WEEKLY - the message in the regulatory drama

plus: assorted links, an evocative anthem and more

Hello everyone! I hope you’re all doing ok and skating through the January chaos.

✨

If you speak Spanish and are interested in a less frequent, shorter update on developments in the crypto-macro intersection, you can subscribe to Cripto es Macro here.

✨

My latest op-ed on American Banker dives into onchain vaults and how they could transform the centralized banking of tomorrow (paywall, sorry!) – “On-chain vault services could give banks an on-ramp to crypto markets”

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

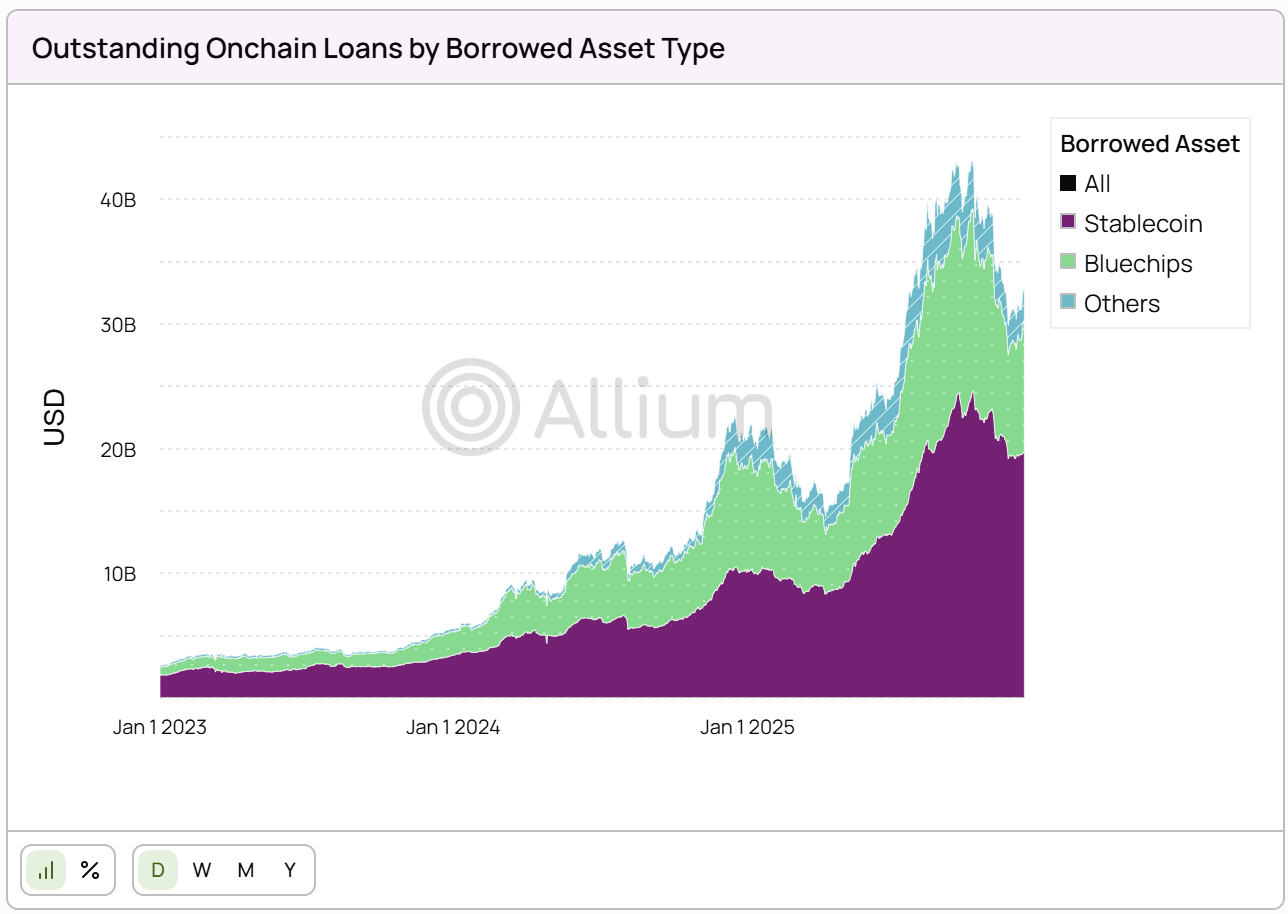

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

In this newsletter:

