WEEKLY - five years ago, things changed

plus, crypto IPOs, and maths vs surveillance

Hello everyone! I hope you’re doing well!

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the week, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one! For $12/month, you’ll get ~daily commentary on how crypto is impacting the macro landscape, and vice versa. I talk about adoption, regulation, tokenization, stablecoins, CBDCs, market infrastructure shifts and more, as well as the economy and investment narratives.

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

Five years ago, things changed

Crypto IPOs

Some of the topics discussed in this week’s dailies:

Memecoins: a step too far

Newsletter stuff

Macro impact: In the room

Five years ago, things changed

Crypto IPOs

Glimmers of institutional momentum

Custody competition

Why Germany’s election matters

Five years ago, things changed

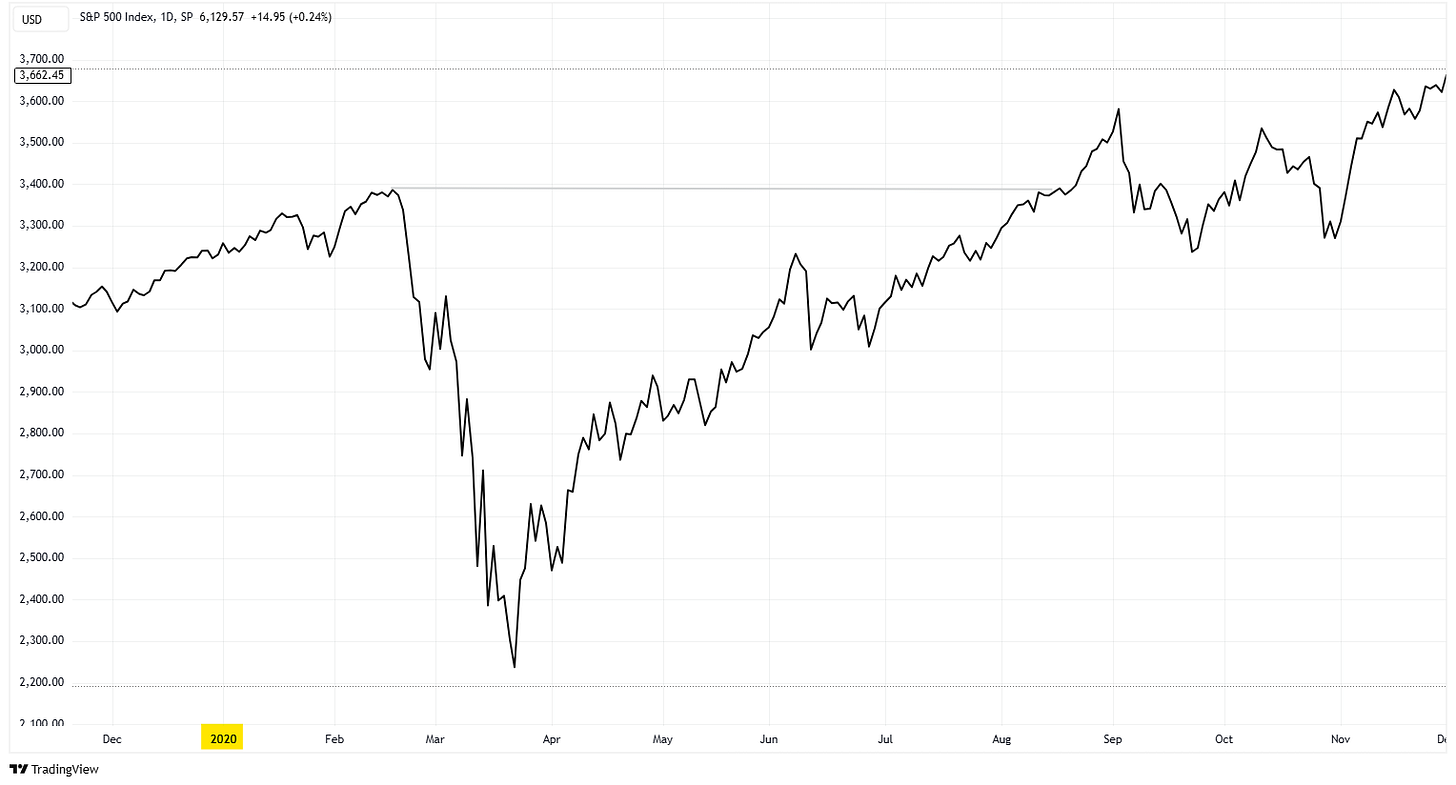

On February 19, 2020, the S&P 500 reached a new all-time high of 3,383.10. Things were chaotic as always, politics was getting people upset as always, and there was ample concern about reports of a virus in China. But almost no-one realized what was about to happen.

The next day, stock markets started to show some weakness on fears the slowdown of activity in Asia could impact earnings.

Within just over a month, the S&P had lost 34%.

(S&P 500 in 2020, chart via TradingView)

Earlier that week, some analysts were suggesting the outbreak in China was being successfully contained and quarantines would soon be relaxed. Tech stocks were benefitting from earnings estimate upgrades, and monetary policy looked stable.

