WEEKLY - geopolitics + crypto

plus: why we won't get a digital euro, and more

Hi everyone! I hope you’re all doing well and are ready for a bracing autumn. Things are accelerating in the crypto-macro overlap. If you’re a premium subscriber, thank you! If not, I hope you’ll consider becoming one, so we can do our best to keep up with the changes together.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days and offer some interesting links.

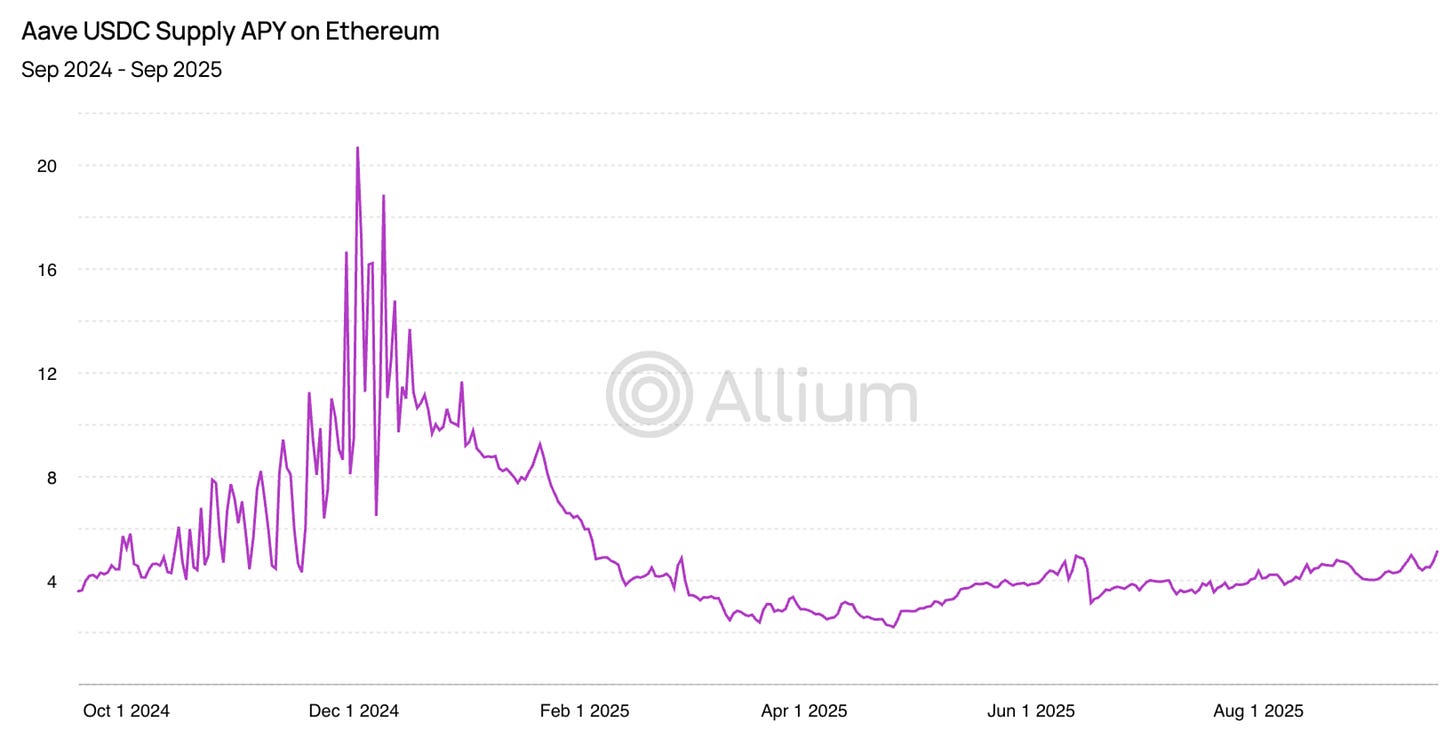

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

In this newsletter:

Geopolitics: an axis shift and the impact on crypto

Why we won’t get a digital euro, despite the ECB’s

Assorted links: political credibility, net zero, casino design, nuclear war and more

Weekend: gritters

Some of the topics discussed in this week’s premium dailies:

Trade optimism

Macro-Crypto Bits: institutional stablecoins, CPI, PMI, market celebration

Also: CFTC nomination, Asian politics and more

Zelle + blockchain: it’s the utility, not the tech

Geopolitics: an axis shift and the impact on crypto

Macro-Crypto Bits: a breather for markets, gold, the next Fed Chair

Also: Asian trade deals, Nigerian infrastructure, Chinese stablecoins and more

Bitcoin’s 4-year cycle: a drag on the price?

