WEEKLY - market rout + Bretton Woods III

Also: assorted links, Olympics and more

Hi everyone! What a week. I hope you’re doing ok, and can step away from screens this weekend – I have a feeling you’re going to need your stamina for next week.

You’re reading the free weekly edition of Crypto is Macro Now, where I re-share one or two posts from the week.

Many of you are new here (hello and welcome!! 👋), so I’ll briefly reintroduce myself: my name is Noelle, and I’ve been writing newsletters about the crypto-macro relationship since 2014, both independently and as Head of Research for CoinDesk and Genesis Trading. I’m here because I care very much about the role of crypto in this rapidly changing world. Thank you for joining me!

If you’re not a subscriber to the premium dailies, I hope you’ll consider becoming one? You’ll get access to market commentary as well as adoption insight and industry trends. Plus, links and music recommendations ‘cos why not…

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

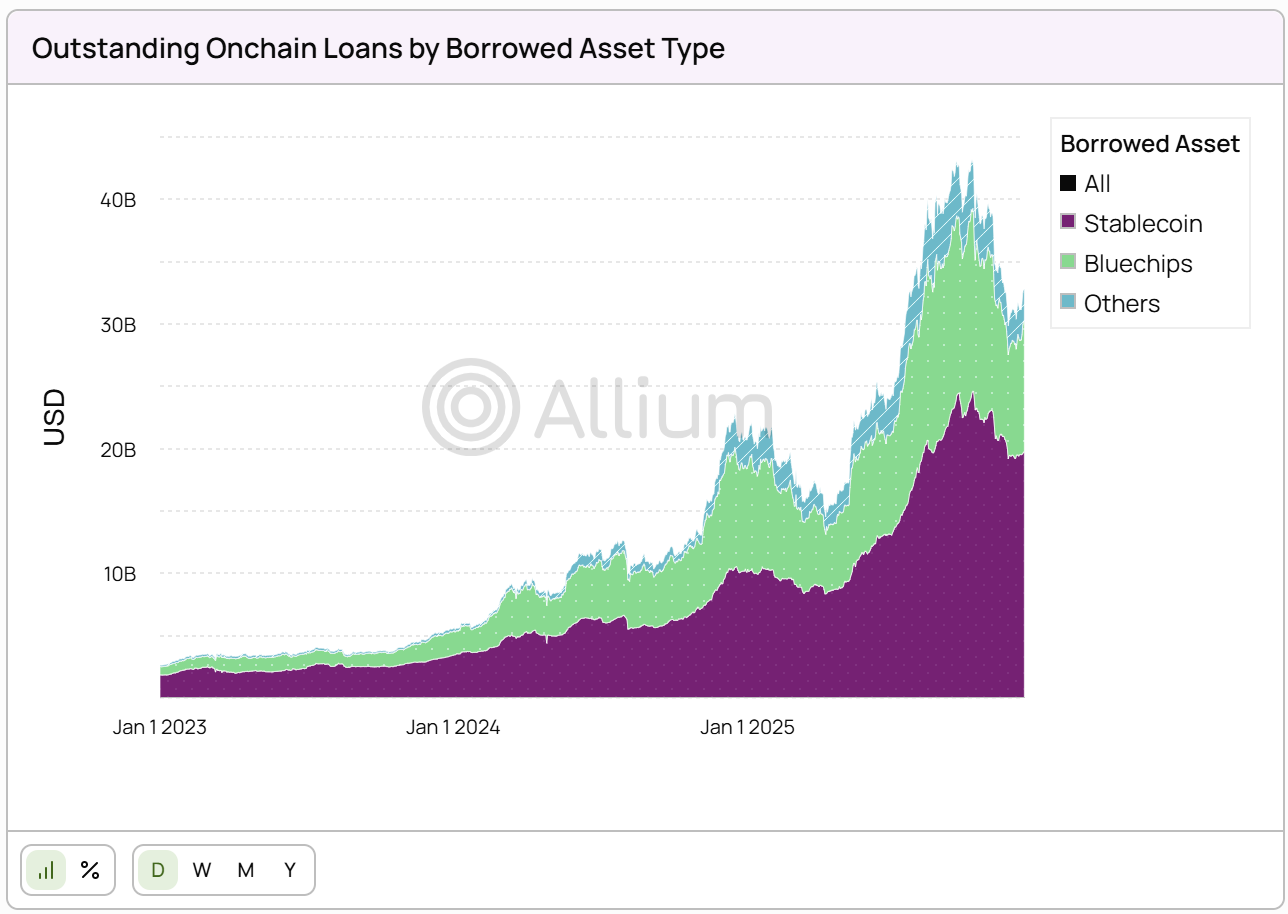

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

My op-ed in American Banker this week (paywall!) thinks through how stablecoins could become a tool to swing economic influence away from monetary policy and towards the Treasury Department. “Stablecoins as an instrument of US fiscal policy”

