WEEKLY - The goal, the mess, and crypto

plus, commons, comics, clothes and more

Hello everyone, I hope you’re all doing well! The weather has turned glorious where I am, the air smells like jasmine and the days are getting brighter and longer – the ideal antidote to the noise and froth in our feeds.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the week, offer some interesting links I came across in my weekly reading, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one! For $12/month, you’ll get ~daily commentary on how crypto is impacting the macro landscape, and vice versa. I talk about adoption, regulation, tokenization, stablecoins, CBDCs, market infrastructure shifts and more, as well as the economy and investment narratives.

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

The Miran paper: off to a bad start, but here’s the plan anyway

Assorted links: some good reads on robots, clothes, commons, comics and more

Some of the topics discussed in this week’s premium dailies:

(since there wasn’t a Weekly last Saturday and both this week and last were short in publishing terms, here I’ll summarize the posts since the last Weekly publication)

Coming up: rates, Powell and more

Macro-Crypto Bits: slowing inflation, tariff confusion, geopolitical realignment

The Miran paper: off to a bad start, but here’s the plan anyway

Macro-Crypto Bits: Markets, Tariffs and Crypto

Inflation expectations: it’s all in the wording

Inconsistency leads to futility

Crypto: Institutional interest

Macro-Crypto Bits: macro, markets, realignment, tariffs

Coming up: IMF, economic activity indices, a round table and a funeral

Assault on the Fed: smokescreen or scapegoat?

Macro-Crypto Bits: macro, markets, tariffs and realignment

Currencies and crypto: Taking advantage of chaos

Markets: breathing space

Macro-Crypto Bits: BRICS, Ukraine, Iran, geopolitical marketing and more

A new type of crypto “system”?

Goldman Sachs: Dollar will go lower

Memecoin utility

Macro-Crypto Bits: BTC-USD correlation, more tariff confusion, possible war in Asia, weakening activity, good news for treasuries.

The Miran paper: off to a bad start, but here’s the plan anyway

By now, you’ve probably heard “the Miran paper” mentioned by people trying to make sense of Donald Trump’s tariff strategy. The reference is to a paper titled “A User’s Guide to Restructuring the Global Trading System” published last November by Stephen Miran, then Senior Strategist at Hudson Bay Capital. In it, Miran presents the outline of a grand strategy to redress trade imbalances, reduce the budget deficit and redraw the security alliance, all with the goal of rebalancing US economic activity.

It’s a good paper. Rather than just talk about tariffs, it examines their potential consequences not just on trade volumes and relationships, but also on financial markets. The strategy sounds like threading a needle while riding a motorcycle through a snowstorm, but at least it offers some original thinking.

What it does not do is describe Trump’s strategy. Rather, Trump seems to have heard Miran’s position, and that of Treasury Secretary Scott Bessent (similar but with a different format), and said “yeah ok, I got it” but then added a barrelful of fireworks and some formulas that make little sense, most likely at the urging of tariff hawk and trade adviser Peter Navarro.

We know now how that’s working out, going by the market reaction, the walkbacks, the exceptions and the replacing of Navarro with Bessent on the front negotiating line.

So, it’s worth revisiting Miran’s paper to see what he suggested and how different it is to Trump’s original plan (if it can be called that), with a view to figuring out if there is any way to salvage the situation.

Below, I summarize what he’s trying to achieve, why, and how – as well as how it could all go wrong, and what they would do if it did. Oh, and crypto gets a mention!

The premise

The two targets of what we’ll call the “Miran strategy” are the persistent overvaluation of the US dollar, and asymmetric trade conditions – these, he insists, are the root of the deep unhappiness with the prevailing economic order.

He also brings in the national security angle: if trading partners involved in key supply chains also trade with China, can we rely on them in times of emergency? Miran believes that shifting the bulk of manufacturing back to the US, especially in certain outputs, is essential for US economic resilience in terms of jobs recovered and supply security.