Good grief, Charlie Brown

Where power lies

A new type of tech regulation

Assorted links: Reasoning, political biology, fiction, short-sighted regulation, experience

Weekend: a tragically evergreen protest anthem

If you’re not a subscriber to the premium dailies, I hope you’ll consider becoming one? You’ll get access to market commentary as well as adoption insight and industry trends. Plus, links and music recommendations ‘cos why not…

If you speak Spanish and are interested in a less frequent, shorter update on developments in the crypto-macro intersection, you can subscribe to Cripto es Macro here.

Some of the topics discussed in this week’s premium dailies:

Coming up this week: CPI, crypto markup, Fedspeak, tariffs, earnings and more

A febrile mood

Markets: still numb

Macro: US jobs

The Fed onslaught has some nuance

Markets: don’t care

Morgan Stanley’s surprising move

Some clarity on CLARITY

Markets: finally, a reaction

Macro: US inflation

Good grief, Charlie Brown

Where power lies

Markets: woven threads

Macro: US retail sales

Macro: US wholesale inflation

The big deal this week: tech regulation

Why cash equivalence matters

Shifting currency politics

Macro: US jobs, again

Markets: the yield curve

Good grief, Charlie Brown

After weeks of excitement build-up and a last-minute frenzy of document parsing, on Wednesday night we got the jug-of-cold-water news that the Senate Banking Committee markup of the CLARITY Act crypto framework, originally scheduled for Thursday, had been postponed.

The story behind the stunning announcement was that at the figurative 11th hour, Coinbase announced that it would not support the bill in its current version and was “walking away”.

If you’re wondering why this is so significant, since Coinbase is not a regulator, you’re not alone. You’re probably also not American. The close relationship in the US market between regulators and business owners is not replicated elsewhere, especially over here in Europe where few lawmakers have ever worked in business and entrepreneurs are often treated as a threat.

In the US, the support of the crypto industry for a crypto bill is seen as essential, and while most big names came out in support of the draft – Circle, Kraken, Ripple, a16z as well several key advocacy groups – the largest of them all didn’t, saying it would “rather have no bill than a bad bill”.

It’s understandable: once a bill is passed, it’s law. Undoing it would be a colossal effort generally only reserved for times of distress. And there are many worrying restrictions and gaps in the draft. Despite this, the general acceptance was based on “not great but better than nothing and we can work with this”.

But Coinbase has some red lines. According to CEO Brian Armstrong, the text included:

“A defacto ban on tokenized equities” (I skimmed the text and didn’t see this – tokenized equities have to follow the same rules as equities, but that’s not a ban, although it could hinder Coinbase’s goal of trading tokenized equities together with native crypto assets which are considered commodities – and the ban on SEC exemptions was bewildering)

“DeFi prohibitions, giving the government unlimited access to your financial records and removing your right to privacy” (I agree the limitations were worryingly strict, more on this below)

“Erosion of the CFTC’s authority, stifling innovation and making it subservient to the SEC” (I assume this is to do with the SEC jurisdiction over “ancillary assets”, or network tokens just starting out – a fair objection)

“Draft amendments that would kill rewards on stablecoins, allowing banks to ban their competition” (not all rewards, just those on idle holdings – but Coinbase currently pays rewards on some USDC balances and so potentially could lose some liquidity here).

Earlier this week I touched on what for me is the most serious bill-related risk for the industry: the definition of “control” in decentralized finance. This is worth expanding on a bit.

According to a strict interpretation of the current text, a protocol or application is NOT decentralized (and therefore has to submit to regulation, disclosures, etc.) if any person or entity can:

influence trading execution by routing, matching, deciding on execution timing, etc. – even if these are programmatic, if anyone can change the rules, the application is not decentralized

determine access, or change the access criteria – including updating sanctions blocks

decide which assets to support, or change the list in any way, even if such a change is to protect users

pause operations, such as in the event of a hack, oracle failure, or similar

freeze accounts, such as if theft is suspected or if law enforcement requires you to

In sum, pretty much all DeFi applications would not qualify for DeFi exemptions, which would essentially kill DeFi by requiring compliance with the Bank Secrecy Act and all of its disclosures.