✨

On Wednesday, I got to chat to the wonderful Maggie Lake on her Talking Markets show – we touched on the crypto rout, the US economy, Bitcoin utility and more – you can see the playback here.

✨

If you speak Spanish and are interested in a less frequent, shorter update on developments in the crypto-macro intersection, you can subscribe to Cripto es Macro here.

In this newsletter:

Markets: bloody hell

Revisiting Bretton Woods III

Assorted links: Bakers’ hours, Dubai, the tech-human relationship, Roblox, US hits

Weekend: the Winter Olympics 2026 opening ceremony

Some of the topics discussed in this week’s premium dailies:

Coming up this week: jobs, geopolitics, crypto politics

Markets: yikes

Crypto: what bear market? Why it doesn’t feel like one.

Vibes or fundamentals?

Revisiting Bretton Woods III

Macro: watch those prices

Markets: all good now? Nope.

Do we really want 24/7?

Markets: rotation and risk-off

January 2025 lookback: What a difference a year makes

Markets: down

Macro: US jobs

Macro: US services

Markets: bloody hell

Markets: pain and pause

Macro: US jobs, again

Crypto: tokenization froth?

Markets: bloody hell

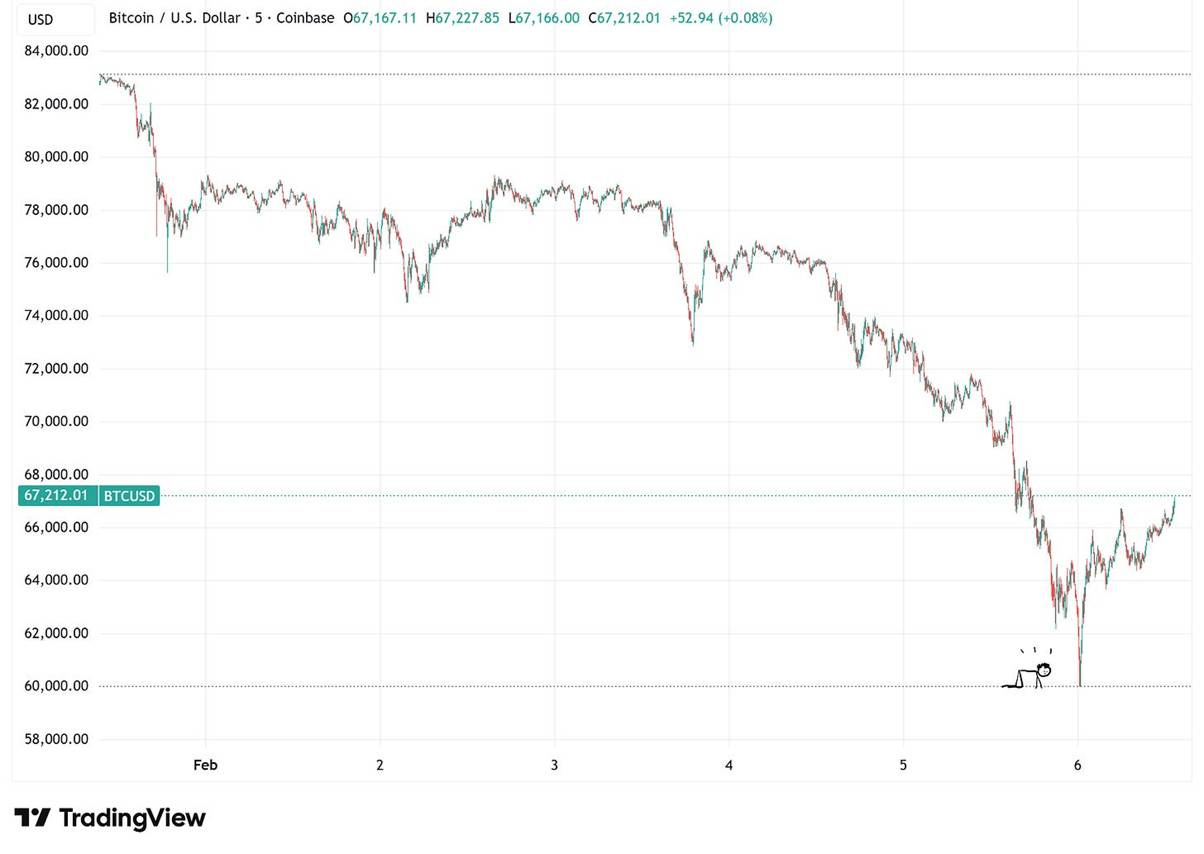

