WEEKLY - power grabs, wholesale CBDCs

plus: capitalism, elites, Davos, wildlife photography and more

Hi all, I hope you’re doing well! Is it just me, or are the weeks flying by?

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days and offer some interesting links.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

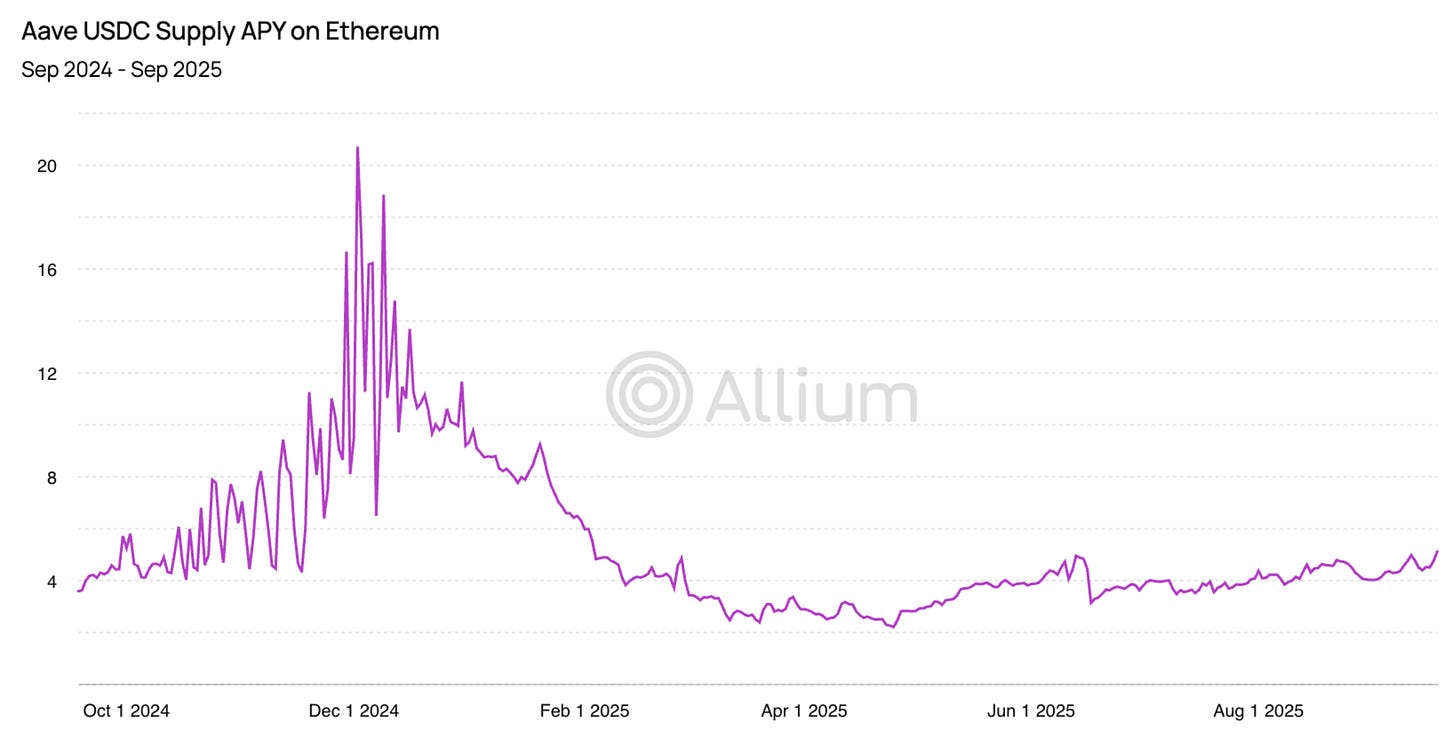

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

In this newsletter:

Who governs?

