WEEKLY - digital euro, gold, crypto use

plus: shifting axes, the infantilization of politics, stunning landscapes and more

Hi all, I hope you’re doing well! The newsletters have had more of a geopolitical focus recently as the pendulum there is starting to swing faster. I have a feeling October will have more of a macro focus, however, with crypto markets finally starting to move again.

I’m off next week, so there won’t be either dailies or next Saturday’s free weekly – back on Monday, September 29th with renewed energy and inspiration 😋.

Here’s a link to my latest op-ed in American Banker: “Stablecoins will disrupt payments, just not in the way you think” (paywall).

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

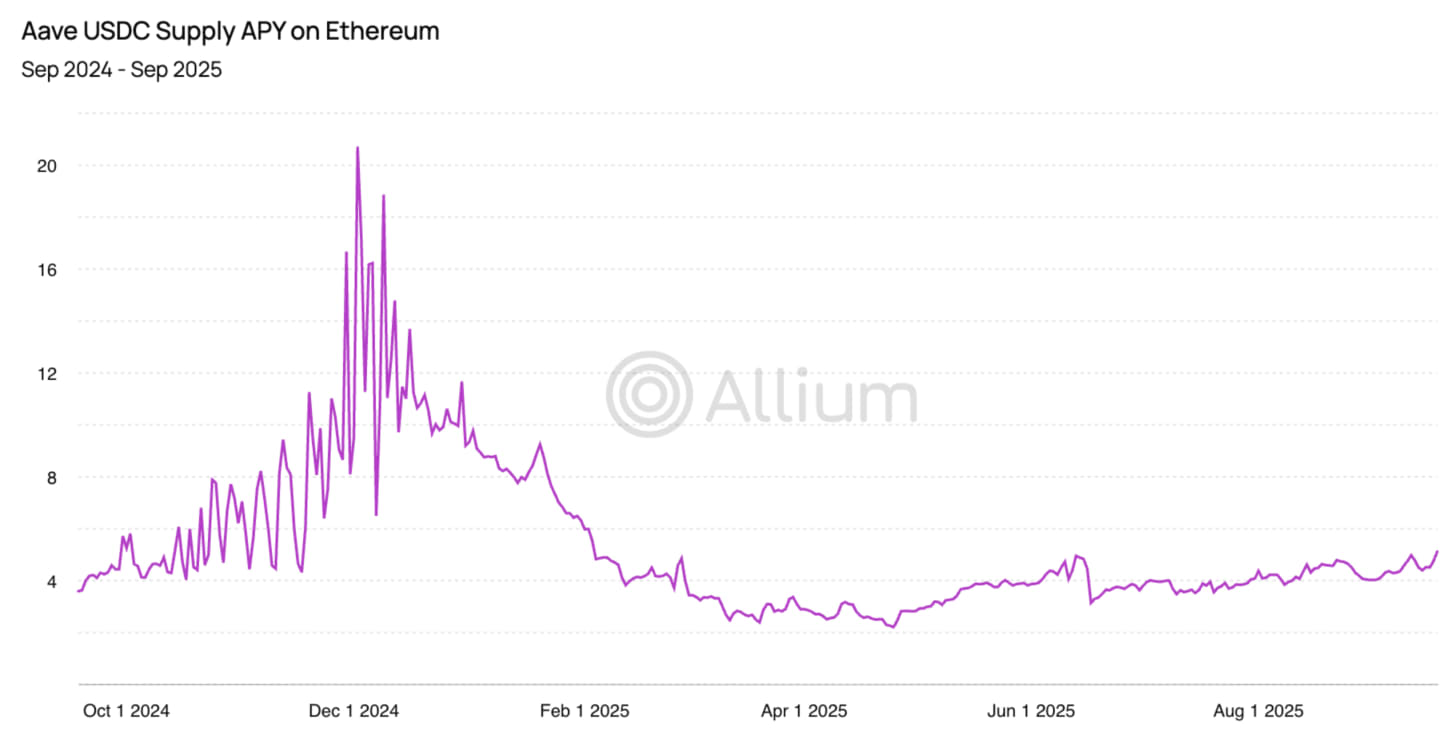

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?"

