WEEKLY - resolutions and dominoes

plus: assorted links, music discoveries and more

Hi all! I hope you’re doing well and taking care of yourselves. Finding sparkle in January takes a bit more effort than in December, but it’s worth it.

✨

If you speak Spanish and are interested in a less frequent, shorter update on developments in the crypto-macro intersection, you can subscribe to Cripto es Macro here.

✨

My latest op-ed on American Banker suggests that eye-watering forecasts for dollar stablecoin adoption in coming years will run into the wall of local politics (paywall, sorry!) – “Broad global uptake of dollar-denominated stablecoins is no sure thing”.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

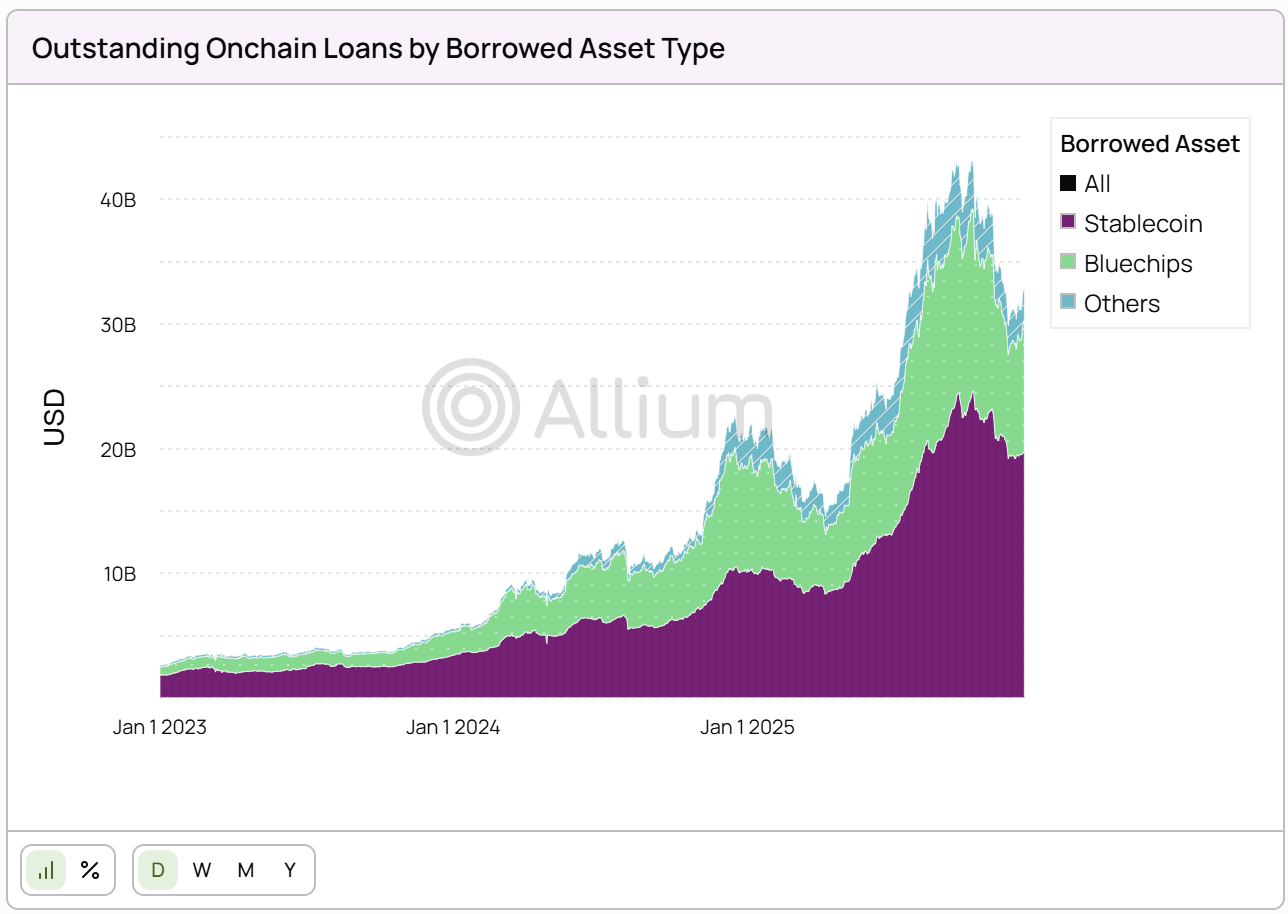

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

In this newsletter:

This newsletter’s New Year’s Resolutions

Greenland: another geopolitical domino?

