WEEKLY - China’s evolving crypto policy

plus, some good things about January

Hello everyone, and HAPPY NEW YEAR TO YOU ALL!!!

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the week, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one! For $12/month, you’ll get (almost) daily commentary on how crypto is impacting the macro landscape, and vice versa.

There are also usually links to good podcast episodes and articles, and to music I’m currently listening to, because why not. AND you get access to a premium subscriber chat over on substack.com or on the app! And audio!

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

China’s evolving crypto policy

Good things about January

Some of the topics discussed this week:

A jittery US dollar

Inflation expectations

Regulatory overreach: Cleaning house

A tenuous tightrope

BRICS expansion

The wrong kind of spark: market impact, political fallout

China’s evolving crypto policy

The insurance debate heats up

China’s evolving crypto policy

I’m hearing from everyone who knows China better than me that a shift in official policy towards crypto is not on the table – but, I think it is. There are signs.

I wrote recently about the potential significance of statements from a high-ranking party official suggesting that China should reconsider its approach to cryptocurrencies. That was back in October and there haven’t, as far as I know, been any repeats of that kind of surprise. But other hints are trickling through.

Lead by following

One, unexpectedly, comes from the central bank. The recent Financial Stability Report from the People’s Bank of China (PBOC) included an extensive comment on global crypto regulation. I don’t speak Chinese so I’m relying on a translation of excerpts by PANews, but apparently it stressed the high number of jurisdictions that have implemented restrictions and even bans on cryptocurrency activity. That doesn’t sound very accommodating, but the report went on to detail how Hong Kong was “actively exploring” the management of crypto asset licences.

The document also made several references to the Financial Stability Board’s Regulatory Framework for Crypto Assets, released in 2023. I may be missing nuances, but the overall message is that the PBOC is paying more attention to the crypto market, and that it thinks more regulation in this area is a good idea.

Authorities are also aware that a significant amount of illicit crypto trading is going on in China, much of it to do with selling yuan for stablecoins. In mid-December, two traders were sentenced to five years in prison for processing RMB 30 million (~$4.1 million) in transactions allegedly to circumvent currency controls. This was small compared to an operation back in May, in which 193 individuals were arrested on suspicion of operating a USDT “banking network” that had processed around $1.9 billion of transactions. The latest move was extensively covered in the local press, according to reports, in what looks like a campaign to dissuade others and warn similar operations they will face consequences.

What’s more, the State Administration of Foreign Exchange (SAFE, China’s foreign exchange regulator) has just tightened trade reporting requirements, requiring banks to flag risky moves including any that involve crypto assets.

Control shift

One read of these moves is increasing determination to clamp down on evasion of currency controls. But there are signs that China would not be averse to a weaker currency to at least partially offset the impact of tariffs imposed by the incoming US Administration, and to perhaps rekindle some growth-stimulating inflation.

Last Friday, the Financial Times reported that the central bank was planning a major policy shift in 2025, substituting lending targets with a monetary policy emphasis more in line with the US, which implies using interest rates to manage both the currency and domestic demand. And a PBOC official confirmed to the FT that rates were likely to head lower. Given the slump in the CNY vs the USD over the past few months, this is a surprising signal and hints that, while the central bank is likely to continue to intervene to prevent a destabilizing exodus, it would be comfortable with further declines.

(chart via TradingView)

Of course, this doesn’t necessarily mean that currency controls will be relaxed. But it could suggest a boost for officially approved investment in non-Chinese assets, such as global cryptocurrencies, especially if official funds and institutions could also benefit.

Widen the lens

Another read is that the digital asset sector is occupying a greater political mindshare in China.

Officials are moving against illicit crypto transactions – but this is because they have realized that the 2021 trading ban was not effective. Put differently, they know that a significant amount of crypto activity is going on that they have no insight into. They want to dissuade it, but they must realize their success in this will be limited.

And a stated priority of the current Congress is to stimulate the tech sector. That will include blockchain and crypto. Last week, the Qiushi Journal – the main theoretical publication of the Chinese Communist Party (CCP) – republished part of a 2023 Xi Jinping speech in which he emphasized the need for modernization. A perusal of recent articles in the South China Morning Post highlights advances in fighter jets, warships, satellites, network technology and more – but not much on blockchain or web3 development, even though China has strong blockchain development labs. While it’s strategically more important to showcase military prowess given rising geopolitical tensions, the upcoming shift in US support for blockchain development is likely to stimulate the Chinese instinct for competition as well as the desire for publicized distributed ledger “wins”.

But for scientific interest in blockchain to pick up, it will need to be able to take advantage of the flexiblitiy, composability and financialization of token issuance. For that, China needs an official cryptocurrency framework.

What’s more, introducing a licensing regime for crypto exchanges would bring a significant portion of current activity under government scrutiny. Most Chinese will not have a problem with this – surveillance is something they’re used to, and respect for authority is on the whole deeply ingrained. Officially recognized exchanges, however, will encourage both retail and institutional investment in existing crypto assets, as well as give new initiatives instant market access.