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days, offer some interesting links I came across in my weekly reading, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

In this newsletter:

The digital euro hits a wall

An antidote to repression and chaos

Asian gold demand

The axis moves

Plus: “wtf?” vibes, the infantilization of politics, motivation and more

Some of the topics discussed in this week’s premium dailies:

Coming up: FOMC, retail sales, Hong Kong, Beijing and more

Real-world adoption

Macro-Crypto Bits: consumer sentiment, BTC cycles, watch the scientists

Also: far-right, Romania, Brazil, debt and more

The sanctions on Russia that aren’t

Military drills and the geopolitical flex

LSEG launches tokenization platform

Macro-Crypto Bits: the USD decline, Fed economic updates

Also: China, Coinbase, CBO, stablecoins and more

Finally, some regulatory convergence?

Asian gold demand

Macro-Crypto Bits: US retail sales and manufacturing

The FOMC statement – not what it seems

The market reaction

The axis moves

Also: EU crypto regulation, SEC ETF standards

Time to address this

The digital euro hits a wall

Bitcoin mining and hydropower

An alternative to the barter economy

Capitalism evolves

Also: US mining, currencies, German budgets, witchcraft, Russian assets and more

The digital euro hits a wall

Politico ran an article this week with the encouraging title: “The digital euro has enraged half of Brussels. Here’s what you need to know.”

Regular readers will know I’ve been writing about the digital euro for what feels like ages. At first is was from a somewhat dismissive “we’re going to get one, but no-one will use it” standpoint, which soon morphed into a “we’re going to get one and they’ll make sure we use it” concern. But when the original “rapporteur” (the EU representative charged with ushering the supportive legislation through passage) resigned last year because he didn’t believe in the mission, I started to feel encouraged that there were MEPs willing to take a principled stand.

This got stronger when his replacement – Fernando Navarrete – turned out to also be sceptical but does not seem to have any plans to step down. It got stronger still when it turned out that virtually no progress had been made on even drafting a bill for debate; the ECB has to make a final decision on whether or not to proceed, after two years of loud messaging that everything was full steam ahead, by the end of October. Lagarde has also in the past promised to not make a decision without the rules in place, which they won’t be. The Parliament has said it won’t reach a final position until next May.

What’s more, the European Parliament is not the only legislative body the ECB has to convince. It also has to work with the Council of the European Union, which represents member countries whose ministers are being fiercely lobbied by their respective banking industries. These, rightfully, see the digital euro as an unnecessary threat, a solution looking for a problem that will create many more problems.

And all this is happening at a time when the EU has to be focused on holding itself together. There’s the widening fractures of political polarization, the mounting bill from supporting Ukraine, the need to ramp up defence spending across the bloc but with wavering commitment from some, the need to figure out resilient energy supply, and the realization that their powerful trading partners are starting to flex that power and not to Europe’s advantage. Forcing a disruption on both the banking industry and on consumer payment habits is not going to be a priority, especially when hardly anyone outside the ECB actually wants this. Polls show that there would be some use, sure – but even the more open-minded among us would not care if it didn’t happen. Payments work pretty well within the European Union as it is.

So, hopefully the ECB’s campaign will meet enough resistance to fizzle out, and the EU can pivot to focusing on a wholesale CBDC which will actually bring economic advantages. Then again, when it comes to pride, unelected bureaucrats with little accountability can be unpredictable.

See also:

The digital euro gets shakier (July 2025)

The race to the digital euro is getting tense (June 2025)

The digital euro: more smokescreens (March 2025)

An EU digital euro twist (December 2024)

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

An antidote to repression and chaos

“It’s not used for anything.”

I have lost count of the number of times I’ve heard intelligent analysts and financial experts from comfortable economies insist that “crypto” – by that, they usually mean Bitcoin – is useless and therefore shouldn’t have any value.