By now, you’ve probably seen the numbers: early yesterday morning, BTC touched $60,000, a 24-hour drop of over 17% – this was even more in percentage terms than the black day in 2022 that FTX closed withdrawals. ETH did even worse, down 19%. SOL was down almost 27%.

(BTC/USD chart via TradingView)

I have to admit I was expecting some downward choppiness, but not the scale of what we saw.

There are signs of a respite: throughout the course of yesterday, BTC gingerly climbed towards $72,000, but was not able to hold that trend and, as I type, is bouncing along under $69,000.

So much to go into here, but we have to start with an attempt at some explanations. What happened?

The speed of the move suggests this was concentrated institutional selling, which rhymes with one or more large funds “blowing up” and having to unwind fast. In this macro environment, buyers stood back.

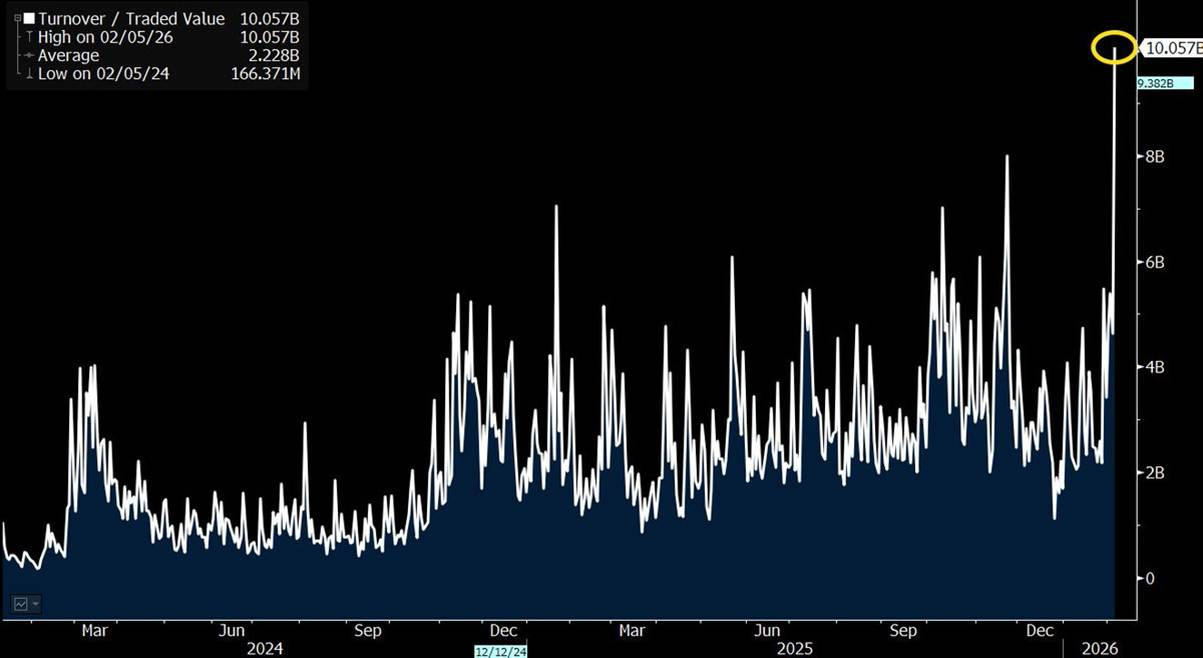

A plausible theory from @TheOtherParker_ on X is that the affected funds are based in Hong Kong, dedicated BTC funds with heavy positions in IBIT options, run by macro players and therefore under the crypto radar (they don’t use crypto exchanges nor interact much with other crypto investors, and large option positions won’t show up on any crypto investor dashboards). Thursday saw the highest volume on IBIT ever, and the highest volume for IBIT options.

