WEEKLY - digital euro + Bitcoin mood

plus: digital competitiveness, assorted links and more

Hi everyone! I hope you’re all doing well and are taking care of yourselves – this news flow may feel like a sprint, but it’s actually a marathon, so conserve your stamina.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days and offer some interesting links.

Some news: I have finally launched Cripto es Macro, a “light” version of this newsletter in Spanish. It felt like a logical step as 1) I live in Spain and 2) a few readers have asked for it. For now, it will publish 2-3 times a week, it will share less content than this newsletter, and it doesn’t have access to the archive. Also, for now, it’s free – it will move to paid probably in a month or so. If you know anyone that might be interested, do please let them know!

My latest American Banker op-ed is out (paywall): I look at white-label stablecoin issuance, from the legal aspects (cloudy) to the impact on our understanding of money (which is kinda wild when you realize we’re effectively talking about branded money).

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

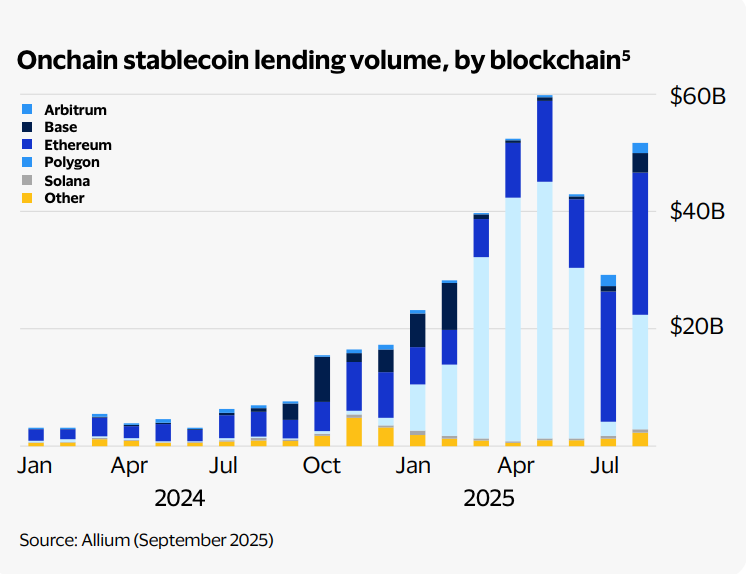

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

In this newsletter:

Bitcoin’s IPO

More roadblocks for the digital euro

Digital competitiveness

Assorted links: moral certainty, nuclear testing, Europe’s lack of humility and more

Weekend: vicarious train rides

Some of the topics discussed in this week’s premium dailies:

Coming up this week: lots of Fedspeak, Supreme Court, US jobs, ISM, China inflation

Stablecoins and power

Bitcoin’s “IPO”

Macro-Crypto Bits: DXY and gold

The Supreme Court and tariffs: volatility ahead

Macro-Crypto Bits: blech markets, liquidity squeeze, US manufacturing

More roadblocks for the digital euro

Basel stubbornness

Macro-Crypto Bits: ouch, bank liquidity, Supreme Court odds, digital competitiveness

The stablecoin scramble: Canada, UK, Switzerland

Size matters: Hong Kong relaxes crypto exchange rules

A different type of tariff turmoil

Macro-Crypto Bits: US payrolls, US services activity, market divergence

Apollo Global: from onchain funds to onchain lending

Macro-Crypto Bits: markets glum, US layoffs not great either

Bitcoin’s IPO

In a well-written and a refreshingly original take on crypto markets, Jordi Visser puts the recent BTC market indifference in the framework of traditional finance, and suggests that it’s going through what is the equivalent of an IPO. In tradfi, that is when insiders sell out to more mainstream investors – for insiders here, read “long-term investors”, who we know from onchain data have been selling (I’ve been writing about this).

“It’s not a moment of failure, it’s a moment of success. The company doesn’t die during its IPO. It transitions. It matures. Ownership becomes distributed.”

That does explain why we’re not seeing weakness, as long-term holders are careful sellers. But we are seeing a counterweight to new entrants coming into the market, which is keeping the price muted.

(BTC/USD chart via TradingView)

Only, old-timers are not selling because they no longer believe. They’re selling because it’s time, and because they know that they can in this liquid, deep market without triggering any distortions.

“The sellers aren’t selling because they’ve lost faith. They’re selling because they’ve won.”

What we’re seeing is a changing of the guard, from old investors to new investors – and, in retrospect, Jordi is right, it’s natural.

It’s also good for the market in that it more widely distributes the investor base, from early believers to more mainstream holders, both small and large. From narrow to broad.

“The OG whales are having their liquidity event. Let them. They earned it. And what they’re leaving behind is a Bitcoin that’s stronger, more distributed, and more resilient than the one they accumulated.”

As I’ve written before, this is one of the key reasons I don’t think the four-year cycle holds any more, which is relevant since we’re at the four year mark now: the market is no longer driven by the factors of its early days.

More roadblocks for the digital euro

Earlier this week, the European Parliament met to discuss the digital euro. But it does so amid increasingly vocal opposition.

Fourteen European banks, including Deutsche Bank, BNP Paribas, ING and others, are warning that the digital euro will undermine private sector payment systems – such as Wero, their alternative to Mastercard, Visa and PayPal.

I confess I hadn’t looked into Wero before, as it’s not yet available where I live (Spain) – but according to some cursory research, it’s popular in Belgium, France and Germany where it launched as a pilot last year. While not yet pan-European, its aim is to get there within the next couple of years.

So why, again, do we need a retail digital euro?

We don’t – and Fernando Navarrete Rojas, the European MP charged with ushering the digital euro legislation through Parliament, agrees. He points out that the ECB project addresses the same use cases as private solutions, “without offering any clear added value for consumers.”