Assorted links: glamour, food, games, lack of vision, the right questions

Weekend: my top music discoveries of 2025

If you’re not a subscriber to the premium dailies, I hope you’ll consider becoming one? You’ll get access to market commentary as well as adoption insight and industry trends. Plus, links and music recommendations ‘cos why not…

Some of the topics discussed in this week’s premium dailies:

Coming up: US jobs, economic activity and more

The geopolitical drums

The market reaction: numb?

New Year’s Resolutions

Greenland: another geopolitical domino?

Macro: US activity weakens

Markets: stock taking

Digital euro deadlines

Stablecoin interest: the deeper issue

Macro: US jobs

Macro: US services activity

The big deal this week: geopolitics

Markets: quiet for now

China’s digital yuan changes shape

Tariff policy alternatives

Macro: trade and GDP

Macro: US job cuts

Macro: US wage inflation

New Year’s Resolutions

A controversial topic, I know, but I do love New Year’s Resolutions. The self-reaffirming goalpost, the promise of growth and achievement, the chance to think about the kind of person you want to be (yes, even at my age) and the opportunity to plan steps to get there. Of course we can set ourselves either modest or ambitious destinations at any time, but there’s something about the “new beginning” implicit in the change of the calendar year that gives fresh objectives a solemn heft and a ceremonial glow.

My list includes the usual – read more, walk more, work less, clear cupboards – as well as a few that affect this newsletter, so I’ll share these with you.

Before I do, I want to thank you for being here. I write for you, and I’m so grateful that you read what I put out. You are appreciated, and I feel privileged to be able to spend time thinking about what matters as well as what you might find interesting.

Right then, this coming year:

1) I plan to continue production as before, publishing daily although with gaps here and there.

Some have suggested I drop the frequency in order to go deeper, to write longer “think pieces” which would be more value-add for readers than a barrage of regular comment. That does sound tempting as I am often frustrated at the lack of time to do big-picture sweeps, and the additional schedule flexibility would be liberating. But I believe I can be more useful to you with shorter pieces, especially as things are moving so fast. Plus, the pressure of a daily deadline is productive, and the exhilarating click on the Send button marks a divide in my work day after which I can stretch my legs, grab something to eat, and then give some focus to other things.

2) Because of these other things, I am going to try to publish earlier – my goal is now 2:00pm CET but, realistically, it’ll be 2:30pm.

A big part of what bogs me down every day is the urge to share fresh developments with you as soon as they happen, which means skimming all my main news sources plus X first thing – enjoyable for the news adrenaline rush, but too noisy for actual thinking. While bringing you a summary of relevant headlines would be fun, there are other sources that can do that probably better than I could (BitDigest is a good example). Going forward, I will endeavour to write before skimming, which means my comments will occasionally be timely, but more often not. I see my role as piecing together a puzzle, not winning a race.

3) About these “other things”: I’m reluctant to say much about this yet as it’s early days, but I will be trying out new formats this year.

I reluctantly had to acknowledge earlier last year that I just can’t do audio recordings of this newsletter – the production part was so frustrating, and it didn’t feel like a good use of my scarce hours at a time when I was anyway feeling overwhelmed by all I wanted to learn. I tried relying on an AI voice app for a while, but in the end I couldn’t stomach how fake it felt. Apologies to all of you who want audio, I do get that it’s more convenient for many.

But that doesn’t mean I won’t be producing audio – just that I won’t be reading out what I’ve written. More to come on this, as well as other new written and live formats.

4) I will continue to focus on the topics I care about, all tying in to how crypto is impacting the macro landscape and vice versa (I wrote more here about why this matters now more than ever).

There will, of course, be a heavy weight of stablecoin, CBDC and tokenization comment, but by no means exclusively (if you’re interested in a more focused approach, I recommend following Currency of Power and/or The Peg). I’ll also be writing about geopolitics as the breakdown of the old order accelerates, economics as orthodox beliefs get thrown out the window, DeFi as institutions reluctantly warm to the idea, regulation as governments belatedly wake up, markets as the narratives seep beyond exchanges, currency management as financial systems fracture, social trends as unrest and new networks shape the next generation, and a lot more. I am but one person and do not plan to expand the team (my ambition is to learn, share and be able to support myself by doing what I love, that’s all), so I of course won’t be able to cover everything relevant – but I am confident I’ll be able to get to most of the main trends.

5) To help me with this and the timing issue, I’ll be bringing back the monthly summaries of key developments in stablecoins/CBDCs, tokenization and regulation.

I’ll also offer a monthly look-back at what I was writing about a year ago, so we can all keep track of progress, what trends fizzled out, what promises were not kept and so on. I loved doing these and I know many of you found them useful, but they got aggressively shoved to the side by the chaos of stuff happening and my attempt to keep up. Since this year I’m focusing more on “useful” than “timely” (with exceptions), I have a better chance of keeping the summaries going.

