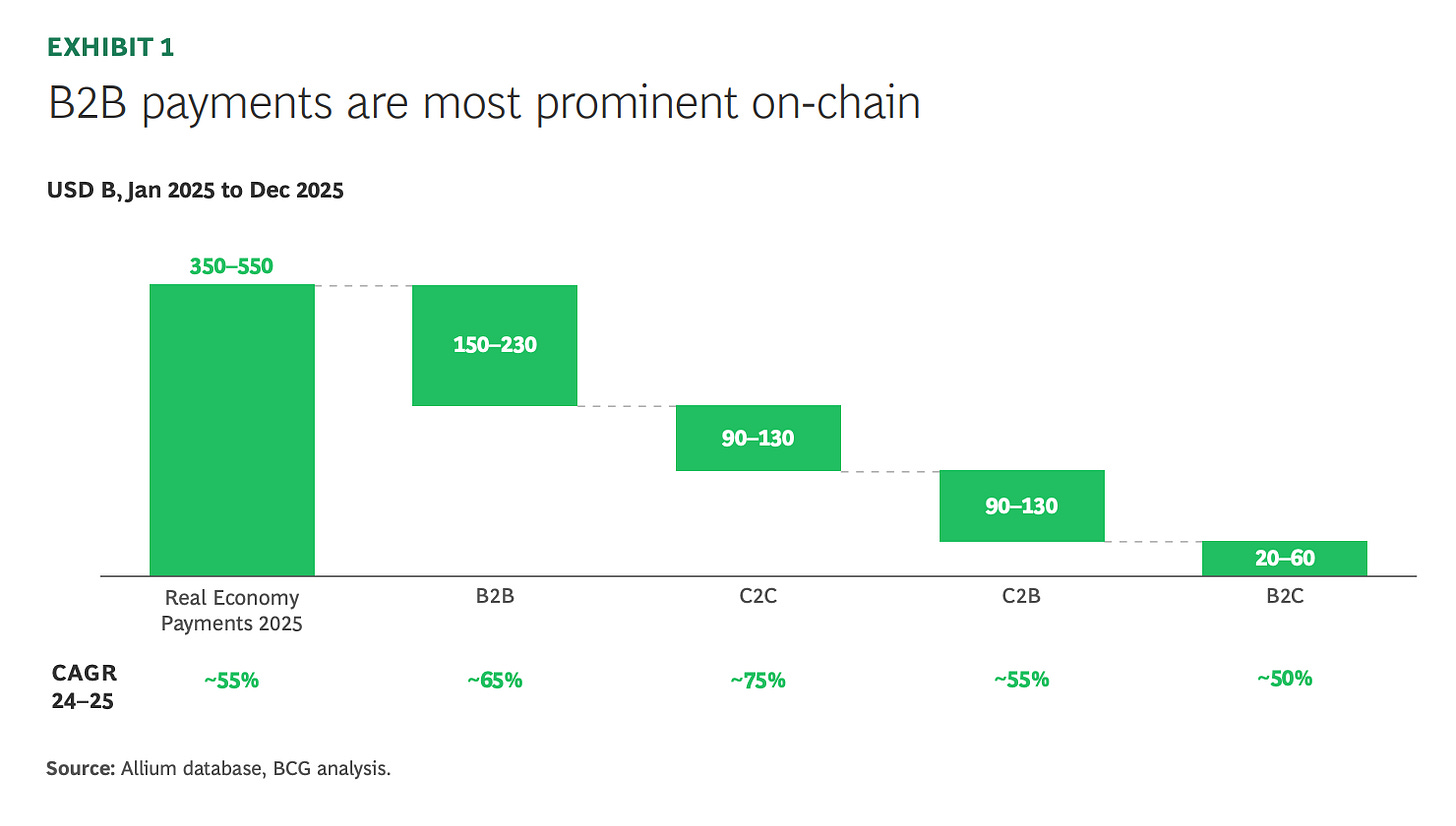

The latest whitepaper published with BCG, Stablecoin Payments: The Truth Behind the Numbers, examines how stablecoins are being used in the real economy today. The analysis estimates $350–550B in on-chain payments in 2025, led by $150–230B in B2B activity, with consumer flows contributing another $200–320B.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

