WEEKLY - Crypto in Q4, Tether + Rumble

plus: assorted links, football + community, and more

Hi all, I hope you’re doing well! October seems to have hit the ground running – I hope you’re marshalling your energy, I have a feeling you’ll need it.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days and offer some interesting links.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

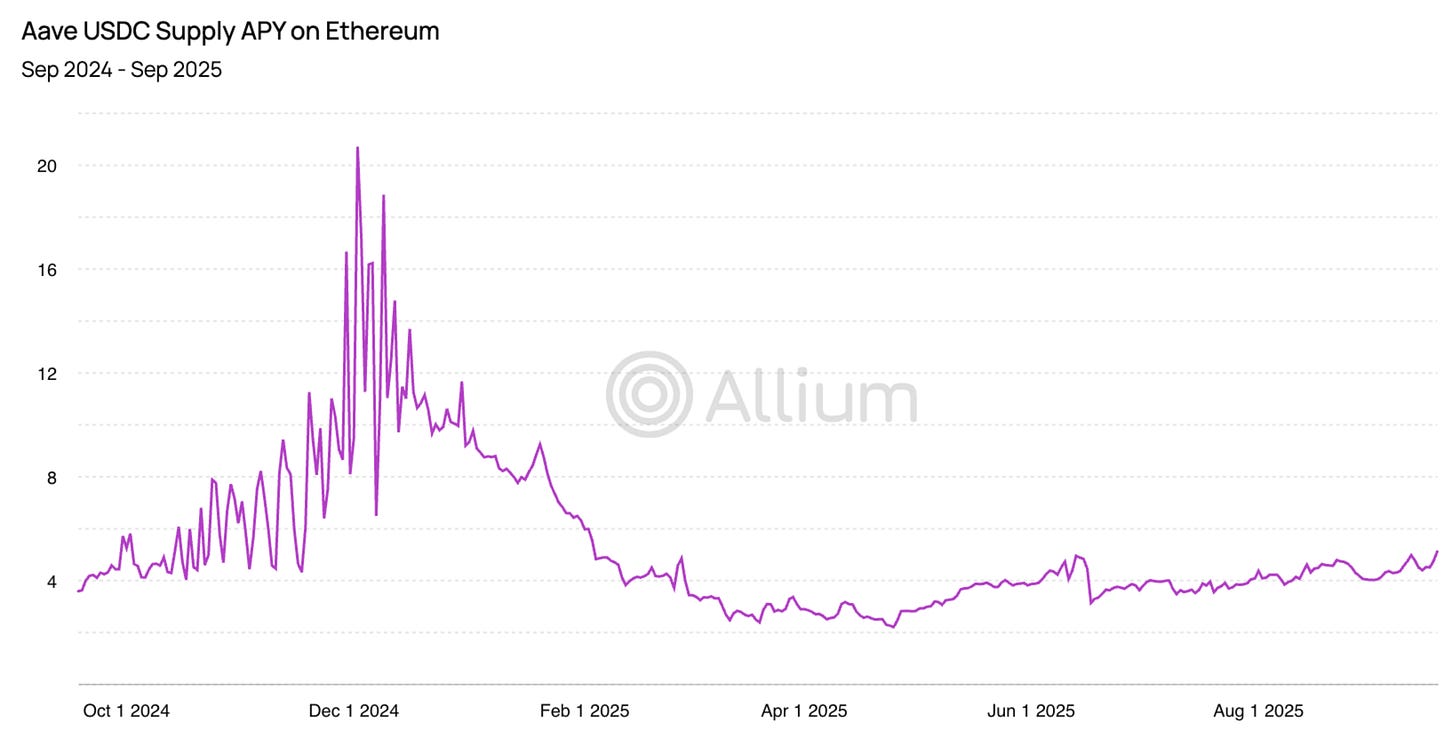

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

In this newsletter:

Looking ahead to Q4: Crypto

Tether, Rumble and AI

Assorted links: government overreach, improv theatre, AI froth, the healing in art, and more…

Football and community and loyalty and love

Some of the topics discussed in this week’s premium dailies:

Coming up: jobs data, shutdown, confidence, Japan elections and more

Turning up the temperature

The waning relevance of the UN, and why it matters

GDP and PCE

The BTC flush

Vanguard’s change of heart

Looking ahead to Q4: Crypto

SWIFT and connectivity

Circle and reversibility

Shutdown jitters

Tether’s valuation

An end to the Gaza conflict?

The Q4 macro outlook

Shutdown and the dollar

US jobs and consumer confidence

Visa’s stablecoin onramp

Nominations withdrawn

How the mighty have fallen

Stablecoins and European markets

Tether, Rumble and AI

A central bank changes tack

Markets embrace the shutdown

Drones, GenZ protests, a US/Qatar pact

The stampede away from globalization

An SEC Commissioner makes fun of crypto

Tokenization in Q4: the new narratives

Stripe’s evolving stablecoin ecosystem

BTC momentum

JPMorgan’s BTC target

Long-term BTC holders

Private sector jobs data

Drones, threats, and more

Looking ahead to Q4: Crypto

(I wrote this on Tuesday so some numbers will be out of date.)

