WEEKLY - the new geopolitical landscape

plus: Tempo's strategy, media mood and more

Hi all – what a dark week. I hope can take some time this weekend to hug the ones you love, and to appreciate the good things in life, of which there are many.

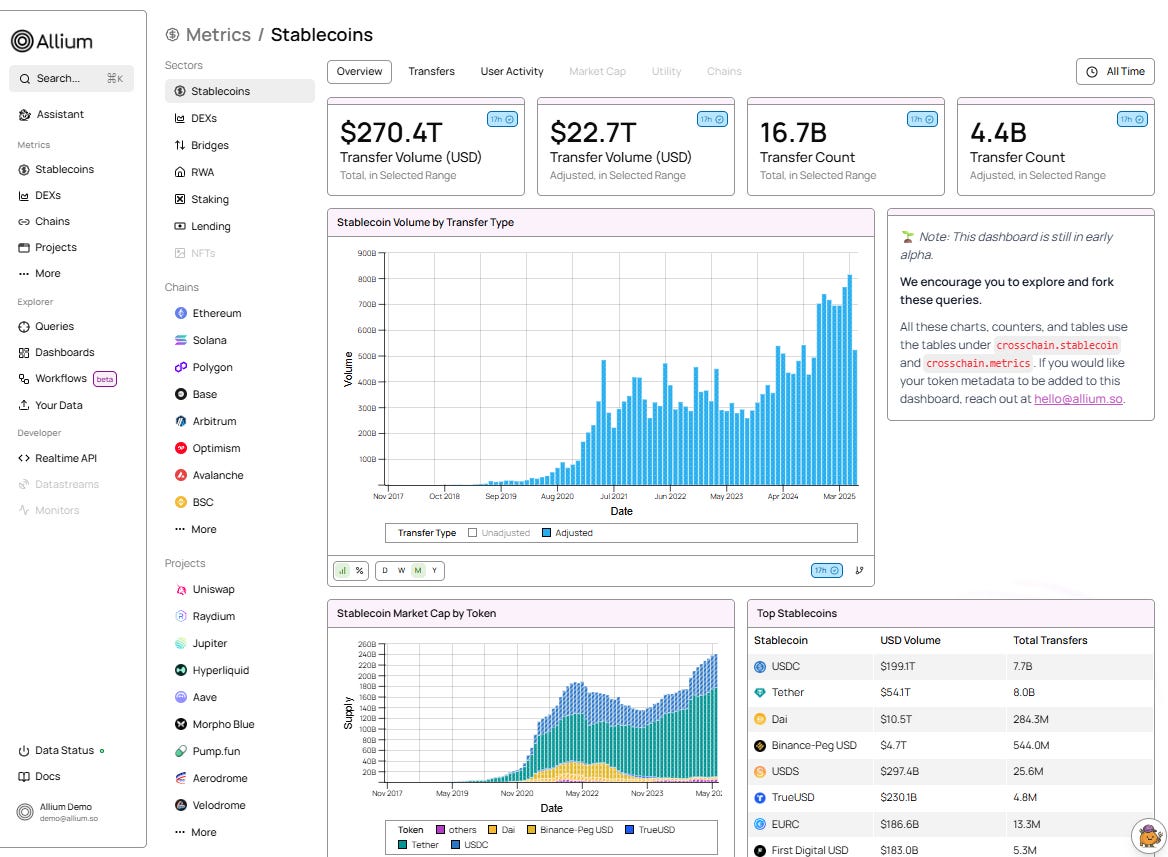

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days, offer some interesting links I came across in my weekly reading, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

In this newsletter:

The new geopolitical map takes shape

Tempo: words matter

Media mood matters

Some of the topics discussed in this week’s premium dailies:

Coming up: jobs, manufacturing activity, a military parade and more

What does GPS jamming have to do with gold?

Why the origin of gold purchases matters

A flailing France prepares for defeat

Stablecoins: the Korean dilemma

A tariff unravelling?