In this newsletter:

No, China is not banning tokenization

Stablecoins and the new Gresham’s Law

Assorted links: AI friction, Japanese politics, curling stones, military technology, superbowl ads, venture investing

Weekend: Winter Olympics

Some of the topics discussed in this week’s premium dailies:

Coming up this week: US jobs, inflation, crypto/banks and geopolitics

Monday mood: identity

Macro: Japanese elections

Markets: a different type of rotation

Macro: US consumer sentiment

No, China is not banning tokenization

Confusion around stablecoins as collateral

Markets: ETF flows

Stablecoins and the new Gresham’s Law

Broadridge: stablecoins for treasury

Macro: wow, that jobs report

Roundup: big tokenization moves

Markets: the jobs reaction

The Russia memo

The EU DLT Pilot Regime: let’s move faster

Markets: breathe

No, China is not banning tokenization

As if the crypto ecosystem wasn’t depressed enough, over the weekend reports emerged that China was banning both stablecoins and tokenization more broadly.

While the reports are not incorrect, they overlook the nuance in the official statement.

On Friday, Chinese authorities announced a clampdown on tokenization of real world assets both onshore and by overseas entities. The statement was signed by the People’s Bank of China, the China Securities Regulatory Commission and six other departments, so we know it carries weight.

On Sunday, China Daily (the CCP’s official English language media) offered the following summary:

“China has officially banned onshore activities related to real-world asset tokenization … as part of broader efforts by regulators to crack down on illegal activities, contain financial risks and impose clearer rules on emerging digital asset activities to safeguard financial stability.

Overseas RWA tokenization of domestic entities will also be subject to strict compliance requirements, a landmark move that will pave the way for regulated, risk-controlled digital asset innovation, analysts said.”

Note that the focus is on risks. This is in line with the authorities’ determination to dampen financial speculation, out of concern it could trigger social unrest and resentment – the country is still recovering from the damage of the real estate boom and bust of a few years ago.

The China Daily report quotes an official statement as saying:

“Speculative activities related to virtual currencies and RWA tokenization occurred from time to time, posing new challenges and new situations for risk prevention and control.”

It adds that fending off these risks is necessary in order to “safeguard national security and social stability”.

This is not a ban on all tokenization or stablecoin issuance, however. The official notice specifies that there are exceptions, such as activities with regulatory approval and those “conducted based on designated financial infrastructure”.

In sum, authorized tokenization is allowed. Unauthorized tokenization isn’t.

This should not surprise us. Nor is it an unreasonable stance. Even in the US, tokenizers have never been able to do whatever they want, not even under the current Administration.

And the risks carry a heavier weight in China. At the risk of generalizing, the Chinese do like to gamble – in part, it’s an ancient tradition as well as a reflection of the cultural respect for luck, and in part it’s a reaction to the lack of other get-rich-quick opportunities such as meme stocks and high-leverage derivatives.

And because Chinese savers have no problem with speculative bets, they often fall prey to scams – many of you probably remember the ICO craze of 2017, with stories about grandmothers getting scammed out of their pension because of an opportunity they heard about at the tea shop. The damage there triggered a national ban on ICOs.

What the authorities are doing is banning is tokenization they can’t control.

This is not about tokenization. It’s about speculation.

Only, there’s probably something else going on here as well, with potentially bigger picture impacts.

According to an expert quoted in the South China Morning Post, RWA tokenization schemes were also being used to move funds offshore. Given China’s strict capital controls, the authorities have to clamp down on outflow channels as they emerge.

This could be taken as proof that China does not want a tokenized market to emerge, as it would be too hard to control.