Follow the incentives

It would also benefit Bitcoin miners. Despite the 2021 headlines, the activity was never officially banned in China. Today, it is often carried out with local government support. After all, mining operations provide free heat which has many industrial, agricultural or even social applications. In addition, Bitcoin mining can help cover hydroelectric generation costs by absorbing excess supply, an acute issue during “wet” months of June-September.

(image by AFP for Getty Images, via Bloomberg)

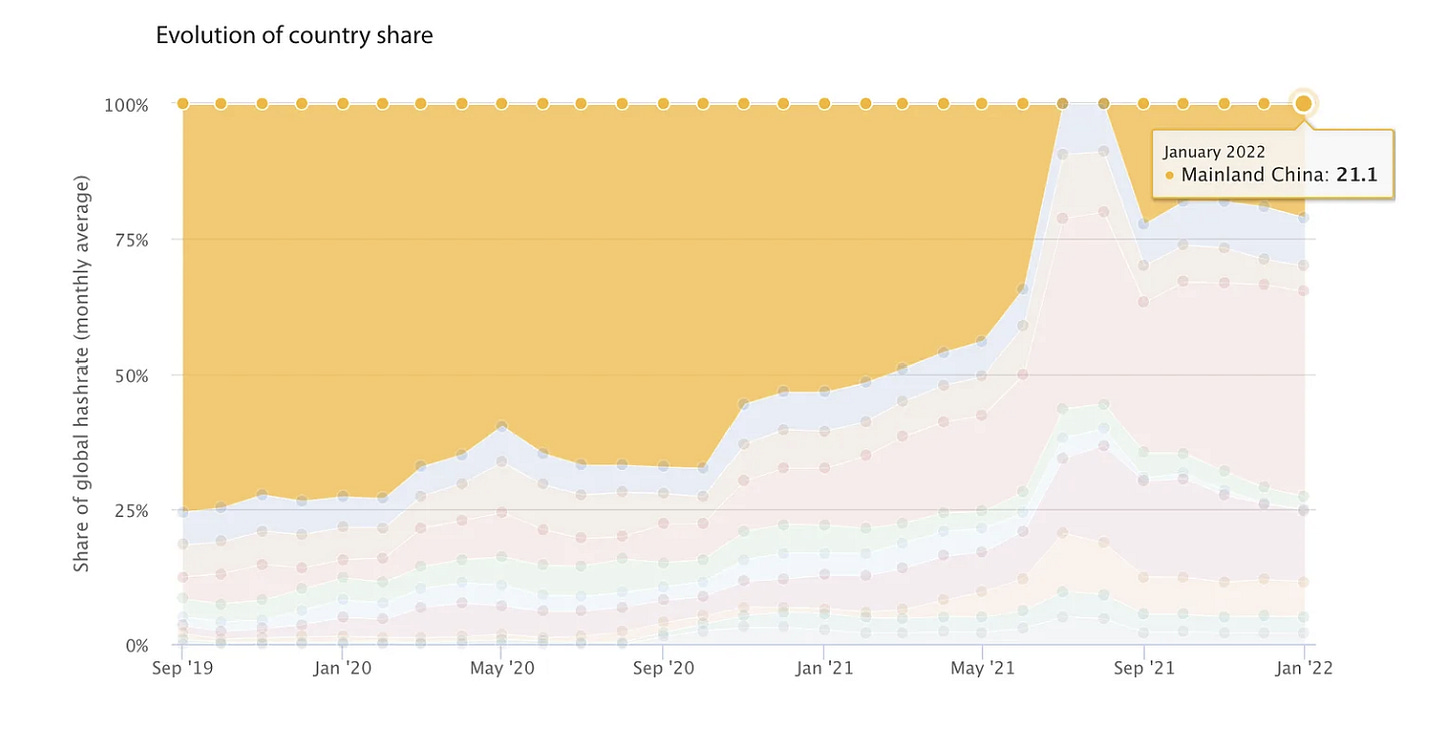

Estimates of China’s hashrate vary, but a reliable source puts it at around 15%, second only to the US.

(chart via Batcoinz)

Now, if only miners had official exchanges on which they could sell some of their output to fund expansion or cover operating costs…

Another sign that the stage is being set for official acceptance of crypto activity is the decision in November of a Shanghai court that cryptocurrencies are “property”, and are therefore legal to hold.