The EU’s wholesale CBDC takes shape

Assorted links: capitalism, Davos, elites, globalism and more

Weekend: Wildlife Photographer of the Year

Some of the topics discussed in this week’s premium dailies:

Coming up: some big geopolitical events, a lot of economics meetings, Q3 earnings and China activity

US and China: Scoring points and own-goals

Crypto markets: misconceptions and lessons learned

The EU’s wholesale stablecoin takes shape

Diplomatic spats move markets

Scepticism and the institutional stablecoin rush

Macro-Crypto Bits: nervous markets, systemic risks

Also: a dangerous EU precedent, crypto politicians, Luxembourg

Who governs?

Macro-Crypto Bits: growth, China, NFIB, yields, crypto market cap

Also: gold mania, the Fed, Gen Z, nuclear reactors and more

Playgrounds and mirrors: the US/China spat gets crazier

Stablecoin scaremongers

Macro-Crypto Bits: US inflation, business mood, market complacency

Also: another bank stablecoin, another provocation

Stablecoins and lending

Macro-Crypto Bits: credit fears, gold craziness, transparency

Also: protests, a new type of bank, blurring market boundaries, common market

Who governs?

Here’s an important question for you: who do you think should decide how much tax you pay?

My answer would be the government of the jurisdiction in which I am domiciled. The same goes for my business, if I have one. We can quibble about the rate, but the government provides me and my business with valuable services, even beyond the essential pillars of infrastructure and the protection of law.

Taxes should not be decided by the United Nations, which is accountable to no-one, and does nothing useful (created to maintain world peace, where were they during the Israel-Gaza negotiations?).

This week, the International Maritime Organization (IMO), a UN body based in London, votes on a “net-zero framework” for shipping which will impose a tax on ships that emit carbon-dioxide above a certain limit. The amounts discussed are not enormous – perhaps an annual take of $10-12 billion – but they’re not nothing, and the administrative burden will add further friction to the already struggling transport industry.

Much more relevant is the principle: who gave the UN the power to add more cost to the goods you buy?

We can agree that trying to slow down climate change is good, but we can also acknowledge that taxing emitters will do nothing for that.

The reason I bring it up is that it is painfully relevant to the macro-geopolitical shifts I talk about in this newsletter: power expands until it is stopped.

Centuries ago, it could expand outward, exploring and conquering new territories. Now, the earth is explored, space is expensive, and invading your neighbour is frowned upon.

So, the expansion is inward, funnelling deeper into our lives and stealthily carving out more of our economic activity. It’s an inevitable trend, and even revolts do little more than reset and pause before embarking on what power always does – take more.

This is one of the many reasons the rapid evolution of crypto markets and services is so important as the power grab accelerates. Digital resistance: it’s not just about the significant value of a hard asset at a time when power is bought by printing as much money as is needed; it’s also about the possibility of existing outside the centralized systems when someone in authority notices you’re alarmed about their plans.

Back to my original question: who should be able to levy taxes that, directly or indirectly, affect you personally? Inherent in that thought process is the very essence of our contract with government, which we tend to forget about in the noise of daily life. It’s worth examining every now and then, especially in this era of over-reach.

If you find this newsletter useful, do please share with friends and colleagues, and nudge them to subscribe? 😃 I’d appreciate it!

The EU’s wholesale CBDC takes shape

Messaging from the European Central Bank (ECB) around CBDCs is shifting. After a barrage of posts from officials over the past few weeks about how the retail-facing digital euro would make our daily lives so much easier, last week we got a breath of fresh air from an unexpected source.

On Thursday, the governor of the French central bank, François Villeroy de Galhau, gave a speech at the Fintech Forum in Paris. He repeated the ECB’s warnings about dollar stablecoins introducing a “disorderly proliferation of private settlement solutions and a growing dependence on non-European and unregulated players”. And, true to form, he suggested that the solution was more regulation: MiCA’s rules should be tightened to dissuade multi-jurisdiction issuance of stablecoins (for instance, USDC is issued in under US and EU rules). Sigh. By making euro stablecoin issuance even more limited in potential for the large players, it won’t be the first time EU regulation achieves the opposite of what it intended.

But then the governor pivoted to a summary of the ECB’s work on a wholesale CBDC. We haven’t heard much about this, as the messaging has been full-on promotion for the retail-facing digital euro. Villeroy de Galhau acknowledged as much, that the wholesale project was “less well known and less high-profile” than the digital euro, but emphasized that “it is even more important” (yes!) and that it has “become a high priority: we must accelerate our efforts”. This is a big deal – there is a strong case to be made for wholesale digital central bank money (wCBDC), none at all for the retail version.