And yet, there were signs.

By mid-February of that fateful year, the World Health Organization reported over 74,000 cases in China, with more than 2,000 deaths; elsewhere, the number of reported cases was up to 900, and three people had died.

In markets, the CEOs of transport companies such as A.P. Moller-Maersk and Air France were issuing warnings. Apple said the virus-related supply chain disruption would cause it to miss sales targets. Nissan was talking about closing down plants. And several industry events were being cancelled as the number of cases climbed.

Yet it took a big-name analyst report to spook investors. On February 19, 2020, Goldman Sachs issued a note suggesting that investors were underestimating the potential fallout. “A sustained bear market does not look likely,” analysts wrote, but “a near-term correction is looking much more probable.”

They were correct in that the bear market ended up not being “sustained”. The fall was short and sharp enough to spook central banks and governments around the world to print enough money and organize enough handouts to cushion the damage. Within six months, the S&P 500 had recovered losses, and would go on to smash one all-time high after another. Today, it is 169% higher than the March trough, 78% higher than the February peak.

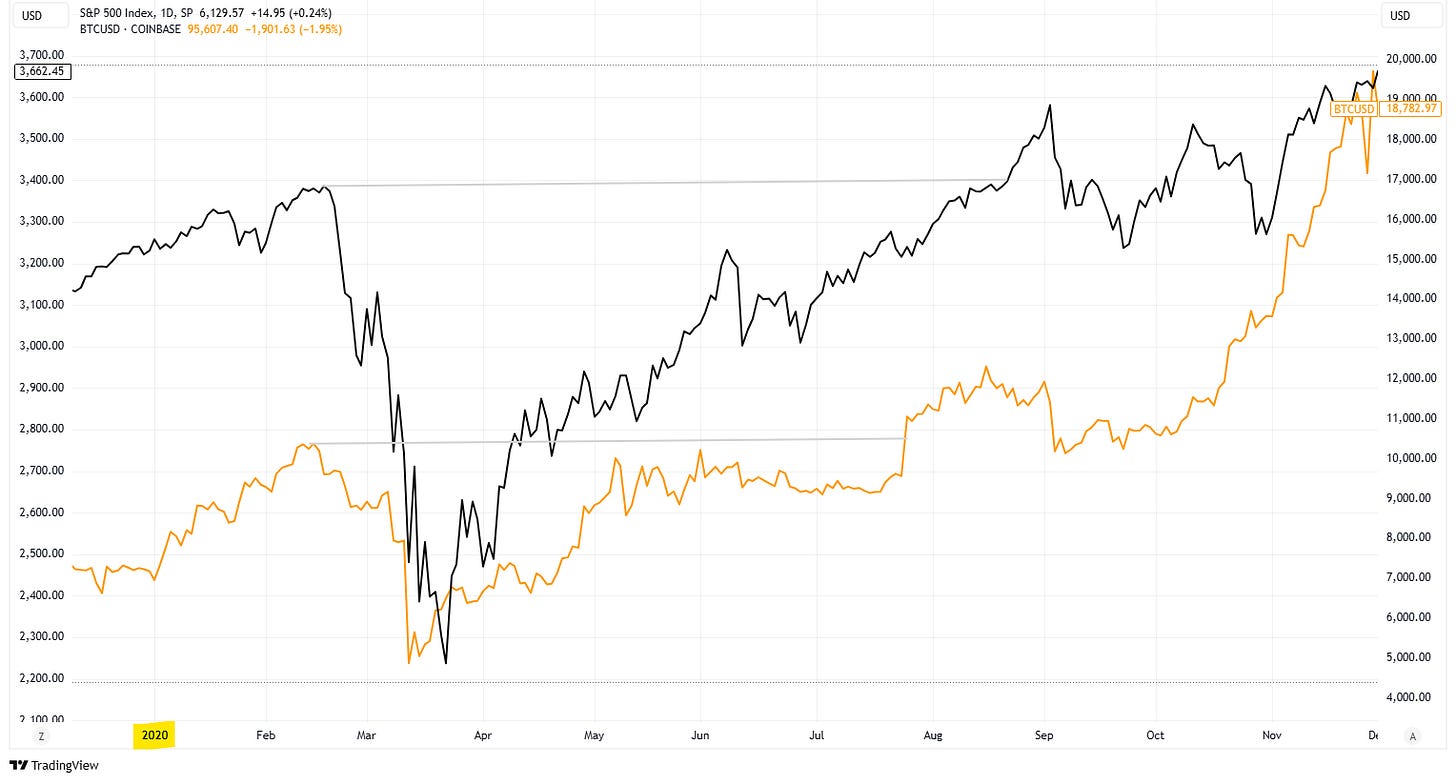

BTC followed a similar pattern – it peaked a few days earlier, on February 14, at $10,371. It dropped by much more, and it did so faster – in less than a month, it had lost 76%. It recovered faster, as well, and even after a dire 2022-2023, its outperformance is notable. Today, BTC stands a proud 833% higher than its February peak, and an eye-watering 3,800% above its March 2020 low of $2,480.