One of the reasons so much manufacturing went overseas is the relative cost, in part due to the persistently overvalued US dollar. In normal trading conditions, currencies would rebalance, making the destination economy’s currency more expensive relative to the US and encouraging more relocation back. But that hasn’t happened to the US because of the reserve currency role of the US dollar.

Nations and corporations around the world hold US dollars as a store of value, rather than converting them into local currency and helping to restore the balance. Put differently, demand for US dollars is not driven just by trade, as with other currencies.

This has three main benefits for the US:

Lower inflation via cheaper imports.

Lower yields due to global demand for US treasuries – this helps the US government, corporates and consumers borrow relatively inexpensively.

A financial weapon: the US can inflict pain on enemy nations by denying them access to the world’s reserve currency and the systems it moves on.

A flip side is the dollar’s persistent overvaluation continues to push manufacturing offshore, creating uncomfortable dependencies and exacerbating the inequalities in American society.

The thesis is that the benefits no longer compensate the tradeoffs. Something has to be done to stop the downward spiral. This involves tackling both roots: bring manufacturing back to the US, and lower the equilibrium value of the US dollar relative to other currencies.

Fine, but how?

The first hit: Tariffs

Adding trade friction to incentivize reshoring is the low-hanging fruit. Trump has experience with this, and the IEEPA emergency regulation gives him the power to act unilaterally.

Miran’s recommendations include:

Implement tariffs gradually, starting low and eventually reaching the maximum of 10% if conditions are not met.

For China, also gradual but more aggressive, say 2% per month.

Be clear in the schedule and stick to it, so markets can adjust their projections.

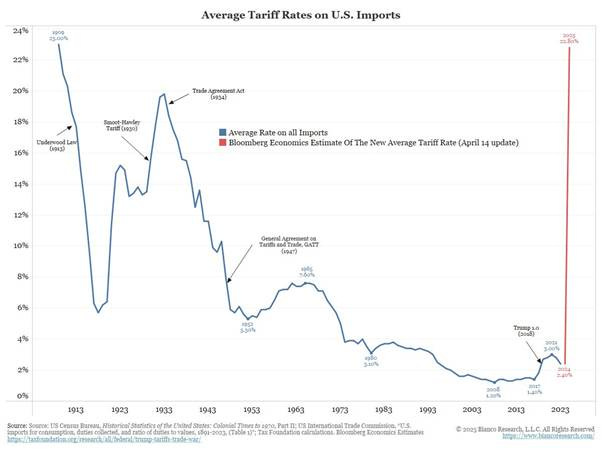

What is the optimal tariff rate? Miran cites research that shows tariffs above 20% are welfare reducing, as the net demand destruction offsets any gains. Bloomberg has updated its average tariff calculation to 22.8%, even after the 90-day pause. Plus, there’s nothing “gradual” about that chart.

(chart via @BiancoResearch)

Miran also sets out Treasury Secretary Scott Bessent’s recommended tariff strategy which brings in considerations other than trade:

Segment the world into “buckets” according to friendliness and cooperation on trade and security matters – a broader categorization would reinforce the idea that trade and security are joined.

Set tariffs according to bucket group, and incentivize a move from one group to a more favourable one.

The relative clarity will enable either more revenues via tariffs if there is no movement, or a stronger trade and security relationship if there is – a win for the US either way.

This approach could also strengthen a united front against China, if trading partners are offered favourable conditions should they join the US in its tariff plan.

A big risk is retaliatory tariffs which could mitigate the positive effects for the US. This could be dissuaded by combining the tariffs with security negotiations. If nations reject that part of the deal, at least the US will be spending less on defense.

Market adjustment

The critical question is whether currencies adjust to offset tariffs, and Miran thinks they will.

What he means is that the USD would need to appreciate to offset the higher cost of imports, as it did in 2018-19.

Why would, in theory, tariffs boost the USD? An improved trade balance means that fewer dollars would be flowing offshore to pay for imports, which means that there would be less selling of dollars into local currency. Less selling = USD higher.