Western Union’s stablecoin: scalability wins

Macro-Crypto Bits: market confidence, consumer confidence, AI capex, new ETFs, Pakistan

The G2 Summit

The FOMC surprise

Manipulating time

Also: more stablecoin M&A, Circle testnet, enterprise treasury, Japan and more

Why we won’t get a digital euro, despite the ECB’s insistence

Macro-Crypto Bits: markets, rates, liquidity, Coinbase volumes

Also: a retreat from populism, nuclear testing, Western Union

Geopolitics: an axis shift and the impact on crypto

Last weekend, I came across one of the most conclusive signs yet that the US has irrevocably ceded its global authority to a multipolar balance.

Many of us have been saying this for a while, but to see the US Administration not only accept it but make it part of its policy platform has been disconcerting. Back in February, Secretary of State Marco Rubio startled many of us by saying in one of his first interviews after taking the job:

“So it’s not normal for the world to simply have a unipolar power. That was not – that was an anomaly.”

This diplomatic messaging shift accompanied presidential rhetoric about “America First”, and a trade policy which punished friends and foes alike.

It even extends to the US military. True, we have heard repeated motivational assurances from Secretary of Defence (sorry, Secretary of War) Pete Hegseth and others that the US has “the strongest, most powerful, most lethal and most prepared military on the planet ... It’s not even close.” But the US is notably avoiding hardware involvement in an ally’s drawn-out war in Europe, is considering downsizing overseas bases, and is signalling that it does not want to get involved in any aggression in the South China Sea.

The conclusive signal I mentioned above came in the form of a report published earlier this month by the Rand Corporation, the US military’s main think tank. Called “Stabilizing the U.S.-China Rivalry”, it explicitly recognizes China’s ascendancy. This is relevant not just for military deployment and for trade, but also for Taiwan.

The report offers a list of guidelines on how China and the US can ensure a mutually beneficial acceptance of each other’s evolution – essentially, how to peacefully co-exist in a multipolar world. These cover general principles such as accepting each other’s political legitimacy, restraint in the development of hostile military capabilities, and the cultivation of relationships and channels of communication. The whole document is an explicit recognition that the world is not so much multi- as bi-polar:

“Each side accepts some essential list of characteristics of a shared vision of organizing principles for world politics that can provide at least a baseline for an agreed status quo.” (my emphasis)

It also suggests that both China and the US deepen their dialogue on AI risks, promise restraint in technologies such as gain-of-function research and AI-powered cyber capabilities, and expand collaboration in scientific areas “of limited security concern”.

To ensure peace in the South China Sea, the US and allies should clarify what “red lines” cannot be crossed, and allow China to specify its “red lines”. This implicitly acknowledges that there is provocation taking place on both sides, sometimes deliberate but often born out of a lack of clear limits.

In a surprising section on finger-pointing, the authors recommend against taking certain official comments on China seriously, pointing out that aggressive wording attributed to Chinese officials is usually down to poor translation.

But the most unexpected comments concern Taiwan, with an explicit recognition that reunification is inevitable, and a recommendation that US policy prioritize making sure it is peaceful:

“Examples could include U.S. statements that it does not support Taiwan independence, seek a permanent separation across the Straits, or oppose peaceful unification. China could reaffirm that peaceful reunification is the preferred approach, describe persuasive ways that could happen, and clarify that the use of force is only an option under the most extreme circumstances stipulated in the Anti-Secession Law.” (my emphasis)

What’s more, the authors recommend that the US use its influence “to ensure that Taiwan’s actions do not escalate tensions with China”.

In sum, the leading US military think tank suggests that the US help China to peacefully occupy Taiwan.

The tone of the document matters for much more than chip supply chains and the reliability of the US as a strategic ally.

It hints at a world in which the dollar is no longer the trade currency. Of course, it will continue to be the main one for years to come as it is liquid and convenient. But it will gradually lose market share. We’re already seeing this in moves from China, India and others to boost trade settlement in local currencies. Given recent damage to trust in dollar access, this is not a trend that can be reversed any time soon.

For crypto, this matters on several tracks: one is that a weaker dollar is generally good for commodity prices, including BTC and others. But, shorter term, it’s about the need for alternative rails that don’t touch the dollar system, and safe haven assets that are not dependent on any nation’s financial strategy. It’s also a call to trading nations to focus on modernizing their settlement systems, in terms of technology as well as regulation. For many, modernization will require more than a few tweaks, it will necessitate new builds with a focus on systems that can not only move value in a fast and transparent manner, but can also interconnect with other similar networks.

In sum, geopolitical fragmentation is more than a catch-phrase, it’s a reality and will change more than alliances and even boundaries. It will also inevitably impact global finance, and new financial technologies that stress independence and resilience – blockchains, stablecoins, CBDCs and BTC – will have a key role to play.