He is arguing for a significantly scaled-down digital euro proposal.

In a draft report published on Monday (download link), he suggests some pretty big changes to the EU draft digital euro legislation.

He proposes that the digital euro be limited to an offline solution, leaving online money to commercial bank and other private sector systems. That way, it would represent a digital evolution of cash rather than support the expansion of territory the ECB deems necessary.

He suggests that legislators first establish that a pan-European private payments system doesn’t and can’t exist before proceeding with an online central bank digital currency.

He would like the text to point out that other major economies have ditched retail CBDC plans to focus on wholesale.

And he proposes swapping out language highlighting political support back in 2022 for the digital euro study with the need to consider whether the digital euro addresses “clearly defined problems”, and that it be compared to the “best available market alternatives, in line with necessity, proportionality and opportunity-cost tests”. That’s a hefty dunk.

His text changes will be hotly debated – this is still a draft, after all. And many in Parliament do support the digital euro idea. But Rojas has the backing of Germany’s most powerful bank lobby, which insists that the current plans are too expensive and offer “little tangible benefit for consumers”.

I do think the digital euro is done for – I’ve said this many times before, and convincing signs continue to emerge. Such a seismic change to Europe’s banking industry would need overwhelming political and industry support to get through the tortuous process of legislation without being watered down into irrelevance. Rojas’ draft tells us that the watering down has started.

See also:

Why we won’t get a digital euro, despite the ECB’s insistence (Oct 2025)

The digital euro hits a wall (Sept 2025)

The digital euro gets shakier (July 2025)

The race to the digital euro is getting tense (June 2025)

The digital euro: more smokescreens (March 2025)

If you’re a premium subscriber, thank you! ❤

If not, you could be getting SO much more out of this newsletter! Deeper and more frequent commentary on the crypto/macro overlap; economic takes; market vibes; geopolitics + why it matters; plus links, music and more. ✨

Digital competitiveness

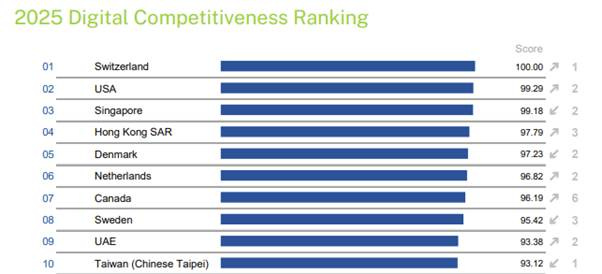

Every year, the International Institute for Management Development (IMD) publishes a ranking of “digital competitiveness”, which in its lexicon means “the capacity and readiness … to adopt and explore digital technologies as a key driver for economic transformation”.

It researches and canvasses 69 countries, talking to business leaders and government officials, and compiles its findings into an index that reflects “digital savviness”.

The number one spot in the ranking this year is claimed by Switzerland, which moves up from second.

That place is taken by the US, which has climbed two levels but is held back by the Talent ranking and the Globalization impact.

Singapore comes third, dropping from first.

Perhaps most intriguing of all is Hong Kong’s climb of three places to take fourth, while China sits at 12th.

(chart via IMD World Digital Competitiveness Ranking)

Spain, where I live, is 29th. Italy is 40th. Most of the EU, unsurprisingly, does not shine, with the exception of Denmark (fifth) and Netherlands (sixth).

Do these rankings matter? In detail, no, but stepping back they are a useful gauge for investment in systems and integration. The Hong Kong move is relevant for its goal to unseat Singapore as Asia’s fintech capital, and for its role as gateway into the massive Chinese market. Blockchain technology is mentioned in passing a couple of times in the study, more out of concern for regulatory fragmentation and overlapping yet contradictory priorities from various organizations.

But for connectivity, arguably a key component of digital readiness going forward, blockchain will no doubt play an increasingly significant role.

🍂 If you find this newsletter at all useful, would you mind sharing with colleagues and friends and nudging them to subscribe? I’d appreciate it! 🤗

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Jacob Shapiro wonders why the US military is sending battleships to the area just off the Venezuelan coast, and what an action against Maduro could mean for the region and for the US. (Is the U.S. about to invade Venezuela?, Intersubjectively transmissible)

On Europe’s lack of humility and what it could end up costing. (Strategic Humility, The Brawl Street Journal)

A powerful essay from Noah Smith lamenting the end of moral certainty – after WWII, we all knew the face of evil and vowed to never let that inhumanity resurface again. After 80 years of peace, we’ve diluted certain hot-button terms beyond recognition and we can’t agree on who the bad guys are. And even if we did, the “good guys” no longer have the industrial capacity to fight for what’s right. (The Great World War 2 Afterparty is over, Noahpinion – paywall)

A sobering piece by Andreas Kluth on the secondary effects of a resumption of nuclear testing, including angering residents of Republican states and giving China an asymmetrical advantage in knowledge gained. And about that Nobel Peace Prize. (Just the Threat of US Nuclear Testing Is Bad Enough, Bloomberg – paywall)

An eye-opening report from the Financial Times with exclusive comment and spectacular graphics on the frustrated development of Saudi Arabia’s ambitious Neom project. (End of The Line: how Saudi Arabia’s Neom dream unravelled, Financial Times – paywall)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

I have just discovered (thanks, Jonathan!) 4k Cab Views on YouTube. Train drivers stick a camera on the dashboard and record as they tootle through mountains, glens, towns, valleys… They’re hypnotic and uplifting, ideal for when your brain is in knots and yet you still want to move forward.

My favourites so far:

Scotland

Switzerland

Norway

Bosnia and Herzegovina

Japan

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.