In sum, I’m feeling determined and confident that I’m doing what I need to be doing at this point in history. This coming year will be exciting for some, alarming for many and meaningful for all. My aim is to show how the details that cross our screens are feeding the civilizational change enveloping the world, and to help make sense of it all. I’m looking forward to embarking on this journey with you.

Greenland: another geopolitical domino?

Earlier this week, I wrote that I didn’t see Trump ordering an invasion of Greenland. I still don’t – the bluster so far falls into his pattern of causing chaos in order to get what he wants (security and resources), which is usually a strong strategy for experienced negotiators. And the diplomatic, economic and reputational cost would be painfully high, surely the cooler heads in his Administration know this.

But smart people are talking about it as a likely outcome, especially after the White House press secretary reiterated the US intention to “acquire” the land mass, and confirmed that the Administration was “discussing a range of options”, including “utilising the US military”. That makes it worth looking at more closely.

On Wednesday, however, the French foreign minister said that US Secretary of State Marco Rubio had told him that a military operation in Greenland similar to that carried out in Venezuela was not on the table. Does that mean another type of military manoeuvre is being considered? Or are the press secretary’s words purely for domestic political messaging? I think it’s the latter.

It makes a lot of sense that the US wants Greenland. The region is rich in rare earths the US so badly needs for industrial and military production, and becoming self-sufficient in those supply chains is a stated priority for the Administration.

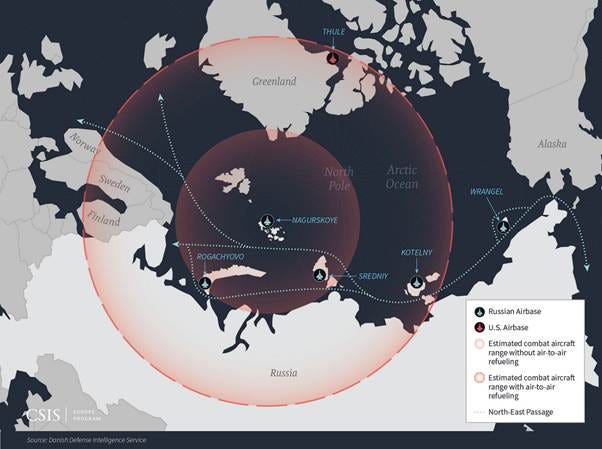

Even more relevant is the location: the role of Greenland as a listening post, monitoring station and naval base will become increasingly significant as melting ice caps open up more routes through the Arctic – take a look at a globe from above and you can see just how close Russia is to Canada and the mainland US.

(map via the Center for Strategic and International Studies)

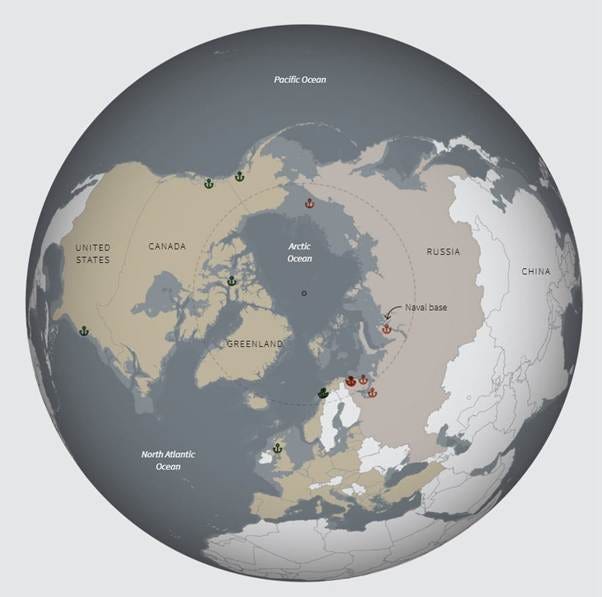

What’s more, Russia has invested heavily over the years in military bases in the Arctic region, whereas NATO hasn’t.

(map via Reuters)

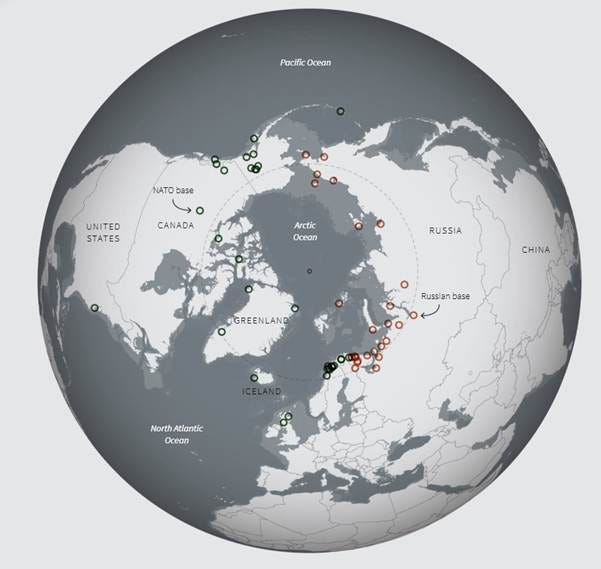

Broaden the scope to include all military bases, not just naval, and the region looks more populated, but Russia’s positioning advantage is still clear.