But that’s not necessarily what happened in 2018 – the Fed was raising rates, and tax cuts boosted the outlook for US growth, further enhancing reserve currency demand. In other words, the USD appreciation back then was probably more due to other factors.

What could impede the USD from appreciating into this tariff cycle?

Short-term rates are expected to come down, which implies lower dollar yield investment.

Concerns around US debt sustainability could weaken demand for US treasuries.

The USD is starting from stronger levels than in 2018.

That said, Miran still believes an offsetting dollar appreciation is likely, given the growth impetus from tariffs and deregulation, a likely improvement in the budget deficit, and the relative weakness of alternatives.

A bigger shift: currencies

The second prong of the strategy, once the inflation impact from tariffs has been absorbed, is to bring down the USD relative to other currencies.

How can this be done without market disruption?

One way is through a multilateral agreement, such as with the Plaza Accord in 1985 in which the world’s leading central banks coordinated to devalue the US currency.

Given geopolitical strains, it is unlikely China and the EU would sign up to a similar arrangement today.

But a deal could potentially be struck along the lines of dictating that security umbrella membership includes switching out of shorter-term US treasury holdings and into, say, zero-coupon longer-term bonds. These would have lower liquidity than shorter-term instruments, but this could be offset by swap lines, which are essentially promises of liquidity loans from the Federal Reserve.

The “terming out” of government debt (moving to longer-term zero-coupon tenors) would reduce the interest burden for the US government as well as the dollar demand inherent in rolling over short-term debt. A healthier budget deficit, and a gradually declining dollar.

If there is no agreement on that, there are still unilateral measures available to the Trump Administration. For instance, Trump could draw on the Emergency Powers Act to limit transfers of credit, payments or securities internationally, essentially implementing a form of capital control. The Act could also be used to disincentivize the accumulation of foreign exchange reserves, such as by withholding a portion of interest payments on treasuries for the foreign official sector. This would be sold as “fair” since reserve asset holders impose a cost on the US.

Yes, alarming stuff, which could take the “gradual” out of any dollar decline, and send the treasury market into a tailspin.

Calming markets

Miran has that possibility covered, though.

First, he acknowledges that the currency leg of this strategy has the potential to cause more mayhem than the tariff part. (This is sobering, considering how volatile the market reaction to tariffs has been so far.)

So, the currency issue should only be tackled once the inflationary impact of tariffs has been absorbed, and once there is a new head of the Federal Reserve who might be more cooperative (he actually says this).

An ideal approach would be for broad cooperation between trading partners – but, as mentioned above, this is unlikely unless the threat of higher tariffs can persuade otherwise.

Without that, markets could be mollified by aggressive deregulation leading to lower operating and energy costs.

Also, the Fed could print money to buy foreign assets to encourage the dollar’s descent, or domestic assets should panic take hold – this, presumably, is why Miran recommends waiting for a more cooperative Fed chair (and notice that news reports are already circulating about the search for the current Fed chair’s replacement).

Or, the Treasury could resort to Activist Issuance, which favours short-term bills over longer-term bonds, offsetting the impact from foreign selling with higher domestic demand relative to supply.

None of the above suggests calm, however. Some hint at liquidity-driven rallies, but this stage will come well after the tariff turmoil has done its damage to equity multiples and bond risk premia.

Miran also, to his credit, recognizes that the Administration’s moves to reshape the currency market while passing more cost on to trading partners will accelerate interest in alternative non-dollar systems where participants are less subject to the whims of a President who is only in office for a few years. There remain significant structural challenges to broader use of the renminbi or the development of a BRICS currency – but, and this is a direct quote, “alternative reserve assets like gold or cryptocurrencies will likely benefit.”

Where now?

In sum, the paper presents some original ideas for long-standing problems. Plenty of holes can be found in his reasoning (for instance, a strong dollar has in the past coincided with strong trade growth, and he overlooks the role of burdensome regulation in pushing manufacturing offshore) – but at least he does not shy away from tackling a gargantuan barrier: that of inertia.

