WEEKLY - sanctions and stablecoins

plus: betting vs trading, assorted links, and more

Hi everyone! I hope you’re all well and can touch grass this weekend.

Yesterday was quite the day, both on the geopolitical front and for market moves. Whether President Trump changes strategy now or not, new cards have been played that will end up being relevant for both crypto assets and the industry’s evolution. I’ll be diving into this next week.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days and offer some interesting links.

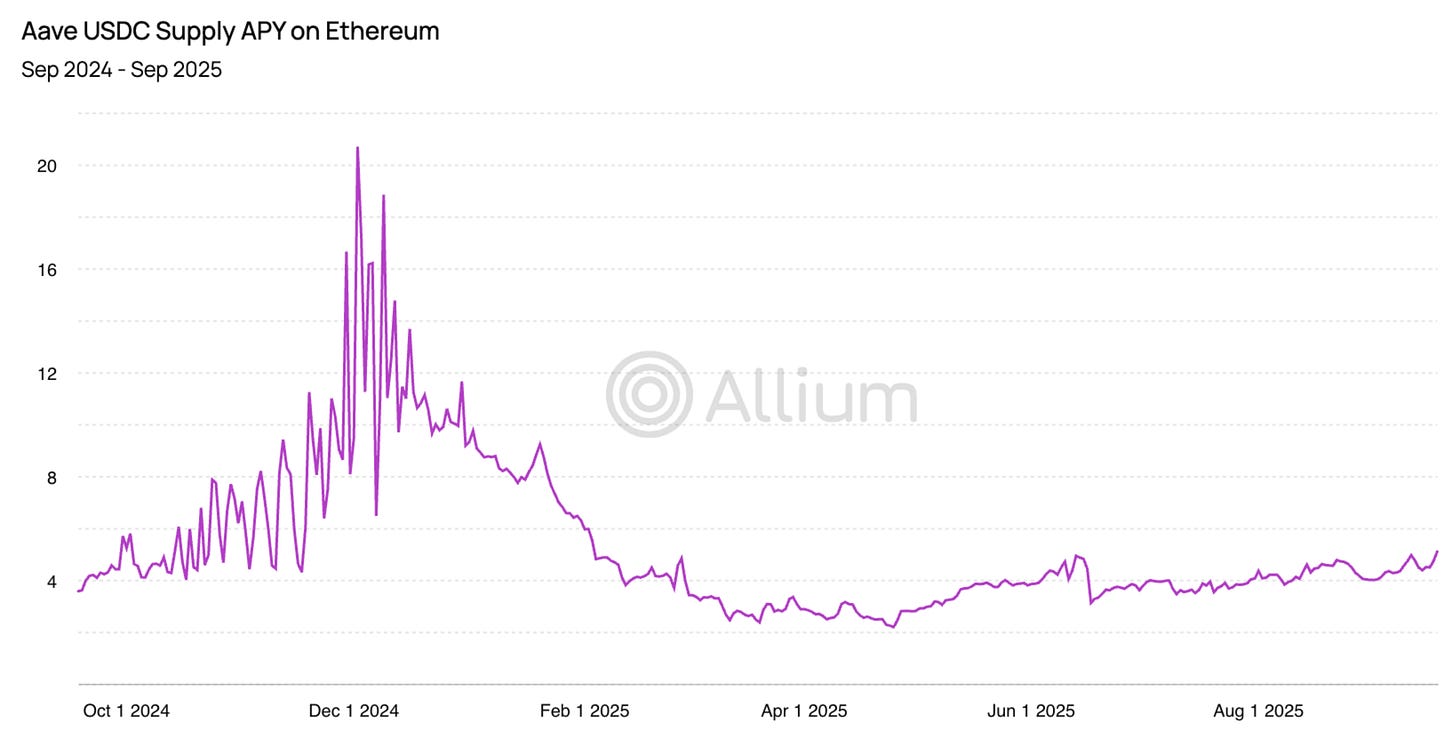

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

In this newsletter:

Sanctions on a stablecoin

Betting vs trading

Assorted links: the source of populism, Latin America, Hamlet and more

Weekend recommendation: the enduring format of collaborative music

Some of the topics discussed in this week’s premium dailies:

Coming up: not much actually, unless the government shutdown gets resolved

The slippery slope: politics and debt

The message from markets

Macro-Crypto Bits: stagflation, shutdown mood, Japan’s reaction

Also: Europe, Russia, Chinese stablecoins and staking distribution

The AI bubble

FIFA, tokens and questions

Macro-Crypto Bits: BTC consolidation, ETH catch-up, record inflows and crypto regulation

Also: the blurring of boundaries, empty pilots, transfer agents and more

Sanctions on a stablecoin

Betting vs trading

Macro-Crypto Bits: gold, inflation expectations and political priorities

Also: peace in Gaza?, France tries again, China weaponizes exports, BNY tokenization

Stablecoins, CBDCs and a unified European market

Macro-Crypto Bits: gold, yields, jobs and BTC

Also: Argentina, Japan and sea beds

✨Interested in how the shifting geopolitical landscape will impact crypto and macro markets? Me too! For ~daily updates on trends and narratives, I hope you’ll consider becoming a premium subscriber. ✨

Sanctions on a stablecoin

It looks like we’re about to see the first official sanctions imposed on a stablecoin! This is a huge conceptual leap for both sanctions and what stablecoins represent.

Some background: The European Union is reportedly proposing sanctions on A7A5, the largest non-dollar stablecoin in the market, which happens to be backed by roubles.

A7A5 was a platinum sponsor of the recent Token2049 conference in Singapore (touted as the largest crypto conference in the world), its team manned a booth on the showroom floor, and one of its directors spoke on stage – all this, despite the developers behind it and other related businesses currently under sanctions from the US and the UK.

The token was developed by a sanctioned cross-border payments company called A7, owned by Moldovan fugitive banker Ilan Shor (who played a role from the sidelines in the recent Moldovan elections) and the sanctioned Russian state-owned lender Promsvyazbank (PSB).

Given its ownership structure, you can imagine the type of cross-border payments A7 handles – these are usually executed via entities such as sanctioned Russian crypto exchange Garantex, and alleged affiliate Grinex.

Despite sanctions, A7’s business has been growing as there seems to be considerable demand for its services. It recently started offering digital bills of exchange that can change hands up to three times, and be paid out in the A7A5 stablecoin. (Who could have guessed sanctions wouldn’t work here?)

(For more detail, I wrote about this token in June: “The story of Garantex, Grinex and A7A5 is really a story of the dark side of technological evolution colliding with financial incentives, with users as well as officials scrambling to figure this all out.”)

It’s not a secret that Russian businesses and the state have increasingly turned to stablecoins and other crypto assets for trade purposes. Last month, Reuters ran a report on the growing use of barter in the region, with a local financial representative insisting that small businesses were actively using crypto.

Of course, the US and EU authorities have done their best to prevent this, leaning on Tether to freeze USDT accounts in violation of OFAC terms. So, users switched to a new stablecoin. In August, blockchain forensics firm Elliptic suggested that A7A5 was facilitating around $1 billion in financial flows daily, benefitting from a growing number of onramps and market liquidity.

True, a rouble-backed stablecoin does not have the same level of demand as a dollar-backed one, but it does the job in getting funds across borders. And while Tether is working hard on compliance with international rules, other, smaller dollar-backed stablecoins – perhaps even some not issued by US-based entities – could step in as a bridge between the rouble economy and trading partners.

This will all become even more complex when a liquid yuan-backed stablecoin joins the market, probably within the next year.

Back to the proposed sanctions: they won’t work. The relative ease with which users switched from USDT to using A7A5 highlights how trivial it would be for another rouble-backed stablecoin to emerge. This can happen faster than new sanctions can be proposed, leading to a tedious game of whack-a-mole.

What’s more, they’re an astonishing breach of precedent. Sanctions have typically been aimed at individuals and entities who have agency, who are capable of actions the sanctioners want stopped. A7A5 is a stablecoin, a snippet of code, with no agency at all! It does what its users tell it to do. It’s like sanctioning a particular type of vehicle because of what it’s used for.