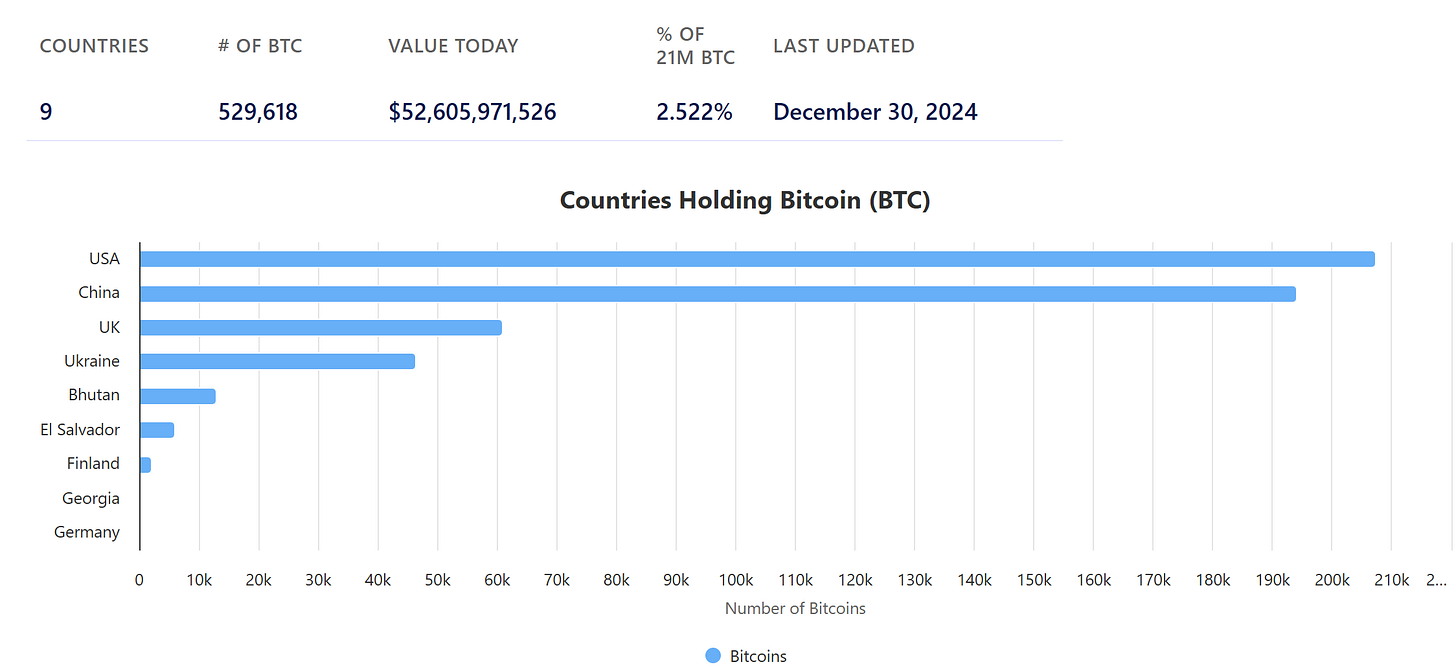

This is just as well – according to Bitcoin Treasuries, China is the world’s second-largest state holder of BTC.

(chart via BitcoinTreasuries.com)

Finally, the recent crypto prosecutions that have made the headlines involved USDT. It’s not unreasonable to expect less hostility to the idea of Chinese investors switching from yuan into crypto assets not directly tied to the United States currency – such as, BTC, ETH, SOL and others. The easiest way to channel investor preference is through licensed crypto platforms that only list approved assets.

In sum, there have been no “official” indications that China is considering relaxing its crypto policy. But there are plenty of signs it is no longer a taboo subject, and bountiful incentives to do so.

This doesn’t necessarily mean we will see Chinese regulators propose a crypto licensing regime this year, as big changes move slowly through the Party’s labyrinthine politics. But it is certainly more likely now than at any time in recent history.

And, sure, perhaps Chinese investors are not necessarily pro-crypto on average. But that could to a large extent be because of a lack of familiarity as well as the absence of legal venues through which to acquire crypto assets. With an official nudge, that could change fast, and even if this only impacts demand in a small percentage of the population, that’s still a potentially massive inflow.

I’m skeptical of the narrative that the Chinese authorities are going to unleash a wave of liquidity to stimulate demand, despite recent (and frequent) promises – even with a change in interest rate priorities, liquidity intervention will be as targeted as possible, and measures will be implemented to curb speculation.

Rather, I believe the China impact on crypto markets in 2025 will come from greater support for asset investment, bringing a wave of longer-lasting new money into the market.

See also:

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

I’m not a winter person. Nope, I like sultry summers, watermelon, long days and not worrying about where you put your scarf…

But I am a silver linings person, and I’m determined to enjoy January. So, this week I made a list of what I like about the depressing, sorry, transitional period right after Christmas and New Year. It was unexpectedly easy, and ideas kept flowing once I’d started. I’m sharing it with you today in case it helps cheer you up – and let me know if you have any highly recommended additions!

(photo by Anna Kumpan on Unsplash)

Warm cocktails that involve cinnamon sticks

Days getting longer

Roast root vegetables

Spicy stews

Fluffy socks

City walks

Scented candles

Being up in time for the sunrise

Hand creams

Clearing out cupboards

Snow globes of any kind

Popcorn and old movies

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.