(S&P 500 and BTC in 2020, chart via TradingView)

The reason I bring this up today is not just for the sake of respecting this week’s anniversary, although I do believe it was an important moment in our history. It’s also not just because I enjoy looking back to remind myself of how far we’ve come, and how some patterns repeat while others don’t (regular readers will know that I do a biweekly lookback at what I was writing about a year ago, to gauge progress and to hold myself accountable).

No, it’s also because I believe we could all use a reminder every now and then of how viruses, trends and worries can spread fast, and how institutions themselves are navigating unchartered waters. All this makes predictions both harder and more futile than ever.

In an uncanny coincidence, I’m halfway through Adam Tooze’s book “Shutdown”, which chronicles the global economic impact of the pandemic. My main takeaway so far is how dependent we have become on centralized financial institutions, and the risk we take in assuming they will step in again if necessary. It’s a reasonable assumption, but one that, even if correct, underlines the interconnected risk inherent in an increasingly financialized and politicized society.

We hear this in crypto often: “Here comes the money printer!” They did it once, they’ll do it again, especially now that they know it works. If that assumption turns out to be correct, risk assets will do well. But underlying fragility will become even more brittle, putting economies and geopolitical balance at risk.

If the assumption is not correct, if the Fed’s influence is no longer enough or if the US is itself undergoing a crisis of trust, then what? I imagine safe havens would do well.

Either way, we’re now at an interesting nexus in which we expect more centralized help even if it costs us economic resilience, while at the same time we recognize that structural and societal risk is rising. This could go some way toward explaining the growing popularity of the “barbell” portfolio strategy: increased weightings of both risk assets and safe havens.

Anyway, back to February 19, 2020. While digging through archived news from that day, I came across two reports that you might find interesting.

One was on that night’s Democratic primary debate, featuring Bernie Sanders, Elizabeth Warren, Michael Bloomberg, Steve Buttigieg, Amy Klobuchar and Joe Biden. At the time, Sanders was well in the lead with 27%, Biden was trailing far behind with 15%, and hot on his tail with 14% were Michael Bloomberg and Elizabeth Warren. Like I said above, things can change fast.

Another was a report from the head of Trump’s Council of Economic Advisers Tomas Philipson, who acknowledged that the President’s trade stance had depressed economic growth and business investment.

“Uncertainty about trade policy is one often-cited culprit in the manufacturing slowdown,” he wrote, acknowledging that China’s deceleration also played a role. He added:

“These reasons make it difficult to isolate the effects of trade policy uncertainty, and possibly result in an upward bias of its effects on the global economy.”

Again, this is from Trump’s own economics chief. And first-term tariffs were not nearly as hard-hitting as the second term’s could be, if the threats come to pass.

It’s worth bearing in mind.

Crypto IPOs

This week, Bitcoin financial services firm Fold debuted on Nasdaq, via a merger with the special purpose acquisition company (SPAC) FTAC Emerald Acquisition Corp. It will trade under the symbol FLD.

Several others are poised to follow it this year. From what I can gather, paperwork has been filed for:

And reports suggest the following are considering it:

There’s probably several that I’m missing, and I intentionally haven’t listed those that talked about it years ago but have since gone quiet on the topic.

This coming flow matters not just for the funding of crypto businesses, and the availability of a wider range of assets offering crypto investment exposure.

It’s also hugely significant for what we can learn from their accounts. Crypto businesses have typically been chaotic, struggling with a range of issues such as banking access, dubious funding sources, lax internal security and immature leadership. (Of course, there are notable exceptions!)

But, I for one am looking forward to seeing how exchanges beyond Coinbase manage order books, how they are structured, who their key people are, and which markets are delivering the most growth. The greater the number of public crypto companies, the more information we have on how crypto businesses work. Plus, the more “establishment” the industry becomes, the greater the potential to disrupt traditional finance.

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

I’m halfway through the Apple+ series “Prime Target”, which is based on the intriguing premise that “mathematicians are the most dangerous people on the planet”. That is a quote from one of the surveillance characters, and just one example of many of the deep issues raised in this surprising thriller.

The point the security services make is that finding patterns in prime numbers could unlock cryptography. I haven’t yet had time to dig deeper into how accurate this is – regardless, it speaks to the weaponization of code, of which we have so far seen isolated yet painful examples such as yesterday’s Bybit hack. It’s not hard to imagine the chaos should this kind of attack become more common, nor is it hard to imagine that actually happening.

Another question raised is: how far should surveillance go in the name of protection? Instinct and emotion tell us that human life comes first, but what if a handful of intellectuals threatens to undo the rails on which global finance and therefore society operate? What if they’re actually good people, with knowledge and science as their only motivator? Do we block progress for the sake of security? Is that even possible?

Surveillance and mathematical exploration are an uncomfortable and yet gripping pairing that raises some deep questions.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.