(chart via @EricBalchunas)

Parker posits that these macro players could have been loading up on silver positions to cover losses lingering on their BTC positions from the October 10th crash, and that Thursday’s silver rout tipped their leverage over the edge. Or, it’s possible that the window for redemptions from 10/10 ran out. Or the funds got hit by rising Japanese bond yields breaking the “carry trade”. Or all of the above.

He also notes that, on January 21, the SEC hastily approved Nasdaq’s request to remove the cap on IBIT options positions, instantly enabling higher leverage without the standard review period – possibly at the urgent request of a prime broker? Speculation, but the timing raises questions.

The reason we’re searching for an explanation is not just the age-old human coping strategy – it will say a lot about what happens next.

It may be some time before we get the full forensics of what really happened. But something broke this week. Back in 2022, we knew what it was – FTX suspended withdrawals, and its tendrils throughout the industry were, while not exactly clear at the time, at least relatively public. Even those of us, shall we say “lacking in optimism” of late, were surprised by the drop’s ferocity.

There is potential upside in this: usually in active markets, sharp falls are followed by sharp rises.

Unfortunately, in crypto that could take some time. And the rout is not necessarily over, as Thursday’s move most likely killed other funds, which will have some unwinding to do.

Yet, buyers are seeing opportunity in these prices. If BTC manages to hold on to current levels for a couple of days, we should see them start to step in.

That said, the impact may at first be muted. Confidence has taken a hit and will need some time to recover. Investors nursing losses may choose to sell as soon as they hit breakeven, weighing on any rally.

Bigger picture, we’ve been here before. There are horrendous losses out there, as well as widespread fear. Funding for crypto projects could contract which will inevitably lead to projects winding down and people losing their jobs. That is sad, no upside there.

But we know the industry will recover.

And the main narratives are still intact – those insisting that no “store of value” can go down this much are judging Bitcoin on too short a timeframe. Debasement hedges are always long-term. What’s more, the utility of an asset that can act both a hedge against fractures in the global financial system and insurance against censorship and repression is arguably stronger than ever.

Over the years, I’ve found that even those who live in stable democracies with reliable financial systems understand the “debasement trade”, and see gold exposure via ETFs or derivatives as a good way to play it. But hardly any of that global subset fully appreciate the need for an insurance asset. Those that do, hold gold bars in their home safe or Bitcoin in a self-custodial wallet.

Most of the world doesn’t enjoy the stability and reliability privilege. They instinctively understand the insurance angle. And, going by recent headlines, their number is likely to grow, even in the West. For most of the world, access to insurance assets is not easy – but, in the case of Bitcoin, it’s getting easier. This narrative is quiet and won’t move the price in the short-term. But it is unfortunately real and, over time, we will see its hand in the longer-term effect.

In sum, I know that I’ve said before that down is better than sideways. But ouch. This market is painful for all, and the fear is extending well beyond crypto. I hope you and your friends and family are doing ok. This is a time to reach out to others, to trim expenses where we can, and to remember that, for everyone, watching a regime change is both terrifying and foundational.

🎿 If you find this newsletter interesting, would you mind sharing with friends and colleagues, and nudging them to subscribe? I’d appreciate it! 🎿

Revisiting Bretton Woods III

Back in March 2022, many of us were fascinated by a theory put out by Zoltan Pozsar, then chief economist at Credit Suisse (his note seems to have gone offline, here I’m going by my notes). The Russian invasion of Ukraine was sending commodity prices haywire and triggering signs of stress in money markets – and Pozsar recommended going long shipping freight rates. Depending on which index you prefer, rates since then have either normalized (Drewry, Baltic Dry) or remained elevated although declining (PPI), but they’re not the point here.

In suggesting going long shipping, Pozsar was drawing our attention to the fundamental shift in global value away from finance and towards physical goods, specifically commodities. What’s more, he predicted this shift would form the basis for a new global monetary order: Bretton Woods III.

Today, his point hits home even harder, as money and financial engineering struggle to solve supply chain vulnerabilities that end up depending on the location and processing of actual atoms.

It also hits home as we see certain jurisdictions increase their stockpiles of commodities. In March 2025, China approved a budget to aggressively accelerate its accumulation of key resources. Its record purchases of oil over the past year are said to be supporting the oil price. China’s nickel stocks have more than doubled since 2024. Some estimates put China’s stockpiles of corn at 70% of global reserves, wheat and rice at 50%. I have not seen reports of the US stockpiling at anything like that scale, although – in what looks like a scramble to catch up – this week President Trump announced a $12 billion “critical minerals” accumulation program called Project Vault.

