WEEKLY - fiscal dominance, CBDCs in the Middle East

plus: assorted links, and a seasonal lump-in-throat

Hey everyone! I hope you’re all doing well, and my US readers, I hope you had a fantastic Thanksgiving. I took a couple of days off in solidarity – well, one to celebrate a wedding anniversary, the other to get the seasonal vaccinations out the way. It was my first time having the pneumonia jab and holy cow it hurt – so, feeling even loopier than usual today. 😝

Here’s a link to my op-ed published last week in American Banker (paywall, sorry), in which I show that “deposit tokens” and “tokenized deposits” are not the same thing at all, and why this matters.

🍂

And here’s a link to this week’s American Banker op-ed (also paywall). I dive into how recent stablecoin-related proposals from the US and UK central banks suggest a fundamental restructuring of banking as well as an economic shift away from monetary and towards fiscal policy.

🍂

I was interviewed by the impressive Savannah Fortis for the CoinTelegraph podcast this week, you can listen to that here.

🍂

If you speak Spanish and are interested in a less frequent, shorter update on developments in the crypto-macro intersection, you can subscribe to Cripto es Macro here - it’s free for now!

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

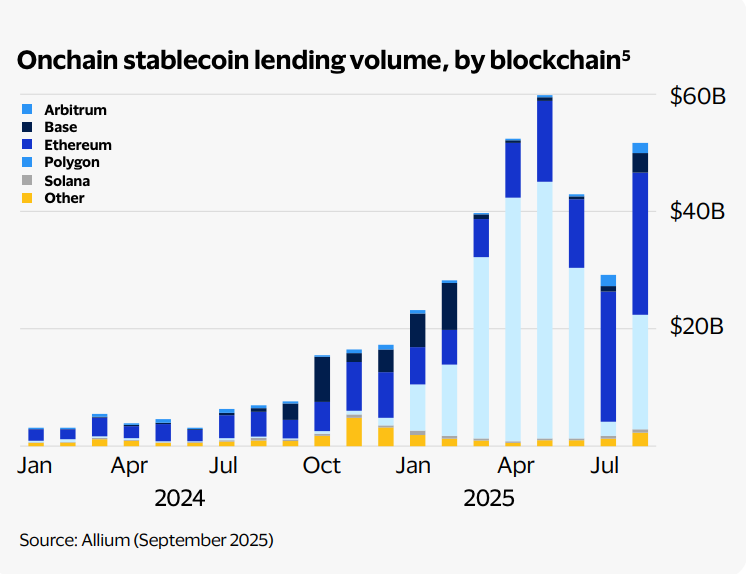

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

In this newsletter:

The deeper issue in the Fed Chair selection

CBDCs: mBridge launches in the Middle East

Assorted links: the new investing, why people feel poor, European defence, economic comics, Bhutan

Weekend: the seasonal tug at the heartstrings

Some of the topics discussed in this week’s premium dailies:

Coming up this week: US jobs data, MBS in the White House, a digital euro hearing and more

JPMorgan: banking goes onchain

The strangest crypto rout

We need this narrative shakeout

What’s next, a phase or a trend?

When is a dollar not a dollar?

BNY: banks and stablecoin services

OCC: Banks and public blockchains

Macro-Crypto Bits: BTC buyers, US jobs

Bitcoin near a bottom?

Geopolitics: Ukraine and Japan

Macro-Crypto Bits: US consumer confidence, economic activity

Why the gulf between sentiment and economic activity matters

CBDCs: mBridge launches in the Middle East

Markets: short-termism

The deeper issue in the Fed Chair selection

KlarnaUSD: when PR takes over

Macro-Crypto Bits: capital ratios, consumer sentiment, retail sales, wholesale prices

The deeper issue in the Fed Chair selection

Kevin Hassett for Fed Chair? Sigh.

Bloomberg reported earlier this week that White House insiders are pointing to the White House National Economic Council Director as Trump’s pick for Chairman of the Federal Reserve when Jerome Powell steps down next May. Last week, President Trump told reporters that he knew who he would choose. And this week, Treasury Secretary Scott Bessent finishes his interviews of likely candidates. So the timing checks out.

While it would be good to know who it will be, I can’t help but feel disappointment reinforced with concern. Hassett is the least likely to maintain a semblance of central bank independence as his talking points have underscored his loyalty to a President determined to get interest rates down.

And so far, his many (many, many) public comments have bordered on the inane.

So, sigh.

But, let’s focus on the upside, and on the bigger picture here.

For one, the bond market likes the increased likelihood of substantially lower rates. Treasury prices rose, and the benchmark yield on the US 2-year treasury almost touched 3.45% for the first time since late October.