Military might

Macro-Crypto Bits: manufacturing, long bonds, blockbusters

Tariffs: Overuse of a blunt instrument leads to bruising

A scene change: Central banks and stablecoins

Macro-Crypto Bits: gold, jobs, yields, mood

Coming up this week: CPI, France, BIS, jobs revisions and more

The debt crisis is unfolding

Macro-Crypto Bits: the jobs data, rates expectations

Tempo and permissionless: words matter

Macro-Crypto Bits: inflation expectations, yields and easing, Tether and gold

Also: China + gold, BRICS, old/new cash, Hong Kong stablecoins and more

Labour data: Forget what you saw

Nasdaq: Tokenization moves in

Macro-Crypto Bits: PPI, CBOE, Vietnam

Also: flash points erupting – Qatar, Poland, Nepal

The new geopolitical map takes shape

Media mood matters

Macro-Crypto Bits: PPI, safe havens, stablecoin devaluation?

Also: capitalism, defence, India, energy tokenization

The CPI debate: did tariffs hurt?

Unemployment claims spike

The rates risk

The literal weaponization of time?

Also: China + stablecoins, polarization, Brazil, BlackRock and more

The new geopolitical map takes shape

The contours of the new global geopolitical order is starting to emerge from the fog of supposition into the tenuous light of action.

Last week, we got hints of the new US National Defense Strategy, currently in draft form, which reportedly emphasizes domestic and regional priorities above countering China and Russia.

This is still a draft and could change. But it’s not a surprise. President Trump ran on an “America First” platform, and the Administration’s desire to withdraw from Europe has been clear, as is its reluctance to antagonize China or Russia. The military parade in Beijing earlier this month will only have reinforced the US reticence to engage in a conflict in Asia it could not win without unfathomable losses.

We also have on deck the reassurances from US Defence Secretary Pete Hegseth to his Chinese counterpart that the US does not want conflict or regime change, according to a statement released this week by the Pentagon.

This matters not just for China’s expansionist strategy – more mercantile than territorial – but also for Russia’s growing confidence in Ukraine and along the border with Europe. I doubt the timing of the incursion of Russian drones into Poland this week was a coincidence, and both the EU and Russia are waiting to gauge the US reaction.

It’s also relevant for US industrial policy, putting the government’s stake in Intel in a new light: if Taiwan becomes Chinese, which is now likely, then a new chips supply chain will become existential.

And, it adds another layer to the Administration’s support for crypto and stablecoins: a multipolar world will have more incentive to develop payments networks that don’t touch the US dollar. All the more incentive to promote global use of dollar stablecoins.

What’s more, the strategy goes a long way towards explaining the hostile military action against a Venezuelan boat, as well as soldiers on the streets of US cities.

All this comes as China has been making significant inroads in Latin America, which the US will want to slow down. Earlier this year, Colombia officially joined the Belt & Road Initiative, China’s infrastructure-diplomacy outreach to the Global South. Brazil is now China’s third largest destination for foreign investment. And China has been getting bolder, breaking precedent by releasing details of a meeting in Beijing between the state’s security chief and his Cuban counterpart.

And then there’s the natural gas pipeline between China and Russia, announced earlier this month. Gazprom will build the Power of Siberia 2 gas pipeline to China via Mongolia, which will be capable of transporting as much as 50 billion cubic meters a year via the Power of Siberia 2 for 30 years, potentially doubling current volumes sold to China and effectively replacing European demand. This binds China and Russia even more closely together in economic terms, and reduces Russia’s vulnerability to US and EU sanctions – and it comes as the EU is preparing its 19th sanctions package (on the assumption that the previous 18 didn’t work because they weren’t strong enough?) while still importing Russian gas itself.

In sum, I’ve been writing about the geopolitical pendulum for what feels like ages. It feels both disconcerting and also reassuring to start to see actual lines being drawn. Early days, yet, though, and things can change – but, new maps are emerging, and will hopefully give some pattern to the chaos.

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

Tempo: words matter

A month ago, I wrote about reports that Stripe was building a layer-1 blockchain specifically for payments. On Friday, we got confirmation and more details from the involved teams, as well as insight into the strategy roadmap.

Built by Stripe and crypto VC Paradigm, Tempo will operate as a separate entity with design input from likely users such as Anthropic, Visa, Deutsche Bank, Standard Chartered, Shopify, DoorDash and others.

It won’t be based on a specific stablecoin – rather, anyone can issue a stablecoin on Tempo, and any stablecoin can be used to pay transaction fees. Initial use cases are expected to include commerce payouts, remittances, payroll, deposit token movements, agentic transfers and microtransactions. Privacy is opt-in, fees will be predictable and low, and transaction finality (beyond which it becomes irrevocable in the technical sense, this does not include refunds) can be achieved in less than a second. Plus, it will be compatible with Ethereum and most of its layer-2s.