What does that have to do with monetary systems? Pozsar explained it as a shift from “inside money” (assets and debt created by the dollar-dominated financial system) to “outside money” (gold, oil, other commodities).

The world earns dollars when it exports to the US – and, despite tariffs, it is still doing a lot of that (November’s trade data released last week shows an almost 6% year-on-year bump). The dollars could be recycled into US assets – or, they could be used to accumulate reserves of commodities. US assets are still popular, but will that hold going forward as trade uncertainty climbs?

Pozsar presents the Chinese central bank (PBOC) as the only potential global backstop capable of restoring stability in the current commodity-triggered turmoil – it’s the “buyer of last resort” for global commodities (the US and the EU are limited by the sanctions they have imposed on key producers). What’s more, it’s the world’s largest exporter of rare earths, refined nickel, magnesium, gallium, tin, refined zinc and a lot more. And it’s the world’s largest importer of crude oil, liquefied natural gas, iron ore, soybeans, grains and other commodities. It’s the world’s largest gold producer and its second-largest silver producer. I could go on.

The US is no slouch when it comes to commodities, especially oil, natural gas and corn. But it does not have China’s commodity heft – and it is still anchored to “inside money”, the US dollar asset system. It has a lesser chance of becoming the world’s backstop to a commodity-based economy, and may not get to continue calling the shots in Bretton Woods III. Stand back and squint, and it’s possible that we’re starting to see that play out.

To see how, here’s a quote from Pozsar’s March 2022 note:

“When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities.” (my emphasis)

The CNY exchange rate ended up dropping sharply for most of 2022, for a bunch of reasons mainly to do with the dollar’s safe haven status, US rate hikes and China’s zero-COVID policy.

But since January 20, 2025, it is up more than 5% against the dollar. Over the same period, the DXY dollar index has dropped more than 10%. Since the war in Ukraine tragically looks like it will be dragging on a while longer, Pozsar could well end up being right on that prediction.

The same goes for his continuation of the above quote:

“From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities).

After this war is over, “money” will never be the same again…

…and Bitcoin (if it still exists then) will probably benefit from all this.”

See also:

How the Chinese navy is relevant to crypto (Feb 2024)

Odd Lots Podcast: Zoltan Pozsar on His Next Big Move and the Coming Monetary Divorce (June 2023)

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

I am not an early morning person, although I would love to be – it’s my favourite time of day, quiet, peaceful and when the sun starts peeking above the horizon, utterly magical. Cake Zine shares tricks and tales from bakers for whom 5am is a sleep-in. Inspiring stuff. (How Bakers Survive Winter Mornings, Cake Zine)

Tomas Pueyo takes us on a fascinating journey through the history of Dubai, highlighting what turned it from a tiny fishing village into a global super-port. A lot of stuff I didn’t know in here. (Dubai: The Anti-Petrostate, Unchartered Territories)

From the archives, but it resurfaced in my feed this week – a reading list for those wishing to dive deeper into our relationship with technology, spanning classic tomes and new analysis, with a sprinkling of related fiction. (Unmachined Words: A Reading List to Keep You Human, School of the Unconformed)

I know Roblox exists only because I see it mentioned in so many of the tech-related articles I read. But I had no idea what it really was or how it worked. Jeremiah Johnson to the rescue. (Everything you ever wanted to know about Roblox, but were afraid to ask a 12-year-old, Infinite Scroll)

Hit songs in the US from each decade from the 1840s to the 2010s, and what they said about America at the time. (20 Songs That Defined America, Wall Street Journal – paywall)

🥌 If you’re not a subscriber to the daily premium newsletter, I hope you’ll consider becoming one! 🥌

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

I am a sucker for big celebrations that tug on cheap emotions with glitz and kitsch, and the Winter Olympics Opening Ceremony did not disappoint. The musical and dance numbers were overflowing with self-importance, the athletes were parading in a confusing number of locations, but the whole thing was utterly enjoyable.

As usual, Reuters has the best photo gallery, featuring artists, stagecraft and the beaming faces of participants from all over the world. I recommend taking a look at the whole thing, but here are a few of my favourites:

(all images from Reuters)

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.