According to documents seen by Bloomberg, the EU is also drafting sanctions on several banks in Russia, Belarus and Central Asia for enabling onchain transactions.

This is also a worrying precedent, on two fronts: enabling crypto transactions is not illegal. Enabling certain types of transactions is even a stretch, as how would these be differentiated from the normal course of business? The net effect, rather than stop the use of sanctions-busting stablecoins, will be to further incentivize the complete divorce from “Western” payment systems, weakening any remaining influence the EU and US might have.

Betting vs trading

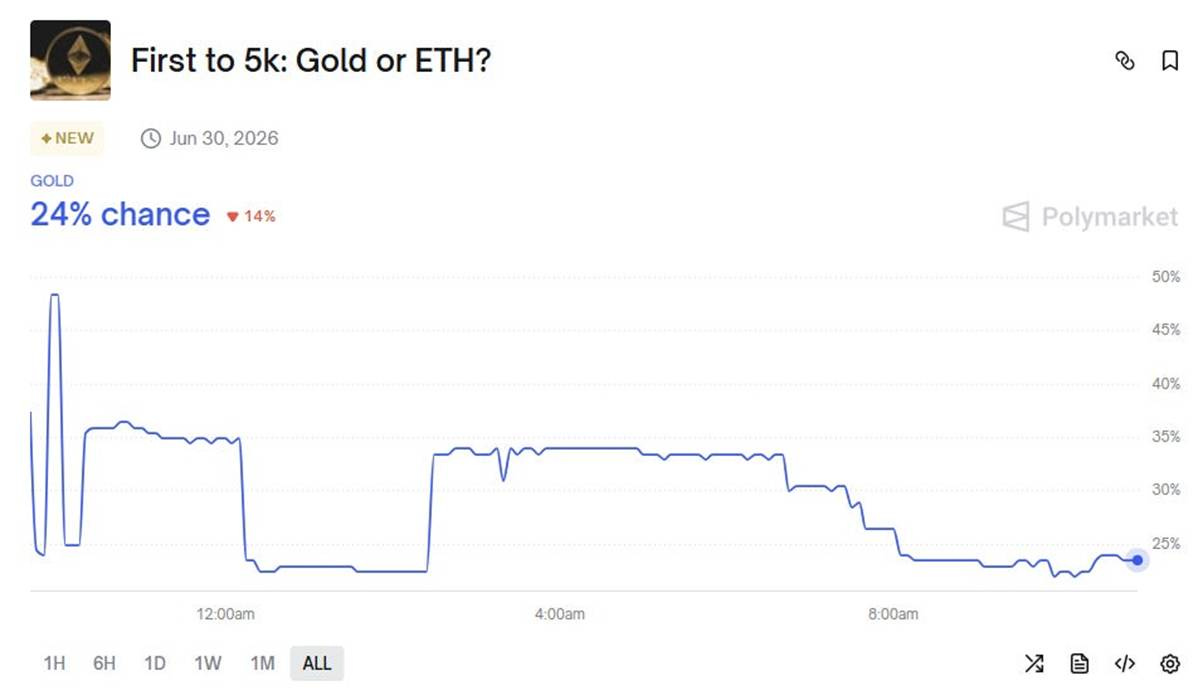

The owner of the New York Stock Exchange (NYSE) is investing $2 billion into blockchain-based betting platform Polymarket, which this week added BTC to the range of accepted tokens. This will embed Polymarket’s indicators into the group’s market data, further blurring definition boundaries. And the two parties have agreed to partner on future tokenization initiatives – I’m not sure what that means, but I am intrigued.

Polymarket’s bets have in themselves become widely cited macro indicators: Who will win the election? What will the price of gold be by year end? When is the next US rate cut? How long will the government shutdown last? When it comes to upcoming market-moving events, it helps to know where public sentiment lies as that speaks to what is or is not “priced in”.