The most interesting part of the specifications for me was the ability to pay fees in any stablecoin. Compare this to Circle’s Arc layer-1 payments network, in which fees can only be paid in USDC. That will be fine for many users who are already comfortable with Circle’s stablecoin, but the vast market that has yet to start using onchain transfers may prefer a partner that offers greater flexibility.

But even more interesting than the specifications has been the heated controversy.

This has come not from the decision to launch a layer-1 – there is still plenty of argument about whether a layer-2 would have been better, but as I’ve argued before, Stripe will want to control the whole transaction stack rather than depend on base layer validation, technological evolution and zero flexibility on the token used for fees.

No, the controversy has been triggered by Tempo leadership’s insistence that the blockchain will be permissionless.

Lifting the lid on the details, we see that initially the network will be run by a permissioned validator set, and with time it will add more.

The question is, can Stripe and/or Paradigm control who becomes a validator? Any familiarity with how traditional finance works will lead us to conclude: “of course”. To pick one example, can you imagine the regulators being ok with a Russian-affiliated bank, even one that is not subject to sanctions (there are still a few), join the network, issue a dollar-backed stablecoin, and freely transact with any business on the network?

But if there is control of validators, it’s not permissionless. Adding more permissioned validators does not make it so, even if they are businesses unrelated to Stripe.

And, can you imagine Stripe allowing a company it sees as hostile to spin up a set of validators, potentially to disrupt the network? It insists the network will be neutral, open to anyone, but do we believe Stripe would hold to that if commercial interests or even official pressure are in play?

Even if you think these scenarios are unlikely, the fact that they can conceivably happen means that Tempo is not permissionless, and the leaders do themselves no favours by pretending that “not centralized” is the same thing.

That said, the emergence of a new type of global payments network is exciting, and the design seems to be a big step towards pushing stablecoins into the background, where they should be. Most users don’t care about stablecoins, they want better payments service.

And I am encouraged to see this particular debate get so loud. For years I’ve been saying that a danger to the ecosystem’s potential is that we sleepwalk into centralization, as we did with the internet. I’ve also been saying more recently that I think “tradfi” services will end up being built on permissioned networks, even though I believe permissionless is the way to go. All of that is fine – businesses should be able to choose their structure, as should consumers.

Where I get nervous is when I see promoters try to pass one off as the other, as it demeans the meaning and importance of each.

So, even though this particular controversy will blow over as we move onto the next trigger, I sincerely hope the debate doesn’t go away.

See also:

✨SUBSCRIBE✨

If you’re not a Premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

Media mood matters

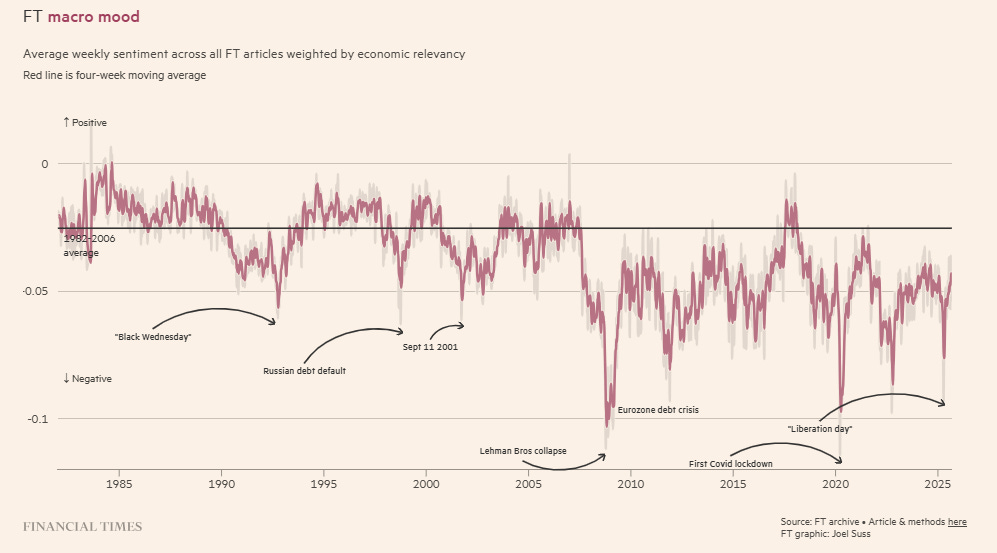

It turns out that “the 80s were happier” narrative is not just nostalgia, there’s actual data. The Financial Times has shared a chart tracking sentiment in its articles going back four decades – and, reporting is more miserable now than back then.