(map via Reuters)

So, it’s understandable that the US Administration sees Greenland as a key component of future security. Given how slow the EU is at just about everything, Trump is unfortunately correct to assume that only new management could get military bases built in a short timeframe. And control of Greenland fits into the “Donroe Doctrine” strategy of focusing on the Americas.

But a military invasion, when there are deals to be had? A more likely scenario is that Europe will huff and puff and eventually agree to either a sale – on Tuesday, the Danish Central Bank published a report on just how dire Greenland’s finances were (probably not the best timing) – or joint governance. Of course it breaks diplomatic protocol and geopolitical precedent, but that ship sailed a while ago.

Meanwhile, we will continue to hear talk of an invasion as it serves as a useful distraction while a less violent path is being paved. Yes, this is the playground bully scenario of handing over your lunch to avoid being beaten up – but that is the world we now live in, and it’s tragically effective. Plus, we know the smart kids that end up reaching a deal with the bully to willingly hand over a fraction of their lunch money in exchange for protection end up doing well in life.

As usual, European ministers convened an urgent gathering to figure out a response. This took the usual form of harsh and increasingly desperate words, which the US will ignore. China and Russia will vigorously protest, and each will feel more emboldened to expand their territory where possible.

But, searching for silver linings, there is a chance the attention on Greenland will help bring about the end of the war in Ukraine. Russia will no doubt be spooked by the military threat, and realize that it has a short window to fortify its northern flank. Time, perhaps, to close up the drain on resources in the South, and move them to where the stakes are getting higher?

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Liv Elnisky expands on fashion in the 1920s-60s and what that says about the role of glamour in our psyche and our society. (The War on Glamour, Articles of Interest)

Mark Hyman celebrates the long-awaited acknowledgement that the US food guidelines have been wrong for decades. Two things never fail to surprise me when I visit the US: the disconcerting number of obese people, and the paltry fresh produce section in grocery stores while the processed food aisles are bountiful. One of the many reasons I love living in Spain is the culture of food shopping and the availability of natural ingredients. It has always bewildered me how the US could officially put vested interests before the health of its citizens, and it’s refreshing to see that finally addressed. (Mark Hyman: At Last, the Truth About Food, The Free Press)

Wherever you may fall on the UK political spectrum, this scathing takedown of Keir Starmer is beautifully, cathartically written. (Something Deeply Wrong With Keir Starmer, Guy Montrose)

Douglas Rushkoff tries his hand at reassuring those of us that question the current system that we’re not totally crazy, even though the mainstream disconnect may often make us feel like we are. (You Are Not Crazy, Rushkoff)

Games are an integral part of childhood, and captivate our imaginations and focus even as adults. This Bloomberg compilation draws direct connections between leading adult games and trading, drawn from interviews with active participants in both fields. (The Games Wall Street Plays, Bloomberg – paywall)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Clinging to the New Year retrospective mood, this weekend I want to share with you my key music discoveries of 2025.

First has to be the latest album “Lux” from Rosalía, a Spanish artist who completely erased genre boundaries in an album that is both surprising and utterly compelling. If all you want is “nice” music, this is not for you – but if you like to be moved emotionally while being challenged, you might find something memorable here. The whole album is worth a listen, but if you’re short of time, dive right into “Berghain”, a collaboration with Icelandic musician Björk and rapper Yves Tumor, with lyrics in German, Spanish and English.

Second, Raye. My daughter recommended I check out her Royal Albert Hall performance, but instead – thanks to the Spotify algorithm – I dove into “Where Is My Husband” and was instantly hooked. The Royal Albert Hall performance is, by the way, both inspiring and moving – her awe at being there is palpable and almost made me cry. She also defies boundaries with a young (she’s 28!) take on retro style.

Third, Jellyroll. I confess I’ve always liked the tunes, lyrics and emotion of modern country music, but he takes the genre to a new level by incorporating big-picture issues that affect all generations and tastes. Check out “I Am Not Ok” and tell me that doesn’t apply to a broad swathe of culture, or “Liar” and tell me that doesn’t cross boundaries.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.