What’s more, they are opportunities for anyone to make some profit, or not. Have a feeling about the next winner for Best Picture at the Oscars? The likelihood of an earthquake, the winner of the League Championship, whether Taylor Swift will have a baby next year? If you don’t see a particular conviction offered on the platform, you can create an appropriate bet and see if others bite.

Is this gambling? Or is it a wager powered by informed opinion? And how is that different from trading assets? Ok, in asset trading, there’s an object to buy or sell – ownership is part of the equation. But in betting also: you “own” a position. I could say, for instance, that I am “long” the French government muddling through its mess without calling a new election this month. It’s intangible, sure – but so are most of the liquid assets on traditional markets.

Here’s an example: I could take out a cash delivery futures position on gold for $5000 by the end of the year. Or, I could take out a bet on Polymarket that gold will reach $5000 by Dec 31. What, really is the conceptual difference? (There will, most likely, be different returns due to the different structures.)

I could also get sophisticated and buy derivatives expressing my view that both gold and ETH will reach $5000 by then, and take out a bet on Polymarket as to which one gets there first. That feels like a type of leverage to me, but obviously not in the traditional sense.

(chart via Polymarket)

So, here we have a blurring of definitions between trading and betting, between assets and opinions.

We also have the emergence of some big questions.

Such as, what does the merging of trading and betting do to our understanding of portfolio management? Will political opinions become part of wealth management?

If so, could this end up totally distorting the betting platforms behind this societal shift? Such as, someone thinks one thing but takes a bet on the opposite as a hedge, sending a misleading signal out there (Yes, this happens frequently in markets, but not so much in non-market-related opinions.)

And when does the merge of betting into trading result in the gamification of everything? If I can take a position on the colour of Taylor Swift’s wedding dress on my brokerage platform, isn’t that the total financialization of culture? Especially if the dress designer can make a fortune based on insider information?

Markets are changing much faster than most realize.

If you find this newsletter useful, do please share with friends and colleagues.

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Francis Fukuyama decides that the main cause of the relentless creep of populism around the western world is social media and the internet. That itself doesn’t sound particularly eye-opening as you’ve no doubt heard the theory before – what makes this article interesting is how he goes through all the other potential causes and explains why they’re not convincing, highlighting how we often confuse cause and effect. (It’s the Internet, Stupid, Persuasion)

Pippa Malmgren lays out the overlooked geopolitical importance of Latin America, from its financing of global jihad to the “soft power” battle for cultural allegiance to supply chain workarounds. (Bananas, Battleships and Bitcoin: How Latam Became the Epicenter of Superpower Geopolitics, Pippa – paywall)

Ted Gioia writes about how classic and timeless tales such as Hamlet are feeding Gen Z culture today, and why its relevance has lasted generations. (Hamlet Is the Gen Z Story We Need Right Now, The Honest Broker)

Brendan Greeley asks why the US has such a uniquely bad payments system for a developed country. (Why I have to buy doughnuts with cash, Financial Times – paywall)

I’m including this powerful piece from Abigail Shrier because, um, yeah. Parenthood is pain – but it makes your life fuller than you could ever imagine. (When Your Child Is Sick, The Free Press – paywall)

If you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

One of the very, very, very, very few things I miss about the pandemic is the music collaborations on screen. Deprived of venues, artists of all types worked on creative collages, mashups and other formats to deliver a smattering of glimpses and sounds that together created an entirely different musical experience than what could be shared on a stage. More intimate and yet also more universal, with an unexpected emotional impact.

Bear with me, I don’t plan to wallow in the artistic glory of 2020, but there are a couple of videos that I may have watched dozens of times during that period that are worth resurfacing to set the scene for the point I want to make.

One is the magnificent “Resistiré”, featuring a who’s-who of Spanish pop, past and present:

Another is the uplifting rendition of “Memories”, by the One Voice Children’s Choir, which redefined confinement by making it part of the composition:

And now, fast forward to 2025, I am so excited to see confirmation that the format endures. Here’s a version of “Crossroads” performed by artists from around the world, which not only features an iconic song expressed with a multitude of talent; it also reminds us that the roots of blues are international, and that music binds more than it separates.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.