WEEKLY - central banks + BTC, stablecoins + geopolitics

plus: creative Korean markets, assorted links, Russian Siberian music and more...

Hi everyone! I hope you’re all doing well, taking care of yourselves and getting ready for some weeks of speed and drama – the stretch into year-end is always manic.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days and offer some interesting links.

🍂 If you’re not a subscriber to the premium dailies, I hope you’ll consider becoming one? You’ll get access to market commentary as well as adoption insight and industry trends. Plus, links and music recommendations ‘cos why not… 🍂

If you know any Spanish speakers, do nudge them to sign up for Cripto es Macro, a “light” version of this newsletter in Spanish. It shares a few of the Crypto is Macro Now posts, a couple of times a week – and, for now, it’s free!

My latest op-ed for American Banker is out (paywall, sorry), this week about how banks and fintechs come at stablecoins from different angles, which will have a material impact on the onchain and offchain landscape.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

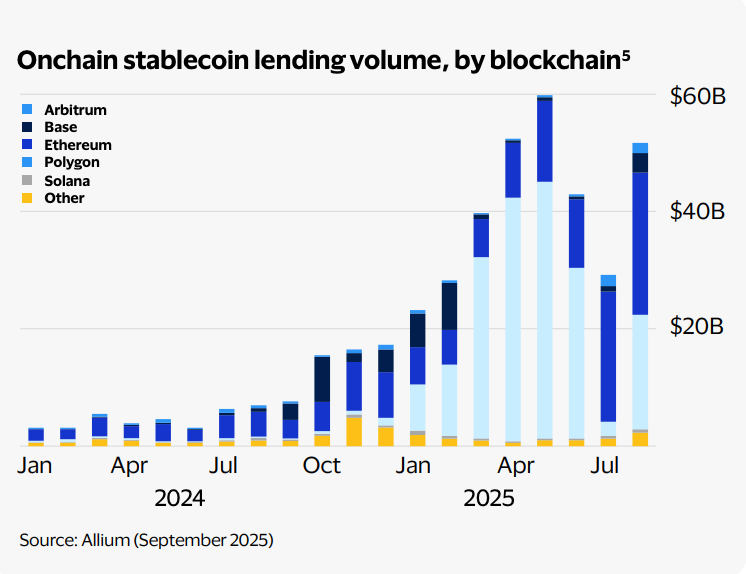

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

In this newsletter:

The Czech National Bank and BTC

The geopolitics of stablecoin demand

The creativity of Korean markets

Assorted links: a meaningful life, NY’s future, the AI Manhattan Project, food books and more

Weekend: Russian Siberian and Turkish music – seriously, just beautiful

Some of the topics discussed in this week’s premium dailies:

Coming up this week: Syria, small business sentiment, Fedspeak and more

Market relief but with caution

Why inflation expectations matter for crypto

The geopolitics of stablecoin demand

Markets: relief from what?

Markets: equities, bonds and jobs

SoFi: A bank goes full crypto

The public-private network bridge

UK: a brake on innovation

Macro-Crypto Bits: rate cut doubts, market caution, small business sentiment

The SEC and crypto assets: new definitions, new markets

Visa: the fiat-stablecoin blend

Circle: I’m missing something

Sui’s stablecoin: why?

The creativity of Korean markets

Tokenized finance for energy projects

Plus: tense waiting, and who is selling BTC?

The silver lining in the market rout

The Czech National Bank and BTC

The Czech National Bank and BTC

A couple of days ago, the Czech National Bank announced that it had purchased BTC for a “test portfolio”. This will not form part of the bank reserves, as some sources are claiming – rather, it’s to kick the tires on digital rails. The portfolio will also hold some USD stablecoin, and a tokenized deposit. The amount invested is tiny, only $1 million, but the signal is huge.

What’s especially interesting is not the investment itself. It’s the stake in the ground.

Back in January, the Czech central bank governor Aleš Michl spoke publicly in an interview with the Financial Times about his interest in BTC as a store of value and how he was going to present a proposal for his institution to put up to 5% of its €140 billion of reserves in the asset. I wrote about it at the time, pointing out that Michl was the second youngest central banker in the EU’s history, which still feels relevant.

Of course, as soon as the interview came out, ECB chief Christine Lagarde reacted, telling a press conference:

“I am confident that ... bitcoins won’t enter the reserves of any of the central banks of the General Council.”

Here’s the interesting twist: Michl sits on the board of the ECB General Council. But the Czech Republic is not part of the eurozone, so technically he can do what he thinks is best for his country.

Central banks move slowly, and the Czech institution’s plans are to present an assessment of the experiment in two to three years, with no increase in investment until then. That’s a lifetime in crypto markets, but the bigger picture here is that a young central banker understands that payment rails and the nature of reserves are changing. More will follow.