Essentially, the wording disincentivizes user protections, definitely not a desired effect especially in a field that is still evolving rapidly.

And if a protocol doesn’t allow any updates to its functionality to qualify as decentralized, it can be prosecuted for non-compliance of sanctions and other restrictions, as the developers of Tornado Cash found out.

So, yes, this is a big deal that needs to be fiercely debated. I’ve said before that stablecoin rewards are not as existential to the industry as are DeFi protections – but, tragically, no bill at all is also really bad.

And that may be what we get. On Capitol Hill, where momentum matters, postponed often means “cancelled” as attention pivots and time runs out. Let’s fervently hope that’s not the case here, but the window is tight.

Next week the Senate is in recess – no debates, no bills tabled. And then there might be another government shutdown starting January 30th as the resolution negotiated last November that continued funding for most federal agencies runs out.

What gives me hope is that the Administration has a Crypto Czar who is determined to get a bill through legislation – he wants it to be one of the crowning achievements of his office, and he appears to have the clout to drag regulators back to the table.

(post by @DavidSacks47)

And, just maybe the banking industry will start to feel a bit less confident – after all, with no CLARITY Act, stablecoin rewards are allowed.

In sum, the delay is a high-risk gamble, but one that just might pay off big time. Let’s hope.

Where power lies

One overlooked aspect of the kerfuffle is the power of one company to influence regulation. I’m not throwing shade at Coinbase here – I believe they have principles not exclusively tied to their profit (they have often taken hits for the sake of the industry), and they can employ among the best lawyers in the business who no doubt carefully weighed the risks of the rejection. Obviously, what’s good for the industry is also good for them, but I do believe Coinbase leadership cares.

But the concentration of clout here is jarring in an industry predicated on the decentralization of opportunity. I’m not being naïve, of course concentration was bound to happen, that is how markets work. But we do have to watch out for regulatory capture, when a large company tilts regulation in its favour at the expense of competition.

That would be the case if Coinbase’s move blows up the bill entirely. Even a bad bill is better than none at all for those building crypto services as no framework implies a risk of unforeseen penalties, which Coinbase can afford but new startups can’t. Put differently, no bill at all will stifle innovation much more than one with vague wording and short-sighted restrictions.

Then again, if we get a better bill as a result, the gamble will have paid off in spades, and we’ll have Coinbase to thank. They have a lot on the line, and their objections hint at their corporate objective: the “everything platform” trading tokenized equities together with crypto assets and both being able to access Coinbase-hosted DeFi services.

If you find this newsletter at all useful, would you mind sharing with friends and colleagues and nudging them to subscribe? I’d appreciate it! 😀

The big deal this week: tech regulation

(Trying out a new feature in which I have a think about what I see as the most significant development of the week for the crypto-macro narrative. What one thing has shaped the playing field for what’s ahead? Things are moving fast, it’s helpful to sometimes step back from the noise.)

I thought about titling this week’s topic “regulatory capture”, but I don’t want to give the impression I’m against Coinbase’s blowing up the CLARITY Act markup – it was a ballsy move that could either go spectacularly wrong or set a more solid base for the industry going forward.

“How the sausage is made” is also not quite right, as well as too wordy (and likely to make readers hungry if they haven’t had breakfast). The big deal this week wasn’t the discovery of how messy US lawmaking is, we all knew that, even if the closest we’ve come to Capitol Hill is a few episodes of The West Wing.

No, stepping back and cleaning up the noise a bit, the takeaway is how unusual the CLARITY Act is, and how it is yet another example of blockchain technology’s transformative potential. It’s even changing how laws are made.

A clue is in the level of detail on how the technology and related assets should work.

It’s unusual for a bill to be so “prescriptive”, offering details on how crypto assets should be structured and what can be considered “decentralized” – essentially, telling builders how to build. Usually, bills focus on outcomes and risk mitigation.