(US 2-year benchmark yield, chart via TradingView)

And the move would be good for crypto markets as:

Market liquidity should get a boost from easier monetary policy. Hassett has often said wants deeper, faster cuts and while he doesn’t get to unilaterally decide, the Fed Chair’s opinion is usually influential in the decisions of other FOMC members. So, more easing on rates as well as balance sheet runoff, which should be good for liquidity-sentisitve assets.

Bringing inflation down to 2% will cease to be a priority. It already isn’t, as we are seeing officials pivot to fretting more about the jobs situation even though the unemployment rate is still historically low. But pretence will be abandoned, which should rekindle interest in currency debasement hedges such as gold and Bitcoin.

He’s pro-crypto: he served on Coinbase’s advisory board and owns a large stake in the company.

Plus, loyal Hassett as Fed Chair would give President Trump yet another lever with which to execute what is emerging as the Grand Plan.

What is that plan? The Administration has not made a secret of the wanting to diminish the economic relevance of the Federal Reserve. It understands the need for a central bank, but – going by various comments from Administration officials, including the President and the Treasury Secretary – they would like it to be more of a policy executor than a policy setter.

Again, whatever you may think of the potential consequences, this desire is understandable given just how big the ambition is. Trump and Bessent aren’t just trying to ease monetary liquidity. They’re trying to re-route monetary plumbing.

Stablecoins are the main spanner in the toolbox. If you’ve ever wondered why Bessent is so enthusiastic about the potential for blockchain-based dollar representations, consider what backs them: US treasuries. But it’s not just about boosting demand and bringing down yields.

Consider also the suggestion by Fed Governor Chris Waller of “Skinny Master Accounts”, which would give licensed payments institutions such as stablecoin issuers access to central bank liquidity – this has traditionally been a privilege reserved for lending banks.

Fast forward, and you’re potentially looking at a shift in economic power from banks (whose lending decisions are influenced by monetary policy) to stablecoin issuers (who provide demand for Treasuries). Put differently, you’re looking at a shift from monetary to fiscal policy dominance.

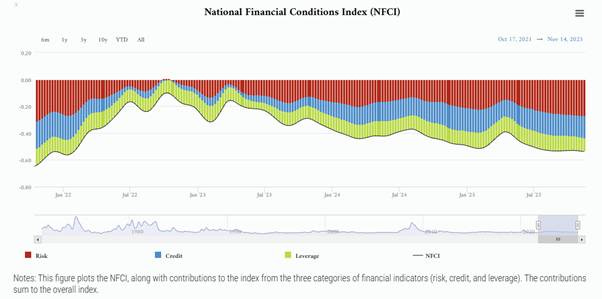

The thing is, this wouldn’t be radically new – we’ve known for some time that the federal funds rate is no longer particularly relevant for financial conditions. According to the Chicago Fed, these are looser than before the Fed started hiking back in 2022.

(chart via the Chicago Fed)

Much of this is down to the emergence of non-bank lenders. A blog post by the New York Fed published last month shows that non-bank lending to middle-market private firms rose in 2024 to around 30% of total lending to this segment, up from around 13% just after the Great Financial Crisis.

It’s also down to the surge in fiscal spending, keeping the economy humming despite attempts by the central bank to choke off activity in order to bring down inflation. In other words, fiscal dominance has been a driving factor ever since the pandemic – the Trump Administration wants to formalize that.

The idea is bold, and it could do more to bring down bond yields than cautious tweaks to the federal funds rate. Given the impact of treasury yields on mortgages and the overall cost of corporate capital, this is likely to have a more stimulative impact on economic activity than would cheaper interbank lending.

Trump made a good choice in Bessent as Treasury Secretary – he’s tough and smart (can you imagine Lutnick pulling this off?). He’s also diplomatic enough to make sure he insists that Fed independence will be maintained, so as to not rattle markets.

But Trump has often said that he would like Bessent to take over at the Fed – Bessent wants to stay at Treasury. With Hassett at the helm of the central bank, echoing the Trump/Bessent line, they might both get their wish.

CBDCs: mBridge launches in the Middle East

Just the other day, I was wondering whatever happened to mBridge, the CBDC platform jointly developed by the central banks of China, Hong Kong, Thailand and the UAE, with oversight from the Bank of International Settlements (BIS). The last time I had a reason to write about it was over a year ago (more links below), not long after the BIS withdrew out of concern it could end up helping Russia develop a platform to evade sanctions (which, indeed, it is doing).