All they’ve ever needed to do is consider the view from outside their airconditioned offices. Crypto, whether Bitcoin or stablecoins, is more than a new payments rail or a speculative/store-of-value asset. It is also “freedom technology”, or “dissident tech” – in other words, a literal lifeline. But awareness is growing.

Last week, Cointelegraph published a report on Venezuela where USDT is known as “Binance dollars” (because that’s where most users in the country get it from) and is now widely used across the country for buying groceries, paying rent, receiving salaries, paying suppliers and more. This adds more detail to a similar report in the Financial Times that I featured a couple of weeks ago.

Also, downloads of peer-to-peer encrypted messaging app Bitchat, developed by Twitter co-founder Jack Dorsey, surged in Nepal and Indonesia, both hit by severe waves of civil unrest. Bitchat enables users to communicate off traditional telecommunications grids, even when internet is down.

And The Street published a report on the surge in stablecoin use in Nepal during last week’s unrest. The article quoted a protester:

“We can’t rely on banks. They serve politicians, not the people … USDT is the only money that moves when everything else is blocked.”

And it’s not just the young, here’s a quote from a 63-year-old shopkeeper:

“I never thought I would use crypto … But when banks close and cash disappears, you have no choice.”

Crypto is not just about speculation or improving payment speeds or making equities more accessible. It’s also about helping people to be more human and to get by in times of extreme turbulence and censorship. Unfortunately, we’re likely to see more reports like this in coming months – I say “unfortunately” because it’s tragic when decentralized solutions are needed. But we can be glad they exist.

✨SUBSCRIBE✨

If you’re not a Premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

Asian gold demand

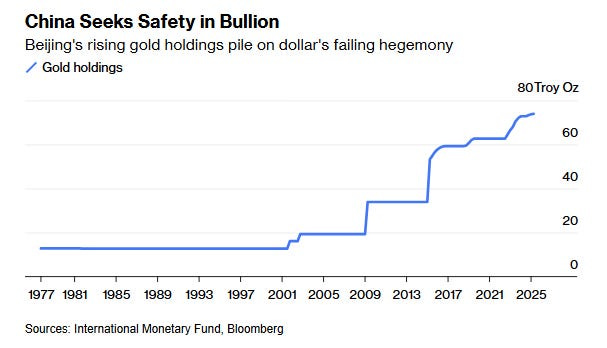

I’ve been writing over the past few months about how China’s central bank buying of gold is not just a driver of the gold price – it’s also a geopolitical signal.

(chart via Bloomberg)

That signal is getting louder with some intriguing moves from China to boost gold imports.

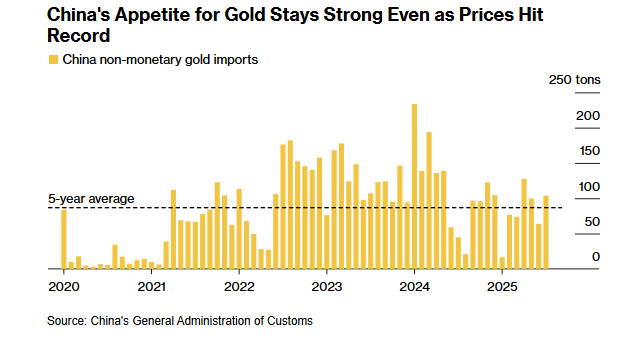

A few days ago, the central bank released a draft rule that would speed up gold imports by easing permit restrictions. And authorities plan to authorize more Chinese ports to process bullion.

Demand has been high since the pandemic, not just from the central bank but also from private investors who often have to pay a premium due to import restrictions.