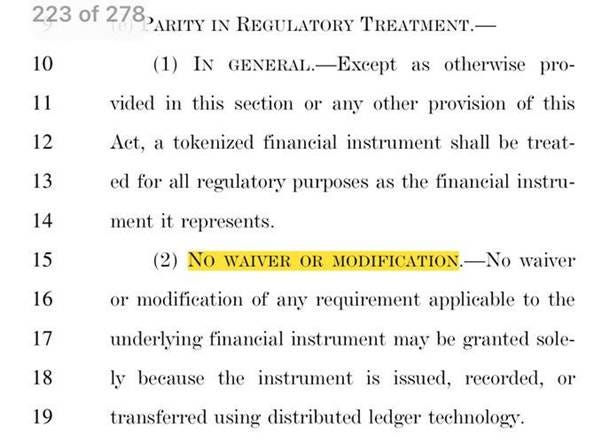

When a bill focuses on a new technology or its application, most of the details are left to the agencies to fill in via rulemaking. CLARITY doesn’t do that, it dives right in – there is some scope for the SEC and the CFTC (and plenty of study requests), but it’s surprisingly limited. For instance, as TuongVy Le pointed out, a provision in the Tokenized Assets section blocks, forever, the SEC’s ability to offer exemptive relief where appropriate – she (an experienced crypto lawyer who used to work for the SEC) does not recall ever seeing this type of limitation before, and it’s especially concerning given how the technology and its application are still evolving.

(screengrab via @TuongvyLe12)

Another twist to rulemaking here is the whiff of “regulatory capture” I touched on above, positing that Coinbase’s gamble might turn out to be a win… but maybe not. Either way, a more disconcerting takeaway is the power of one company in a new space. In US lawmaking, industry participation is essential for both education and making sure a bill is workable, especially relevant here given how new and complex blockchain technology is. Coinbase has done great things for the industry in this respect over the years (and has spent a fortune on lobbying), but so have many, many other firms. That one business can delay a hard-fought markup should give us all pause, especially when most industry participants were eager to maintain the momentum. Put differently, Coinbase wants different rules from the rest of the sector, it has different priorities. It may be right in setting a higher bar, as potentially all will benefit. But as industry leader, should it be that influential in what is a key step that supposedly levels the playing field?

In sum, this is all new, not just the technology being regulated, but also the way the regulation is being crafted. I’m not a lawyer and I’m sure there are details and nuances I’m overlooking – but there’s more at stake here than most realize.

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Mike Solana sounds the alarm over an overlooked detail in California’s motion for a “one-time” tax on the wealthy: the bill’s authors want it to take into account voting share multipliers (a standard practice that gives certain share classes more voting rights), which would bankrupt most founders. In that scenario, leaving doesn’t become a choice, it becomes a necessity. (California’s Tech Industry Kill Switch, Pirate Wires)

Rickie Elizabeth explains why people who are good at reasoning tend to do so little of it. Put differently, having reasoning skills doesn’t mean they will be reliably used, because we need context. (Why Intelligence Doesn’t Improve Reasoning, Dianoia Protocol)

“…when beliefs signal moral virtue, political loyalty, or group membership, people get defensive and reason poorly—becoming more incentivized to stay aligned with their group than be correct. This is why people are better at reasoning when it comes to neutral topics, like chess, rather than identity-based topics.”

An intriguing take with a sobering conclusion on why data shows women tend to be more left-leaning than men – it’s to do with our ingrained instinct to preserve community, which back in the day was more essential for female than male survival. And then structural momentum (educational capture, the comfort of consensus, societal shifts to accommodate, etc.) does its thing. (Why Young Women Moved Left While Young Men Stayed Sane, @IterIntellectus)

Ted Gioia on how fiction is flattening, mainly because of publishing economics but also because of the state of newspapers, indie bookstores and schools. (The Day NY Publishing Lost Its Soul, The Honest Broker)

Jonah Weiner and Erin Wylie on experiencing vs filming, on reading vs reacting, on remembering vs taking a picture, on the everywhereness of screens. “The Goon Cave is becoming life’s organizing principle.” (This life gives you nothing, Blackbird Spyplane)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

From three years ago, but as just as relevant, just as moving:

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.