Or, it could be taken as a sign that China is working on regulated tokenization. In the 14th Five Year Plan (2021-2025), blockchain featured prominently as part of the financial modernization drive and the creation of “Digital China”. The 15th Five Year Plan (2026-2030) has less emphasis on blockchain and more on “digital finance”, but work has been ongoing on tokenized trade finance, interbank settlement and government services. Hong Kong – a separate jurisdiction, but one that wouldn’t do anything China didn’t approve of – has been one of the most active regions in the world in tokenized assets, and last November was behind the largest digital bond issuance to date (HK$10 billion, or US$1.3 billion). And in December, a leasing subsidiary of a Chinese bank issued a RMB 4.5 billion (US$640 million) digital bond settled in e-CNY.

Of course, all this work is carried out on permissioned blockchains, not public networks. We can’t count on China to encourage decentralized finance, given its priority of stopping capital flight and preventing excessive speculation.

But tokenization is not banned in China, despite what the headlines would have you believe. Unregulated tokenization is, but China is not alone in that.

Where it will stand apart is in its focus on domestic applications. China’s tokenization work is not about expanding markets, unlike other initiatives that emphasize the potential connectivity of blockchain networks and the “democratizing access” of tokenization. China’s blockchain work is about modernization and efficiency.

What’s more, it is well in the lead in terms of official support for industrial distributed ledger applications, while other markets focus on global payments and trading opportunities.

In the development of any new technology, different approaches will produce different outcomes. Since we’re talking about financial and industrial competitiveness, this will matter for the global realignment – yet another example of how crypto technologies impact geopolitics.

🥌 If you find these newsletters at all useful, would you mind sharing with your colleagues and friends, and nudging them to subscribe? I’d appreciate it! 🎿

Stablecoins and the new Gresham’s Law

(The below is a rough summary of notes I took while listening to a Macro Musings interview, in which David Beckworth chatted to Dan Awrey about his recent book “Beyond Banks: Technology, Regulation, and the Future of Money”, now on my list. Dan’s ideas are so relevant to the evolution of stablecoins in the US, and the intersection of technological innovation and financial regulation more broadly, that I felt they were worth sharing.)

It took centuries of experimentation to come up with the current business model for banks and payments – the result is pretty good credit-based money, but it created a path dependency in giving control of the payment system to banks who were not prepared for the technological disruption from the Internet Age.

So, the US ended up with a system of good money, bad payments. Non-bank solutions (PayPal, Venmo, stablecoins, tokenized deposits) are solving the payments issue, but they don’t have the backing of the central bank, which means they have to manage payments with weaker monetary IOUs.

What makes “good money” (the protection of law, institutions) is not what makes “good payments” (technology, governance frameworks around its adoption). Banks have a hard time separating the two ideas in their heads, and this is creating a risk as demand for good payments increases.

Gresham’s Law points out that bad money crowds out good money – or rather, bad money circulates and has short-term utility, while good money is held as a longer-term store of value. Because it circulates while good money doesn’t, bad money ends up driving monetary patterns.

But now we have the Reverse Gresham’s Law – utility decisions are not based on the quality of the money, they’re based on the quality of the payment system, these are now driving monetary patterns. You still have bad money driving out good, but with a different incentive driver.

Why are the monetary IOUs from non-banks (PayPal, Circle, etc.) not “good” money? Because they don’t have bankruptcy protection. PayPal’s terms and conditions specify that the user with funds in their account would be an unsecured creditor in the event of a bankruptcy, subordinate to many others so whatever little they get back would take a long time. The GENIUS Act has a muddled treatment of bankruptcy which will do more harm than good: it specifies that stablecoin holders get priority, even over trustees – but then it will be hard to find willing trustees, which could tie up the process.

Of course, in the event of a bankruptcy of a large non-bank, the Federal Reserve would probably have to intervene for the sake of market stability. Even if Tether, an offshore issuer, were to have problems, the Fed could not allow destabilization of the Treasury market and so would probably step in, with perhaps something like a swap line. As we have seen with banks over the past few decades, this creates moral hazard – we could see the same behavioural pattern emerge with non-banks.