(chart via Bloomberg)

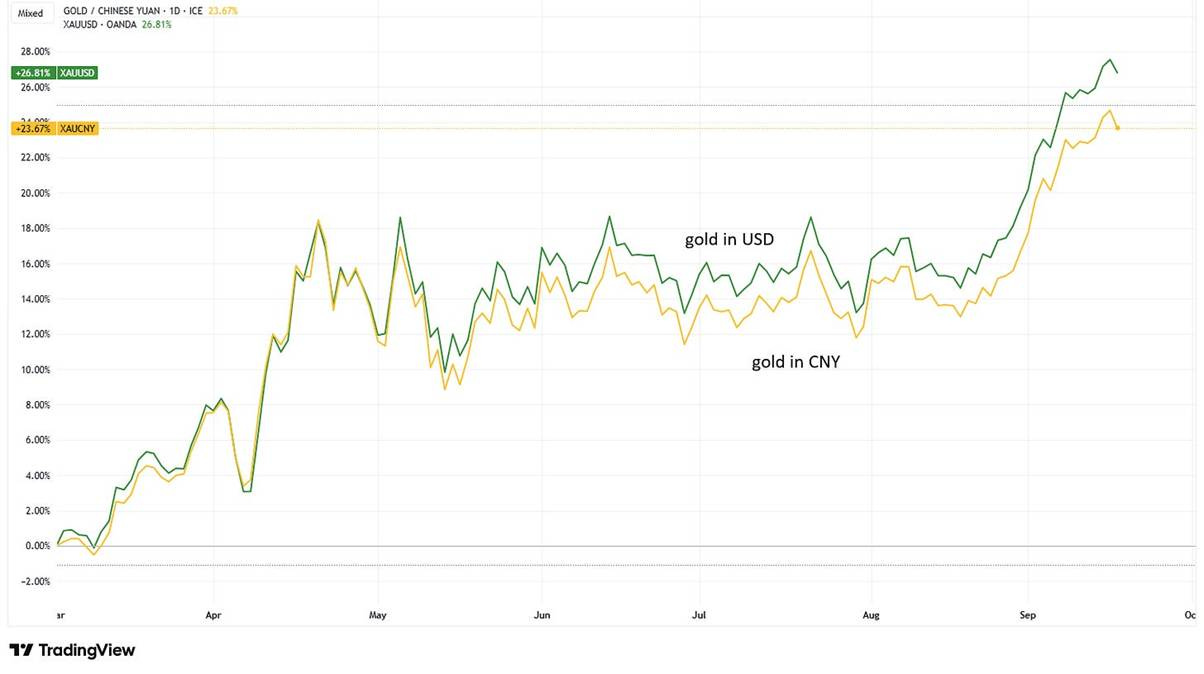

More imports suggest buying should increase, fuelled by the recent appreciation of the yuan relative to the US dollar which makes gold cheaper in yuan terms as well as a hedge against any currency depreciation that might lie ahead.

(chart via TradingView)