(chart via the Financial Times)

This is fascinating, not just for the obvious trend. It’s worth dwelling on because of the questions it raises.

Does media reflect, or influence? Put differently, was coverage more positive back then because people were, or did more neutral coverage help people to feel more positive?

Of course, the moderate answer is going to be “both”, but I’m inclined to think media leads rather than follows.

And the driver here is that negativity sells better than positivity and certainly than neutrality, especially these days when we pay with our attention, triggered by fear. Liberation Day got a more negative coverage score than the collapse of Lehman Brothers – seriously?? Something’s way off there.

The FT argues that people are more fearful since the dot com crash and the Great Financial Crisis which explains the negative tone, but I don’t buy it. Markets and finance – the FT’s core constituency – are not showing notable scars in terms of performance and extension of reach. In fact, they’re doing pretty well.

Maybe the negativity is because politics feels increasingly antagonistic and geopolitics is swinging wildly, which seeps into financial commentary because everything is more intertwined these days?

Hmmm, that doesn’t explain the bearish and often alarmist tone. The tone in the FT around crypto, to pick as an example a topic I know something about, has been resoundingly negative even though five minutes of research shows the real-world positive impact easily trumps the negative. Perhaps they’re pandering to what they think their supposedly conservative audience wants to hear? I’m not convinced, it feels more like they’re trying to influence through clickbait negativity.

Or, maybe the tone is negative because journalists are depressed and fearful? They have reason to be, given teetering revenue models and the inevitable public ridicule, no matter what they say. The “you don’t hate journalists enough” message streaking through X over the past few days certainly isn’t helpful. Or fair.

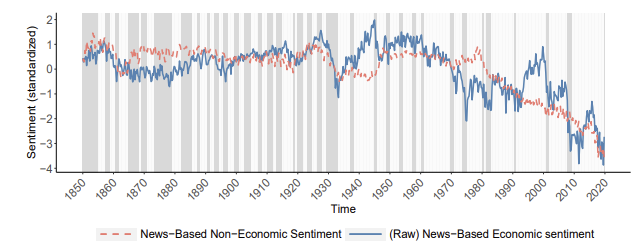

Speaking of fair, the negativity is not isolated to the Financial Times. In an article from last year, it highlighted an NBER paper whose authors parsed 200 million pages from 13,000 local newspapers going back 170 years. The results reveal an even steeper drop in sentiment.

(chart via (Almost) 200 Years of News-Based Economic Sentiment, NBER)

Kudos to the FT for publishing this – media matters, even though we like to say it doesn’t. It’s role in our lives is evolving, which encourages us to examine it more closely. And, one of the strongest antidotes to being manipulated is realizing it’s happening.

ASSORTED LINKS

Like many of you, I spent way too much time this week scrolling through my feed with building horror. So, I don’t have “assorted links” to share, since what I did read was either bleak and raw, or feels irrelevant and/or frivolous for now.

We started the week shaken by the video the stabbing of Irina Zarutska as she was heading home from work. We fretted about the reaction to the Banksy mural. Us Europeans were spooked by Russia’s incursion into Polish airspace. And then Charlie Kirk got assassinated in plain daylight for his beliefs.

There have been barrels of pixelated ink spilled in trying to put words around what everyone is feeling – but most are playing to our emotions, telling us things we already know, offering encouraging declarations but no solutions.

Many I’ve spoken to this week have expressed despair – that’s understandable, since there’s no way of pretending things are “fine”. But we can’t let despair define us, so we have to think about how to move forward, about what we can do to help those around us, about what’s next.

Next week, I’ll get back to sharing links that remind us of how varied and interesting life is. For now, I’m giving space to the giant question mark hovering in our line of sight – it will no doubt shrink back to its tool-box size as emotions settle, but first the ink it has splattered on our mental pages needs to dry.

This weekend, be kind to yourself and to others, please.

TAKE CARE OUT THERE!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

It’s been a while since I shared a photo competition with you, so the timing of the 2025 Pet Photography Awards couldn’t be better. Here’s a reminder of the beauty of simplicity and the connection of soulful gazes and innocent souls.

photo by Shandess Griffin

photo by Andrea Wafler

photo by Frankie Adamson

photo by Renate Zuidema

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google, but never for writing.