Trump and his advisers have no doubt read that paper as last month Miran was appointed to head Trump’s Council of Economic Advisers. But, in a typical move, it seems that Trump felt Miran’s suggestions were not bold enough, and went off script.

He did not use caution or clarity when implementing tariffs, as Miran urged. And the dollar has not appreciated, as Miran predicted.

(chart via TradingView)

What’s more, at the first sign of turmoil in the Treasury market, Trump blinked, which suggests that negotiating partners now have a powerful card to play.

Still, it’s worth referring back to the document from time to time to remind ourselves of the various solutions in the toolbox to achieve the end goal and to mitigate market volatility. We’re still in the first inning, and the only obvious corrective measures so far have been strategy flip-flops. Perhaps the rest of the strategy will be abandoned in fear of stronger market reactions. Or, perhaps – when it comes to volatility – we ain’t seen nothing yet.

ASSORTED LINKS

Introducing a new section where I share, you guessed it, assorted links that I found interesting over the past few days on topics beyond just macro and crypto. There’s a high risk this ends up getting too long as I read a lot and most of it is jaw-dropping, brow-furrowing, view-changing or just plain inspiring, but I’ll do my best to keep this list varied and relatively concise.

A fun stroll through the four reasons why we wear what we wear: function, aesthetic, signalling and path dependency. Even if you don’t care about fashion, it will make you more aware of your choices. (Tomas Pueyo, Unchartered Territories)

A thought-provoking take by Kyla Scanlon on the new “commons” emerging in this low-trust era: isolation, performative grievance, flattened identities and outsourced cognition. The point is painful but resonates, and Kyla posits that this trend is one of the forces behind flows into safe havens such as gold and Bitcoin. (What Happens When Everything Becomes a Meme?, Kyla’s Newsletter)

America is capable of both building and vision – so argues Mike Solana of Pirate Wires in a description of his recent visit with family to Disney World. As a huge fan of the concept myself (with several visits under my belt when the kids were younger), this resonates: vision + creativity + execution + service + a higher message. Animal Kingdom was my favourite. Anyways, the success of Disney World, whatever struggles it may be currently undergoing, suggests that localized carve-outs for economic innovation can offer opportunity with limited risk. It’s worth asking why this isn’t happening. (Golden Age, Pirate Wires)

Alarming accounts from Yascha Mounk on the march towards censorship in some parts of Europe. Even more alarming is the relative dearth of protests about this – for fear of going to jail, I presume, but that implies acceptance of the erosion of free speech. (Europe Really Is Jailing People for Online Speech, Yascha Mounk)

Ted Gioia defends the literary value of comics, and how they can serve as an introduction for young minds to “big books”. Put differently, “highbrow” can be made fun for kids. Ted laments that screen time has taken away from reading, but story-like games could be today’s comic-book equivalent. Just as some comics contributed little to a greater understanding of humanity, so do most games – but by no means all. (How I Learned About Great Literature from Comic Books, The Honest Broker)

“Change is written about quite enough. The stickiness of things isn’t.” Janan Ganesh acknowledges that the center of civilizational gravity is shifting south-east. But we won’t feel this in daily life for decades yet, and maybe we never will. (Where the west still wins, Financial Times, paywall)

Keith Bradsher writes in the New York Times about the rate of automation at Chinese factories, and what that implies for the trade war and for declining demographics. (China Has an Army of Robots on Its Side in the Tariff War, New York Times, paywall)

Crimefighting goes sci-fi – the Financial Times reports on Interpol’s tech lab. (Inside Interpol’s innovation lab, Financial Times, paywall)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

I’m loving The Rest is History’s series on The Rolling Stones. It’s not about their music as much as it is about their formation, growth, hair, decency and their relationship with The Beatles. The telling is rife with anecdote, and paints a colourful picture of the changing culture of the 1960s.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

I’m not that much of a Rolling Stones fan, I come from a time when you were either The Who or the stones and I was on the Mod side of the street. I don’t think they’ve made any good records since 1973 but good on them for keeping going. I completely agree with you about these podcasts, though. They were fantastic and so thought provoking.