Bull market?

The next quarter is likely to see the start of the crypto bull market. I say “start” because what we’ve seen so far can’t really be called “bullish”. Strong price action among those with market cap greater than $10 billion has largely been concentrated in a handful of names (HYPE, BNB, XRP), and even the +21% and +25% moves of BTC and ETH respectively are not exactly frothy. Well ahead of the S&P 500’s 13%, but not great when you adjust for risk/volatility.

Remove the market caps of BTC, ETH and stablecoins, and the crypto market has grown a measly 7%.

(chart via TradingView)

Nevertheless, spirits seem to be high among crypto natives, many of whom insist we’re just not “ready” for what’s ahead – but I’ve been hearing that all year. And I, too, have been saying for what feels like ages that the tailwinds are strong; indeed, they are now arguably stronger than ever. But uncertainty is pervasive, risk sentiment is inconsistent, AI is the tech flavour of the year and the institutional adoption has been encouraging but also slower than many of us expected.

That said, the delay in the start of the bull market means it will have longer to run. And signs are pointing to some sort of ignition in coming months if not weeks.

Bitcoin

Regular readers will know that I often write about geopolitical developments here, because they are an intensifying tailwind for BTC. As I wrote yesterday, we are seeing signs that the market is starting to take on board the building uncertainty – just look at the gold price and stubbornly high long-term bond yields.

(chart via TradingView)

Even beyond the escalating risk of new conflicts, US inflation is more likely to increase than decrease, increased borrowing around the world will intensify currency concerns, and what’s good for gold is also good for BTC, especially since it is still woefully under-allocated.

(chart by Bank of America via @Callum_Thomas)

Plus, the incoming rush of market support – lower rates, yield curve control and lots and lots of “money printing” – will boost global liquidity, which will seep into the riskier corners of institutional portfolios. For many of the “big money” players, BTC is as “risky” as they’ll be allowed to get.

And the retail market will start to stir. So far, we haven’t seen signs of the typical retail excitement associated with the late stages of bull markets. There have been inflows into the ETFs, but not nearly on the scale as we are likely to see going forward with newcomers finally realizing some “insurance” is a good idea, and those with BTC exposure fearing they don’t have enough. This will accelerate as headlines start to comment on the price increases, and momentum kicks in.

In the crypto world, we’re used to thinking retail will prefer the rollercoaster of smaller tokens, especially when there’s hype behind them. But we forget that our world is still small, and most mainstream retail investors do not consider themselves either traders or risk-takers. Most don’t want to have to check prices every hour. For them, exposure to BTC, ETH and maybe one or two other big names will be risky enough. And, in aggregate, their market influence is huge.

Altcoins

The coming quarter should bring the kickoff of “alt-season”, as attention starts to turn away from the “majors” (BTC and ETH) and towards smaller, more volatile tokens. In aggregate, they haven’t yet done much – the OTHERS index (the total crypto market capitalization outside the top 10 tokens) is down 11% so far this year, and even over the past few months, has not notably moved relative to BTC.

(chart via TradingView)

The catalyst for the kickoff should be a combination of liquidity as central banks around the world deliver rate cuts and other forms of market support (more on this tomorrow), as well as a flurry of big-name token issuances that remind investors of the innovation. Just some of the names I’m familiar with that have plans to issue tokens in coming weeks: MetaMask, OpenSea, MegaETH, Build on Bitcoin, Katana, maybe even BASE…

It’s not so much the token generation events (TGEs) themselves that I’m interested in as the reawakening of interest in the purpose of the web3 ecosystem beyond memes and gambling (nothing wrong with either of those, but they’re not exactly transformational).

Combine this with progress on regulatory clarity around the world, and we’re likely to see a notable mood shift.

Actually, it’s already started. I’m probably not alone in thinking that blockchain building has felt insular recently, with more focus on the big institutions than the upstart visionaries working on the pipes of new transaction layers; and with more emphasis on doing the old stuff on new rails than on blurring boundaries. Ahead, we’re going to be hearing more about layers, DeFi, composability, fractionable yield and probably some things I’m not yet aware of.

Plus, we’re almost certainly going to see a flood of crypto spot ETF issuance, starting soon, now that the SEC has approved a standard framework and has asked ETF issuers to withdraw their filings (with clear rules, they won’t be necessary).

This will add to the overall noise, but it will help “mainstream” some of the smaller tokens as brokers start to help clients allocate some of the “play money” part of their portfolios to riskier ventures – in the process, broadening awareness that the crypto market is not a monolith and not just about macro, that it is about a new technology still finding its feet.

This newsletter is not about to go all “degen” on you, it will continue to weave together the macro and crypto threads, especially as things start to unravel on the big board over the coming months. But I am looking forward to getting back to why I fell in love with this sector in the first place, 11 years ago: creating a new financial system.

DATs

The Digital Asset Treasury (DAT) frenzy will quieten down. We’ll still see new raises and continued buying, but some vehicles created exclusively to offer crypto leverage in equity format will fall by the wayside as market attention wanders, which will spook those that assumed these were a no-lose bet. I haven’t been following DATs closely as I don’t find them interesting, but the flood of filings has been astonishing and the buying demand has been relevant. This will continue as the market heats up, but at a slower pace, and concentrated mainly in the big players.