Or, we could give non-banks the ultimate protection of access to Federal Reserve master accounts: central bank backing and access to bank payment rails will provide assured liquidity and less friction, smoothing issues and letting inter-bank lending fill in gaps.

Wait, doesn’t Fed Governor Waller’s idea of a “Skinny Fed Master Account” suggest this? No – there is no such thing as a “skinny” or “fat” master account. Amending Section 13(1) of the Federal Reserve Act (which dictates what types of institutions can have access) will require an act of Congress. But it for sure should be done.

The US encourages technological innovation in the evolution of payments, understanding that it is good for both consumers and the growth of small businesses. But it continues to favour the monetary IOUs created by banks – this is a conscious decision about the balance between good money and good payments. Non-bank payment systems remove some of the pressure from bank payment systems, sort of like a release valve. But they introduce vulnerabilities, for consumers as well as for the government that might have to bail out failing entities.

Speaking of which, the idea of bailouts has been so normalized now, it is almost assumed. But this means that the US is choosing to not regulate ex-ante, but bail out ex-post.

A potential solution would be to treat the policy problems of payments and money separately.

On money: introduce rules to reduce the possibility of a non-bank payments firm hitting the bankruptcy wall, such as limiting the sources of their financing to customer funds and equity. If, despite that, a bankruptcy occurs, ensure that users can remove funds in full and immediately – no waiting, no haircut. This makes it almost like “good” money.

On payments: give payment providers access to Fed master accounts. Insist that all payment systems be interoperable. And decide who should have oversight of governance, design decisions, etc. – historically, this has been the Federal Reserve, but the central bank has a specific set of objectives, mostly linked to financial stability and monetary policy implementation. Banks are understandably reluctant to give up control, which is why a separate overseer could ensure a more level playing field.

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

An on-the-ground view by Quico Toro of the popularity of Japanese Prime Minister Sanae Takaichi – in Japan, she has become a role model, but not because she’s a woman. (The Japanese Love Their Prime Minister. This Is Huge, Persuasion)

An enchanting report on the remote Scottish island, accessible only a few weeks of the year, that provides the granite for all of the Winter Olympics curling stones. (From island to ice, Reuters)

For history, military and innovation buffs among you, Davis Kedrosky offers a deep dive into the thesis that “interminable warfare” led to technological innovations which in turn required more sophisticated fiscal systems. (Is there still life in the Military Revolution?, Great Transformations)

I’m still catching up on Super Bowl ads, but here’s a selection of a few with a catchy ‘90s feel. (Super Bowl 60 Went Heavy on the ‘90s Nostalgia, AdWeek)

More food for thought than can be digested in one sitting – but all worth digesting. One idea that resonated on the role of AI in our lives is that of the gym:

“A simple way to figure out whether to use AI at work, or in life, is to think about the difference between a gym and a job. At a gym, the point isn’t for the weight to be lifted, but for you to lift the weight. At a mere job, however, ‘the point is for the weight to be lifted.’” (The 11 Most Interesting Ideas I Read on Paternity Leave, Derek Thompson)

In case anyone out there thinks venture investing looks easy, Mario Gabriele shares some advice for first-time fund managers. (Lessons of a First-Time Fund Manager, The Generalist – paywall)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Whether you’ve been glued to the Winter Olympics or not, it’s hard to completely ignore the dramatic pull of ambition, grit, talent and community. My fascination is the ice skating, and have been blown away by the mastery and moved by the mistakes.

I know I shared photos last week from the opening ceremony, but I’m going to stick to the format this week and show some of the best photos I’ve seen of the actual sport – this event is only once every four years after all. As usual, these are all from Reuters:

by Kal Pfaffenbach

by Marko Djurica

by Dylan Martinez

by Annegret Hilse

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.