🍂 Interested in how crypto impacts macro and vice versa? Subscribe to the premium dailies to get more frequent updates on developments, trends and why they matter. 🍂

Why we won’t get a digital euro, despite the ECB’s insistence

To the surprise of no-one, the European Central Bank (ECB) has decided to proceed with the digital euro. Yesterday was the deadline for an official decision after two years of design work and opinion-gathering (or rather, public campaigning).

This is not, however, a decision to issue a digital euro. The ECB can’t make that call until the legislative framework has been adopted. Which it hasn’t, not even close.

Rather, it’s a decision to continue with the development, under the assumption that the legislation will come together and that the public will of course love the idea.

If only they would stop insisting it’s about “giving us greater choice” when it’s the opposite. The ECB assures us that the use of the digital euro will be optional. But, they can’t fail on this, it would further damage the credibility of the institution. So, if we don’t use it, the authorities will find ways to “incentivize” us to do so. That may take the form of banning competitive payment rails, or insisting certain categories of activity can only be paid for with the digital euro, or some other initiative that will be presented as for our benefit. Those may seem like drastic measures, and they are if anything way off in the future: if legislation gets passed next year, the digital euro wouldn’t launch until 2029.

But, once launched, there is no putting that genie back in the bottle, and we will all have to download the ECB-designed wallets. It’s not about choice, it’s about central bank relevance.

That said, I still believe it won’t happen.

First, I don’t get the impression that the legal framework has progressed much through the relevant EU committees. And EU legislation moves slowly. Policy makers started working on the crypto framework MiCA, for example, in 2018 – it wasn’t published as law in the Official Bulletin until June 2023, five years later. Let’s say there’s a rush put on the ECB request – unlikely, since legislators don’t seem convinced of its urgency, and there’s a lot of other things going on. But let’s take a leap of faith and assume the multiple sections of EU government reach an agreement on the wording in two years (which would be incredibly fast by EU standards). Christine Lagarde’s term as head of the ECB ends in 2027, and we can’t be sure that her successor would be as determined to push this through.

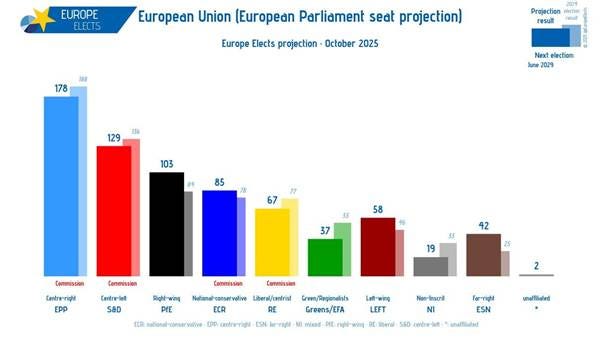

What’s more, the EU holds parliamentary elections in 2029; as that date approaches, politicians are more likely to listen to banks and consumers than an institution increasingly seen as out of touch. Polls suggest that we will see a drift to the right, which should make legislation passage even less likely.

(chart via Europe Elects)

In the shorter term, there’s the somewhat immovable barrier of Donald Trump.

One of the explicit reasons given for the digital euro is the need to reduce dependence on the US dollar and US payment platforms such as Visa and Mastercard. Lagarde has obviously not noticed that President Trump spits hellfire at any government even talking about moving away from use of the US currency – remember the threat of 100% tariffs on BRICS members?

It’s worth asking who has more clout in the European Parliament: Trump or Lagarde? Given a contentious trade relationship and the desperate need for US help with Ukraine, it’s not going to be Lagarde.

In sum, the ECB is forging ahead and spending a small fortune (initial development costs estimated at €1.3 billion) on a product that will not find market fit on its own – it will have to be shoehorned into our payments experience, and it is not clear what the EU will gain from depriving banks of deposits, consumers of choice and member governments of a trade ally.

Stepping back, the diverging priorities will reawaken a long-overdue debate about the role of central banks in today’s developed economies. To whom should the ECB be beholden? Who does it work for? It’s behaving as if we, the consumers, are its priority, when it should be putting the banking system first. Yes, the banking system that the ECB is supposed to regulate, and that sees the digital euro as a threat to deposits.

Plus, it’s not a stretch to accuse the ECB – an unelected body – of “mission creep” in its drive to get closer to the consumer; politicians are unlikely to want to cede that territory.

The ECB could counter with the argument that what’s good for the euro is good for everyone, banks and consumers alike. Only, doesn’t that start to sound like currency control? Especially since the ECB is not doing much to encourage the EU to accelerate the reforms necessary for euro stablecoins to become practical, and for European industry and innovation to become a magnet for global investment.

In sum, the digital euro would be bad news for European consumers, not just because of the potential for surveillance, but for the likely loss of choice when it comes to payments. It would also cement an uncomfortable new role for the central bank, which typically has a distant relationship with voters, with direct contact limited to issuing the cash some of us carry around.