If you find this newsletter useful, do please share with friends and colleagues. 💖

Tether, Rumble and AI

Earlier this year, I wrote about Tether’s $775 million “strategic” investment in P2P video platform Rumble, musing that we would soon see signs of a rethinking of the traditional media business model. How? By linking stablecoins to video consumption.

An overlooked feature of stablecoins is their suitability for micropayments, something credit card-based commerce has not managed to pull off.

And Rumble prides itself on being censorship-free, which makes the case for a decentralized web of connected wallets rather than centralized payment providers that can have their deplatforming arm twisted.

Well, what do you know, Tether has announced that Rumble will be a key launch platform for its planned US stablecoin USAT. It most likely won’t end up being the only one, but it’s an intriguing partnership for both Tether and Rumble.

The video platform is well-connected: JD Vance’s company Narya Capital was one of the first investors in Rumble, and the Vice President has personally invested, according to filings. And Secretary of Commerce Howard Lutnick was instrumental in taking Rumble public back in the day. But Rumble’s business model is flagging: Q2 revenue was up 12% vs the same period last year, but losses continued to deepen.

Introducing stablecoin wallets and payments will help with reducing transaction costs and therefore boosting margins for the media business. But there could be something more going on here: the nexus between artificial intelligence, stablecoins and media.

The media industry is still collectively trying to figure out the AI business model as it relates to content consumption.

Tether, meanwhile, has been investing heavily in AI functionality, aggressively hiring and developing proprietary platforms. It would make sense for Rumble to harness the margin and revenue possibility of agentic commerce, just as it makes sense for Tether to enter the US market on a totally different track from that of its competitor Circle, which is going after the institutional market.

The result could end up being not just an eager market for USAT, but also a step forward in the business model powering the creator economy. And, unlike most stablecoin platforms that take traditional finance and make it better, what Tether seems to be focusing on is: what can stablecoins do that hasn’t been done before?

See also:

🌟 Interested in how the rapidly changing geopolitical landscape is impacting crypto? Me too! 🌟

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

This Doomberg post may seem like an article about climate regulation, but it’s really about whether individuals should be able to make whatever they want if it’s for personal consumption. (In the Aggregate, Doomberg)

Mario Gabriele has penned a fascinating account of how improv theatre can help with life. It’s not what you think, it’s not about confidence or being able to react – it’s about status, space, responsibility and gaming the plot. (Palantir’s Weirdest Book Recommendation, The Generalist)

The insidious creep of antisemitism in the West is reaching truly alarming levels, and most are avoiding even talking about it because the topic is “controversial”. Not Ayaan Hirsi Ali, who has published a searing blast against the tolerance of intolerance. (The Manchester Attack and the Subversion of Britain, The Free Press)

Ted Gioia writes about the healing in art, the danger of irony, the fragmentation of society, the crisis of loneliness, the power behind the screen and what all of this has to do with one of America’s great writers. (David Foster Wallace Tried to Warn Us About these Eight Things, The Honest Broker)

You might have heard some rumblings of skepticism over the expectations of return on the eyewatering capex plans for AI infrastructure. Derek Thompson packages the doubts into an eloquent and alarming package, while recognizing that the potential is real. (This Is How the AI Bubble Will Pop, Derek Thompson – paywall, but the podcast is free to listen)

Oliver Bateman dives into the relationship between Halloween decorations and “doom spending”, touching on cultural trends, relative value, recycling, the commodification of everything, the economic outlook, emergency rooms, the constraints of adult life and the real “skeleton in the closet”. Warning: you will probably never look at whimsy through the same eyes again. (The Work of Giant Yard Skeletons, Oliver Bateman Does the Work – paywall)

The crypto community no doubt still vividly remembers the almost biblical flood at the crypto conference in Dubai in April of last year. It turns out it was not a “freak storm” after all. Bloomberg’s Kit Chellel has unearthed evidence and collected witness accounts that suggest it was the result of cloud seeding – a controversial practice used to trigger rain. The result is a compelling account of how cloud seeding works as well as the timeline leading up to the deluge, how most media misreported the events and how official accounts still deny it was anything other than “climate change”. (What Really Happened in the Storm Clouds Over Dubai?, Bloomberg – paywall)

If you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

With the kickoff of the League, weekends now mean football at my house (soccer for you Americans). Personally, I find the games too stressful, while accepting that the catharsis is part of the point. The bigger point for me, however, one that I can observe from the sidelines, is the community. The loyalty. The flattening of social boundaries, the opening of doors. The shared thrill of the win and the grief of the loss.

The part I most enjoy is watching my son and his father hanging out together, intensely focused on the screen, forgetting to breathe at the same time, shouting at the same time. Rather than the game, I love watching them and their bonding dialogue that doesn’t need words.

Which brings me to this video for Liverpool, my son’s favourite team. It’s about belonging and friendship and faith, and it always, always makes me cry.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.