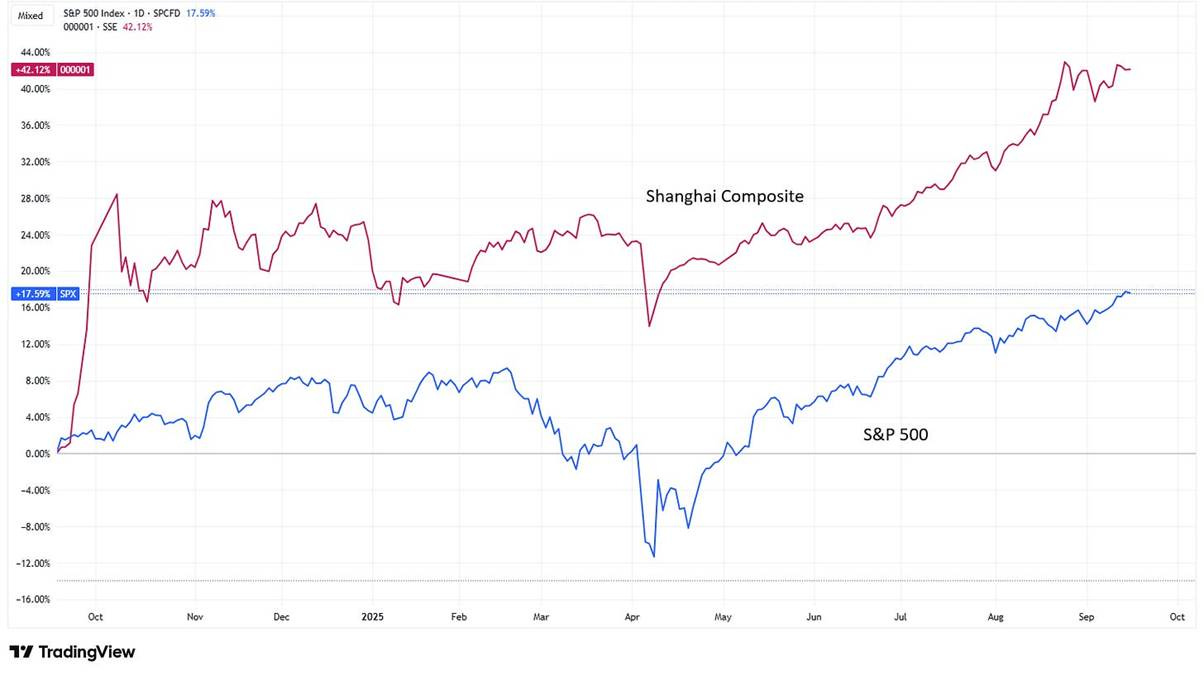

And earlier this month, Bloomberg reported that Chinese financial regulators were considering measures to cool stock market speculation, adding further risk to what is starting to look like a frothy market – the Shanghai Composite Index is up 42% over the past year, vs the S&P 500’s 17%.

(chart via TradingView)

Plus, with the housing market still under a cloud, families are turning to an alternative store of wealth.

China’s interest in encouraging more private investment in gold is most likely related to concerns about capital flight – the Chinese authorities would much rather citizens parked their savings in gold than in Bitcoin or US equities. Rumblings are getting louder that a regulatory framework for crypto assets is being considered – but, for now, it is not a priority, especially when a BTC surge would benefit the US more.

Increasing gold imports would not just benefit individual investors – back in February, when the price of gold was around $2,800/oz, China kicked off a pilot program that would allow the 10 largest insurance companies to invest up to 1% of their assets under management in gold, a potential investment of $27 billion. This wouldn’t necessarily be in the form of physical bullion, but even China-based paper versions would prefer to house the gold domestically.

Next, over to Hong Kong, where Chief Executive John Lee gave his annual policy speech on Wednesday. One of his announcements was a plan to expand the city’s gold storage facilities, in part to satisfy demand from the mainland. He also revealed plans to establish a central clearing system, with a view to boosting Hong Kong’s role as a bullion trading hub for all of Asia. In June, the Shanghai Gold Exchange (SGE) – the region’s largest gold trading venue – opened a vault in Hong Kong, and earlier this year the London Metal Exchange approved Hong Kong as a warehouse location, with eight operational by mid-July.

Gold exposure doesn’t have to be physical, though – Lee also mentioned support for tokenized gold trading, which could entirely bypass the dollar-dominated payments system as well as set up regional commodity markets for collateral efficiencies and other innovations.

The axis moves

We’ve had a loud wake-up call: Saudi Arabia has signed a “strategic mutual defence” pact with Pakistan. It’s loud because it reminds the world that Pakistan is the world’s only Muslim nuclear power, one that gets most of its military hardware from China. It’s also loud because it reminds the world that the US is no longer the only viable military ally for developing nations.

And the combination of the two forces is strategically significant: Pakistan’s military dwarfs that of Saudi Arabia in terms of firepower and troop size. But Saudi Arabia has an edge in terms of technology and overall investment – its defence budget is roughly 10x that of Pakistan, in dollar terms.

The agreement comes a week after Gulf states convened an emergency meeting to discuss Israel’s strike on Doha, although a Saudi official told the Financial Times that conversations around the agreement had been ongoing for a couple of years.