See also:

Central banks and BTC: it’s an age thing (Jan 2025)

🍂 If you’re not a premium subscriber, you could be getting so much more out of these newsletters! 🍂

The geopolitics of stablecoin demand

Earlier this week, I finally got around to reading the text of Federal Reserve Governor Stephen Miran’s speech last week at the Harvard Club about stablecoins.

His focus was the impact of stablecoins on the macro economy, and he made some key points that tie into what I’ve been trying to map out recently – where will stablecoin demand come from? This matters for their impact on treasuries, banks and dollar demand.

Most of what he said, I agree with, especially when it comes to the importance of foreign demand. But he’s complacent in a couple of areas, which I’ll tackle further down.

Stablecoins offer relatively easy access to US dollar exposure, attractive for anyone living in jurisdictions with volatile currencies. They also embed users in a global network of applications and transfer destinations, enabling digital transactions even for those without bank accounts. And they facilitate trade settlement, for which the dollar is still the preferred currency in most regions, some of which have restricted dollar availability. In sum, given a choice, much of the world will see the appeal of US dollar stablecoins.

While dollars do already circulate around the world, the net new demand born of easier access and greater convenience is likely to be considerable. This is where the impact on the market for US government debt comes from – net new demand for stablecoins is essentially net new demand for treasuries. More demand for treasuries means a lower cost of borrowing for the US government, which in turn should alleviate some of the upward pressure on the budget deficit, perhaps smoothing debt concerns and further boosting demand for US government debt. This in turn will further lower yields, and so on. You can see the appeal for US officials.

Miran takes this further and discusses the likely impact on r*, the neutral interest rate at which the economy is in balance. He believes that global stablecoin demand will lead to a “savings glut”, which needs a lower r* in order to recover the balance with demand. A lower r* means the federal funds rate needs to come down farther.

I have one quibble with this conclusion, but it’s a small one. Miran seems to assume that stablecoin convenience will be limited to dollar representations – put differently, he doesn’t expect there to be any geopolitical or market-based barriers to their use.

He’s right that dollar stablecoins are easily the most appealing option available today. They have a supportive regulatory framework behind them, a broad and expanding network of liquidity and applications, onramps galore, and proven global demand.

Other jurisdictions correctly recognize the threat to their own monetary sovereignty posed by USD stablecoins, but can’t get out of their own way to stop this. The EU’s stablecoin rules are structured such that the backing reserves have to be partially in low-yielding bank deposits and distributed amongst several institutions, which adds friction for issuers and makes the reserves less secure (commercial bank deposits are less secure than government debt, and anyway, Europe does not have a deep, liquid government debt market).

And the UK earlier this week unveiled its framework for stablecoin legislation, with holding caps for businesses and retail.

Both the EU and the UK are giving more weight to protecting the banking system from internal innovation, without realizing that the real threat is coming from outside.

But, Asian stablecoins and/or CBDCs could end up being a strong competitor in their fields of influence. China is dampening enthusiasm for the idea of yuan stablecoins and encouraging more focus on the central bank’s digital yuan – but there is talk of banks being able to issue currency tokens before long. Both are likely to see strong demand among China’s trading partners, which ties into China’s push to internationalize its currency.

And Russia’s central bank digital currency looks to be on track to launch in 2026 (although there have already been several delays to this project, so I’ll believe it when I see it). Meanwhile, according to a recent Chainalysis report, Russia is easily Europe’s largest crypto market, and not long ago the EU proposed sanctions on a Russian stablecoin (overlooking that it would be relatively trivial for funds to flow to an unsanctioned rouble stablecoin in what could end up being a futile game of whack-a-mole).

Why would trade partners of China or Russia prefer their home-grown versions rather than USD stablecoins? Most likely because of a combination of domestic network effects, official incentives, patriotism and the fear of retribution if they don’t.

And non-dollar stablecoins could become especially relevant should the US show signs of pressuring dollar stablecoin issuers to cut off certain jurisdictions – earlier this year, a senior Russian Finance Ministry official publicly encouraged the development of rouble stablecoins after Tether blocked Russia-linked accounts.

So, Miran is showing some complacency about the global spread of dollar demand. But, he’s right in that offshore dollar stablecoin demand will balloon in coming years.

He also shows considerable complacency about the potential impact on domestic banks – he assumes that, since stablecoins don’t deliver a yield and aren’t insured by the FDIC, users will prefer to hold funds in bank accounts.

True, the aversion most people have to changing habits is a considerable friction. If you’re used to handling all your payments through your bank, it would take a meaningful incentive to get you to learn a new process. For many, that incentive is still lacking – paying for your bagel with stablecoins is not yet an improvement over swiping your card or waving your phone over a reader. But for a growing number of large businesses that regularly send money cross-border, stablecoins are a cost-saver in terms of fees and time. And once some businesses use stablecoin rails, it becomes more convenient for others to also do so, and network effects kick in. This will divert funds and activity from the corporations’ US bank accounts, something banks are obviously worried about.