For that reason, I don’t see European politicians – a fractious bunch at best – getting behind the idea with enough conviction to pass the required legislation, especially once President Trump realizes that it’s really all about preventing greater use of the US dollar.

See also:

The digital euro hits a wall (Sept 2025)

The digital euro gets shakier (July 2025)

The race to the digital euro is getting tense (June 2025)

The digital euro: more smokescreens (March 2025)

An EU digital euro twist (December 2024)

🌻If you find this newsletter at all useful (or even if you just like my music recommendations), would you mind sharing with colleagues and friends and nudging them to subscribe? I’d appreciate it! 🤗

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Inspired by the steady flow of embarrassing gaffes such as the theft at the Louvre, the “one-in-one-out” UK immigration policy and the nothingburger of the Epstein files (and there’s plenty more), Marvin Barth turns his sharp eye to the economic consequences of political incompetence. (Keystone Cops, Seriously, Marvin?)

Adam Mastroianni suggests, with sound reasoning, supportive data and convincing visuals, that despite so much abundance, things have gotten same-y. We’re safer, and therefore also more risk-averse – and that takes some beautiful weirdness out of life. (The Decline of Deviance, Experimental History)

An insightful (and kinda funny) take by Irina Slav on why the “net zero” nonsense has lasted for so long – it’s about tribal belonging, aspirational beliefs, performative empathy and a desperate need to be “right”. (Better dead than proven wrong, Irina Slav on energy – paywall)

Ted Gioia laments the gamification – or rather, the gamblification – of life, and how the basic principles of casino design are visible everywhere. (Why Is Everything Turning into a Casino?, The Honest Broker – paywall)

Andreas Kluth penned (typed? doesn’t sound right) a review of a movie about nuclear war that highlights how absurd the entire concept of mutual deterrence is – although it’s not nearly as absurd as the concept of nuclear war itself. Absurd, but sadly real. (‘A House of Dynamite’ Nails the Psychological Reality of Nuclear War, Bloomberg – paywall)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

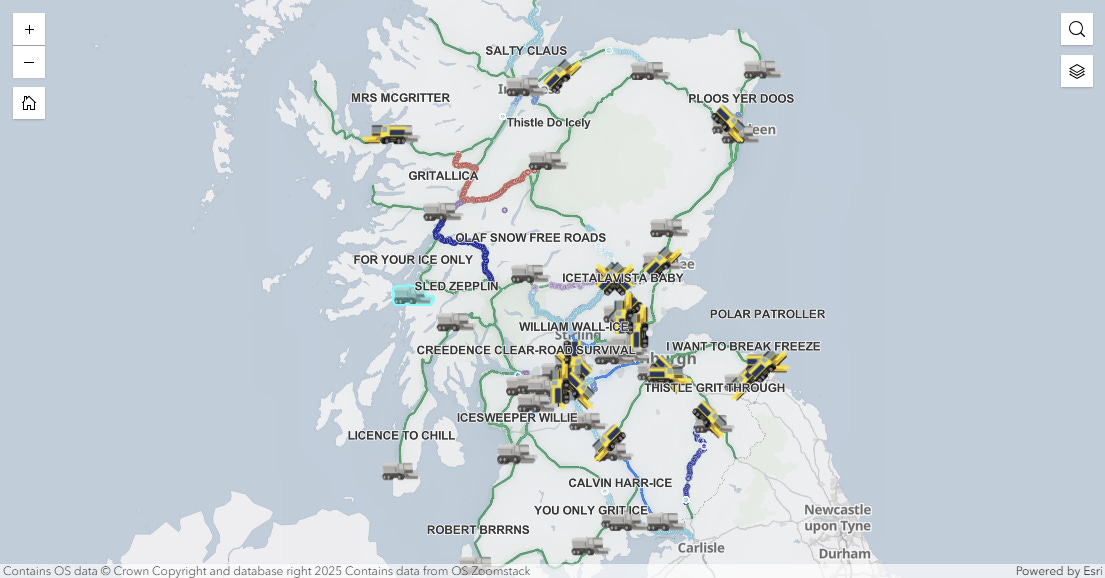

Do you know what a gritter is? As its name suggests, a gritter spreads grit and/or salt on roads in icy weather (I had to look it up since I live in Spain and we don’t have much need for them).

Scotland has around 240 gritters. Like most things Scottish, they have personality. Tradition dictates that the operating companies run public competitions to name the machines. These used to be open to schools, but extended to everyone during the pandemic, and the results are hilarious. Gritty McGrit Face, Icetalavista Baby, Gritty Gritty Bang Bang… Music lovers seen to have an inside track, with Skid Vicious, Credence Clear-Road Survival, Gritallica and Sled Zeppelin clearing the roads.

What’s more, Scotland has a website where you can track the movements of Salt Shaker, Blizzard Wizard, Gritter Bug and all their mates.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.