The work ahead has two phases:

1) Next year, we should see the launch of the Pontes pilot which will test the settlement of tokenized assets using central bank money, either via a connection between distributed ledgers and the TARGET settlement network, or on a new Eurosystem distributed ledger.

The former option was a key feature of the recent ECB trials (I wrote more about them here), and involves inserting a step that syncs the distributed ledger on which tokenized assets move with traditional payments rails. The advantage is that it’s a relatively low lift for banks, which makes adoption more likely; the disadvantage is that it severely limits the harnessing of blockchain efficiencies, and could become entrenched enough to dissuade the further step to full blockchain integration.

2) The Appia project is working on a shared ledger where tokenised central bank money, commercial bank money and assets can interact. This one is especially interesting, given its potential to “help overcome many technical obstacles to the integration of European capital markets”.

By this, Villeroy de Galhau is referring to the stubbornly fragmented nature of European finance – I wrote about this last week, how the EU has a common currency but still doesn’t have either banking or capital markets union, which hinders raises and returns. Without a unified capital market, Europe can’t develop a deep and liquid pool of “safe” capital that can back the stablecoins central bankers such as Villeroy de Galhau think it should issue. And, national variations in the application of the MiCA crypto framework add friction.

But, the emergence of an EU digital market could change that. Moves are afoot to move all MiCA-related enforcement under the umbrella of the markets regulator ESMA, rather than leave it in the hands of national authorities – a necessary step for the development of a bloc-wide digital market.

See also:

In this free weekly newsletter, I re-share a couple of posts from the week - but you could be getting SO much more if you upgraded to premium. 🙏

You’d get ~daily commentary, useful links, a deeper understanding of the geopolitical shifts shaping crypto (and vice versa!) as well as my deep appreciation. 🌼

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Chris Miller compares the growth of global auto manufacturing in the 1930s – which involved tech transfer and localization requirements – to the scramble for industrial independence today, and questions whether what we’re seeing is the end of globalization, or its remaking. (The ‘War of the Factories’, Chris Miller’s Newsletter)

This piece by Alex McCann on salaries vs rewards is both harshly sobering and oddly uplifting, and left me feeling hopeful for the next generations. (The Epidemic of Wasted Talent, Still Wandering)

Bleak for sure, but worth thinking about even if you don’t agree: Douglas Rushkoff argues that “the wealthiest among us genuinely believe that the systems through which our society organizes itself are breaking down”, and that they prefer to accelerate and control the destruction of society to ensure their survival. I don’t agree, and certainly don’t subscribe to his level of cynicism – rather, I am convinced that many billionaires very much care about humanity, and did set out to make life better for people. But Douglas’ viewpoint is worth considering if only because it seems to be widely held and perhaps even self-fulfilling. (The Intentional Collapse, Rushkoff)

Jonathan Levy writes about on the constant tension between capitalism and democracy, and how the widening chasm of inequality inevitably leads to resets. (Capitalism and Democracy Often Clash in America. They Usually End Up Better for It., Wall Street Journal – paywall)

Mercedes Ruehl, writing for the Financial Times, delivers a fascinating dive into the disintegration of the World Economic Forum and its flagship event in Davos, at a time the multilateral global order it champions is also crumbling. Can it reinvent itself, in a world that no longer believes in elite consensus? Or has it already ceded power to similar events in the Middle East, China and Munich, more willing to tackle controversial (or less “woke”) topics such as defence spending, media control and cracks in democracy? (The Davos set in decline: can the World Economic Forum save itself?, Financial Times – paywall)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

It seems to be photography contest season, so today I’m going to share some of my favourites from the latest Wildlife Photographer of the Year 2025. You can see all the finalists and winners here (warning: some of them are scary and there seems to be a preponderance of snakes this year).

photo by Stefan Gerrits

photo by Luca Lorenz

photo by Willie van Schalkwyk

photo by Roberto Marchegani

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.