As for people not wanting to lose access to the interest on their bank deposits, well, for most this is negligible and banks have been notably reluctant to change that. And tokenized money market funds pay a decent yield of around 4% or higher. For now, the infrastructure and the legislation is clunky as these are treated as restricted securities (which is ridiculous, I mean how much risk is there in a money market fund, from what exactly are retail investors being protected?). When minimum investments are no longer prohibitively high, corporations will be able to sweep idle stablecoin balances into a product on the same network that starts paying yield almost instantly. What’s more, they’ll be able to do this 24/7, and even earn yield for a few hours.

And about that FDIC insurance – with stablecoins, backed by government debt or cash held an an institution that is insured, insurance is not necessary.

So, either banks will find ways to compete with the evolving onchain ecosystem, or their deposit base will shrink.

In sum, I think Miran is right in focusing on offshore dollar stablecoin demand for the net impact on the macro economy, but he too swift to dismiss potential competition from certain regions. I also think he is too swift to dismiss the threat to US banks of domestic stablecoin demand.

The most encouraging aspect of his talk is just how seriously the US Administration is taking the stablecoin potential, how it sees the opportunity more than the risks, and in so doing, will push the global financial network onto a technology that will bring not only greater transparency and lower costs, but also the flexibility to change how money moves and why.

See also:

🏵 If you know of anyone who might find this newsletter interesting, would you share it with them, and nudge them to subscribe? I’d appreciate it! 🏵

The creativity of Korean markets

South Korea has long had an original approach to markets. For instance, its army of retail traders has a much stronger influence in the overall stock market than in other jurisdictions – and they tend to treat stock trading as a sport. The implied volatility of the country’s KOSPI index is usually roughly double that of US stocks.

What’s more, the Financial Times reported earlier this week that South Korea’s frenetic trading is spilling over into US markets, especially into some of its more volatile stocks.

And, of course, there’s the trading public’s relationship with altcoins, which have at times accounted for around 80% of volumes on crypto exchanges.

But so far, stocks and crypto assets have operated on different venues. That may be about to change in an unexpected way, that itself could usher a new type of asset innovation.

Back in March, Nextrade emerged as an alternative to South Korea’s main stock exchange – with longer trading hours and cheaper fees, it quickly managed to grab 30% of total trading volume. Now, according to reports, it wants boost its competitiveness by taking “alternative” even more seriously.

One set of products it is looking into is tokens linked to K-pop song licenses, building on a partnership with music royalty platform Musicow. Music tokens are not a new idea – but dropping them into a market passionate about K-pop, and with few inhibitions about trading new ideas, could move the needle on traction and liquidity.

This could even end up being more than a blockchain-related innovation. K-pop is a cornerstone of Korean soft power, with fans around the world – the success of Netflix’s K-Pop Demon Hunters film (so good!) is but one small example.

And, it would further blur the boundaries between crypto and traditional “alternative” assets, bringing even more liquidity to each.

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Stephen Innes points out that AI is the next Manhattan Project, with vast investment needed for national security purposes and currency dilution justified as national necessity. “Gold’s bull market isn’t a trade. It’s a diagnosis.” (Gold and the Manhattan Project of the AI Age, The Dark Side of the Boom)

Marvin Barth outlines the economic forces that drove educated yet under-employed youth to vote for socialist NY Mayor Zohran Mamdani: it’s about creating a larger surface of opportunity, with looser borders and a large bureaucracy that might hire them. (The Politics of (Mamdani) Rage, Seriously, Marvin?)

Noah Smith points out that, even before Zohran Mamdani’s win, the finance industry was leaving New York. If the exodus accelerates or even just continues at the current pace, the city could become the next Detroit, losing a “tent-pole” industry and never getting it back. (Mamdani’s biggest challenges, Noahpinion – paywall)

Ted Gioia sketches a map to a more meaningful life, drawn with young people in mind, but none of us are ever too old to stop and breathe. (A Young Reader Asks for Help, The Honest Broker)

Anthropic issues a sobering warning about AI espionage. (Disrupting the first reported AI-orchestrated cyber espionage campaign, Anthropic)

Irina Slav is incomparable when she gets scathing, and her scorn is deservedly earned by the European Union’s flip-flopping and blinkered insistence on unrealistic environmental goals and self-defeating energy policies. (Infantilia tantum, Irina Slav on Energy – paywall)

Food critic and author Ruth Reichl offers a long recommendation list of cookbooks and other writings on food that made me want to rush out to the bookstore. (Tuscany in the Fall, La Briffe)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Regular readers will know that I like to share, um, “alternative” music here, for the spectacle if nothing else.

Well, here’s Russian Siberian indigenous group Otyken with Turkish singer Ummet Ozcan with a haunting and visually stunning performance of Altay. Don’t ask me to describe what kind of music it is, but check out the gorgeous instruments.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.