Then, last week, I read that the UAE had executed a live transfer on the platform, officially launching its use in the Gulf region. In the presence of Pan Gongsheng, the governor of the People’s Bank of China (PBOC), the UAE’s Vice President and Deputy Prime Minister Sheikh Mansour bin Zayed Al Nahyan pressed the button that sent the first cross-border payment between the UAE and China using the Digital Dirham, which became legal tender in a financial ruling earlier this month.

This is a notable milestone for many reasons.

There’s the confirmation that the mBridge project is still active, arguably more relevant now given fracturing trade and shifting geopolitics than when its development officially began in 2021. It will enable the original central banks, plus that of Saudi Arabia which joined last year, to settle with each other without touching SWIFT or any other aspect of the dollar system. Commercial and regional banks can also access the platform, and July and August saw several Chinese institutions use it for cross-border transfers.

It’s also a further consolidation in the already strong relationship between China and the Gulf state. China is the UAE’s largest trading partner for non-energy goods, and the UAE is China’s primary non-energy gateway into the Middle East and Africa. The UAE hosts more than 16,500 Chinese trade licenses, and more than 15,000 Chinese companies are active in the Emirates. More than 770 Chinese businesses set up operations in Dubai in the first half of 2025 alone. Over 3% of the UAE’s population is Chinese. Of course the first Digital Dirham transaction on mBridge would be with China.

The next steps include, according to reports, further expansion of the mBridge platform in 2026 to include more central banks.

And, of course, we’re all waiting to see what happens when President Trump notices that trading partners are moving away from dollar settlement. Remember when he threatened BRICS countries with a 100% tariff if they tried to replace the dollar? Well, here we have a strategic Middle East ally (the UAE is part of the Abraham Accords, host to a US military base, and a key partner in containing Iran’s nuclear expansion) developing and using a payments platform with the express intention of diminishing use of the dollar for cross-border trade. What’s more, this platform wants to expand access to more countries.

Of course, there’s not much that President Trump can do to stop sovereign nations developing new versions of their currencies and expanding their use. This week, Hong Kong Monetary Authority CEO Eddie Yue urged attendees at the Asean+3 (members of Association of Southeast Asian Nations plus China, Japan and South Korea) Economic Cooperation and Financial Stability Forum to increase use of local currencies across the region, in order to boost resilience and stability. A key pillar of this, according to Yue, is “ensuring financial infrastructures are interoperable across borders”.

This goes beyond digital currencies to include traditional rail connectivity, card interchange and more. But it does signal a wholesale CBDC push is on the short-term roadmap.

See also:

mBridge update: is sharing possible? (Nov 2024)

mBridge gets complicated (Oct 2024)

A CBDC alternative to SWIFT? (Nov 2023)

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

A Financial Times deep dive, with cool graphics, on how European defence spending will need to focus on simple infrastructure such as trains and bridges – it’s not much good having military equipment you can’t move because of fragmented standards and poor upkeep. (The surreal 45-day trek at the heart of Nato’s defence, Financial Times – paywall)

A thought-provoking article by Lu Wang in Bloomberg on how investing is now more about vibes than fundamentals. This is not new, we saw it barge onto the mainstream stage a few years ago with the GameStop saga, and it continues today with the surge in popularity of prediction markets. It’s also not going away, especially for a younger generation convinced things don’t make sense anyway. (Why It’s Harder to Tell Gambling From Investing Nowadays, Bloomberg – paywall)

Here’s a link to Michael Green’s take on why so many American families feel poor even though they’re nowhere near the official poverty line. I wrote about this earlier this week, about how it does bring some numbers to the explanation of why consumers are so glum while the economic data is still strong. Since it was published, so many takes have focused on “you’re not poor, the numbers say you’re doing well!” which is exactly the frustrating gaslighting that widens political divides. So many other takes are quibbling about what the adjusted poverty level should be, and missing the bigger point that most Americans do not feel “successful”, nor that success is possible with unaffordable housing and high fixed costs. Most doubt that they can build a better life for their kids, even if they want to have any. Greens essay isn’t so much about economics as about institutional dysfunction, and will make sense to many. (My Life Is a Lie: How a Broken Benchmark Quietly Broke America, Yes, I give a fig…)

Making economic debate accessible to anyone, via comics – I’m all for it. (An alternative to capitalism is possible, at least in comic books, El País)

For a quick and vicarious getaway, Tim Urban shares stories from Bhutan. (The sights and sounds of Bhutan, Wait But Why)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

In the US, I gather that the Holiday Season kicks off right after the Thanksgiving Superbowl. In the UK, it starts when department store John Lewis drops their seasonal ad.

These are known for their glimpses of how hope and love weave into human connections, and they avoid the trap of unrelatable sugariness by focusing on understated emotion. Most of them over the years have made me cry – this year’s also had my stoic husband in tears.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.