Now, should Israel go after Hamas targets in Riyadh, for example, they are essentially striking Pakistan. It is starting to look like the Middle East is splitting into two blocs: US and Israel on one side, and the Arab States plus Pakistan (and, by extension, China) on the other.

This has potentially meaningful implications for the US dollar. The agreement, originally struck in 1945 by President Franklin D. Roosevelt and later updated in the 1970s by US Secretary of State Henry Kissinger and US Treasury Secretary William Simon, offered military protection in exchange for the international pricing of oil in dollars, with Saudi trade surpluses recycled into US treasuries. What happens when that protection is no longer a key pillar of Saudi Arabia’s monetary and foreign policy?

It also takes off the table for now any “normalization” between Saudi Arabia and Israel. This rupture has long been one of Hamas’ goals, and will have longer-term consequences for the region’s economy.

Moving beyond the Middle East, on Thursday Chinese Finance Minister Dong Jun addressed the Beijing Xiangshan Forum, a military summit attended by more than 100 defence officials, including from the US, Russia, France, Singapore, South Korea, Brazil, Nigeria, Malaysia and Vietnam. China is, he insisted, a “stabilizing ballast” to deter war, and the PLA is a force for “peace, stability and progress”.

He also spoke of “small circles of hegemony” and “inclusive” security partnerships, while flattering leaders from the Global South by describing them as “unstoppable, driving the wheels of history steadily forward”. Contrast that with the sometimes conflicting messages sent from the US Administration and its newly named Department of War, and you can see the appeal for nations seeking a stable security partner that won’t interfere in their domestic politics and penalize trade with seemingly random tariffs.

Beyond security, China is also trying to leverage the US treatment of trading partners to bolster its global influence. In a meeting this week with his South Korean counterpart, Chinese Foreign Minister Wang Yi urged the Asian nation to join it in defending free trade from a system in which “unilateral bullying is rampant”. The two nations have many mutual points of contention, and the US is now more or less tied with China for total trade volume with South Korea – but, especially in Asian societies, pride matters and forgiveness can be hard to come by.

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

I love how Kyla Scanlon attempts to encapsulate the “wtf???” vibe of the current news flow, while tackling the thorny “does social media create or reflect?” debate (the chicken-and-egg for the modern age). Authenticity and an analytical mind are a compelling combination. (6 Economic Lessons from Books About Power, Propaganda, and Decline, Kyla’s Newsletter)

An intense yet reasonable debate between two people who agree on very little – Ezra Klein and Ben Shapiro – on the rage permeating society, when the descent into polarization started, the origin of Western civilization, and a whole lot more. It opens with a truly moving essay in print and video from Ezra Klein about the moment we are living and the choices we have ahead. (We Are Going to Have to Live Here With One Another, The New York Times – paywall)

Related, Kathleen Stock writes for UnHerd on the infantilization of everything, from politics and social discourse through to medicine and education. It’s a powerful read that connects threads into a convincing yet alarming fabric of complacency wrapped around fear. (Toddler logic is poisoning politics Welcome to the puerility spiral, UnHerd)

Oliver Bateman tackles something I touch on every now and then in the daily newsletters: why gold is getting more attention these days. But he does so in a big-picture, human way. It’s not trend lines or relative yield, it’s about insurance and weakening confidence in US hegemony. Oh, and nickels are a good investment. (The Work of Gold, Part 2, Oliver Bateman does the work)

A motivating piece from Doomberg on drive and finding joy in our work. It’s not what we have to do that should consume so much of our energy, it’s what we get to do. (Get To, Doomberg)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

Another photography competition to share today, this time of one of my favourite subjects: landscapes – the Natural Landscape Photography Awards. With so much noise on our feeds and in our hearts, gazing at stunning images that remind us of how magnificent this planet can be is, well, uplifting.

photo by Joy Kachina

photo by Roger Kristiansen

photo by Hanneke van Camp

photo by Rupert Kogler

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.